Stock Market Valuation Concerns? BofA Offers A Different Viewpoint

Table of Contents

BofA's Contrarian Stance on Stock Market Valuation

While many analysts express concerns about inflated stock market valuations, BofA maintains a more optimistic outlook. Their analysis suggests that current valuations, while seemingly high based on traditional metrics, are justifiable considering several key factors. This contrasts sharply with the prevailing narrative of impending market downturn fueled by overvaluation concerns.

- Highlighting BofA's Reports: BofA's research reports, frequently cited by financial news outlets, highlight the strength of corporate earnings and the potential for continued growth, tempering concerns about excessive equity valuation. These reports often delve into sector-specific analyses, identifying pockets of undervaluation within the broader market.

- Key Metrics Used: BofA utilizes a range of valuation metrics beyond simple Price-to-Earnings (P/E) ratios. They employ more sophisticated models, including discounted cash flow analysis, to assess the intrinsic value of companies and the overall market. This multifaceted approach offers a more comprehensive view of stock market valuation than simpler, potentially misleading metrics.

- Specific Sectors and Companies: BofA's analysts have consistently pointed to specific sectors, such as technology and certain segments of the healthcare industry, as potentially undervalued despite the broader market concerns. They cite strong future earnings potential and disruptive technological advancements as drivers of future growth within these sectors.

Analyzing the Factors Shaping BofA's Perspective

BofA's differing valuation opinion stems from a careful consideration of several key factors, painting a more positive picture than many other analyses.

- Interest Rates and Monetary Policy: BofA's assessment considers the impact of interest rates and the overall monetary policy environment. While rising interest rates can theoretically put downward pressure on valuations, BofA analyzes the potential for continued economic growth to offset this effect.

- Corporate Earnings Growth: A crucial aspect of BofA's analysis centers on strong corporate earnings growth and projections for future profitability. Their research suggests that many companies are exceeding expectations, supporting the current valuations.

- Macroeconomic Factors: BofA's view incorporates a thorough assessment of macroeconomic factors such as inflation, global economic growth, and geopolitical risks. Their analysis considers the interplay of these factors and their potential impact on valuations. They acknowledge potential risks but believe the current growth trajectory outweighs these concerns.

- Technological Advancements: Disruptive technologies and industry transformations are integral to BofA's outlook. The potential for innovation to drive future growth and profitability plays a major role in their valuation assessment.

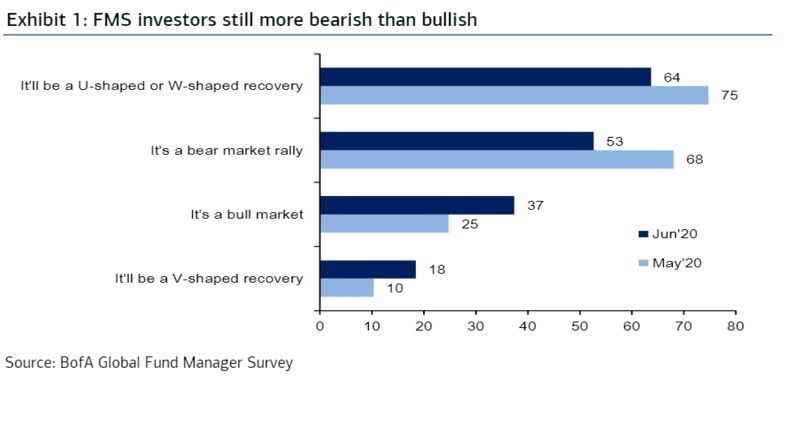

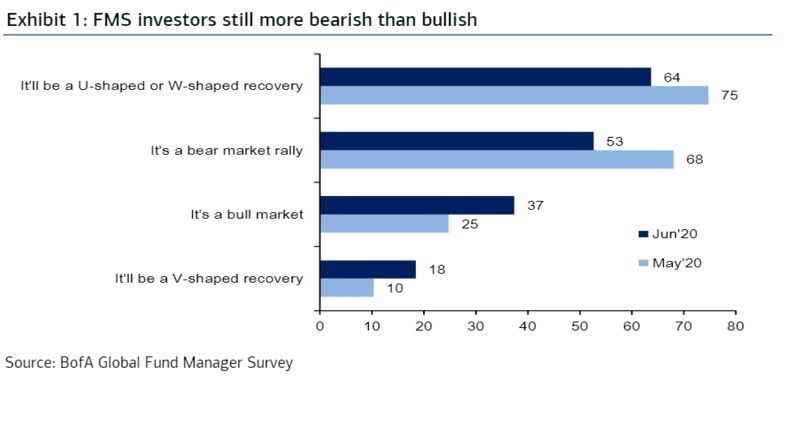

Comparing BofA's Viewpoint with Other Market Analyses

BofA's perspective isn't universally shared. Many other financial institutions and analysts hold more cautious views on stock market valuation.

- Differing Viewpoints: Some analysts express significant concern about market overvaluation, highlighting potential risks associated with high P/E ratios and potential interest rate hikes. They often advocate for a more conservative investment strategy.

- Points of Convergence and Divergence: While differing in their overall conclusions, various analyses often agree on certain aspects, such as the importance of corporate earnings and macroeconomic factors. However, the weight given to each factor and the interpretation of current trends significantly influence the final valuation assessment.

- Implications for Investors: These contrasting viewpoints underscore the complexity of market valuation and highlight the need for investors to conduct thorough due diligence before making investment decisions. The potential consequences of choosing the wrong strategy based on one biased viewpoint are considerable.

Navigating Investor Uncertainty in the Face of Conflicting Opinions

The divergence in market valuation opinions can be daunting for investors. Navigating this uncertainty requires a well-defined approach.

- Diversified Investment Strategies: A diversified portfolio is crucial to mitigate risk associated with market fluctuations. Spreading investments across different asset classes reduces the impact of any single market segment's underperformance.

- Thorough Due Diligence and Fundamental Analysis: Investors should conduct thorough research, focusing on fundamental analysis to understand the intrinsic value of companies before making investment decisions. This includes scrutinizing financial statements and conducting industry research.

- Consult Financial Advisors: Seeking guidance from a qualified financial advisor can provide personalized advice tailored to individual investment goals, risk tolerance, and financial circumstances.

Conclusion

BofA's alternative perspective on stock market valuations provides a crucial counterpoint to the prevailing concerns. Their analysis emphasizes the role of strong corporate earnings, technological advancements, and a nuanced view of macroeconomic factors. While concerns about market valuation remain valid, it's crucial to consider multiple viewpoints, conduct thorough research, and potentially consult with a financial advisor before making any investment decisions. By understanding both perspectives and conducting thorough research, investors can make more informed decisions regarding their investment strategies. Learn more about BofA's insights and develop a robust approach to managing your stock market valuation concerns.

Featured Posts

-

Charlene De Monaco El Lino Una Opcion Elegante Para El Otono

May 26, 2025

Charlene De Monaco El Lino Una Opcion Elegante Para El Otono

May 26, 2025 -

Understanding The I O And Io Debate Google And Open Ais Rivalry

May 26, 2025

Understanding The I O And Io Debate Google And Open Ais Rivalry

May 26, 2025 -

A Fathers Strength Jonathan Peretz Holds His Son After A Year Of Grief

May 26, 2025

A Fathers Strength Jonathan Peretz Holds His Son After A Year Of Grief

May 26, 2025 -

Jadwal Moto Gp Inggris 2025 Saksikan Race Dan Fp 1 Di Trans7

May 26, 2025

Jadwal Moto Gp Inggris 2025 Saksikan Race Dan Fp 1 Di Trans7

May 26, 2025 -

Deces D Albert Luthers Thierry Luthers En Deuil

May 26, 2025

Deces D Albert Luthers Thierry Luthers En Deuil

May 26, 2025

Latest Posts

-

Accords France Vietnam Investir Dans Une Mobilite Durable Et Innovante

May 30, 2025

Accords France Vietnam Investir Dans Une Mobilite Durable Et Innovante

May 30, 2025 -

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025

Cooperation Franco Vietnamienne Nouvelles Perspectives Pour Une Mobilite Durable

May 30, 2025 -

Mobilite Durable Le Renforcement De La Cooperation Entre La France Et Le Vietnam

May 30, 2025

Mobilite Durable Le Renforcement De La Cooperation Entre La France Et Le Vietnam

May 30, 2025 -

Bordeaux La Piste Secondaire Au C Ur D Une Manifestation

May 30, 2025

Bordeaux La Piste Secondaire Au C Ur D Une Manifestation

May 30, 2025 -

France Et Le Vietnam Un Partenariat Renforce Pour La Mobilite Durable

May 30, 2025

France Et Le Vietnam Un Partenariat Renforce Pour La Mobilite Durable

May 30, 2025