Strategic Shift In Commodities: Walleye Cuts Credit To Strengthen Core Groups

Table of Contents

The Rationale Behind Walleye's Credit Cuts

The current economic climate is undeniably challenging. Rising interest rates, increased inflation, and geopolitical instability have created a volatile environment for the commodities market. Walleye, like many other companies in the sector, is facing significant headwinds. These challenges include increased risk, margin pressure, and rapidly changing market dynamics. The company's decision to cut credit is a direct response to these pressures, aimed at strengthening its financial position and focusing on its most profitable ventures.

- Rising interest rates and increased borrowing costs: Higher borrowing costs make credit more expensive, impacting profitability and increasing financial risk for Walleye. "Walleye Cuts Credit" is a direct attempt to mitigate these risks.

- Increased volatility in commodity prices: Fluctuating prices create uncertainty and make it difficult to accurately predict future revenue streams. This volatility necessitates a more conservative approach to credit extension.

- Need to focus on profitability and risk management: By reducing credit exposure, Walleye aims to improve its bottom line and reduce its overall risk profile. This focus on profitability is a key element of the "Walleye Cuts Credit" strategy.

- Strengthening financial position for long-term sustainability: The ultimate goal is to create a more resilient and financially stable company, better equipped to weather future economic storms.

This strategic realignment involves a sharp focus on core business units, such as [mention specific examples, e.g., grain trading, livestock processing, etc.]. This may include divesting from less profitable or strategically misaligned assets and restructuring internal operations to enhance efficiency.

Impact on Walleye's Supply Chain and Partners

The reduction in credit availability will undoubtedly have a ripple effect throughout Walleye's supply chain. Smaller suppliers heavily reliant on credit from Walleye may face short-term challenges, potentially impacting their operations and financial stability. This could lead to consolidation within the supply chain, with larger, more financially secure suppliers gaining a competitive advantage.

- Short-term challenges for smaller suppliers relying on credit: Some suppliers may struggle to meet immediate financial obligations, potentially leading to delays or disruptions in production.

- Potential for consolidation within the supply chain: Weaker suppliers may be forced to merge or be acquired by larger competitors.

- Increased negotiation power for larger suppliers: Larger suppliers, less dependent on Walleye's credit, may have increased leverage in price negotiations.

- Impact on pricing strategies for Walleye's products: Changes in supplier relationships and input costs could lead to adjustments in Walleye's pricing strategies.

Walleye is likely implementing mitigation strategies to minimize the negative impact on its partners, such as offering alternative payment terms, providing financial support to key suppliers, or establishing more flexible contract agreements.

Long-Term Implications for the Commodities Market

Walleye's decision to cut credit has profound implications for the broader commodities market. It signals a potential industry-wide shift towards more conservative lending practices and increased scrutiny of credit risk. Other companies may follow suit, leading to a tightening of credit availability across the sector.

- Increased scrutiny of credit risk within the industry: The "Walleye Cuts Credit" strategy will likely prompt other companies to reassess their credit policies and risk management procedures.

- Potential for higher borrowing costs across the board: Reduced credit availability could lead to higher interest rates and borrowing costs for all players in the commodities market.

- Shift towards more conservative lending practices: Lenders may become more cautious in extending credit, demanding higher collateral or stricter financial covenants.

- Increased focus on financial stability and risk management within the commodity sector: The industry as a whole will likely prioritize financial stability and implement more robust risk management frameworks.

The impact on various commodity types will depend on the specifics of Walleye's business and its supply chain, but this move undoubtedly sets a precedent within the entire commodities industry.

Opportunities Arising from Walleye's Strategic Shift

While Walleye's decision presents challenges, it also creates opportunities. The reduced credit availability creates a gap in the market, opening avenues for alternative financing solutions and potentially fostering innovation within the commodities sector.

- Growth opportunities for alternative financing solutions: Companies offering alternative financing mechanisms, such as factoring or supply chain finance, may experience significant growth.

- Emergence of new players in the market: New entrants with innovative financing models could capitalize on the increased demand for credit.

- Potential for technological advancements in risk management: The need for better risk assessment and management will likely spur technological advancements in this area.

Conclusion

Walleye's decision to cut credit, a move encapsulated by the term "Walleye Cuts Credit," is a strategic response to a challenging economic climate. This move will have significant repercussions for the commodities market, impacting supply chains, credit availability, and competition. The ripple effect will necessitate adaptation and innovation within the industry.

The strategic shift by Walleye, highlighted by its "Walleye Cuts Credit" strategy, marks a turning point in the commodities sector. Stay informed about these crucial market developments and adapt your strategies accordingly to navigate the changing landscape of commodity trading and risk management. Understanding the implications of Walleye's actions is crucial for success in this evolving market.

Featured Posts

-

Cronica Atalanta Y Venezia Igualan Sin Goles

May 13, 2025

Cronica Atalanta Y Venezia Igualan Sin Goles

May 13, 2025 -

Southampton Manager Hunt Is Gerrard The Leading Candidate

May 13, 2025

Southampton Manager Hunt Is Gerrard The Leading Candidate

May 13, 2025 -

Catch Every Texas Rangers Game In 2025 A Complete Guide To Broadcasting And Blackouts

May 13, 2025

Catch Every Texas Rangers Game In 2025 A Complete Guide To Broadcasting And Blackouts

May 13, 2025 -

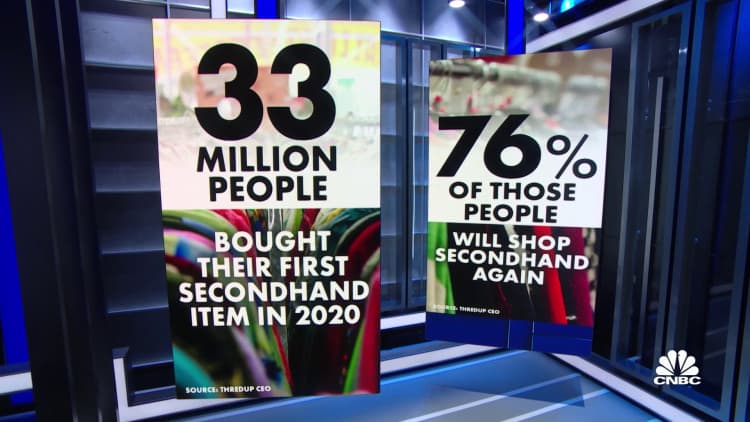

Secondhand Shopping A New Era Of Sustainability And Style

May 13, 2025

Secondhand Shopping A New Era Of Sustainability And Style

May 13, 2025 -

Decoding Tory Lanezs Alone At Prom Understanding The New Album Alone At Prom

May 13, 2025

Decoding Tory Lanezs Alone At Prom Understanding The New Album Alone At Prom

May 13, 2025

Latest Posts

-

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025