Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Perspective on Current Stock Market Valuations

BofA's analysis provides a nuanced perspective on current market valuations, challenging the narrative of an impending crash. Their assessment considers several key factors, offering a more balanced view than headline-grabbing news might suggest.

Considering Long-Term Growth Prospects

BofA's analysis emphasizes the long-term growth potential of the market, looking beyond short-term fluctuations. This long-term perspective is crucial for understanding current valuations in context.

- Technological innovation driving productivity gains: Breakthroughs in artificial intelligence, automation, and biotechnology are poised to significantly boost productivity and corporate earnings over the next decade, supporting higher stock prices.

- Emerging markets presenting significant investment opportunities: Rapid economic growth in developing nations offers substantial investment opportunities, contributing to overall market expansion and diversification.

- Long-term economic growth projections remain positive: Despite near-term challenges, many economists predict sustained long-term economic growth, supporting the case for positive stock market performance. This positive outlook underpins BofA's relatively optimistic valuation assessment.

The Role of Interest Rates and Inflation

Rising interest rates and persistent inflation are major concerns for investors. BofA addresses these concerns directly, arguing that the market has already priced in much of the anticipated impact.

- Market already anticipating further interest rate hikes: Current stock prices reflect the expectation of further interest rate increases by central banks, mitigating the potential for a significant negative shock.

- Inflation expectations moderating, potentially easing pressure: While inflation remains a challenge, signs of moderation suggest that inflationary pressures may ease in the coming months, reducing the downward pressure on stock valuations.

- Analysis of historical data showing market resilience during inflationary periods: BofA likely points to historical precedent, showcasing the market's ability to navigate inflationary environments and recover over time. This historical analysis supports their less pessimistic outlook.

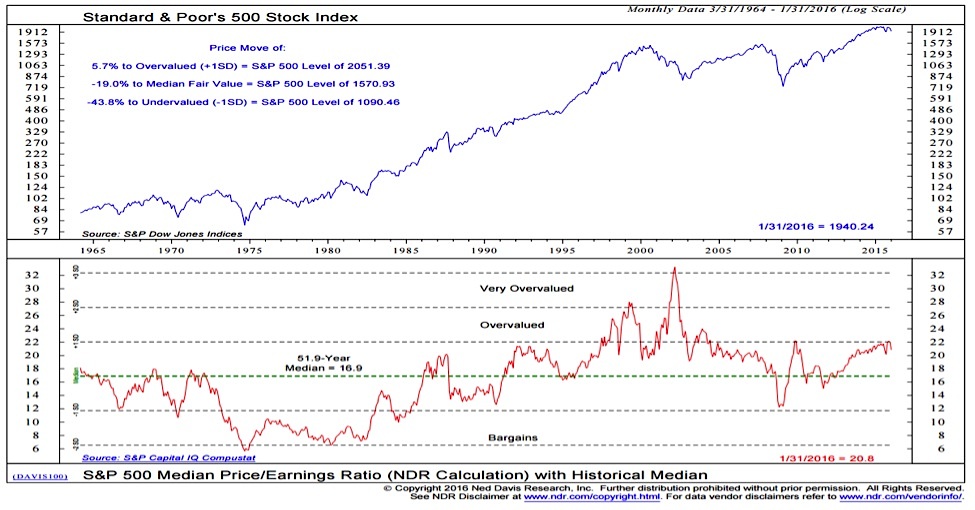

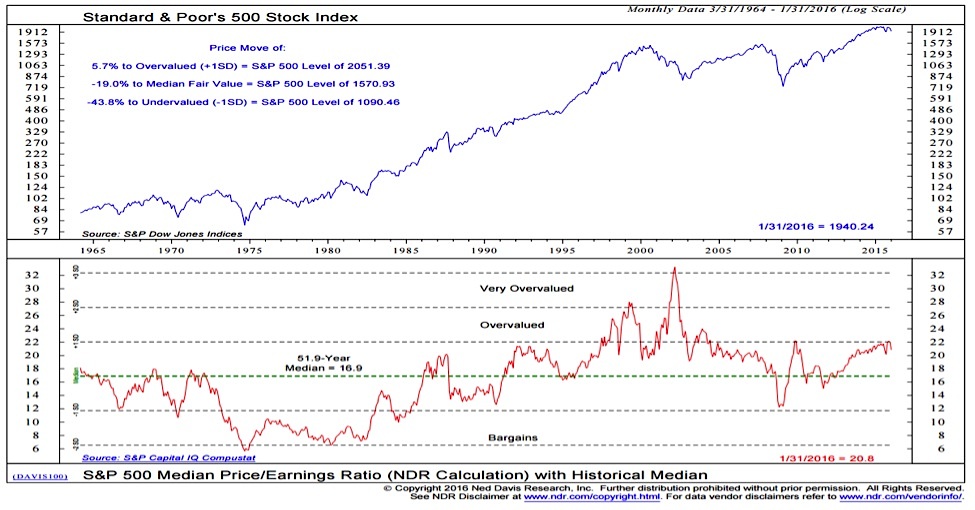

Analyzing Price-to-Earnings Ratios (P/E) and Other Key Metrics

BofA's assessment likely involves a detailed examination of key valuation metrics, providing a more nuanced picture than simply looking at headline P/E ratios.

- Comparison of P/E ratios across different sectors and historical periods: A granular analysis across different sectors reveals that valuations vary significantly. Some sectors might be overvalued, while others offer attractive entry points.

- Discussion of other valuation metrics like Price-to-Sales and PEG ratios: Reliance solely on P/E ratios can be misleading. BofA likely considers additional metrics like Price-to-Sales and Price/Earnings to Growth (PEG) ratios to provide a comprehensive valuation picture.

- Contextualization of valuations within a broader economic framework: BofA's analysis likely places valuation metrics within a wider economic context, considering factors such as interest rates, inflation, and projected economic growth.

Addressing Investor Concerns and Misconceptions

Many investors are understandably nervous about market volatility. BofA directly addresses these concerns, aiming to alleviate anxieties and promote informed decision-making.

Debunking the "Overvalued Market" Narrative

The perception of an "overvalued market" often leads to inaction and missed opportunities. BofA's analysis aims to dispel this misconception.

- Highlighting selective market segments showing higher valuations: Not all sectors are equally valued. BofA likely highlights segments where valuations might appear stretched, while emphasizing undervalued or fairly valued sectors.

- Emphasizing the importance of diversification to mitigate risks: Diversification across different asset classes and sectors is crucial to manage risk and reduce exposure to any single overvalued segment.

- Presenting evidence supporting reasonable valuations in certain sectors: BofA likely points to specific sectors where valuations appear justified given the strong growth prospects and competitive landscape.

The Importance of a Long-Term Investment Strategy

BofA's message emphasizes the importance of long-term planning rather than reacting to short-term market noise.

- Benefits of dollar-cost averaging to mitigate risk: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, mitigates the risk associated with trying to time the market.

- Importance of patience and discipline in investing: Successful investing requires patience and discipline, avoiding impulsive decisions based on short-term market fluctuations.

- Risks associated with trying to time the market: Attempting to time the market is inherently risky and often unsuccessful. A long-term approach is far more effective.

Conclusion

BofA's assessment of current stock market valuations offers a reassuring perspective for investors. While acknowledging market volatility and legitimate concerns surrounding inflation and interest rates, their analysis suggests that current valuations are not excessively high, particularly when considering long-term growth prospects. By focusing on a long-term investment strategy, diversifying portfolios, and understanding the nuances of valuation metrics, investors can navigate the market confidently. Don't let fear dictate your investment decisions; understand the facts about stock market valuations and make informed choices for your financial future. Consider consulting with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Ohio Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 15, 2025

Ohio Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 15, 2025 -

Carneys Cabinet Picks Key Business Appointments To Watch

May 15, 2025

Carneys Cabinet Picks Key Business Appointments To Watch

May 15, 2025 -

Padres Vs Yankees Analyzing San Diegos Chances Of A 7 Game Win

May 15, 2025

Padres Vs Yankees Analyzing San Diegos Chances Of A 7 Game Win

May 15, 2025 -

Cody Poteets First Abs Challenge Win Chicago Cubs Spring Training

May 15, 2025

Cody Poteets First Abs Challenge Win Chicago Cubs Spring Training

May 15, 2025 -

Declassified The History Of A U S Nuclear Installation Beneath Greenlands Ice

May 15, 2025

Declassified The History Of A U S Nuclear Installation Beneath Greenlands Ice

May 15, 2025