Stock Market Valuations: BofA's Case For Investor Calm

Table of Contents

BofA's Valuation Methodology: A Deep Dive

BofA employs a multifaceted approach to stock market valuation, incorporating various established models and indicators. Their analysis isn't solely reliant on any single metric, but instead leverages a combination of techniques to provide a comprehensive overview. This includes but isn't limited to:

- Discounted Cash Flow (DCF) analysis: Projecting future earnings and discounting them back to present value to estimate intrinsic value. This stock valuation model provides a long-term perspective on a company's potential.

- Price-to-Earnings Ratio (P/E): Comparing a company's stock price to its earnings per share. BofA analyzes both individual company P/E ratios and broader market P/E ratios to gauge overall market valuation.

- Other key market valuation metrics: BofA's comprehensive analysis also incorporates other relevant metrics, such as Price-to-Sales ratio, Price-to-Book ratio, and dividend yield, providing a more nuanced picture of stock market valuation.

Specific data points from BofA's report (Note: These are hypothetical examples for illustrative purposes and should be replaced with actual data from the BofA report):

- BofA's analysis shows a current market P/E ratio of 25, compared to the historical average of 18.

- Their discounted cash flow model projects future earnings growth of 5% annually over the next five years.

- Their analysis suggests a slight undervaluation in certain sectors, based on a combination of these stock valuation models.

Understanding BofA's valuation methodology – encompassing stock valuation models and market valuation metrics – is crucial to grasping their conclusions about the current market.

Addressing Current Market Concerns: Inflation and Interest Rates

Investor anxiety is often fueled by concerns about inflation and interest rate hikes. BofA directly addresses these concerns in their analysis:

- Inflation's Impact: BofA anticipates inflation to moderate to 3% by the end of 2024, based on their assessment of various economic indicators. They acknowledge the impact of inflation on corporate profits but believe that current valuations already reflect much of this anticipated impact.

- Interest Rate Hikes: The report suggests that the current pace of interest rate hikes is largely priced into the market, meaning that the market has already adjusted to the expectation of further increases. While future hikes could create further short-term volatility, they may not necessarily signal a major market downturn.

BofA's key arguments regarding inflation and interest rates, addressing crucial elements of market outlook and stock market forecast, paint a picture less dire than some market forecasts might suggest.

Long-Term Growth Prospects: BofA's Bullish Case

Despite short-term uncertainties, BofA maintains a relatively bullish long-term outlook for the stock market. Their analysis points to several key factors:

- Technological Innovation: BofA expects strong growth in the technology sector, driven by continued innovation in areas like artificial intelligence, cloud computing, and cybersecurity.

- Renewable Energy: The potential for growth in renewable energy is highlighted, presenting attractive investment opportunities.

- Emerging Markets: Specific emerging markets are identified as offering promising long-term growth potential.

BofA's positive long-term stock market growth forecast is supported by their sector analysis focusing on investment opportunities and future market trends.

Risk Management and Portfolio Diversification

BofA emphasizes the importance of prudent risk management and diversification in navigating the complexities of the stock market. They advocate for:

- Diversification across asset classes: This includes investments beyond stocks, such as bonds, real estate, and alternative assets, to reduce overall portfolio risk.

- Strategic asset allocation: Tailoring the asset mix to reflect individual risk tolerance and financial goals.

- Regular portfolio rebalancing: Periodically adjusting the portfolio to maintain the desired asset allocation.

BofA's advice on risk management strategies and portfolio diversification emphasizes the importance of investment risk mitigation through careful asset allocation.

Conclusion: Maintaining Calm Amidst Stock Market Valuations

BofA's analysis paints a nuanced picture of current stock market valuations. While acknowledging short-term uncertainties related to inflation and interest rates, they highlight the long-term growth potential across various sectors. Their emphasis on risk management and diversification offers a path toward navigating market volatility. The key takeaway is to maintain a calm and measured approach to investing, focusing on a long-term strategy rather than reacting to short-term fluctuations. Learn more about navigating stock market valuations and developing a robust investment strategy. Consult a financial advisor to discuss your individual needs regarding stock market valuations and to create a personalized plan that aligns with your risk tolerance and financial goals. Remember, understanding stock market valuation and market valuations is key to making sound investment decisions.

Featured Posts

-

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025

Cote D Ivoire Le Port D Abidjan Accueille Le Plus Grand Navire De Son Histoire

May 20, 2025 -

Agatha Christie And Sir David Suchet A Review Of Their Travel Documentary

May 20, 2025

Agatha Christie And Sir David Suchet A Review Of Their Travel Documentary

May 20, 2025 -

New Hmrc Measures To Tackle Undeclared Side Hustle Income What You Need To Know

May 20, 2025

New Hmrc Measures To Tackle Undeclared Side Hustle Income What You Need To Know

May 20, 2025 -

Dusan Tadic Dalya Hedefi Ve Tarihi Basarilar

May 20, 2025

Dusan Tadic Dalya Hedefi Ve Tarihi Basarilar

May 20, 2025 -

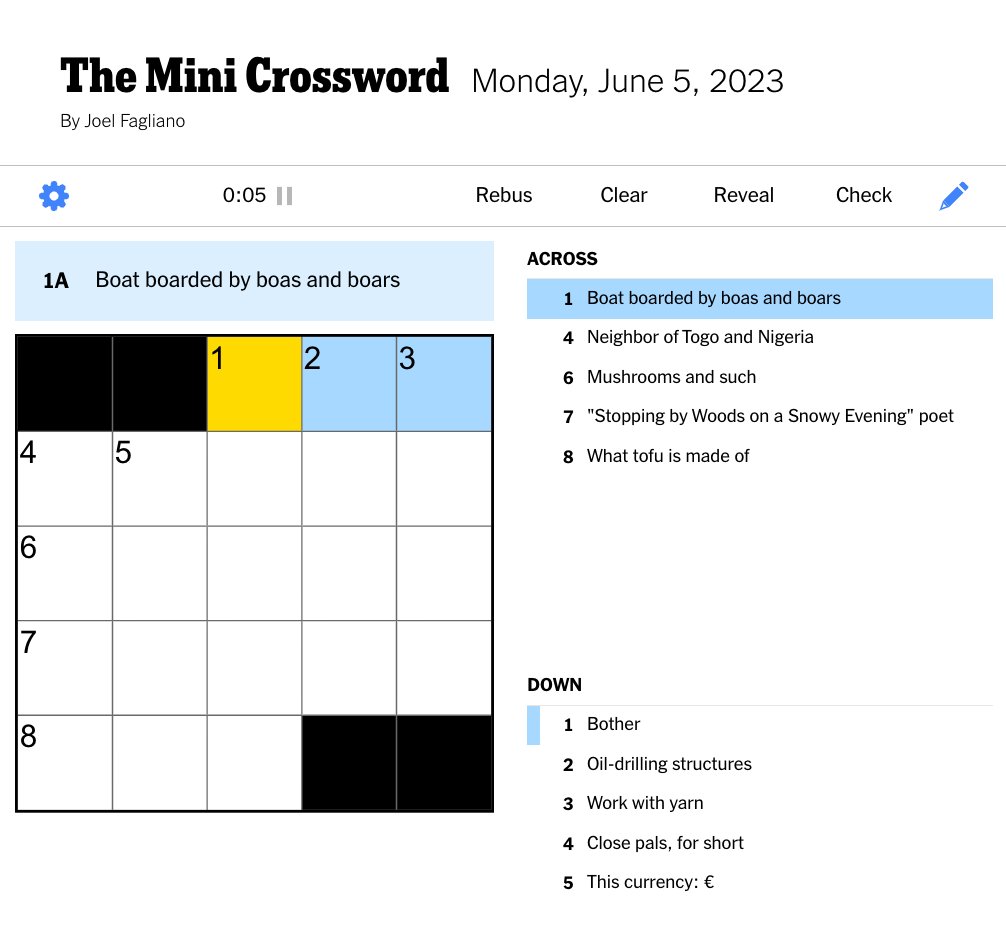

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 20, 2025

Nyt Mini Crossword Today Hints And Answer For March 5 2025

May 20, 2025

Latest Posts

-

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Trump Tariffs And Statehood The Unlikely Debate Sparked By Wayne Gretzkys Canadian Patriotism

May 20, 2025

Trump Tariffs And Statehood The Unlikely Debate Sparked By Wayne Gretzkys Canadian Patriotism

May 20, 2025 -

Paulina Gretzkys Husband A Rare Public Outing

May 20, 2025

Paulina Gretzkys Husband A Rare Public Outing

May 20, 2025 -

Wayne Gretzky And The Canada Us Relationship Examining The Impact Of Trumps Policies

May 20, 2025

Wayne Gretzky And The Canada Us Relationship Examining The Impact Of Trumps Policies

May 20, 2025 -

Rare Sighting Paulina Gretzky And Husband Step Out

May 20, 2025

Rare Sighting Paulina Gretzky And Husband Step Out

May 20, 2025