Stock Market Valuations And Investor Concerns: BofA's Response

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations is nuanced, acknowledging both risks and opportunities. While specific data points fluctuate, their overall stance often reflects a cautious optimism. They typically analyze valuations using a multi-faceted approach, considering both absolute and relative metrics.

BofA's methodology involves a comprehensive review of various market indicators. This includes:

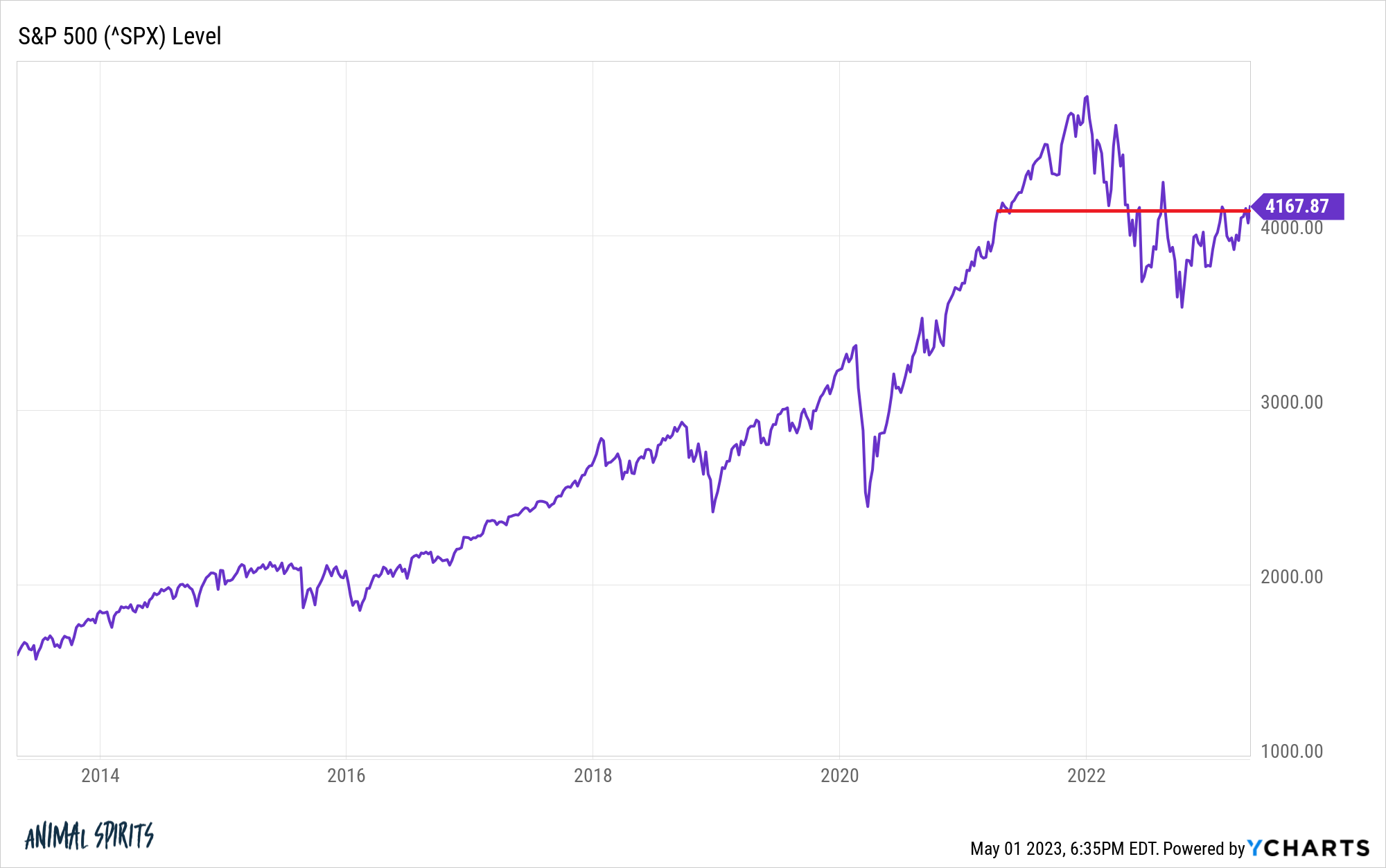

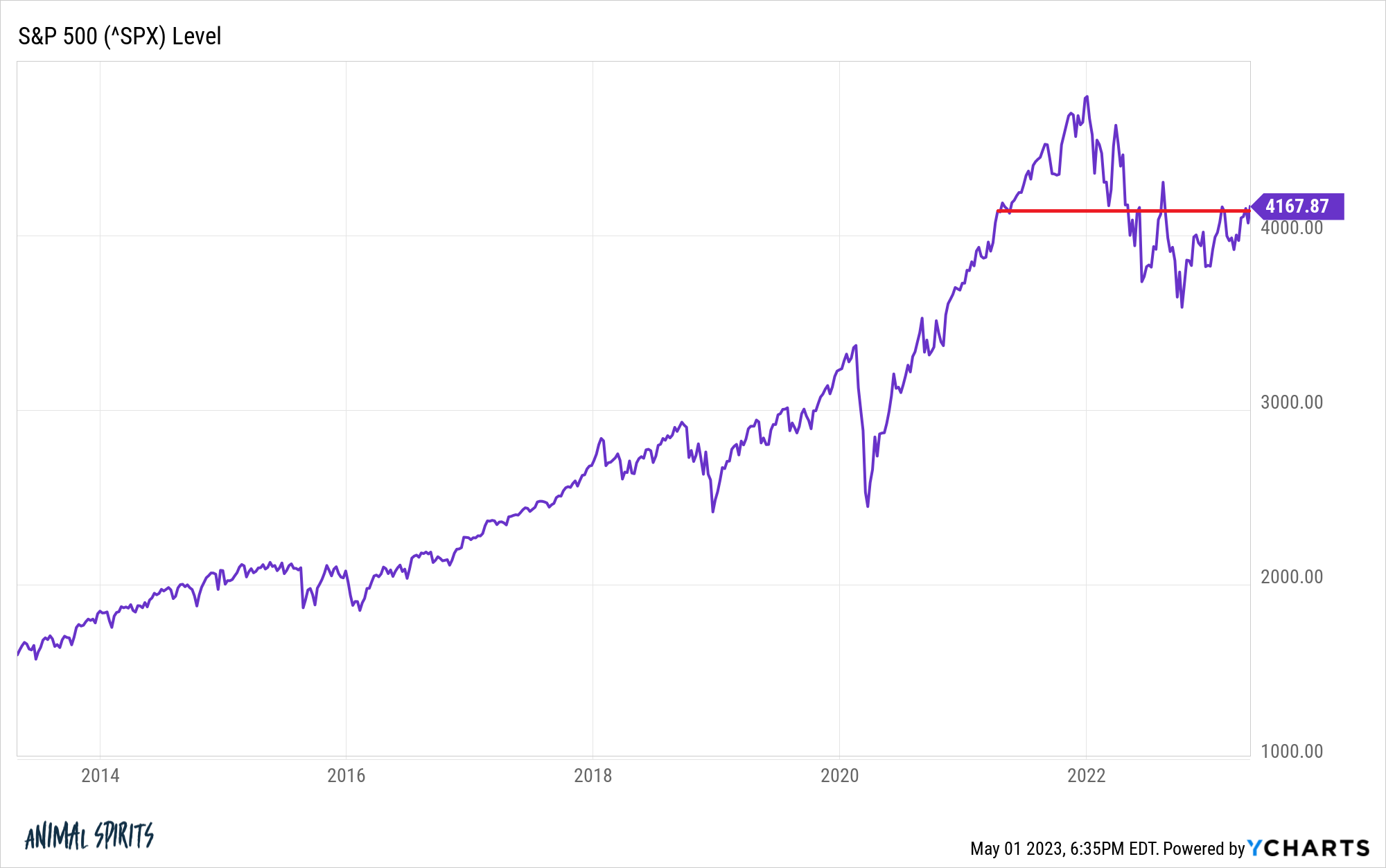

- Analysis of key market indicators: This involves examining metrics like the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and price-to-book ratio (P/B) across different sectors and the overall market. They compare these ratios to historical averages and industry benchmarks to gauge whether valuations are expensive, cheap, or fairly valued.

- Comparison to historical valuations: BofA analysts often compare current valuations to historical averages to determine if the market is trading at a premium or discount to its long-term average. This provides valuable context for assessing whether current prices reflect sustainable growth or potential overvaluation.

- Sector-specific valuation analysis: BofA recognizes that valuations vary significantly across different economic sectors. They conduct sector-specific analysis, identifying undervalued or overvalued sectors based on their growth prospects and fundamental strength. This allows for more targeted investment strategies.

- Consideration of macroeconomic factors: Macroeconomic factors such as inflation, interest rates, economic growth, and geopolitical events significantly influence stock market valuations. BofA incorporates these factors into their analysis, adjusting their valuation estimates to reflect the prevailing economic environment. For instance, rising interest rates can impact corporate earnings and discount rates, influencing stock prices.

Key Investor Concerns Addressed by BofA

Several key investor concerns dominate the current market landscape. BofA addresses these concerns with detailed analysis and strategic recommendations:

-

Inflation's impact on stock valuations: High inflation erodes purchasing power and increases the cost of doing business for companies. BofA typically analyzes how inflation affects corporate profitability and its impact on future earnings expectations, which are crucial factors in determining stock valuations. They carefully examine which sectors are more or less sensitive to inflation.

-

The effect of rising interest rates on corporate earnings: Higher interest rates increase borrowing costs for companies, potentially reducing profitability and impacting investment decisions. BofA models the effects of interest rate hikes on corporate earnings and assesses their influence on stock valuations and investor sentiment. They might highlight companies with strong balance sheets and low debt levels as being more resilient to rising rates.

-

BofA's outlook on potential recession scenarios: Recessions can significantly impact stock market valuations. BofA's economists and strategists actively monitor economic indicators and provide their outlook on the probability and severity of a potential recession. Their analysis considers factors such as consumer spending, employment data, and manufacturing activity. They might suggest defensive investment strategies during periods of heightened recession risk.

-

Geopolitical risks and their influence on market sentiment: Geopolitical events such as wars, trade disputes, and political instability can create uncertainty and volatility in the markets. BofA monitors geopolitical developments and assesses their potential impact on stock valuations and investor sentiment, often highlighting the importance of diversification to mitigate such risks.

BofA's Recommended Investment Strategies

Given the current market dynamics, BofA typically advocates for a well-diversified investment portfolio employing various strategies:

-

Diversification strategies: Diversification across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk. BofA emphasizes the importance of a well-balanced portfolio tailored to individual risk tolerance and financial goals.

-

Sector allocation advice: Based on their valuation analysis, BofA might suggest overweighting specific sectors deemed undervalued or under-represented in a portfolio while reducing exposure to sectors deemed overvalued or overly risky.

-

Risk management techniques: Effective risk management is essential, especially during periods of market uncertainty. BofA might recommend strategies such as stop-loss orders, hedging, and portfolio rebalancing to manage downside risk.

-

Long-term versus short-term investment horizons: BofA generally encourages a long-term investment horizon, recognizing that short-term market fluctuations can be unpredictable. They emphasize the importance of staying focused on long-term investment goals and avoiding impulsive decisions based on short-term market noise.

Conclusion

This article explored Bank of America's assessment of current stock market valuations and their response to prevalent investor concerns. BofA's analysis, while acknowledging existing challenges like high inflation and rising interest rates, offers a framework for investors to navigate the complexities of the current market. Understanding these perspectives is crucial for informed decision-making regarding your investment portfolio.

Call to Action: Stay informed about evolving stock market valuations and consider seeking professional financial advice to tailor your investment strategy based on your individual risk tolerance and financial goals. Regularly review your portfolio and adjust as needed based on updates and analysis from reputable sources like Bank of America's market reports on stock market valuations and related investment strategies. Remember that investing involves inherent risks and past performance is not indicative of future results.

Featured Posts

-

Municipales Dijon 2026 Programme Et Objectifs Des Ecologistes

May 10, 2025

Municipales Dijon 2026 Programme Et Objectifs Des Ecologistes

May 10, 2025 -

Wynne Evans Health Battle His Illness And Potential Stage Comeback

May 10, 2025

Wynne Evans Health Battle His Illness And Potential Stage Comeback

May 10, 2025 -

Months Of Warnings Incredibly Dangerous Incidents Before Newark Atc Outage

May 10, 2025

Months Of Warnings Incredibly Dangerous Incidents Before Newark Atc Outage

May 10, 2025 -

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025

Lac Kir Dijon Violente Agression De Trois Hommes

May 10, 2025 -

Msyrt Barys San Jyrman Nhw Tarykh Jdyd Fy Dwry Abtal Awrwba

May 10, 2025

Msyrt Barys San Jyrman Nhw Tarykh Jdyd Fy Dwry Abtal Awrwba

May 10, 2025