Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Current Market Valuation Assessment

BofA's recent report suggests that current stock market valuations are slightly above average but remain within a reasonable range, offering a relatively positive outlook for investors. This assessment isn't a blanket endorsement of aggressive investing, but rather a cautious optimism based on a detailed analysis of several key metrics.

BofA's analysis incorporates several key factors:

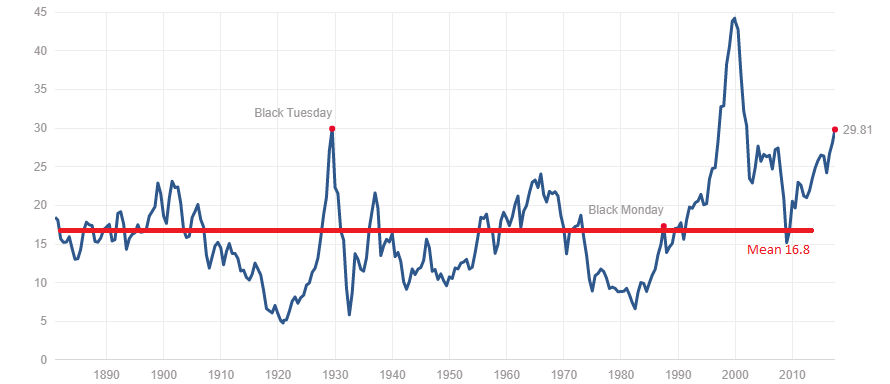

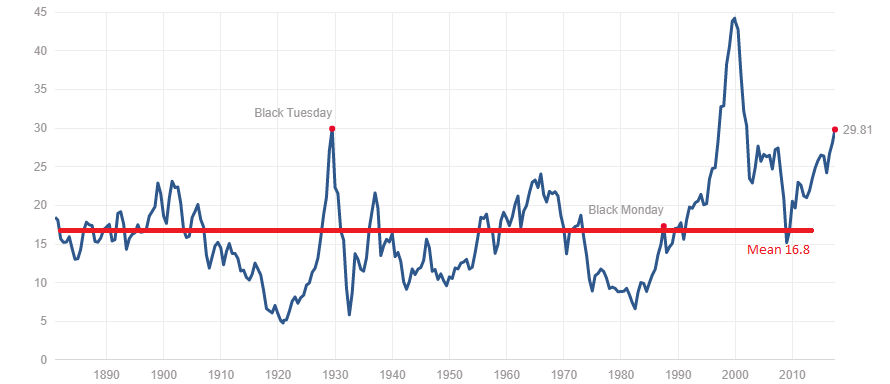

- Price-to-Earnings (P/E) Ratios: While P/E ratios are currently elevated compared to historical averages, BofA considers them justifiable given the robust corporate earnings growth projected for the coming year. They've compared current P/E ratios across different sectors and found several undervalued sectors with potential for growth.

- Dividend Yields: BofA notes that dividend yields remain relatively attractive, offering a cushion against potential market volatility and providing a steady stream of income for investors. This provides a key point of stability in their assessment.

- Interest Rates: The anticipated trajectory of interest rates factored significantly into BofA's analysis. The anticipated increase, while posing some risk, also supports stronger corporate profits and valuations in select sectors.

Key metrics used by BofA in their valuation analysis:

- Price-to-earnings ratios (P/E)

- Price-to-sales ratios (P/S)

- Dividend yields

- Free cash flow yields

- Cyclically adjusted price-to-earnings ratio (CAPE)

Comparison to historical valuations: BofA compared current valuations to historical data, noting that while above average, they are not at levels that historically signal an impending market crash.

Specific sectors: BofA highlights the technology and healthcare sectors as particularly attractive, while expressing some caution regarding the energy sector due to potential price volatility.

Factors Influencing BofA's Positive Outlook

Several factors contribute to BofA's relatively optimistic view on stock market valuations:

- Strong Corporate Earnings: Robust corporate earnings growth is a cornerstone of BofA's positive outlook. Many companies are exceeding expectations, boosting investor confidence.

- Interest Rate Increases: While interest rate increases present challenges, BofA believes the measured approach adopted by central banks will allow for sustainable economic growth, positively impacting corporate profitability. This controlled approach was a key factor in their assessment.

- Future Growth Potential: BofA anticipates continued growth in several key sectors, further underpinning their positive valuation assessment. This points to long-term growth opportunities for investors.

Macroeconomic factors impacting valuations: Inflation, interest rates, GDP growth, and unemployment rates all played a role in BofA's analysis.

Specific industry trends influencing BofA's outlook: The growth of the technology sector, advancements in healthcare, and the ongoing energy transition are all noted as influencing factors.

Geopolitical factors and their potential impact on valuations: BofA acknowledges geopolitical risks but believes their impact on valuations is currently contained.

Risks and Considerations Highlighted by BofA

While optimistic, BofA’s report also acknowledges potential risks:

- Inflationary Pressures: Persistent high inflation could erode corporate profits and negatively impact stock valuations.

- Geopolitical Uncertainty: Ongoing geopolitical instability remains a wildcard that could significantly influence market sentiment.

- Interest Rate Hikes: Aggressive interest rate increases could trigger an economic slowdown, impacting corporate earnings and valuations.

Potential downside risks to the market: Recessions, sudden shifts in investor sentiment, and unexpected geopolitical events are all cited as possible downside risks.

Factors that could negatively impact valuations: Supply chain disruptions, rising energy prices, and labor shortages all represent potential headwinds.

Cautions investors should consider: BofA urges investors to maintain a diversified portfolio, carefully assess their risk tolerance, and avoid making impulsive investment decisions.

Investment Strategies Based on BofA's Analysis

Based on BofA's analysis, investors should consider these strategies:

- Maintain a diversified portfolio: Spread investments across different asset classes and sectors to mitigate risk.

- Focus on value stocks: Look for undervalued companies with strong fundamentals and growth potential.

- Consider dividend-paying stocks: Generate income while participating in market growth.

Asset allocation recommendations based on BofA's findings: BofA suggests a diversified portfolio that aligns with individual risk tolerance and investment goals.

Sector-specific investment strategies: Their report suggests focusing on sectors with strong future growth potential.

Potential investment vehicles (e.g., ETFs, mutual funds): ETFs and mutual funds offer diversified exposure to various sectors and asset classes, aligning well with BofA's recommendations.

Conclusion: Stock Market Valuations: Actionable Insights from BofA's Report

BofA's report offers a cautiously optimistic view on current stock market valuations. While acknowledging existing risks, they highlight several positive factors, including strong corporate earnings and potential for continued growth in select sectors. Key takeaways for investors include the importance of diversification, a focus on value, and a thorough understanding of personal risk tolerance.

Understanding stock market valuations is crucial for informed investment decisions. Use BofA's insights to refine your approach to stock market valuations and build a portfolio that aligns with your objectives. Remember to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Unexpected White Lotus Cameo Oscar Winners Guest Appearance

May 07, 2025

Unexpected White Lotus Cameo Oscar Winners Guest Appearance

May 07, 2025 -

Mmr Shhn Jdyd Ebr Almhyt Alatlsy Mn Laram Alsyn Almghrb Albrazyl

May 07, 2025

Mmr Shhn Jdyd Ebr Almhyt Alatlsy Mn Laram Alsyn Almghrb Albrazyl

May 07, 2025 -

Snl 50 Jenna Ortegas Performance And Sabrina Carpenters Supportive Gesture

May 07, 2025

Snl 50 Jenna Ortegas Performance And Sabrina Carpenters Supportive Gesture

May 07, 2025 -

Simone Biles Mi Cuerpo Se Derrumbo

May 07, 2025

Simone Biles Mi Cuerpo Se Derrumbo

May 07, 2025 -

Blockchain Analytics Leader Chainalysis Boosts Ai Expertise With Alterya Purchase

May 07, 2025

Blockchain Analytics Leader Chainalysis Boosts Ai Expertise With Alterya Purchase

May 07, 2025

Latest Posts

-

Oelen Yakininizin Kripto Varliklarina Nasil Erisebilirsiniz

May 08, 2025

Oelen Yakininizin Kripto Varliklarina Nasil Erisebilirsiniz

May 08, 2025 -

Ekonomi Haberleri Bakan Simsek Ten Kripto Varlik Sektoeruene Yeni Uyarilar

May 08, 2025

Ekonomi Haberleri Bakan Simsek Ten Kripto Varlik Sektoeruene Yeni Uyarilar

May 08, 2025 -

Bitcoin Maaslari Brezilya Nin Kripto Para Politikasindaki Son Gelismeler

May 08, 2025

Bitcoin Maaslari Brezilya Nin Kripto Para Politikasindaki Son Gelismeler

May 08, 2025 -

Kripto Varliklarinizi Ailenize Nasil Devredebilirsiniz

May 08, 2025

Kripto Varliklarinizi Ailenize Nasil Devredebilirsiniz

May 08, 2025 -

Tuerkiye De Kripto Para Yatirimlari Bakan Simsek In Goeruesleri Ve Piyasa Analizi

May 08, 2025

Tuerkiye De Kripto Para Yatirimlari Bakan Simsek In Goeruesleri Ve Piyasa Analizi

May 08, 2025