Stock Market Valuation Concerns: BofA's Perspective And Investor Guidance

Table of Contents

The current state of the stock market leaves many investors grappling with significant stock market valuation concerns. High valuations across various sectors have fueled debate about potential market corrections and future returns. This article analyzes Bank of America's (BofA) perspective on these concerns, offering crucial investor guidance to navigate the complexities of the current market landscape.

BofA's Key Valuation Concerns

Elevated Price-to-Earnings Ratios

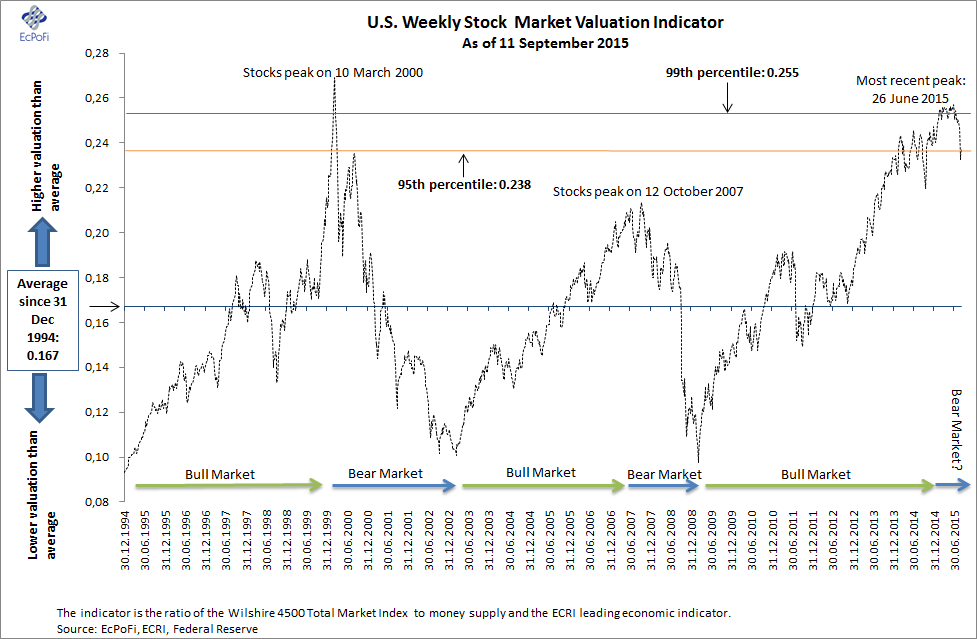

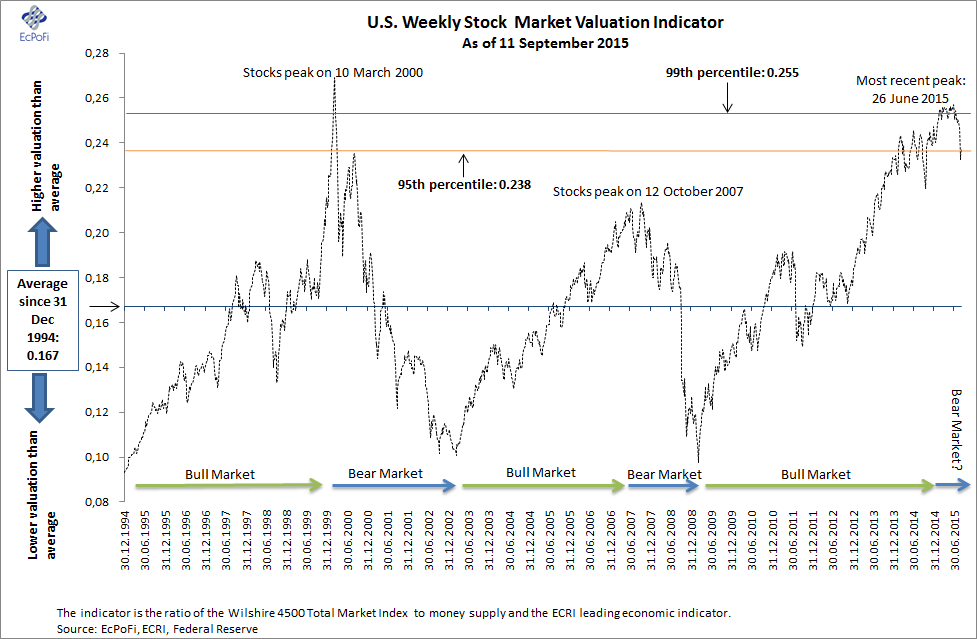

BofA, like many other financial institutions, expresses concern over elevated price-to-earnings (P/E) ratios across significant portions of the equity market. These ratios, a key stock market valuation metric, compare a company's stock price to its earnings per share. Currently, many sectors show P/E ratios exceeding historical averages and industry benchmarks, suggesting potentially overvalued stocks.

- Bullet Point 1: BofA's reports often highlight specific sectors like technology and consumer discretionary as exhibiting particularly high P/E ratios, signaling potential overvaluation compared to their historical performance and industry peers.

- Bullet Point 2: High P/E ratios imply investors are paying a premium for future earnings growth. While this can be justified in certain circumstances, excessively high ratios increase the risk of lower future returns if earnings don't meet expectations. A market correction could lead to significant price drops in these overvalued sectors.

- Bullet Point 3: While specific data points from BofA's internal reports are often proprietary, publicly available analyses from BofA Global Research frequently cite specific P/E ratio comparisons and their implications for various sectors. These reports often use charts and graphs to visualize the discrepancies between current and historical valuations.

Concerns about Interest Rate Hikes

The Federal Reserve's interest rate hikes significantly impact stock market valuation. BofA's analysis emphasizes the negative correlation between rising interest rates and stock prices.

- Bullet Point 1: Higher interest rates increase borrowing costs for companies, potentially reducing profitability and impacting future earnings growth. Simultaneously, higher rates make bonds more attractive, diverting investment away from equities. This shifts investor appetite toward less risky investments.

- Bullet Point 2: BofA's economists and strategists provide predictions for future interest rate movements. These predictions influence their overall market outlook and valuation assessments. Their forecasts affect their recommendations on sector allocation and investment strategies.

- Bullet Point 3: Different sectors react differently to interest rate hikes. Growth stocks, often with high valuations based on future earnings expectations, are typically more sensitive to rising rates than value stocks with more stable, current earnings.

Geopolitical and Macroeconomic Risks

Geopolitical instability and macroeconomic factors introduce considerable uncertainty into stock market valuation. BofA meticulously assesses these risks.

- Bullet Point 1: Specific geopolitical risks, such as the ongoing war in Ukraine, escalating trade tensions, and persistent supply chain disruptions, can significantly impact market sentiment and investor confidence, affecting stock prices and valuations. High inflation also plays a crucial role in this uncertainty.

- Bullet Point 2: BofA incorporates these geopolitical and macroeconomic risks into its sophisticated valuation models, adjusting its forecasts to account for the potential negative impacts on earnings and economic growth.

- Bullet Point 3: To mitigate these risks, BofA often advises investors to diversify their portfolios across asset classes and geographies, hedging against potential shocks. Careful risk management is key during these uncertain times.

BofA's Recommended Investment Strategies

Diversification and Risk Management

BofA consistently advocates for diversification as a cornerstone of a sound investment strategy. This is particularly critical in the current environment of high stock market valuations.

- Bullet Point 1: Diversification involves allocating investments across different asset classes, including stocks, bonds, real estate, and alternative investments. This reduces dependence on any single asset's performance and mitigates risk.

- Bullet Point 2: Before investing, BofA emphasizes understanding your risk tolerance. This involves assessing your comfort level with potential losses and aligning your investment strategy accordingly.

- Bullet Point 3: During periods of market uncertainty, strategies like hedging and stop-loss orders can help manage downside risk. A well-defined risk management plan is crucial.

Sector-Specific Investment Opportunities

Despite broad valuation concerns, BofA identifies sectors that might offer relatively better risk-adjusted returns.

- Bullet Point 1: BofA's analysis may highlight sectors like energy or certain segments of the healthcare industry as potentially undervalued, presenting opportunities for investors. They usually base this on their fundamental analysis and future earnings projections.

- Bullet Point 2: Their recommendations stem from detailed analysis considering earnings growth potential, industry dynamics, and competitive landscapes within each sector.

- Bullet Point 3: However, BofA strongly cautions against chasing high-growth, potentially overvalued stocks solely based on short-term market trends. Careful due diligence and fundamental analysis are necessary.

Long-Term Investment Horizon

Navigating market volatility requires a long-term perspective. Short-term fluctuations are less relevant for investors with longer time horizons.

- Bullet Point 1: A long-term approach allows investors to weather market downturns and benefit from the long-term growth potential of the market.

- Bullet Point 2: Strategies like dollar-cost averaging and systematic investing help mitigate the impact of market timing and emotional decision-making.

- Bullet Point 3: Investors should align their investment strategy with their individual time horizon and risk profile. This helps manage expectations and reduce emotional reactions to market fluctuations.

Conclusion

This article has summarized BofA's key concerns regarding current stock market valuations, highlighting elevated P/E ratios, interest rate hikes, and geopolitical risks. BofA's recommended strategies include diversification, risk management, focusing on potentially undervalued sectors, and adopting a long-term investment approach.

Understanding stock market valuation is crucial for making informed investment decisions. By carefully considering BofA's insights and employing a well-diversified strategy, investors can better navigate the complexities of the current market and potentially mitigate risks associated with high stock market valuations. Continue researching stock market valuation strategies and consult with a financial advisor to create a personalized investment plan that aligns with your goals and risk tolerance.

Featured Posts

-

Analyzing Indias Relationship With Pakistan Turkey And Azerbaijan A Trade Perspective

May 18, 2025

Analyzing Indias Relationship With Pakistan Turkey And Azerbaijan A Trade Perspective

May 18, 2025 -

Alleged Drug Smuggling American Basketball Player Arrested In Indonesia Death Penalty Risk

May 18, 2025

Alleged Drug Smuggling American Basketball Player Arrested In Indonesia Death Penalty Risk

May 18, 2025 -

The Kanye West Kim Kardashian Feud Sex Trafficking Accusation Explained

May 18, 2025

The Kanye West Kim Kardashian Feud Sex Trafficking Accusation Explained

May 18, 2025 -

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025 -

Exploring The Soundscapes Of Damiano Davids Funny Little Fears

May 18, 2025

Exploring The Soundscapes Of Damiano Davids Funny Little Fears

May 18, 2025

Latest Posts

-

Will The Cardinals Opener Overcome Jansen A Preview Of The Crucial Game

May 18, 2025

Will The Cardinals Opener Overcome Jansen A Preview Of The Crucial Game

May 18, 2025 -

Angels Lead Evaporates Tatis Jr S Walk Off Wins For Padres

May 18, 2025

Angels Lead Evaporates Tatis Jr S Walk Off Wins For Padres

May 18, 2025 -

Details Emerge Angels Stars Family Health Challenges This Offseason

May 18, 2025

Details Emerge Angels Stars Family Health Challenges This Offseason

May 18, 2025 -

The Cardinals Opener A Key Game Against Jansen And The Opponent Team Name

May 18, 2025

The Cardinals Opener A Key Game Against Jansen And The Opponent Team Name

May 18, 2025 -

Red Sox Closers Free Agency Choice The Inside Story

May 18, 2025

Red Sox Closers Free Agency Choice The Inside Story

May 18, 2025