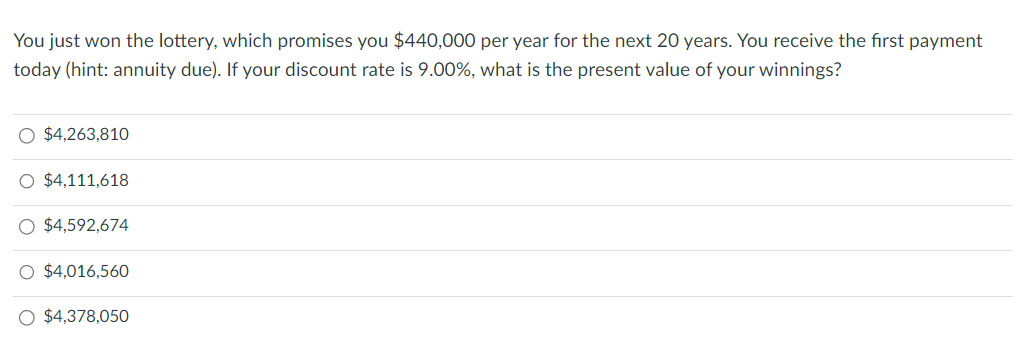

Stock Market Today: Dow & S&P 500 Live Updates For May 27

Table of Contents

Dow Jones Industrial Average Performance

Opening Bell and Early Trading

The Dow Jones Industrial Average opened at 33,950.22, a slight increase of 0.2% compared to the previous day's close. Early trading showed a mixed performance across sectors. Technology stocks experienced a mild dip, while energy stocks saw early gains fueled by rising oil prices.

- Opening Price: 33,950.22

- Percentage Change (Opening): +0.2%

- Key Influencing Factors: Positive economic data released earlier in the morning, anticipation of upcoming earnings reports.

Midday Market Movement

The midday trading session witnessed increased volatility. The Dow experienced a significant drop of approximately 1%, primarily driven by concerns over rising inflation and the potential for further interest rate hikes. The release of weaker-than-expected consumer confidence data further fueled the decline.

- Midday High: 34,010.50

- Midday Low: 33,600.80

- Catalysts for Movement: Release of consumer confidence data, speculation about future interest rate hikes.

- Sector Performance: Technology and consumer discretionary sectors experienced the largest declines.

Closing Bell and Day's Performance

The Dow Jones Industrial Average closed at 33,750.00, representing a net decline of 0.6% for the day. Trading volume remained relatively high, suggesting considerable investor activity throughout the session.

- Closing Price: 33,750.00

- Percentage Change (Closing): -0.6%

- Trading Volume: Above average

- Comparison to Historical Performance: Similar to recent volatility seen in the market.

S&P 500 Index Performance

Opening and Early Trends

The S&P 500 opened at 4,150.00, mirroring the Dow's modest initial gains. Early trading showed strength in the healthcare and utilities sectors, while technology stocks continued their slightly downward trend.

- Opening Price: 4,150.00

- Percentage Change (Opening): +0.3%

- Sectors Showing Notable Gains/Losses: Healthcare and utilities showed gains; technology showed minor losses.

Intraday Volatility

The S&P 500 experienced similar intraday volatility to the Dow, with significant swings throughout the day. A midday surge in oil prices briefly boosted energy stocks, before the broader market retreated due to concerns about inflation.

- Highs and Lows of the Day: High of 4,175.00, low of 4,110.00

- Major News Events Impacting the Index: Release of inflation data, speculation about interest rate hikes.

- Performance of Specific Market Sectors: Energy sector performed relatively well; technology sector underperformed.

Closing Summary and Analysis

The S&P 500 closed at 4,135.00, showing a daily decrease of 0.4%. The index's performance closely tracked that of the Dow, reflecting a general cautiousness among investors regarding the economic outlook.

- Closing Price: 4,135.00

- Daily Percentage Change: -0.4%

- Comparison with Dow's Performance: Similar negative trend.

- Analysis of Overall Market Trend: Cautious sentiment, influenced by inflation concerns.

Impact of Key Economic Indicators and News

The market movements on May 27th were significantly influenced by several key factors. The release of higher-than-expected inflation data fueled concerns about further interest rate hikes by the Federal Reserve. This, combined with weaker-than-expected consumer confidence figures, contributed to the overall negative market sentiment.

- Specific Economic Data Releases: Inflation data, consumer confidence data.

- Impact on Investor Sentiment: Cautious sentiment, driven by concerns about inflation and potential interest rate hikes.

- Analysts' Interpretations of the Data: Most analysts predict continued volatility until inflation shows signs of cooling down.

Conclusion

Today's stock market activity saw a decline in both the Dow Jones Industrial Average and the S&P 500, primarily driven by concerns over inflation and the prospect of further interest rate increases. Weaker-than-expected consumer confidence data added to the negative sentiment. The market's performance reflected a degree of cautiousness among investors. Both indices experienced significant intraday volatility.

Stay tuned for tomorrow's "Stock Market Today" update for continued live coverage of the Dow and S&P 500. Subscribe to our newsletter to receive daily market analysis and insights!

Featured Posts

-

Evaluating Googles Veo 3 Ai Video Generator Hype Vs Reality

May 28, 2025

Evaluating Googles Veo 3 Ai Video Generator Hype Vs Reality

May 28, 2025 -

Natos Northern Flank Us Reinforcement And The Threat From Russia

May 28, 2025

Natos Northern Flank Us Reinforcement And The Threat From Russia

May 28, 2025 -

Italian Open Alcaraz Triumphs Over Sinner

May 28, 2025

Italian Open Alcaraz Triumphs Over Sinner

May 28, 2025 -

The Trump Administrations Proposal To Shift Harvard Funding

May 28, 2025

The Trump Administrations Proposal To Shift Harvard Funding

May 28, 2025 -

Five Days Left To Claim Your 300 000 Euro Millions Lottery Win

May 28, 2025

Five Days Left To Claim Your 300 000 Euro Millions Lottery Win

May 28, 2025

Latest Posts

-

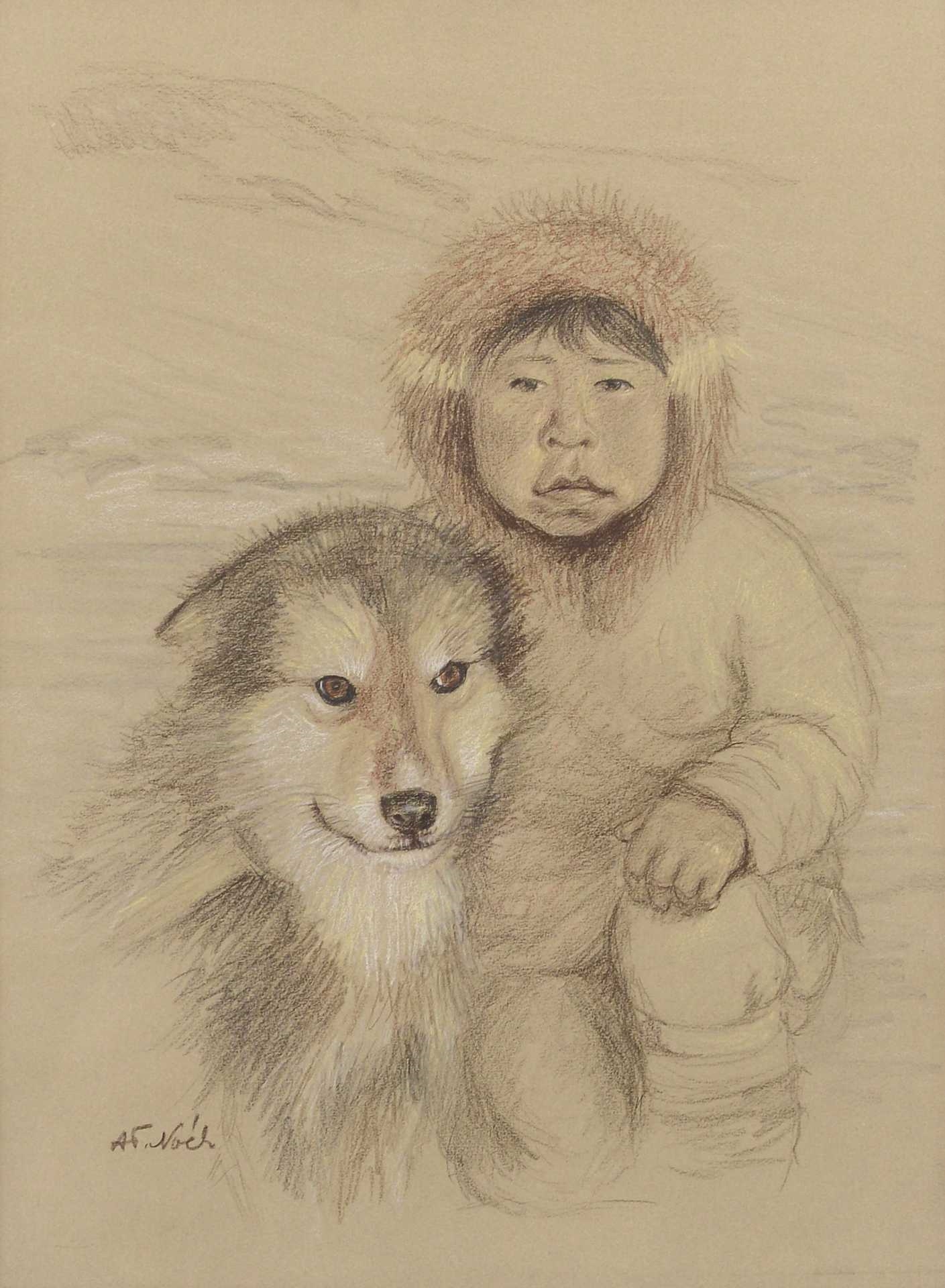

Decouvrir La Vie Et L Uvre D Arnarulunguaq Une Pionniere Inuit

May 31, 2025

Decouvrir La Vie Et L Uvre D Arnarulunguaq Une Pionniere Inuit

May 31, 2025 -

Arnarulunguaq L Histoire D Une Femme Inuit Remarquable

May 31, 2025

Arnarulunguaq L Histoire D Une Femme Inuit Remarquable

May 31, 2025 -

Partir En Mer Pour Une Journee Equipement Et Precautions

May 31, 2025

Partir En Mer Pour Une Journee Equipement Et Precautions

May 31, 2025 -

Arnarulunguaq Une Pionniere Inuit Et Son Heritage

May 31, 2025

Arnarulunguaq Une Pionniere Inuit Et Son Heritage

May 31, 2025 -

Experiences En Mer Un Jour Inoubliable Pour Tous Les Marins

May 31, 2025

Experiences En Mer Un Jour Inoubliable Pour Tous Les Marins

May 31, 2025