Stock Market Valuations: BofA Assures Investors, Addressing Valuation Concerns

Table of Contents

BofA's Key Arguments for a Positive Market Outlook

BofA's recent reports suggest a more optimistic outlook than headline-grabbing volatility might suggest. Their analysis considers various factors beyond simple price metrics, providing a more nuanced perspective on stock market valuations.

Addressing High Price-to-Earnings Ratios (P/E)

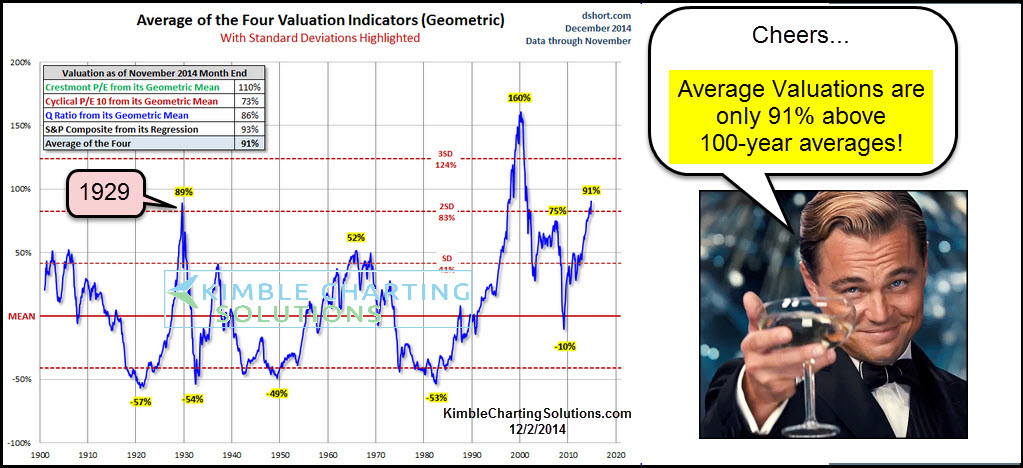

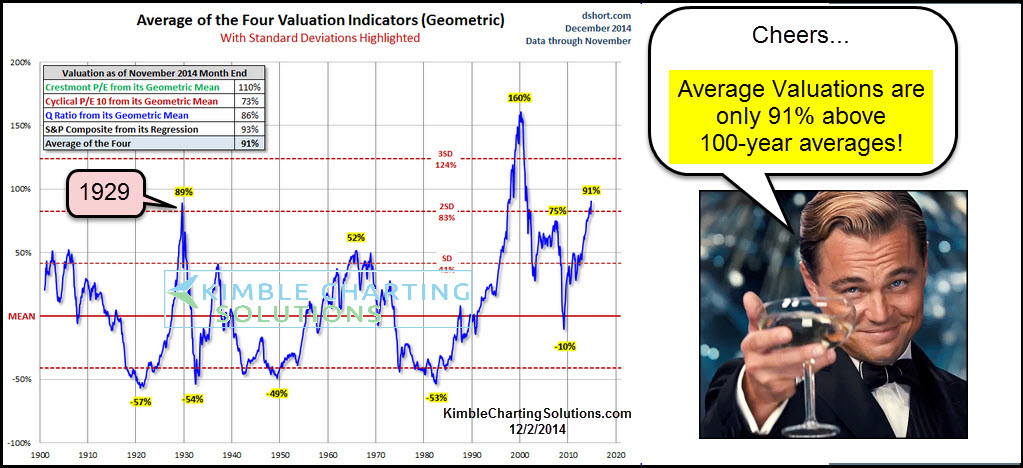

High P/E ratios are a common source of investor anxiety. BofA acknowledges the elevated P/E ratios in certain sectors but argues that a simplistic interpretation overlooks crucial contextual factors. Their analysis suggests that focusing solely on P/E ratios without considering broader macroeconomic conditions paints an incomplete picture of equity valuations.

- BofA's justification for high P/E ratios in specific sectors: BofA points to strong future earnings growth potential in certain sectors, justifying higher valuations. Companies with robust innovation pipelines and strong competitive advantages might command higher P/E multiples, reflecting investor confidence in their future prospects.

- Comparison of current P/E ratios to historical averages: While current P/E ratios might be above historical averages, BofA argues that comparing them to past periods without considering the significant changes in interest rates, inflation, and technological advancements can be misleading.

- Mention of potential future earnings growth as a mitigating factor: The potential for significant earnings growth in the coming years is a key factor cited by BofA in their justification for current valuations. This future growth, they argue, discounts the seemingly high current P/E ratios.

The Role of Interest Rates and Inflation in Valuation

Interest rates and inflation significantly influence stock market valuations. BofA's analysis highlights the crucial interplay between monetary policy and equity markets. Rising interest rates generally increase the discount rate used in valuation models, making future cash flows less valuable and thus lowering valuations. Conversely, inflation can erode corporate earnings and investor confidence, impacting equity valuations negatively.

- Explanation of how interest rate hikes affect discount rates used in valuation models: Higher interest rates increase the opportunity cost of capital, leading investors to demand higher returns. This translates to lower present values of future cash flows, impacting valuation models like Discounted Cash Flow (DCF).

- Analysis of inflation's impact on corporate earnings and investor expectations: High inflation erodes profit margins and can lead to reduced consumer spending, ultimately impacting corporate earnings and investor expectations. This impacts price-to-earnings ratios and other valuation metrics.

- BofA's forecast for interest rates and inflation and their implications for valuations: BofA's forecasts for interest rates and inflation are critical in their overall assessment of stock market valuations. Their projections influence their conclusions on whether current valuations are justified.

Sector-Specific Valuation Analysis

BofA’s analysis isn't a one-size-fits-all approach to stock market valuations. They provide a detailed sector-specific breakdown.

- Examples of sectors with attractive valuations, according to BofA: Specific sectors showing potential for strong growth and considered attractively valued by BofA may include technology sub-sectors focused on AI, or certain energy companies poised for growth, based on their forecasts.

- Reasons for differing valuations across sectors: Different growth prospects, competitive landscapes, and risk profiles explain the divergence in valuations across sectors. Some sectors might be perceived as higher-risk, resulting in lower valuations despite strong growth potential, and vice versa.

- BofA's recommendations for sector-specific investment strategies: BofA's sector analysis informs their investment recommendations. Their insights might suggest overweighting specific sectors and underweighting others based on their valuation assessments.

Understanding BofA's Methodology and Assumptions

To fully understand BofA's conclusions on stock market valuations, it’s vital to grasp their approach.

- Transparency of BofA's methodology: BofA generally employs widely accepted valuation models, such as Discounted Cash Flow (DCF) analysis and relative valuation using metrics like Price-to-Sales (P/S) and Price-to-Book (P/B) ratios. The transparency of their methodology is important for evaluating the validity of their conclusions.

- Potential limitations or biases in BofA's approach: Like any analysis, BofA's approach has inherent limitations. Assumptions about future growth rates, interest rates, and inflation introduce uncertainty. Understanding these potential biases is crucial for a critical assessment of their findings.

- Comparison with other analysts' valuations and outlooks: Comparing BofA's assessment with the views of other reputable analysts provides a broader perspective on equity valuations. This allows investors to gauge the overall consensus and identify areas of divergence.

Investor Implications and Strategic Considerations

BofA's analysis provides actionable insights for investors.

- Strategies for managing risk in the current market environment: Understanding BofA’s assessment helps investors make informed decisions about risk management. This might involve adjusting portfolio allocations, diversifying investments across different asset classes, and setting appropriate stop-loss orders.

- Sector allocation recommendations based on BofA's valuation analysis: BofA’s sector-specific analysis allows investors to refine their portfolio allocations. They might choose to overweight sectors deemed undervalued by BofA and underweight those considered overvalued.

- Importance of diversification in mitigating valuation risks: Diversification remains a cornerstone of sound investment strategy. Even with thorough valuation analysis, diversification helps mitigate the risk associated with individual stocks or sectors that might deviate from expectations.

Conclusion

This article examined Bank of America's (BofA) recent analysis of stock market valuations, addressing widespread investor concerns. BofA's insights offer a more nuanced perspective on current market conditions, considering factors beyond simple price-to-earnings ratios, such as interest rates and inflation. The analysis provides valuable information for investors seeking to navigate the complexities of equity valuations. Understanding stock market valuations is crucial for informed investment decisions. Stay informed about the latest market analysis from reputable sources like BofA to make sound choices regarding your investment portfolio and navigate the complexities of stock market valuations effectively.

Featured Posts

-

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Analysis And Picks

May 05, 2025

Ufc Fight Night Sandhagen Vs Figueiredo Prediction Analysis And Picks

May 05, 2025 -

Kolkata Weather Update Thunderstorm Predicted By Me T Department

May 05, 2025

Kolkata Weather Update Thunderstorm Predicted By Me T Department

May 05, 2025 -

Analyzing The 2025 Tampa Bay Derby Odds Horses And Kentucky Derby Implications

May 05, 2025

Analyzing The 2025 Tampa Bay Derby Odds Horses And Kentucky Derby Implications

May 05, 2025 -

Noche Ufc Vs Canelo Una Nueva Batalla En Mexico

May 05, 2025

Noche Ufc Vs Canelo Una Nueva Batalla En Mexico

May 05, 2025 -

Cannes Film Market Studiocanal Seals Deal For Cedric Klapischs Colours Of Time

May 05, 2025

Cannes Film Market Studiocanal Seals Deal For Cedric Klapischs Colours Of Time

May 05, 2025

Latest Posts

-

Chris Pratts Unfiltered Response To Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025

Chris Pratts Unfiltered Response To Patrick Schwarzeneggers White Lotus Appearance

May 06, 2025 -

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025

Maria Shrivers Comments On Patrick Schwarzenegger And His White Lotus Character

May 06, 2025 -

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025

Patrick Schwarzeneggers White Lotus Role Maria Shriver Speaks Out

May 06, 2025 -

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025

Understanding The Postponement Of Patrick Schwarzenegger And Abby Champions Wedding

May 06, 2025 -

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025

Maria Shriver On Patrick Schwarzeneggers White Lotus Role The Truth Revealed

May 06, 2025