Stock Market Valuation Concerns? BofA Offers A Reason For Calm

Table of Contents

BofA's Bullish Stance on Stock Market Valuation

Despite the seemingly high valuations across the board, BofA maintains a bullish stance on the stock market. Their positive outlook is not blind optimism but rather a reasoned assessment based on several key factors.

The Role of Corporate Earnings Growth

BofA's analysis highlights robust corporate earnings growth as a key justification for current valuations. This strong growth isn't merely projected; it's supported by tangible evidence.

- Strong revenue growth projections for specific sectors: Technology, healthcare, and consumer staples are showing particularly strong revenue growth, exceeding many initial market expectations. This sustained growth fuels investor confidence and justifies higher price-to-earnings (P/E) ratios.

- Improved profit margins due to increased efficiency and cost-cutting measures: Many companies have streamlined operations and implemented effective cost-cutting strategies, leading to improved profit margins, even amidst rising input costs.

- Positive impact of technological advancements on earnings: Technological innovation is driving efficiency gains and creating new revenue streams across various sectors, contributing significantly to earnings growth and bolstering market valuation.

Low Interest Rates and Their Influence

The prevailing low interest rate environment plays a significant role in supporting higher stock valuations. While high valuations might raise eyebrows in a high-interest-rate scenario, the current environment shifts the perspective.

- Comparison of current interest rates to historical averages: Current interest rates remain historically low, making equities a more attractive investment compared to bonds or other fixed-income instruments.

- Impact of low rates on borrowing costs for companies: Low borrowing costs enable companies to invest more readily in expansion and innovation, fueling further earnings growth and supporting market valuations.

- Attractiveness of equities relative to bonds: With low bond yields, investors are increasingly drawn to the potential for higher returns offered by the equity market, driving up demand and, consequently, valuations.

Long-Term Growth Potential and Future Outlook

BofA's optimistic outlook extends beyond the short term, focusing on long-term economic growth potential.

- Key economic indicators supporting their optimistic outlook: Factors like improving consumer confidence, steady job growth, and ongoing government investment in infrastructure support their projection for sustained economic expansion.

- Potential for continued innovation and technological disruption: Continued technological advancements promise further economic growth and create exciting investment opportunities across various sectors. This ongoing innovation is a significant driver for long-term stock market growth.

- Positive demographic trends that support market growth: Favorable demographic trends in several key markets also contribute to the long-term growth outlook, adding another layer of support to BofA's bullish prediction.

Addressing Common Stock Market Valuation Concerns

Despite BofA's positive perspective, concerns about high stock market valuations are understandable. Many investors worry about the potential for a market correction or even a bursting bubble.

Counterarguments to Valuation Concerns

BofA directly addresses these concerns by leveraging data and analysis to refute common fears.

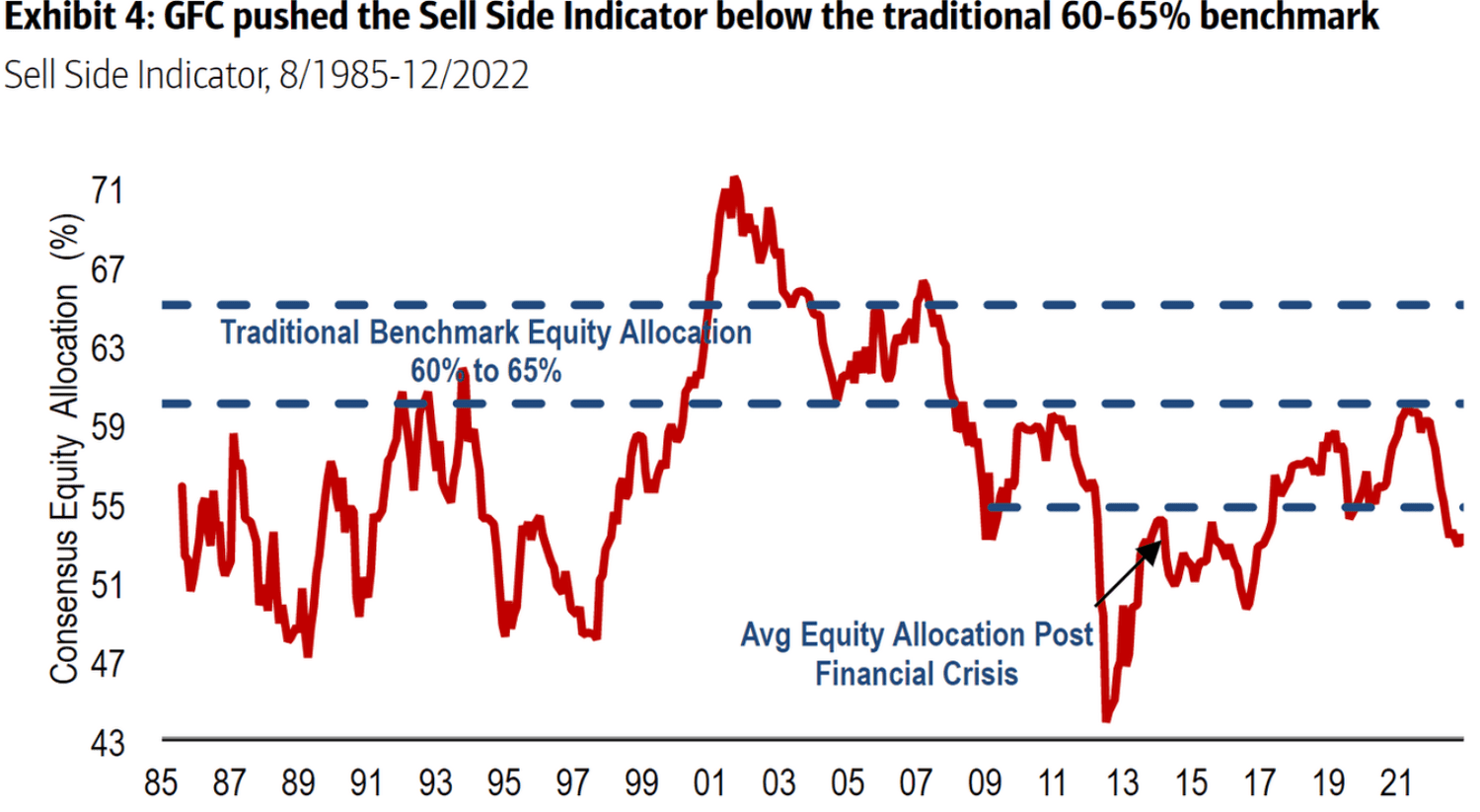

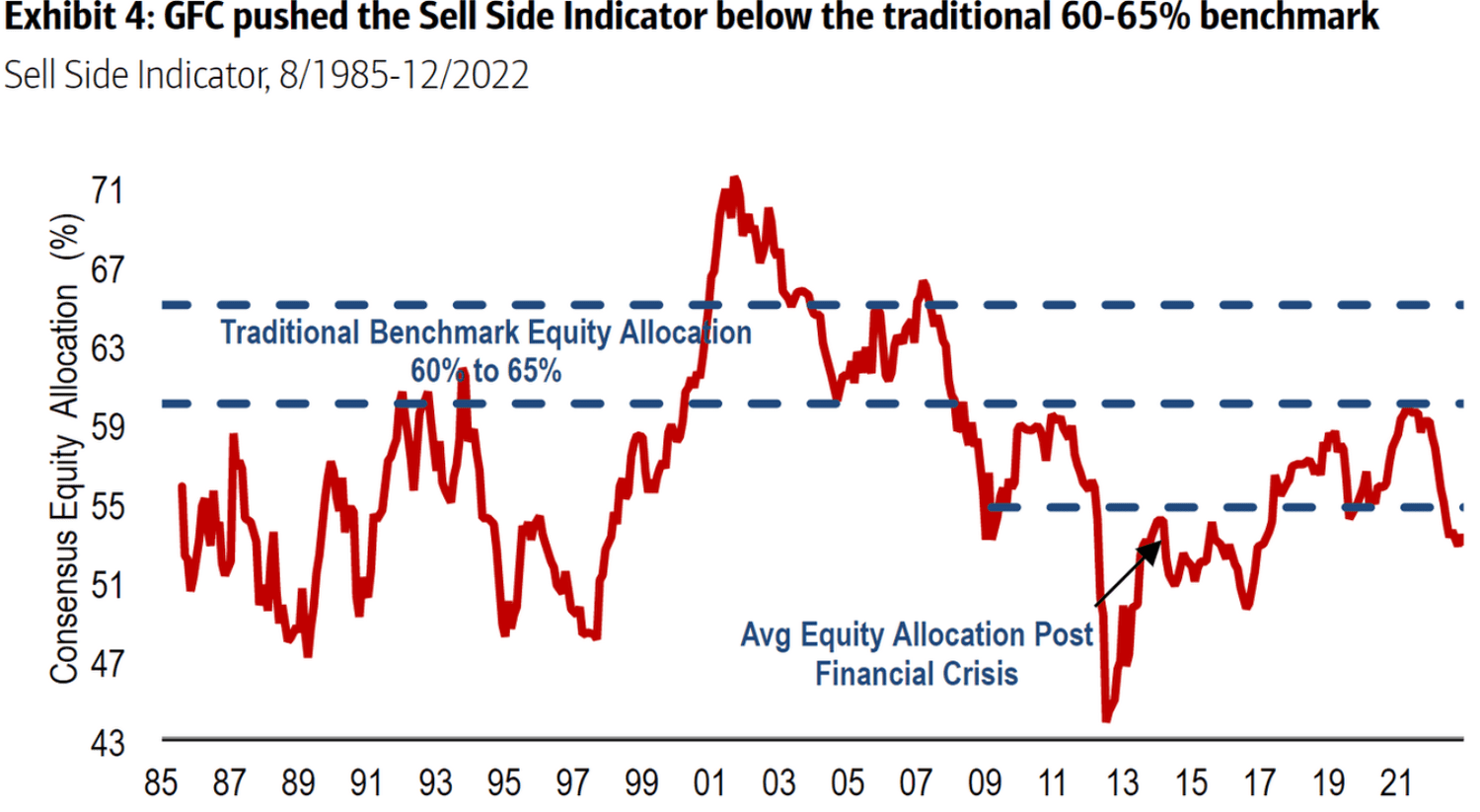

- Refuting the "bubble" argument with specific market data: By comparing current market valuations to historical data, BofA demonstrates that while valuations are high, they don't necessarily indicate a bubble-like situation.

- Highlighting the difference between current valuations and past market peaks: Analysis of previous market peaks and subsequent corrections reveals that current valuations, while high, are not unprecedented and haven't reached the same extreme levels as seen in past bubbles.

- Analyzing historical corrections and their impact on long-term investors: BofA highlights that market corrections are a normal part of the market cycle and that long-term investors often recover from these dips, emphasizing the importance of a long-term investment strategy.

Risk Management Strategies for Investors

Even with BofA's analysis, some investors remain apprehensive. Effective risk management strategies are crucial.

- Importance of a diversified investment portfolio: Diversification across different asset classes and sectors is essential to mitigate risk and reduce portfolio volatility.

- Benefits of dollar-cost averaging: Investing regularly, regardless of market fluctuations, helps mitigate the risk of buying high and selling low.

- Suggestions for risk mitigation strategies: Investors should consider their risk tolerance and adjust their portfolios accordingly, perhaps opting for more conservative investments if necessary.

BofA's Recommendations and Investment Strategies

Based on their assessment, BofA offers specific investment recommendations.

- Specific sectors or asset classes BofA favors: They highlight sectors projected for strong growth, like technology and healthcare, as potentially attractive investment areas.

- Suggested adjustments to investment strategies: BofA might suggest adjustments to portfolio allocation, depending on an investor's risk tolerance and long-term financial goals.

- Call to action: consult a financial advisor for personalized guidance: Individual circumstances vary, emphasizing the need for personalized financial advice.

Conclusion

BofA's analysis presents a compelling case for a more optimistic outlook on the stock market, despite current high valuations. Their focus on strong earnings growth, low interest rates, and long-term growth potential counterbalances many common concerns. While market corrections are inherent risks, BofA's insights provide valuable context for investors to address their stock market valuation concerns. By understanding the nuances of market valuation and implementing appropriate risk management strategies, investors can navigate the current market effectively. Remember to conduct thorough research and consult with a financial advisor to develop a personalized strategy that aligns with your risk tolerance and long-term financial goals. Don't let anxieties about stock market valuation prevent you from making informed investment decisions; actively manage your stock market valuation anxieties with knowledge and a well-defined plan.

Featured Posts

-

Millions Made From Office365 Hacks Inside The Executive Email Breach

Apr 24, 2025

Millions Made From Office365 Hacks Inside The Executive Email Breach

Apr 24, 2025 -

Los Angeles Wildfires The Ethics Of Betting On Natural Disasters

Apr 24, 2025

Los Angeles Wildfires The Ethics Of Betting On Natural Disasters

Apr 24, 2025 -

Feds Uncover Millions Stolen Via Office365 Executive Account Hacks

Apr 24, 2025

Feds Uncover Millions Stolen Via Office365 Executive Account Hacks

Apr 24, 2025 -

Federal Investigation Office365 Data Breach Nets Millions For Hacker

Apr 24, 2025

Federal Investigation Office365 Data Breach Nets Millions For Hacker

Apr 24, 2025 -

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025

From Whataburger Viral Video To Uil State The Story Of An Hisd Mariachi Group

Apr 24, 2025