Stock Market Valuations And Investor Confidence: A BofA View

Table of Contents

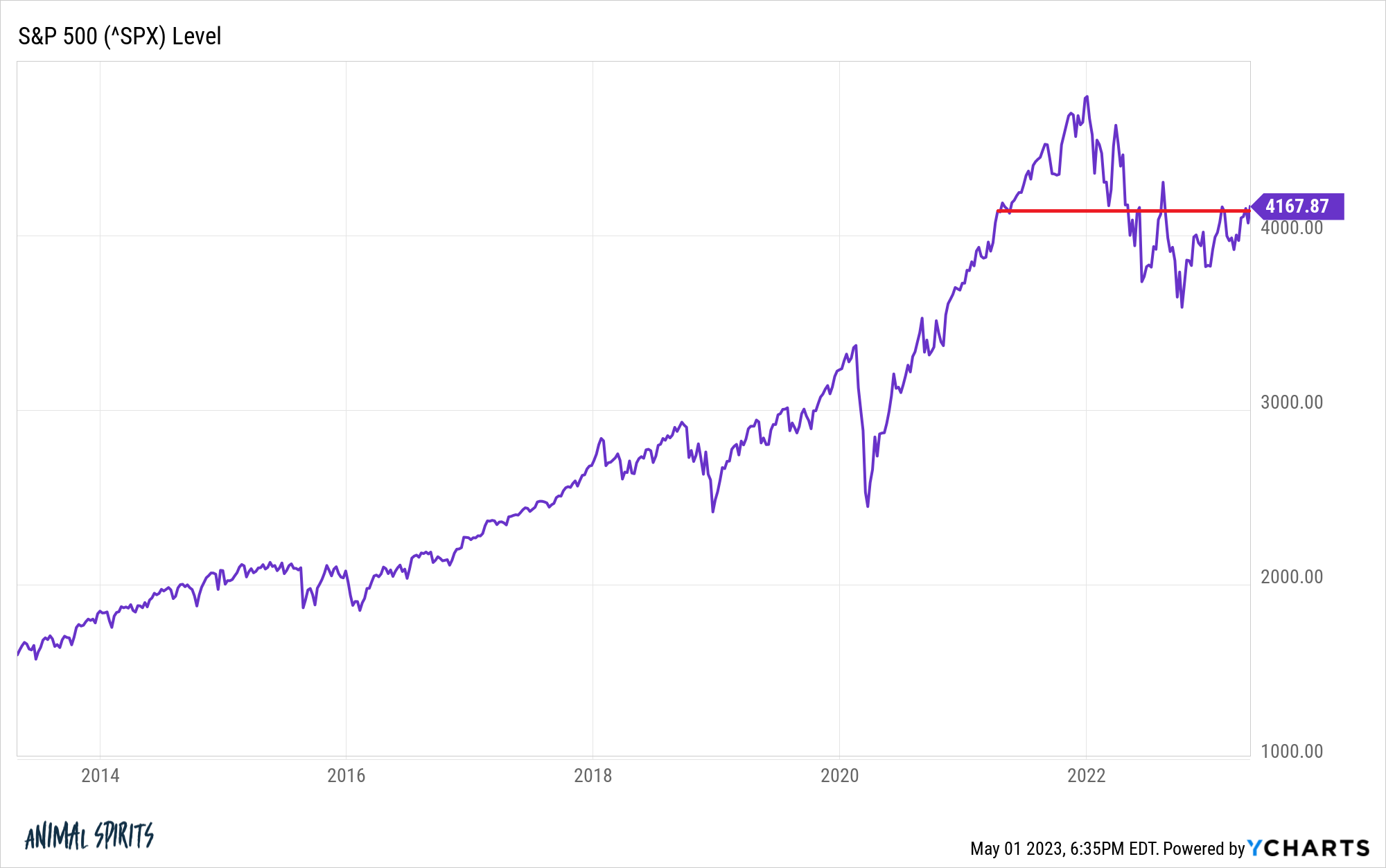

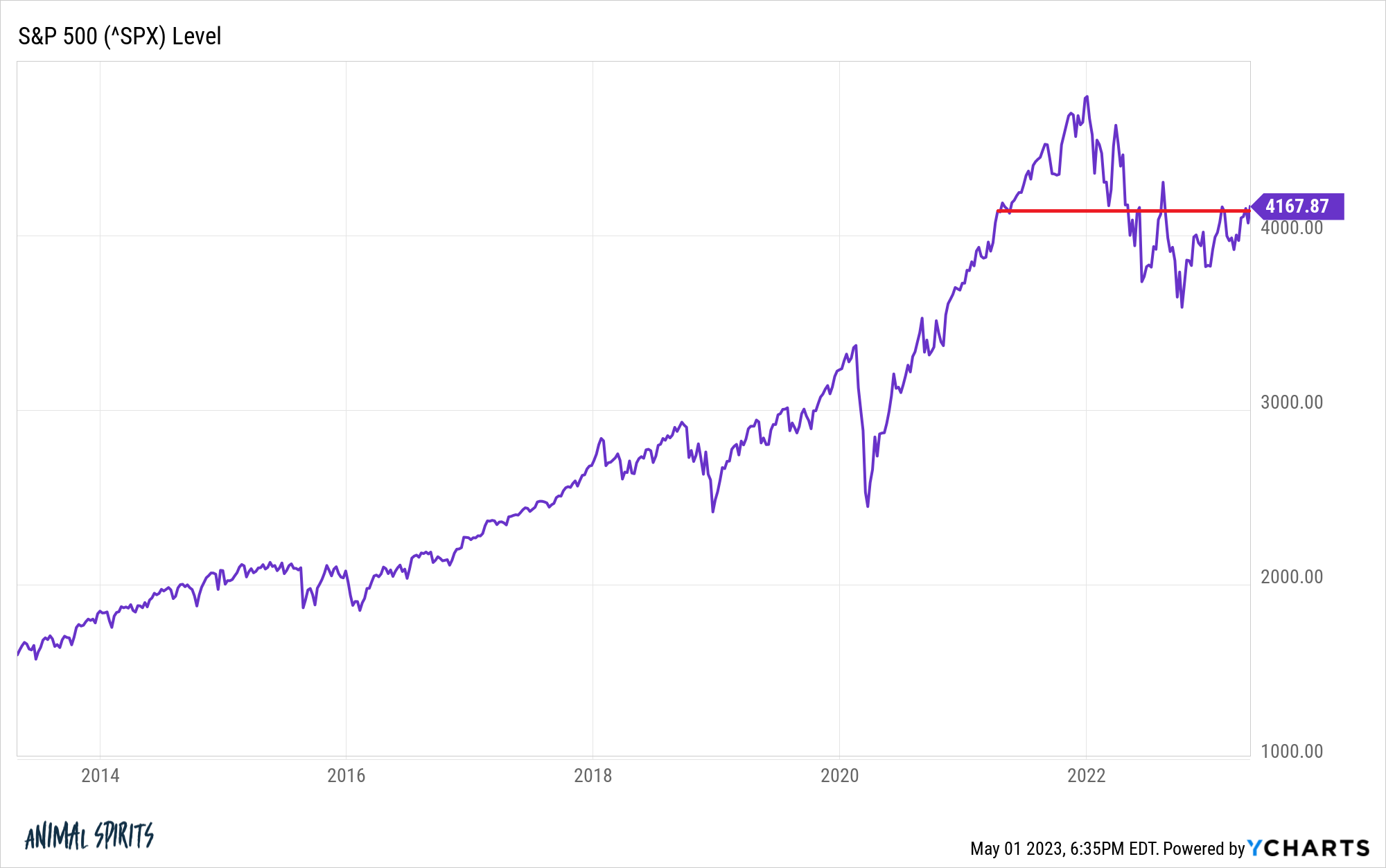

Current Stock Market Valuations

Accurately assessing stock market valuations is paramount for successful investing. Several key metrics provide insights into whether the market is overvalued, undervalued, or fairly priced. Let's examine some key indicators and BofA's take on their current implications.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is a fundamental valuation metric that compares a company's stock price to its earnings per share (EPS). A high P/E ratio suggests investors are willing to pay a premium for each dollar of earnings, potentially indicating overvaluation. Conversely, a low P/E ratio might signal undervaluation.

-

Implications of High vs. Low P/E Ratios: High P/E ratios often occur during periods of strong economic growth and high investor optimism, while low P/E ratios can be seen during recessions or periods of market uncertainty. However, it's crucial to consider industry averages and historical context.

-

Sector-Specific Variations: BofA's research often highlights significant variations in P/E ratios across different sectors. For instance, technology companies tend to command higher P/E multiples than, say, utilities, reflecting different growth expectations and risk profiles. BofA may point out specific sectors currently trading at unusually high or low P/E ratios relative to their historical averages.

-

Comparing Current P/E with Previous Market Cycles: Comparing the current market-wide P/E ratio to its historical average during bull and bear markets provides valuable context. BofA's analysis will likely incorporate this historical perspective, helping investors gauge whether current valuations are exceptionally high or low compared to past cycles.

Other Valuation Metrics:

While the P/E ratio is widely used, it's essential to consider other valuation metrics for a comprehensive picture. BofA likely incorporates these into its overall assessment of market valuations.

-

Price-to-Sales (P/S): This metric compares a company's market capitalization to its revenue. It is particularly useful for companies with negative earnings.

-

Price-to-Book (P/B): This ratio compares a company's market value to its book value (assets minus liabilities). It is often used to assess the value of asset-heavy businesses.

-

Dividend Yield: This metric represents the annual dividend payment relative to the stock price. It’s particularly relevant for income-oriented investors.

BofA's findings on these metrics, along with their interpretations, are vital for understanding the overall health and valuation of the market. Relying solely on one metric can be misleading, hence the importance of a holistic approach using multiple valuation tools as highlighted by BofA.

Investor Confidence Indicators

Investor confidence plays a significant role in driving stock market valuations. Positive sentiment can fuel market rallies, while negative sentiment can lead to declines. BofA's analysis likely incorporates various indicators to gauge investor confidence.

Consumer Confidence Indices:

Consumer confidence surveys provide insights into consumer spending and economic outlook. Indices like the Consumer Confidence Index (CCI) are closely watched by investors and analysts, including BofA.

-

Correlation Between Consumer Confidence and Stock Market Performance: Historically, there's a positive correlation between consumer confidence and stock market performance. Higher consumer confidence often translates into increased spending, boosting corporate profits and driving stock prices higher.

-

BofA's Analysis of Recent Consumer Confidence Data: BofA's research will likely include an analysis of the latest consumer confidence data, examining trends and potential implications for the stock market.

-

Implications for Investment Strategies: Low consumer confidence might suggest a more cautious investment approach, potentially favoring defensive sectors over growth stocks.

Sentiment Analysis of Financial News and Social Media:

BofA likely employs sentiment analysis techniques to gauge investor sentiment from various sources, including financial news articles and social media platforms.

-

How BofA Assesses Sentiment: Sophisticated algorithms are used to analyze the tone and language in news articles and social media posts related to the stock market to determine the overall sentiment (positive, negative, or neutral).

-

BofA's Findings on Current Investor Sentiment: BofA's reports will likely share their findings on prevailing investor sentiment and whether it aligns with or diverges from fundamental valuations.

-

Potential Disconnect Between Sentiment and Fundamental Valuations: It’s crucial to remember that investor sentiment can sometimes diverge significantly from fundamental valuations. Bubbles and crashes can occur when sentiment becomes overly exuberant or pessimistic, regardless of underlying fundamentals.

BofA's Market Outlook and Recommendations

Based on its analysis of stock market valuations and investor confidence, BofA will likely offer its outlook and recommendations for investors.

BofA's Predictions and Strategies:

BofA's predictions might cover both short-term and long-term market performance, suggesting potential opportunities and risks.

-

Suggested Investment Strategies: BofA might recommend specific investment strategies such as favoring defensive stocks during periods of uncertainty or focusing on growth stocks in a bullish market.

-

Specific Sectors or Asset Classes: BofA might highlight particular sectors or asset classes (e.g., technology, healthcare, emerging markets) that they believe are poised for outperformance based on their valuation and sentiment analysis.

-

Rationale Behind Recommendations: BofA will likely provide a clear rationale for its recommendations, explaining the underlying assumptions and supporting data.

Risk Management Considerations:

BofA's analysis will likely highlight potential risks associated with the current market conditions.

-

Potential Market Risks and Uncertainties: This section will likely address potential risks such as inflation, interest rate hikes, geopolitical events, and unexpected economic downturns.

-

How Investors Can Mitigate These Risks: BofA might suggest strategies like diversification (investing in various asset classes), hedging (using financial instruments to protect against losses), and setting stop-loss orders.

-

Importance of Diversification and Risk Management: This section emphasizes the crucial role of diversification and risk management in mitigating potential losses and protecting investment portfolios.

Conclusion

This article has analyzed current stock market valuations and investor confidence, incorporating insights from BofA's research. By examining key metrics like P/E ratios, consumer confidence indices, and investor sentiment, we've gained a clearer perspective on the current market landscape. BofA's outlook and recommendations provide valuable guidance for navigating the complexities of the market. Remember, understanding both stock market valuations and investor confidence is crucial for making informed investment decisions. Continue to research and stay updated on stock market valuations to make sound investment choices. Regularly reviewing BofA's reports and analyses on market valuations will aid you in refining your investment strategy.

Featured Posts

-

Dissecting The Yankees Lineup Judges Wishes And Boones Strategy

May 11, 2025

Dissecting The Yankees Lineup Judges Wishes And Boones Strategy

May 11, 2025 -

Hl Yjmehma Alhb Thlyl Elaqt Twm Krwz Wana Dy Armas Me Farq 26 Eama

May 11, 2025

Hl Yjmehma Alhb Thlyl Elaqt Twm Krwz Wana Dy Armas Me Farq 26 Eama

May 11, 2025 -

Tonights Ufc 315 Event Fighters Fights And Predictions

May 11, 2025

Tonights Ufc 315 Event Fighters Fights And Predictions

May 11, 2025 -

Is Aaron Judge A Future Hall Of Famer Analyzing His Performance After 1 000 Games

May 11, 2025

Is Aaron Judge A Future Hall Of Famer Analyzing His Performance After 1 000 Games

May 11, 2025 -

Wbd Details Grand Slam Tournament Broadcast Strategy

May 11, 2025

Wbd Details Grand Slam Tournament Broadcast Strategy

May 11, 2025