Stock Market Valuation Concerns: BofA's Reasons For Optimism

Table of Contents

BofA's Core Argument: Earnings Growth Outpacing Valuation Concerns

BofA's optimism hinges on the expectation that robust corporate earnings growth will ultimately justify current valuations. They argue that despite high price-to-earnings ratio (P/E) ratios in some sectors, the projected growth in profits will eventually bring valuations back into line. This perspective suggests that the current market pricing isn't necessarily indicative of an overvalued market, but rather a forward-looking assessment of future profitability.

-

Strong projected earnings growth across various sectors. BofA's analysis points to significant growth potential in key sectors, driven by factors like technological innovation, consumer spending, and global economic recovery. This projected growth forms the bedrock of their bullish stock market performance predictions.

-

Belief that inflation is peaking, easing pressure on profit margins. While inflation remains a concern, BofA believes it's nearing its peak. This expectation suggests that the pressure on corporate profit margins – a key driver of stock market valuation – will soon alleviate, boosting earnings growth.

-

Focus on companies demonstrating resilience and strong future potential. BofA isn't simply looking at short-term gains. Their analysis prioritizes companies with proven resilience, demonstrating consistent performance even amidst economic headwinds. These companies are seen as offering long-term value and supporting sustained economic growth.

-

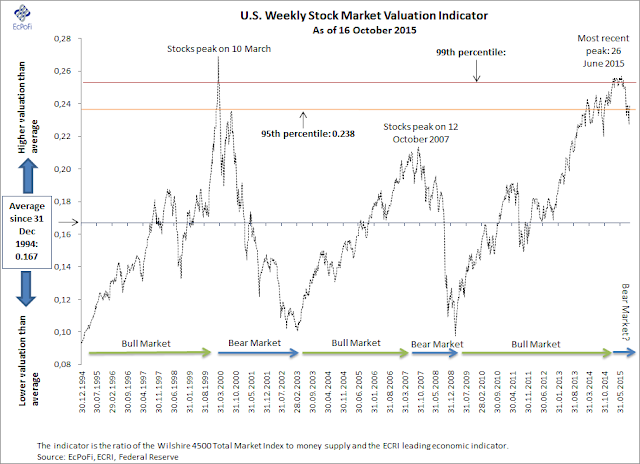

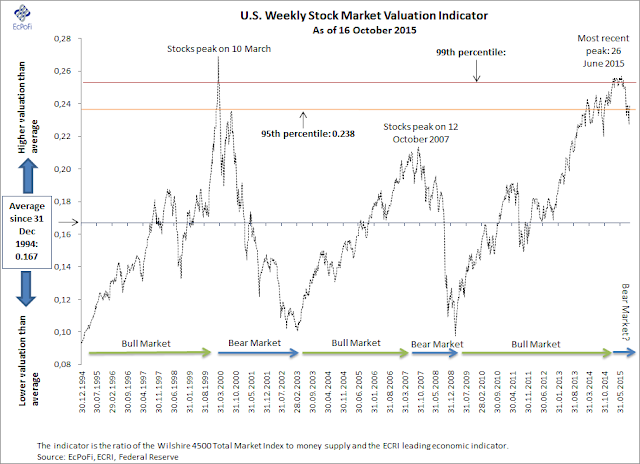

Analysis showing a historical precedent for high valuations preceding strong market performance. BofA's research reportedly highlights instances in the past where seemingly high valuations were followed by periods of significant market growth. This historical context supports their argument that current valuations, while potentially high, aren't necessarily a cause for immediate alarm.

Addressing Specific Valuation Concerns: Sectoral Analysis

BofA acknowledges stock market valuation concerns in specific sectors, but argues these are not uniformly spread across the market. Their detailed sectoral analysis identifies areas of both overvaluation and undervaluation, offering a nuanced perspective beyond generalized concerns. This granular approach allows for strategic stock picking and the identification of investment opportunities.

-

Identification of sectors with compelling growth potential despite high valuations. BofA's analysis pinpoints sectors where high valuations are justified by exceptional growth prospects. This differentiation highlights the importance of understanding individual sector dynamics, rather than applying a blanket assessment to the entire market.

-

Differentiation between cyclical and structural growth, focusing on long-term value. The firm differentiates between short-term cyclical growth and longer-term structural shifts, focusing their investment strategy on companies positioned for sustained growth. This emphasizes the importance of long-term investment opportunities over short-term market fluctuations.

-

Detailed analysis of specific companies showing undervaluation based on intrinsic value models. BofA reportedly uses sophisticated equity valuation models to identify companies currently undervalued relative to their intrinsic worth. This approach provides a more data-driven assessment of overvalued stocks and undervalued stocks.

-

Emphasis on diversification to mitigate sector-specific risks. BofA advocates for portfolio diversification to mitigate the risks associated with sector-specific underperformance. This highlights the importance of a well-rounded investment strategy for managing market correction risks.

Macroeconomic Factors Supporting BofA's Optimism

BofA considers macroeconomic factors such as interest rates, inflation, and the potential for a recession to be transient challenges, not fundamental threats to long-term economic recovery. Their analysis weighs potential geopolitical risks and their impact on the market, providing a comprehensive view.

-

Assessment of the impact of interest rate increases on corporate profitability. BofA's analysis suggests that while interest rate hikes may initially impact profitability, the long-term effects are likely to be manageable, particularly for companies with strong fundamentals.

-

Projected path for inflation and its eventual decline. The firm's economists have reportedly projected a path for inflation that indicates a decline in the coming periods, easing pressure on both consumers and businesses.

-

Analysis of the likelihood of a recession and its potential impact on the stock market. While acknowledging the possibility of a recession, BofA's analysis suggests that the impact on the stock market is likely to be less severe than some predict, given the resilience of certain sectors.

-

Consideration of geopolitical factors and their effect on market sentiment. BofA's analysis incorporates geopolitical risks, providing a realistic assessment of their potential impact on market sentiment and overall stock market valuation.

Conclusion

While acknowledging valid stock market valuation concerns, BofA's analysis points to several reasons for optimism. Their focus on robust earnings growth, sectoral analysis identifying undervalued opportunities, and a measured assessment of macroeconomic factors underpins their bullish outlook. Understanding stock market valuation is crucial for informed investment decisions. While navigating concerns about market valuations is essential, BofA's perspective offers a valuable counterpoint. Learn more about BofA's investment strategies and gain a clearer understanding of the current stock market outlook by [Link to BofA's investment research/relevant resource]. Don't let valuation concerns deter you from exploring the potential for growth in the market; carefully analyze your investment strategy and consider the insights provided to make informed decisions on stock market valuation.

Featured Posts

-

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Securing Entry

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Your Step By Step Guide To Securing Entry

Apr 29, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6 Reporting

Apr 29, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6 Reporting

Apr 29, 2025 -

Anthony Edwards Paternity Case Concludes Custody Decision Announced

Apr 29, 2025

Anthony Edwards Paternity Case Concludes Custody Decision Announced

Apr 29, 2025 -

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025 -

Austria Wien Jancker Folgt Auf Pacult

Apr 29, 2025

Austria Wien Jancker Folgt Auf Pacult

Apr 29, 2025