Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Perspective on Current Stock Market Valuations

Bank of America's analysis of current stock market valuations involves a careful examination of several key metrics. Their assessment isn't simply a gut feeling; it's based on rigorous quantitative analysis and a deep understanding of macroeconomic trends. While specific numbers fluctuate, the general approach remains consistent. BofA typically employs a multifaceted approach, combining quantitative data with qualitative assessments.

Keyword Focus: Stock market valuation metrics, Price-to-earnings ratio (P/E), market capitalization, BofA's market analysis

-

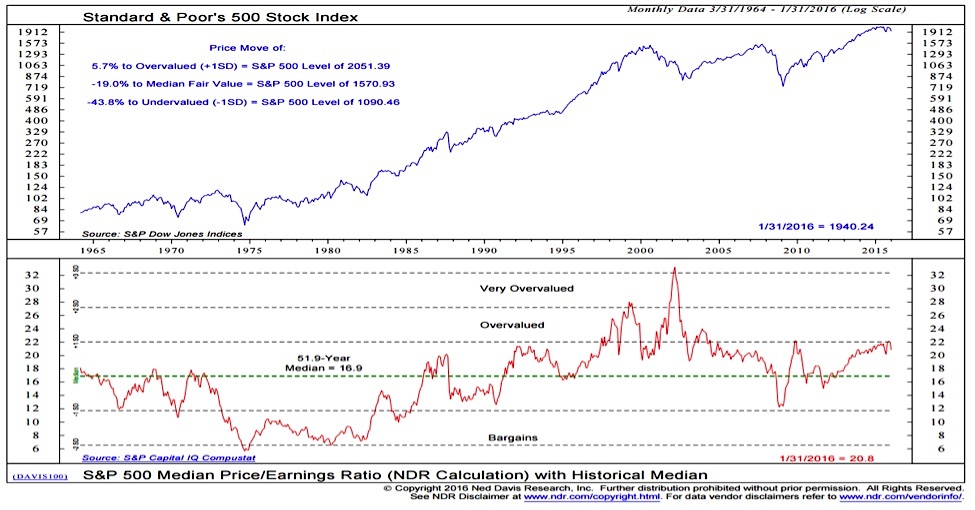

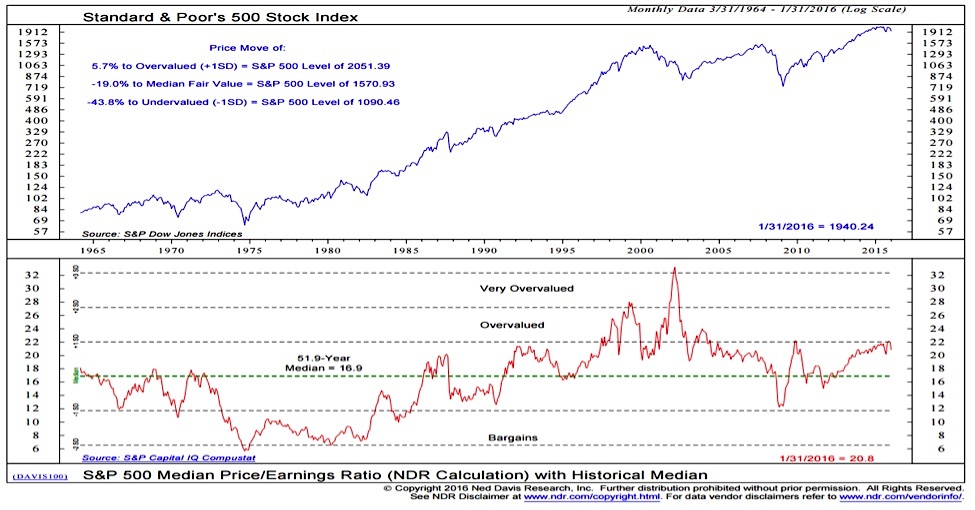

Analysis of P/E ratios across different sectors: BofA analyzes price-to-earnings (P/E) ratios not just for the overall market, but also across different sectors. This allows them to identify potentially overvalued or undervalued sectors, providing a more nuanced picture of the market's overall health. They may find that technology stocks, for example, have higher P/E ratios than more cyclical industries.

-

Comparison to historical valuation levels: Understanding current valuations requires historical context. BofA compares current P/E ratios and other valuation metrics to their historical averages. This helps determine whether the market is trading at a premium or discount relative to its past performance. A comparison to previous market cycles offers valuable insights.

-

Consideration of interest rate impacts on valuations: Interest rates significantly impact stock valuations. Higher interest rates typically lead to lower valuations, as investors demand higher returns to compensate for the increased risk-free rate of return offered by bonds. BofA carefully considers the potential impact of future interest rate hikes on stock prices.

-

Discussion of BofA's proprietary valuation models: BofA likely employs proprietary valuation models that go beyond simple P/E ratios. These models may incorporate more complex factors like discounted cash flow analysis, earnings growth projections, and risk assessments to provide a more comprehensive valuation. These sophisticated models contribute significantly to their overall assessment.

Factors Contributing to BofA's Cautious Optimism

Despite the current market uncertainties, BofA maintains a cautiously optimistic outlook. This stems from their analysis of several key factors, including robust corporate earnings growth projections and a belief that inflation's impact will gradually ease.

Keyword Focus: Economic forecasts, earnings growth, inflation expectations, interest rate hikes, geopolitical risk, BofA's economic outlook

-

BofA's predictions for future economic growth: BofA's economic forecasts play a crucial role in their market valuation assessments. Their projections for future GDP growth, employment levels, and consumer spending will greatly influence their overall market sentiment. They consider various economic indicators to develop these forecasts.

-

Analysis of potential earnings revisions: BofA carefully analyzes potential earnings revisions for companies across different sectors. Upward revisions typically suggest a positive outlook, while downward revisions indicate potential concerns. This analysis is integral to evaluating market valuations accurately.

-

Assessment of inflation's long-term impact: Inflation remains a key concern. BofA assesses the long-term impact of inflation on corporate profits and consumer spending. Their projection for inflation's trajectory will significantly influence their view on market valuations.

-

Discussion of geopolitical factors and their influence: Geopolitical risks, such as international conflicts or trade disputes, can significantly impact market valuations. BofA considers such factors when formulating their overall outlook and investment recommendations.

BofA's Recommendations for Investors

Based on their analysis of stock market valuations and macroeconomic factors, BofA likely recommends a balanced and diversified investment strategy. This approach prioritizes long-term growth over short-term market fluctuations.

Keyword Focus: Investment strategy, portfolio diversification, risk management, BofA's investment advice, long-term investing

-

Suggested asset allocation strategies: BofA might suggest a specific asset allocation strategy, perhaps favoring a mix of stocks and bonds, adjusting the proportions based on the investor's risk tolerance and time horizon.

-

Recommendations for sector-specific investments: They may provide recommendations on sector-specific investments, highlighting sectors that appear undervalued or poised for growth based on their analysis.

-

Advice on managing risk in a volatile market: Managing risk is crucial in a volatile market. BofA will likely advise on strategies for risk mitigation, such as diversification, stop-loss orders, and hedging techniques.

-

Importance of a long-term investment plan: BofA emphasizes the importance of adopting a long-term investment strategy, focusing on the long-term value creation potential of investments rather than reacting to short-term market volatility.

Conclusion

BofA's analysis suggests that while market volatility exists, current stock market valuations don't necessarily signal an impending crash. Their cautious optimism stems from their projections of future earnings growth, a careful assessment of inflation's long-term impact, and a measured consideration of geopolitical risks. While their analysis provides valuable insights, it's crucial to remember that this is not financial advice.

Call to Action: While BofA's analysis suggests a measured approach, thorough research and understanding of your own risk tolerance are crucial before making any investment decisions. Learn more about analyzing stock market valuations and developing a sound investment strategy. Conduct your own research and consult a financial advisor before making any investment decisions based on this information. Don't hesitate to explore BofA's resources for additional insights into current stock market valuations.

Featured Posts

-

Jose Aldos Next Opponent Ex Bellator Champion Patricio Freire

May 12, 2025

Jose Aldos Next Opponent Ex Bellator Champion Patricio Freire

May 12, 2025 -

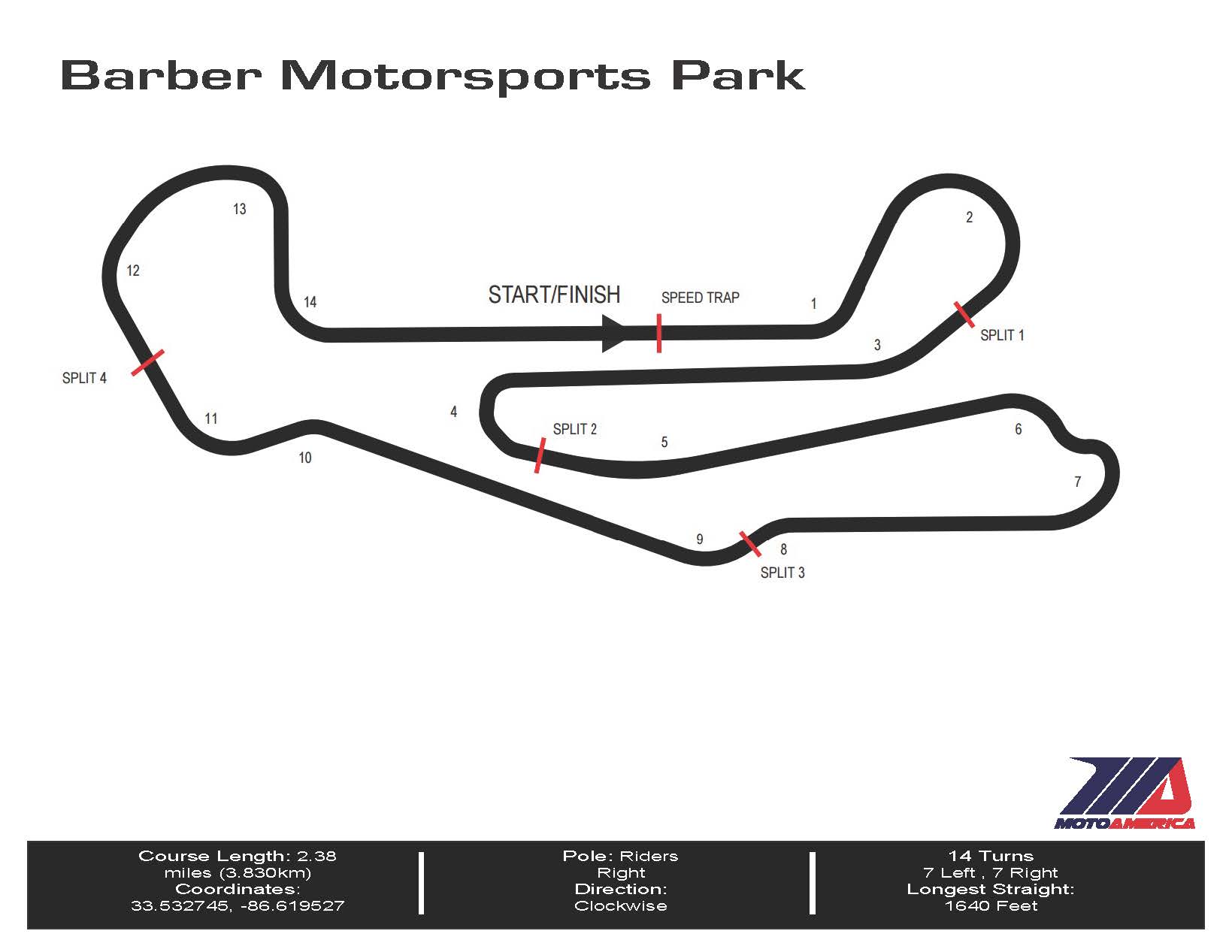

Colton Hertas Barber Motorsports Park Challenge Finding Pace When It Matters

May 12, 2025

Colton Hertas Barber Motorsports Park Challenge Finding Pace When It Matters

May 12, 2025 -

Official Henry Cavill Leads Amazons Highlander Reboot

May 12, 2025

Official Henry Cavill Leads Amazons Highlander Reboot

May 12, 2025 -

Possible Successors To Pope Francis Leading Cardinals And Their Platforms

May 12, 2025

Possible Successors To Pope Francis Leading Cardinals And Their Platforms

May 12, 2025 -

High Stock Valuations And Investor Sentiment A Bof A Analysis

May 12, 2025

High Stock Valuations And Investor Sentiment A Bof A Analysis

May 12, 2025