Stock Market Valuation Concerns? BofA Offers A Different Perspective

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's analysis counters the narrative of an overvalued market by focusing on several key factors. They argue that a simplistic reliance on price-to-earnings (P/E) ratios alone overlooks crucial elements of the current economic climate.

Focus on Earnings Growth

BofA emphasizes robust corporate earnings growth as a key counterpoint to high P/E ratios. Their argument is that while valuations may appear high, strong earnings growth can justify these levels.

- Examples of strong earnings growth: BofA highlights sectors like technology (particularly within AI and cloud computing) and healthcare (driven by innovation and aging populations) as exhibiting exceptional earnings growth.

- Projected earnings growth: BofA's models project continued robust corporate profit growth for the next few years, exceeding the rate of inflation and supporting current market valuations. Specific companies within their analysis, showing impressive year-over-year earnings increases, further reinforce this argument.

- Impact on stock market performance: This sustained earnings growth, according to BofA, is a key driver for positive stock market performance, offsetting concerns about elevated P/E ratios.

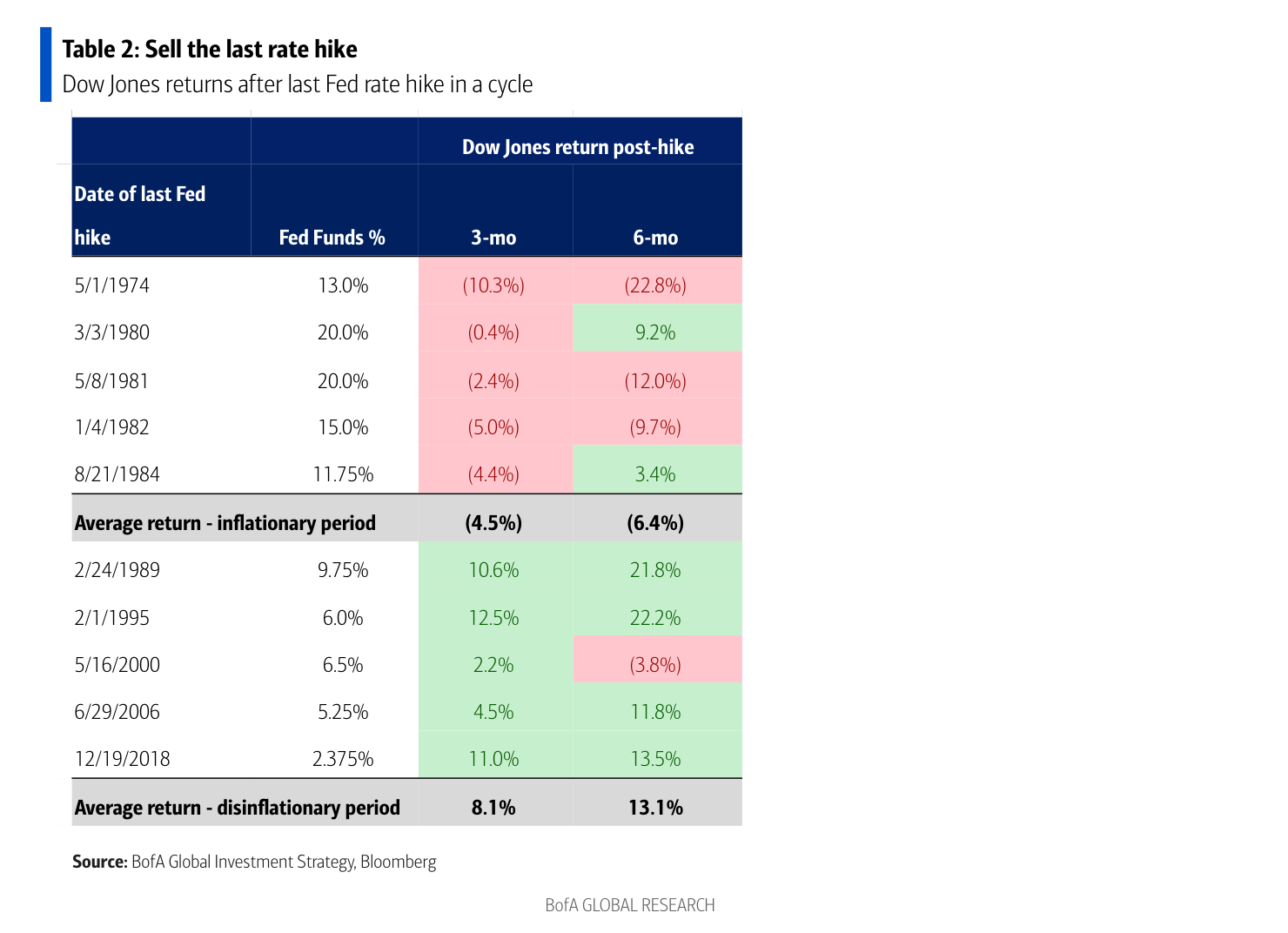

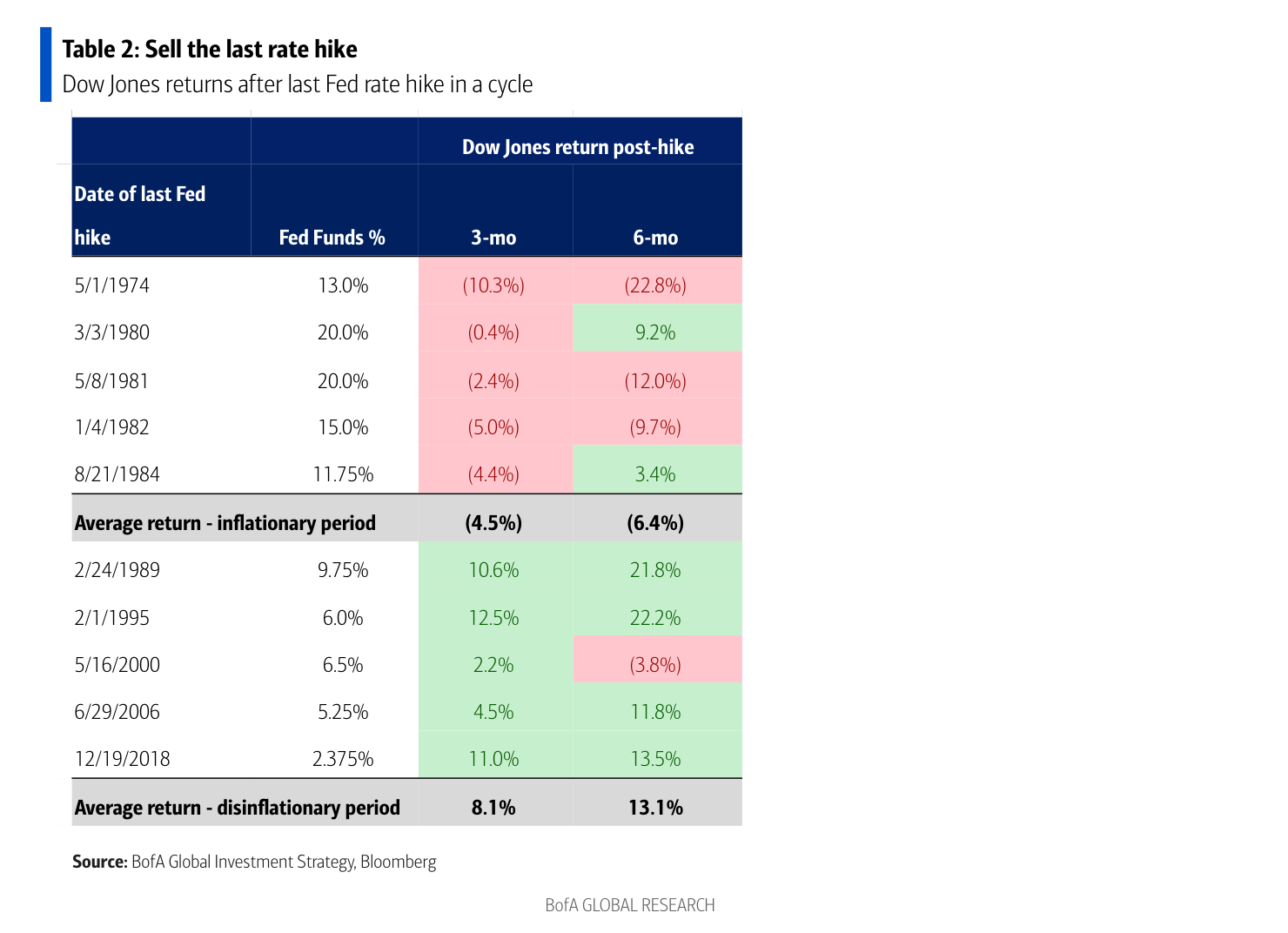

The Role of Interest Rates

BofA's analysis delves into the impact of interest rates on stock valuations, offering a perspective that differs from the prevailing market pessimism.

- BofA's interest rate forecasts: BofA projects interest rates to remain relatively stable, potentially even declining slightly in the medium term, a prediction that differs from those anticipating significantly higher rates.

- Interest rate impact on stock valuations: While higher interest rates generally lower stock valuations (by increasing the discount rate used to calculate present value), BofA argues that the projected stability and potential decline in rates mitigate this negative effect.

- Economic indicators: Their analysis considers various economic indicators, including inflation levels and economic growth, to arrive at their interest rate forecasts and assess their impact on market capitalization.

Addressing Inflation Concerns

BofA acknowledges concerns about inflation's effect on stock prices but presents arguments for why inflation might not be as detrimental as many fear.

- BofA's inflation predictions: Their models suggest that inflation will gradually decline, approaching more manageable levels within the next few years.

- Inflation mitigation strategies: BofA suggests strategies for mitigating inflation risks, such as investing in companies with strong pricing power or those that benefit from inflationary environments (e.g., certain commodities).

- Inflation-resistant sectors: Certain sectors, such as energy and healthcare, might show resilience or even benefit from inflationary pressures, according to BofA's research. This points to specific investment opportunities amidst inflationary concerns.

BofA's Investment Recommendations

Based on their valuation analysis, BofA provides specific investment recommendations for navigating the current market environment.

Sector-Specific Opportunities

BofA recommends a strategic approach to sector allocation, focusing on sectors with strong growth prospects and relatively attractive valuations.

- High-growth sectors: Technology (specifically AI and cloud), healthcare (biotechnology and pharmaceuticals), and selected areas within the energy sector (renewable energy) are cited as promising areas for investment.

- Reasons for recommendations: These selections are based on factors like strong earnings growth potential, technological disruption, and the long-term growth of underlying markets.

- Risk and reward considerations: While these sectors hold potential for significant returns, BofA cautions about inherent risks and the importance of diligent risk management.

Strategic Asset Allocation

BofA proposes a diversified asset allocation strategy that aligns with their valuation perspective.

- Recommended asset classes: While maintaining a core position in equities, BofA suggests including a strategic allocation to bonds to balance portfolio risk and potentially benefit from declining interest rates.

- Percentage allocation suggestions: The exact allocation will vary based on individual risk tolerance and investment goals, but BofA provides guidance on balancing equity and fixed-income exposure.

- Justification for the allocation strategy: This diversified approach aims to optimize portfolio returns while mitigating potential market downturns.

Counterarguments and Potential Risks

It's crucial to acknowledge potential criticisms and limitations of BofA's analysis.

Addressing Criticisms of BofA's Analysis

While BofA presents a compelling case, several points warrant consideration.

- Methodological limitations: The specific methodologies used by BofA might be subject to limitations, and alternative interpretations of the data are possible.

- Alternative data interpretations: Other analysts may disagree with BofA's interpretation of certain economic indicators or market trends.

- Assumptions and uncertainties: BofA's analysis relies on certain assumptions about future economic growth, interest rates, and inflation, which might not materialize.

Geopolitical and Economic Uncertainties

Several geopolitical and economic factors could impact BofA's outlook.

- Geopolitical risks: Geopolitical events, such as international conflicts or trade disputes, introduce substantial uncertainty and could significantly affect market performance.

- Economic downturns: The possibility of an unexpected economic downturn or recession poses a significant risk to the investment outlook.

- Unforeseen circumstances: Unexpected events or "black swan" occurrences can disrupt markets and invalidate even the most well-informed analyses.

Stock Market Valuation Concerns? A Balanced Perspective from BofA

BofA's analysis offers a valuable counterpoint to prevailing anxieties surrounding stock market valuation. They emphasize the importance of focusing on robust earnings growth, considering the impact of interest rate projections, and acknowledging, yet mitigating, inflation concerns. Their investment recommendations include sector-specific opportunities and a balanced asset allocation strategy. However, it's crucial to remember that any investment strategy carries risks, and geopolitical and economic uncertainties remain. Conduct thorough due diligence, assess your risk tolerance, and consider seeking professional financial advice before making any investment decisions. Understand stock market valuation better by exploring BofA's research and develop your own informed approach to navigate stock market valuation concerns effectively. Assess your investment strategy based on BofA's insights to make well-informed decisions.

Featured Posts

-

Andrzej Zulawskis Possession Examining The Complex Relationship Between Sister Faith And Sister Chance Via The Lady Killers Podcast

Apr 27, 2025

Andrzej Zulawskis Possession Examining The Complex Relationship Between Sister Faith And Sister Chance Via The Lady Killers Podcast

Apr 27, 2025 -

The Popes Funeral How Trumps Presence Shaped The Narrative

Apr 27, 2025

The Popes Funeral How Trumps Presence Shaped The Narrative

Apr 27, 2025 -

Posthaste Impact Analyzing The Unforeseen Job Losses In Canadas Auto Sector Due To Trumps Tariffs

Apr 27, 2025

Posthaste Impact Analyzing The Unforeseen Job Losses In Canadas Auto Sector Due To Trumps Tariffs

Apr 27, 2025 -

Major Acquisition Cma Cgm Expands Into Turkeys Logistics Market

Apr 27, 2025

Major Acquisition Cma Cgm Expands Into Turkeys Logistics Market

Apr 27, 2025 -

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 27, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 27, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

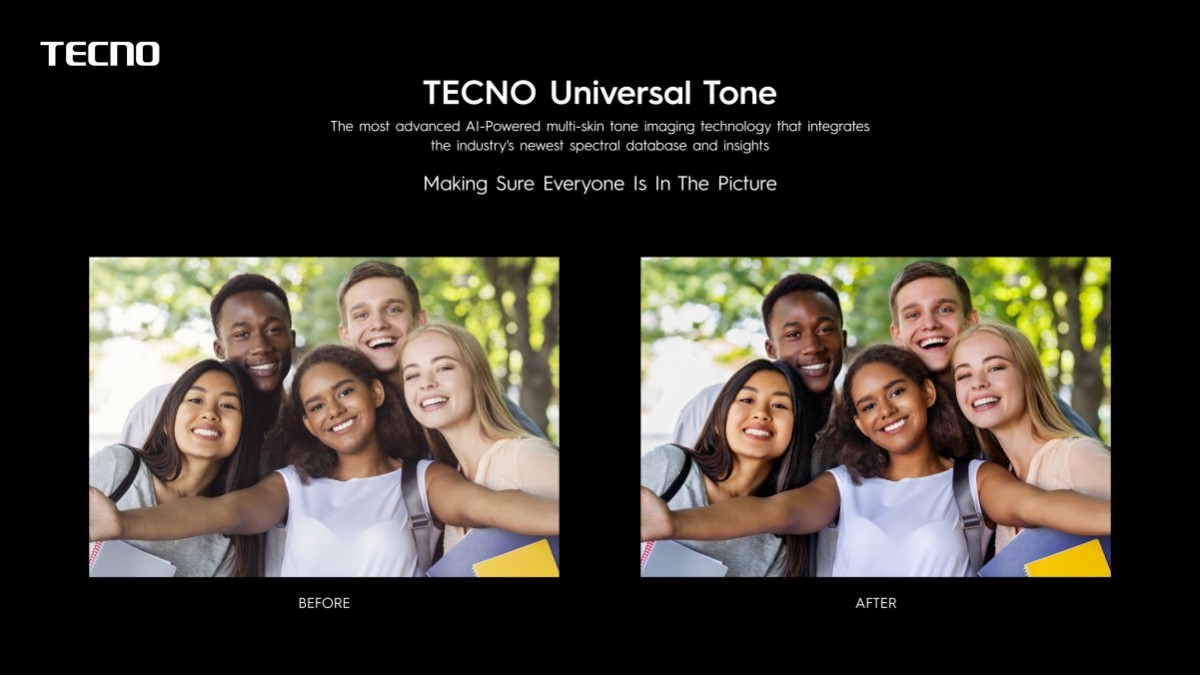

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Oppo Find X8 Ultra

Apr 28, 2025

Oppo Find X8 Ultra

Apr 28, 2025 -

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025

Red Sox Injury Updates For Crawford Bello Abreu And Rafaela

Apr 28, 2025 -

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025

Boston Red Sox Injury News Kutter Crawford Brayan Bello Wilyer Abreu And Ceddanne Rafaela

Apr 28, 2025