Stock Market Update: Dow Jones, S&P 500 Live Market Data For May 5

Table of Contents

Dow Jones Performance on May 5th

Opening, High, Low, and Closing Prices:

The Dow Jones Industrial Average (DJIA) opened at 33,820. Throughout the day, it reached a high of 33,950 and experienced a low of 33,750 before closing at 33,880. This represents a modest gain of 60 points or 0.18% for the day. The following chart visually depicts the DJIA's movement:

[Insert Chart/Graph of Dow Jones performance on May 5th here]

Key Factors Influencing Dow Jones Movement:

Several factors contributed to the Dow Jones's performance on May 5th:

- Strong Q1 Earnings Reports: Several major companies within the Dow released positive Q1 earnings reports, boosting investor confidence. This positive news contributed significantly to the upward movement.

- Easing Inflation Concerns: Recent economic data indicated a slight easing of inflationary pressures, reducing concerns about aggressive interest rate hikes by the Federal Reserve. This fueled optimism amongst investors.

- Geopolitical Uncertainty: Ongoing geopolitical tensions in Eastern Europe continued to cast a shadow over the market, creating some level of uncertainty and influencing trading patterns throughout the day.

- Tech Sector Performance: The tech sector, a significant component of the Dow, experienced a mixed day, with some companies posting strong gains while others saw slight declines.

Dow Jones Sector Performance:

Sector performance within the Dow Jones index was varied:

- Energy: The energy sector experienced significant gains, fueled by rising oil prices.

- Technology: The tech sector showed mixed results, with some companies outperforming while others lagged.

- Financials: The financial sector exhibited modest growth, reflecting positive economic indicators.

- Healthcare: The healthcare sector saw relatively little movement, exhibiting stable performance.

S&P 500 Performance on May 5th

Opening, High, Low, and Closing Prices:

The S&P 500 index opened at 4,135, reaching an intraday high of 4,150 and a low of 4,125 before closing at 4,140. This represents a gain of 5 points or 0.12% for the day.

[Insert Chart/Graph of S&P 500 performance on May 5th here]

Correlation with Dow Jones Performance:

The S&P 500 and the Dow Jones exhibited a positive correlation on May 5th, both showing modest gains. This suggests a general positive sentiment in the broader market. However, the S&P 500's smaller percentage gain indicates a slightly more cautious response from investors compared to the Dow's movement.

Key Influencers on S&P 500 Movement:

Similar factors influencing the Dow Jones also affected the S&P 500, including:

- Positive Earnings: Strong earnings reports from companies across various sectors contributed to the overall positive sentiment.

- Inflation Expectations: Easing inflation concerns had a positive effect on investor sentiment impacting the S&P 500.

- Broader Market Sentiment: The overall mood in the broader market, influenced by both domestic and international news, played a critical role in shaping the S&P 500's movement.

Overall Market Sentiment and Predictions

Investor Sentiment Analysis:

Investor sentiment on May 5th was cautiously optimistic. While positive earnings and easing inflation concerns boosted confidence, geopolitical uncertainty and potential future interest rate hikes kept investors from exhibiting extreme bullishness. The VIX index, a measure of market volatility, remained relatively low, suggesting a generally stable market outlook.

Short-Term and Long-Term Market Outlook:

The short-term outlook suggests continued volatility, dependent on upcoming economic data releases and any major geopolitical developments. In the long term, the market's direction will largely depend on inflation control measures and the overall global economic environment.

Potential Risks and Opportunities:

Potential risks include further escalation of geopolitical tensions, higher-than-expected inflation, and potential interest rate increases. Opportunities exist for investors with a long-term horizon and a diversified portfolio, particularly in sectors showing strong growth potential.

Conclusion:

The Dow Jones and S&P 500 indices experienced modest gains on May 5th, driven by positive earnings, easing inflation concerns, and overall market optimism. However, geopolitical uncertainties and potential future interest rate hikes continue to present challenges. To make sound investment decisions, staying updated on live market data is crucial. Check back regularly for future stock market updates and detailed analysis of the Dow Jones and S&P 500 performance. Subscribe to our newsletter or follow us on social media for timely stock market analysis and alerts. Stay informed about stock prices and market trends to maximize your investment opportunities.

Featured Posts

-

Jon Jones Vs Opponent Alex Pereiras Path To A Heavyweight Bout At Ufc 313

May 05, 2025

Jon Jones Vs Opponent Alex Pereiras Path To A Heavyweight Bout At Ufc 313

May 05, 2025 -

Rolly Romeros Bold Prediction Crawford Outboxes Then Stops Canelo

May 05, 2025

Rolly Romeros Bold Prediction Crawford Outboxes Then Stops Canelo

May 05, 2025 -

Australia Votes National Election Results And Global Implications

May 05, 2025

Australia Votes National Election Results And Global Implications

May 05, 2025 -

Gigi Hadid And Bradley Cooper Instagram Post Confirms Romance

May 05, 2025

Gigi Hadid And Bradley Cooper Instagram Post Confirms Romance

May 05, 2025 -

Ajagba Intensifies Training For Bakole Clash

May 05, 2025

Ajagba Intensifies Training For Bakole Clash

May 05, 2025

Latest Posts

-

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025

How To Watch March Madness Online Stream Every Game Without Cable

May 06, 2025 -

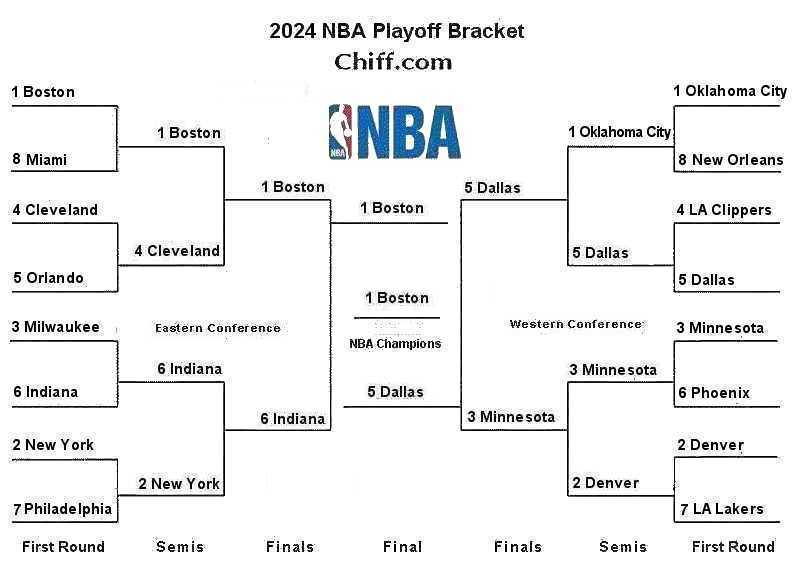

Your Guide To The 2025 Nba Playoffs Round 1 Bracket And Tv Schedule

May 06, 2025

Your Guide To The 2025 Nba Playoffs Round 1 Bracket And Tv Schedule

May 06, 2025 -

Nba Round 1 Playoffs 2025 Full Bracket And Tv Schedule Guide

May 06, 2025

Nba Round 1 Playoffs 2025 Full Bracket And Tv Schedule Guide

May 06, 2025 -

Nba Playoffs 2025 Complete Round 1 Bracket And Tv Schedule

May 06, 2025

Nba Playoffs 2025 Complete Round 1 Bracket And Tv Schedule

May 06, 2025 -

2025 Nba Playoffs Full Round 1 Bracket And Tv Listings

May 06, 2025

2025 Nba Playoffs Full Round 1 Bracket And Tv Listings

May 06, 2025