Stock Market Today: Dow Surges 1000 Points, Nasdaq & S&P 500 Follow Suit

Table of Contents

Analyzing the Dow's 1000-Point Surge: Key Factors

The Dow's 1000-point jump didn't happen in a vacuum. Several converging factors contributed to this impressive stock market rally. Let's break down the key elements driving investor enthusiasm:

Positive Economic Indicators

Recent economic data releases have painted a surprisingly optimistic picture, boosting investor confidence and fueling the market's upward trajectory.

- Stronger-than-expected employment figures: The latest jobs report showcased robust job growth, exceeding analyst expectations. This suggests a healthy economy capable of sustained growth, reducing concerns about an impending recession.

- Easing inflation pressures: Although inflation remains elevated, recent data indicates a potential slowdown in price increases. This could give the Federal Reserve more leeway in its monetary policy decisions.

- Positive GDP growth: Preliminary estimates suggest continued positive GDP growth, signaling economic expansion and strengthening investor sentiment.

Analyst commentary generally supports this positive interpretation of the economic data. Many experts believe that these indicators suggest the economy is more resilient than previously anticipated, leading to increased investment. This positive economic sentiment significantly impacted today's stock market.

Corporate Earnings Reports

Strong corporate earnings reports from several key companies, especially those heavily weighted in the Dow, played a crucial role in the market's impressive performance.

- Tech Giants Delivering Strong Results: Several tech giants exceeded expectations, reporting significant revenue growth and robust profits. This positive news boosted investor confidence in the technology sector and the broader market.

- Positive Earnings Surprises: Many companies delivered earnings surprises, exceeding analysts' forecasts. This signals robust financial health and future growth potential, attracting more investment.

- Strong Consumer Spending: Reports of healthy consumer spending further reinforced the positive narrative around corporate profits and overall economic health. This positive stock performance across key sectors significantly influenced the stock market today.

Easing Interest Rate Concerns

The Federal Reserve's recent statements and actions regarding interest rate hikes have also contributed to the market's positive sentiment.

- Potential Pause in Rate Hikes: Market participants interpreted recent Fed comments as suggesting a potential pause or slowdown in future interest rate increases. This easing of interest rate concerns has reduced investor anxieties about higher borrowing costs.

- Focus Shifting to Inflation Control: The Fed's increased focus on controlling inflation without triggering a recession is being viewed favorably by investors. The belief that the Fed can engineer a "soft landing" is boosting confidence.

- Impact on Monetary Policy: This shift in monetary policy outlook has led to a reduction in uncertainty and risk aversion, allowing investors to become more bullish.

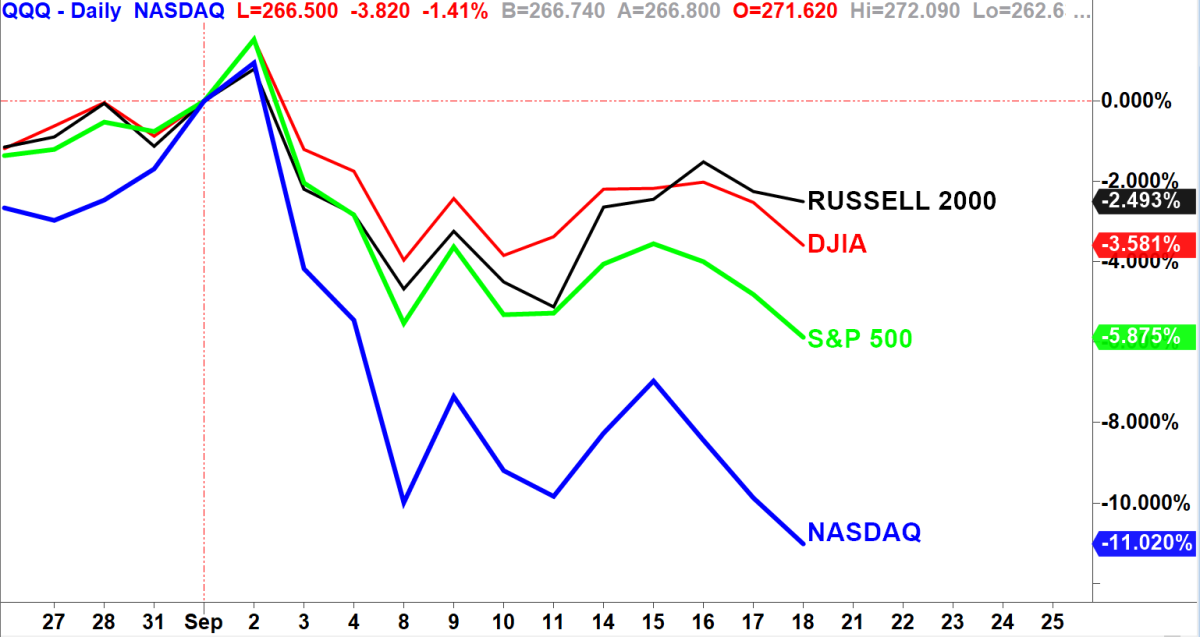

Nasdaq and S&P 500 Performance: Following the Dow's Lead

The Nasdaq Composite and the S&P 500 followed the Dow's lead, registering substantial gains. This suggests a broad-based market rally, not just a sector-specific phenomenon. Both indices saw percentage increases mirroring the Dow's impressive performance. The breadth of the market's rally indicates a strong upswing in overall investor confidence. Leading sectors contributing to gains in the Nasdaq and S&P 500 included technology and consumer discretionary. This broad-based sector performance reinforces the strength of today's stock market rally.

Potential Implications and Future Outlook

This significant stock market surge has significant short-term and long-term implications. While the current picture is positive, potential risks remain.

- Short-Term Implications: The rally could lead to increased investor participation and further upward momentum in the short term. However, the market remains vulnerable to unforeseen events.

- Long-Term Implications: Continued strong economic data and corporate earnings could sustain the upward trend. However, persistent inflation, geopolitical risks, and potential unforeseen economic shocks could reverse the current trend.

- Market Volatility: Despite today's surge, investors should be aware of inherent market volatility. The market can quickly shift, as witnessed by sharp price swings in recent years.

- Expert Opinions: Many experts are cautiously optimistic about the market’s future trajectory, but they emphasize the need for careful risk management and diversified investment strategies. It’s crucial to follow reputable sources for informed investment decisions.

Conclusion: Understanding Today's Stock Market Rally: What's Next?

Today's significant increase in the Dow, Nasdaq, and S&P 500 was driven by a combination of positive economic indicators, strong corporate earnings, and easing interest rate concerns. While this stock market rally is impressive, investors should remain aware of potential risks and the inherent volatility of the market. The key takeaways are the strength of the economic data, the positive corporate earnings reports, and the impact of shifting interest rate expectations on investor sentiment. This improved market outlook provides a better overall picture, but informed decision-making remains paramount.

Stay informed about the daily stock market news and understand the factors driving today's stock market movements. Research potential investments thoroughly and consult with a financial advisor before making any investment decisions. Understanding today's stock market is crucial for navigating the complexities of the financial world.

Featured Posts

-

John Travoltas Lowest Rated Movies A Rotten Tomatoes Analysis

Apr 24, 2025

John Travoltas Lowest Rated Movies A Rotten Tomatoes Analysis

Apr 24, 2025 -

Warriors Victory Sends Hornets To Seventh Straight Loss

Apr 24, 2025

Warriors Victory Sends Hornets To Seventh Straight Loss

Apr 24, 2025 -

Hong Kong Stock Market Rally Chinese Stocks Soar On Trade Hopes

Apr 24, 2025

Hong Kong Stock Market Rally Chinese Stocks Soar On Trade Hopes

Apr 24, 2025 -

Teslas Reduced Q1 Earnings Analyzing The Musk Trump Administration Connection

Apr 24, 2025

Teslas Reduced Q1 Earnings Analyzing The Musk Trump Administration Connection

Apr 24, 2025 -

Google Chrome Acquisition Rumor A Chat Gpt Leaders Perspective

Apr 24, 2025

Google Chrome Acquisition Rumor A Chat Gpt Leaders Perspective

Apr 24, 2025