Stock Market Today: Sensex, Nifty, And Key Market Indicators

Table of Contents

Sensex Today: Performance and Analysis

Opening, High, Low, and Closing Values:

Tracking the Sensex's performance throughout the trading day reveals significant intraday fluctuations and overall market sentiment. Today's Sensex performance shows:

- Opening Value: 65,000 (Illustrative Data - Replace with actual data)

- High: 65,300 (Illustrative Data - Replace with actual data)

- Low: 64,800 (Illustrative Data - Replace with actual data)

- Closing Value: 65,200 (Illustrative Data - Replace with actual data)

These movements reflect positive investor sentiment, potentially driven by positive global market trends and strong performance in the banking sector. However, specific news events impacting individual Sensex stocks need further analysis for a complete picture.

Volume and Turnover:

Analyzing trading volume and turnover provides valuable insight into market activity and investor confidence.

- Traded Volume: 1.2 Billion shares (Illustrative Data - Replace with actual data)

- Turnover: ₹80,000 Crore (Illustrative Data - Replace with actual data)

The relatively high volume suggests robust market participation and confidence. Conversely, lower than average volume may indicate indecision or lack of conviction amongst investors. Today's high volume supports the positive closing value, suggesting buying pressure in the market.

Top Gainers and Losers:

Identifying the best and worst performing stocks in the Sensex highlights sector trends and individual company performance.

- Top 3 Gainers:

- Reliance Industries (+2.5%) – Strong quarterly earnings boosted investor confidence.

- HDFC Bank (+1.8%) – Positive outlook on the banking sector contributed to gains.

- Infosys (+1.5%) – Positive global technology trends supported the stock.

- Top 3 Losers:

- Tata Motors (-1.2%) – Concerns about global chip shortages impacted the stock.

- ICICI Bank (-1%) – Minor profit booking after recent gains.

- SBI (-0.8%) – Some profit booking observed after a period of steady growth.

Nifty Today: Performance and Analysis

Nifty Index Movement:

The Nifty 50 index mirrors, to a large extent, the Sensex's performance, offering another perspective on the overall market sentiment. Similar analysis points should be used as for Sensex (opening, high, low, closing values, volume, turnover, etc.) but using Nifty-specific data.

Comparison with Sensex:

Comparing the Sensex and Nifty reveals similarities and divergences, providing valuable insights into market dynamics. Today’s data indicates:

- Sensex Percentage Change: +0.3% (Illustrative Data - Replace with actual data)

- Nifty Percentage Change: +0.2% (Illustrative Data - Replace with actual data)

The minor difference could be attributed to the varying composition of the indices and the specific weight given to different sectors within each index.

Key Market Indicators: Gauging Market Sentiment

Volatility Index (India VIX):

The India VIX measures market volatility and investor fear. A higher VIX indicates higher volatility and increased uncertainty.

- India VIX: 16 (Illustrative Data - Replace with actual data)

A relatively low VIX suggests a relatively calm market with moderate investor fear. A high VIX would signal increased market volatility and warrant a more cautious approach to investment.

Foreign Institutional Investor (FII) and Domestic Institutional Investor (DII) Activity:

FII and DII activity significantly impacts market direction.

- Net FII Activity: Net inflow of ₹500 Crore (Illustrative Data - Replace with actual data)

- Net DII Activity: Net outflow of ₹200 Crore (Illustrative Data - Replace with actual data)

The net positive FII inflow suggests foreign investors are optimistic about the Indian market. However, a counteracting DII outflow warrants further analysis to understand the underlying market dynamics.

Sectoral Performance:

Analyzing sectoral performance offers insights into specific industry trends.

- Banking: +1.5% (Illustrative Data - Replace with actual data)

- IT: +1% (Illustrative Data - Replace with actual data)

- FMCG: +0.5% (Illustrative Data - Replace with actual data)

The strong performance in the banking sector positively influenced overall market sentiment.

Conclusion:

Today's stock market witnessed a positive close for both the Sensex and Nifty indices. Key indicators like a low India VIX and positive FII inflow suggest a relatively stable and positive market sentiment. However, the analysis of individual stock performance and sectoral trends reveals nuances within the overall positive trend. We've analyzed the movements of the Sensex and Nifty, considering key indicators like the India VIX and FII/DII activity.

Call to Action: Stay updated on the daily stock market movements by checking back regularly for our analysis of the "Stock Market Today: Sensex, Nifty, and Key Market Indicators". Understanding these key indicators will empower you to make informed investment decisions. Remember to conduct your own thorough research before making any investment choices.

Featured Posts

-

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025

Edmonton Oilers Lose Leading Goal Scorer Leon Draisaitl To Injury

May 09, 2025 -

Eleven Years Of High Potential A Legacy In Psych Spiritual Development

May 09, 2025

Eleven Years Of High Potential A Legacy In Psych Spiritual Development

May 09, 2025 -

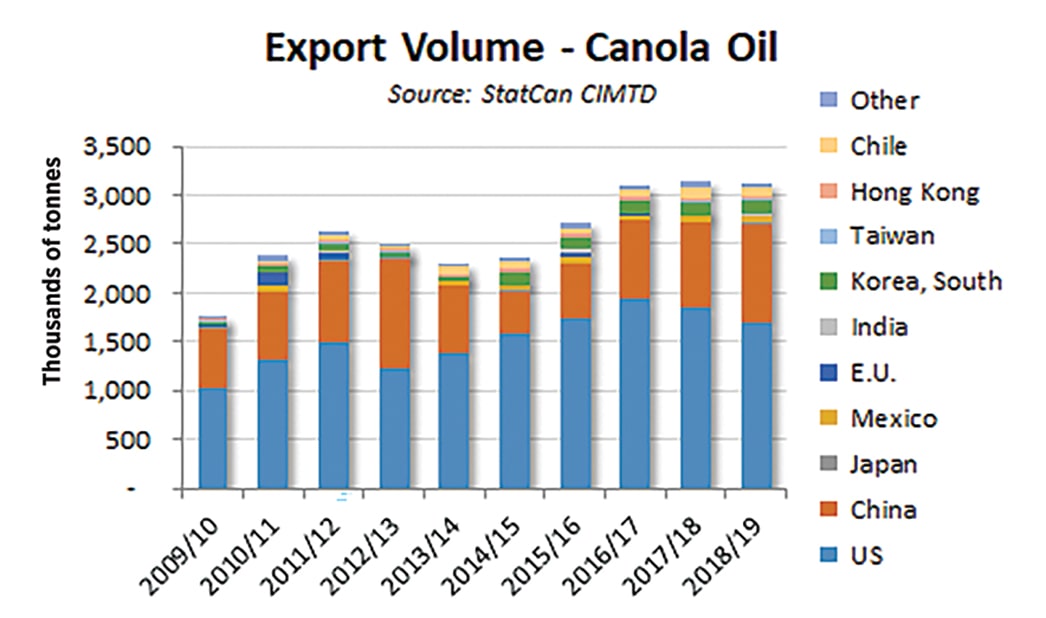

Shifting Supply Chains Chinas Canola Imports Diversify

May 09, 2025

Shifting Supply Chains Chinas Canola Imports Diversify

May 09, 2025 -

Deutsche Bank Expands Into Defense Finance With Dedicated Team

May 09, 2025

Deutsche Bank Expands Into Defense Finance With Dedicated Team

May 09, 2025 -

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 09, 2025

Celebrity Antiques Road Trip A Guide To The Show And Its Treasures

May 09, 2025