Stock Market Valuations: BofA's Reassuring Argument For Investors

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's reassessment of stock market valuations presents a more optimistic outlook than some prevailing anxieties might suggest. Their analysis rests on several key pillars, challenging the narrative of widespread overvaluation.

Considering Long-Term Growth Potential

BofA emphasizes the importance of looking beyond short-term market fluctuations and focusing on the long-term growth potential of the market. Short-term volatility is a normal part of investing; a long-term perspective is crucial.

- Focus on long-term earnings growth projections: Instead of fixating on current earnings, BofA's analysis likely projects future earnings growth, considering factors like technological advancements and economic expansion. This forward-looking approach smooths out short-term market noise.

- Consider the impact of technological advancements and innovation: Disruptive technologies often drive significant long-term growth. BofA likely incorporates the potential for innovation to boost productivity and corporate profits, influencing their valuation models. Sectors like AI, renewable energy, and biotechnology are particularly relevant here.

- Analyze the potential for future market expansion: Emerging markets and expanding consumer bases globally contribute to long-term market growth. BofA's analysis likely incorporates projections for international market expansion and its positive effect on corporate earnings.

BofA's analysis likely uses sophisticated models incorporating these factors. For example, they might employ discounted cash flow (DCF) analysis, projecting future cash flows and discounting them back to their present value to arrive at a fair valuation. This method is less sensitive to short-term market fluctuations.

The Role of Interest Rates in Valuation

Interest rates play a critical role in determining stock valuations. Higher interest rates generally lead to lower stock valuations, and vice-versa. BofA's perspective on this relationship is crucial to understanding their outlook.

- How higher interest rates can impact discount rates used in valuation models: Higher interest rates increase the discount rate used in DCF analysis and other valuation models. This reduces the present value of future earnings, leading to lower valuations.

- The potential for interest rate stabilization and its effect on market sentiment: If interest rate hikes stabilize or even reverse, it could positively impact market sentiment and increase investor confidence, leading to higher stock valuations.

- Discussion of the relationship between bond yields and equity valuations: Bond yields and equity valuations often have an inverse relationship. When bond yields rise, investors may shift funds from equities to bonds, leading to lower equity valuations. BofA's analysis likely considers this dynamic.

Understanding the interplay between interest rates, bond yields, and stock valuations is key to deciphering BofA's argument. Their analysis likely incorporates various scenarios for interest rate movements and their impact on the overall market valuation.

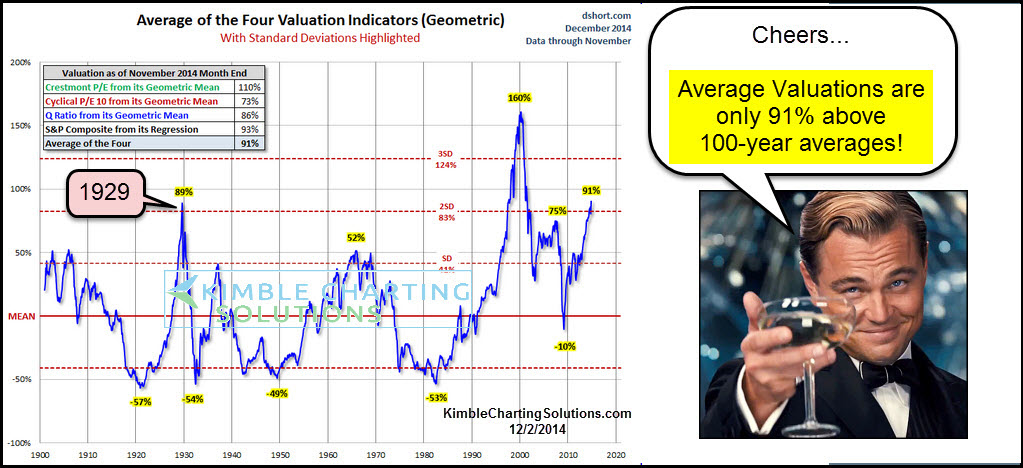

Comparing Current Valuations to Historical Data

BofA's analysis likely involves comparing current market multiples to historical averages to gauge whether current valuations are truly excessive or within a reasonable range.

- Presentation of key valuation metrics (P/E ratio, Price-to-Sales ratio, etc.): BofA likely uses several key metrics, including the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and others to assess the market's valuation.

- Comparison of current metrics to historical averages and ranges: By comparing current metrics to historical averages and ranges, BofA can determine whether current valuations are unusually high or low relative to past market cycles.

- Explanation of potential deviations and their underlying causes: Any deviations from historical norms require explanation. BofA would likely analyze the factors driving these deviations, such as changes in interest rates, economic growth, or investor sentiment.

(Illustrative Chart/Graph would be inserted here showing historical P/E ratios compared to the current P/E ratio)

Addressing Investor Concerns

While BofA presents a reassuring perspective, it's essential to address potential concerns that might influence investor decisions.

Inflation's Impact on Stock Market Valuations

Inflation is a significant concern for investors. BofA’s analysis likely addresses how inflation impacts stock prices and valuations.

- Discussion of inflation's impact on earnings growth and corporate profitability: High inflation can erode corporate profitability by increasing input costs. BofA's analysis likely assesses the impact of inflation on earnings growth and margins.

- Analysis of how inflation affects investor expectations and discount rates: Higher inflation often leads to higher discount rates, lowering the present value of future earnings and thus stock valuations.

- Strategies for mitigating inflation risk in investment portfolios: BofA might suggest strategies for mitigating inflation risk, such as investing in inflation-protected securities or companies with pricing power.

BofA's analysis would likely incorporate inflation projections and assess their potential impact on various sectors and investment strategies.

Geopolitical Risks and Market Volatility

Geopolitical risks are another factor affecting stock market valuations.

- Identification of key geopolitical risks impacting global markets: BofA would likely identify key geopolitical risks, such as international conflicts, trade wars, and political instability.

- BofA's analysis on how these risks are factored into their valuation models: How does BofA incorporate these uncertain elements into their valuation models? This might involve using sensitivity analysis to assess the impact of different geopolitical scenarios.

- Strategies for managing risk in a volatile global environment: Managing risk is crucial. BofA might suggest strategies like diversification, hedging, or focusing on less volatile investments.

BofA's assessment of geopolitical risks and their impact is a critical component of their overall valuation argument.

Conclusion

BofA's reassuring argument regarding current stock market valuations offers investors a valuable perspective. By considering long-term growth prospects, the influence of interest rates, and a historical context, investors can gain a more nuanced understanding of the market. While acknowledging the challenges of inflation and geopolitical risks, BofA’s analysis highlights the importance of a well-diversified, long-term investment strategy. Don't let short-term market fluctuations derail your investment goals. Take the time to understand the full picture of stock market valuations and make informed decisions based on a solid understanding of the current market landscape. Learn more about navigating stock market valuations and building a resilient investment portfolio today!

Featured Posts

-

Sigue El Encuentro Venezia Napoles En Tiempo Real

May 16, 2025

Sigue El Encuentro Venezia Napoles En Tiempo Real

May 16, 2025 -

China Secures Us Deal Xis Team Of Experts Delivers Results

May 16, 2025

China Secures Us Deal Xis Team Of Experts Delivers Results

May 16, 2025 -

Paddy Pimbletts Road To Ufc Gold A Legends Reversal

May 16, 2025

Paddy Pimbletts Road To Ufc Gold A Legends Reversal

May 16, 2025 -

San Jose Earthquakes Fall To Charlotte Fc Three Game Losing Skid Continues

May 16, 2025

San Jose Earthquakes Fall To Charlotte Fc Three Game Losing Skid Continues

May 16, 2025 -

New Photos Tom Cruise And Ana De Armas Spark Dating Speculation In England

May 16, 2025

New Photos Tom Cruise And Ana De Armas Spark Dating Speculation In England

May 16, 2025