Strategy's Bitcoin Investment: 6,556 BTC Acquisition Explained

Table of Contents

The Significance of Strategy's 6,556 BTC Purchase

This massive Bitcoin acquisition isn't just a headline-grabbing event; it's a strategic move with profound implications. Understanding its significance requires analyzing both the market conditions at the time of purchase and how this Bitcoin investment fits into Strategy's broader portfolio strategy.

Market Context and Timing

The acquisition of 6,556 BTC occurred amidst [Insert specific date and timeframe]. At that time, the Bitcoin price was [Insert Bitcoin price at the time], and market sentiment was [Describe prevailing sentiment - e.g., cautiously optimistic, bearish, etc.].

- Bitcoin Price: [Specific price data]

- Market Capitalization: [Specific data on market cap]

- Regulatory News: [Mention any relevant regulatory news or events around that time]

This timing suggests a potential "dip buy" strategy, capitalizing on a period of relative market weakness to acquire a large quantity of Bitcoin at a potentially lower price point. This strategic move could yield significant returns if Bitcoin's price appreciates in the future.

Diversification and Portfolio Allocation

This substantial Bitcoin investment significantly impacts Strategy's overall portfolio diversification. While the exact percentage of their assets allocated to Bitcoin isn't publicly disclosed, it's likely a considerable portion. It demonstrates a strategic commitment to crypto assets as part of a broader risk management strategy.

- Other Asset Classes: [List other asset classes held by Strategy, e.g., stocks, bonds, real estate]

- Proportional Allocation (if available): [Include percentage breakdowns if publicly available]

By diversifying into Bitcoin, Strategy potentially mitigates risks associated with traditional asset classes and benefits from Bitcoin's potential for uncorrelated returns. This demonstrates a sophisticated understanding of risk management and portfolio optimization.

Potential Reasons Behind the Large Bitcoin Acquisition

Strategy's decision to acquire such a substantial amount of Bitcoin likely stems from a combination of factors, reflecting a long-term vision for Bitcoin and a desire to hedge against macroeconomic uncertainties.

Long-Term Vision and Bitcoin's Potential

Strategy's large-scale Bitcoin acquisition signals a strong belief in Bitcoin's long-term value proposition. This is likely driven by Bitcoin's growing acceptance as a decentralized store of value, a limited supply asset, and its potential for increased adoption as a medium of exchange.

- Bitcoin's Scarcity: Only 21 million Bitcoin will ever exist, making it a deflationary asset.

- Growing Institutional Adoption: Major corporations and financial institutions are increasingly acknowledging Bitcoin's value.

- Predictions: [Cite relevant expert opinions or industry predictions about Bitcoin's future price].

This investment could be interpreted as a bullish bet on Bitcoin's future price appreciation, reflecting a confidence in its potential to become a mainstream asset.

Hedging Against Inflation and Economic Uncertainty

Bitcoin's decentralized nature and limited supply make it an attractive hedge against inflation and economic instability. Its price is relatively uncorrelated with traditional assets, offering potential portfolio protection during times of economic uncertainty.

- Inflation Hedge: Bitcoin's fixed supply contrasts with fiat currencies that can be debased through inflation.

- Economic Uncertainty: Bitcoin's independence from traditional financial systems offers a potential safe haven.

- Risk Management: This investment enhances Strategy's overall risk mitigation strategy by diversifying beyond traditional asset classes.

This strategic move demonstrates a forward-thinking approach to risk management, leveraging Bitcoin's potential to act as a safeguard against macroeconomic headwinds.

Implications of Strategy's Bitcoin Investment

Strategy's significant Bitcoin investment carries far-reaching implications, influencing both the Bitcoin market and shaping perceptions of cryptocurrency investments.

Impact on the Bitcoin Market

The acquisition of 6,556 BTC represents a substantial purchase that could have influenced the Bitcoin price, potentially increasing demand and supporting price appreciation.

- Short-Term Price Effects: [Analyze potential short-term impacts on Bitcoin's price - did it cause a price increase?]

- Long-Term Price Effects: [Discuss potential long-term influence on Bitcoin's price].

- Investor Sentiment: This acquisition could boost investor confidence in Bitcoin, driving further investment.

This considerable purchase underlines the growing institutional interest in Bitcoin and could encourage other large investors to follow suit.

Potential for Future Acquisitions

The possibility of Strategy making further Bitcoin investments remains significant. Future decisions will likely be influenced by several factors.

- Market Conditions: Future price movements and market volatility will play a role.

- Regulatory Changes: Regulatory clarity or uncertainty could influence future investment decisions.

- Technological Developments: Advancements in Bitcoin technology could also impact future investments.

This significant investment marks a turning point, demonstrating the evolving relationship between institutional investors and the cryptocurrency market.

Conclusion

Strategy's acquisition of 6,556 BTC is a momentous event, highlighting the growing institutional acceptance of Bitcoin and its potential as a long-term investment. The strategic timing, diversification benefits, and potential for inflation hedging all contribute to the significance of this move. This large-scale Bitcoin acquisition could influence market sentiment and potentially drive further institutional investment in the cryptocurrency market. Understanding Strategy's Bitcoin investment strategy provides valuable insights into the evolving landscape of crypto investment. To learn more about Strategy’s Bitcoin investment and the evolving strategies for Bitcoin acquisition, further research is encouraged. Investigate reputable financial news sources and industry reports to stay informed about this dynamic market.

Featured Posts

-

Understanding Trumps Canada Rhetoric 51st State And Beyond

Apr 30, 2025

Understanding Trumps Canada Rhetoric 51st State And Beyond

Apr 30, 2025 -

Panoramas Chris Kaba Episode Iopc Complaint To Ofcom

Apr 30, 2025

Panoramas Chris Kaba Episode Iopc Complaint To Ofcom

Apr 30, 2025 -

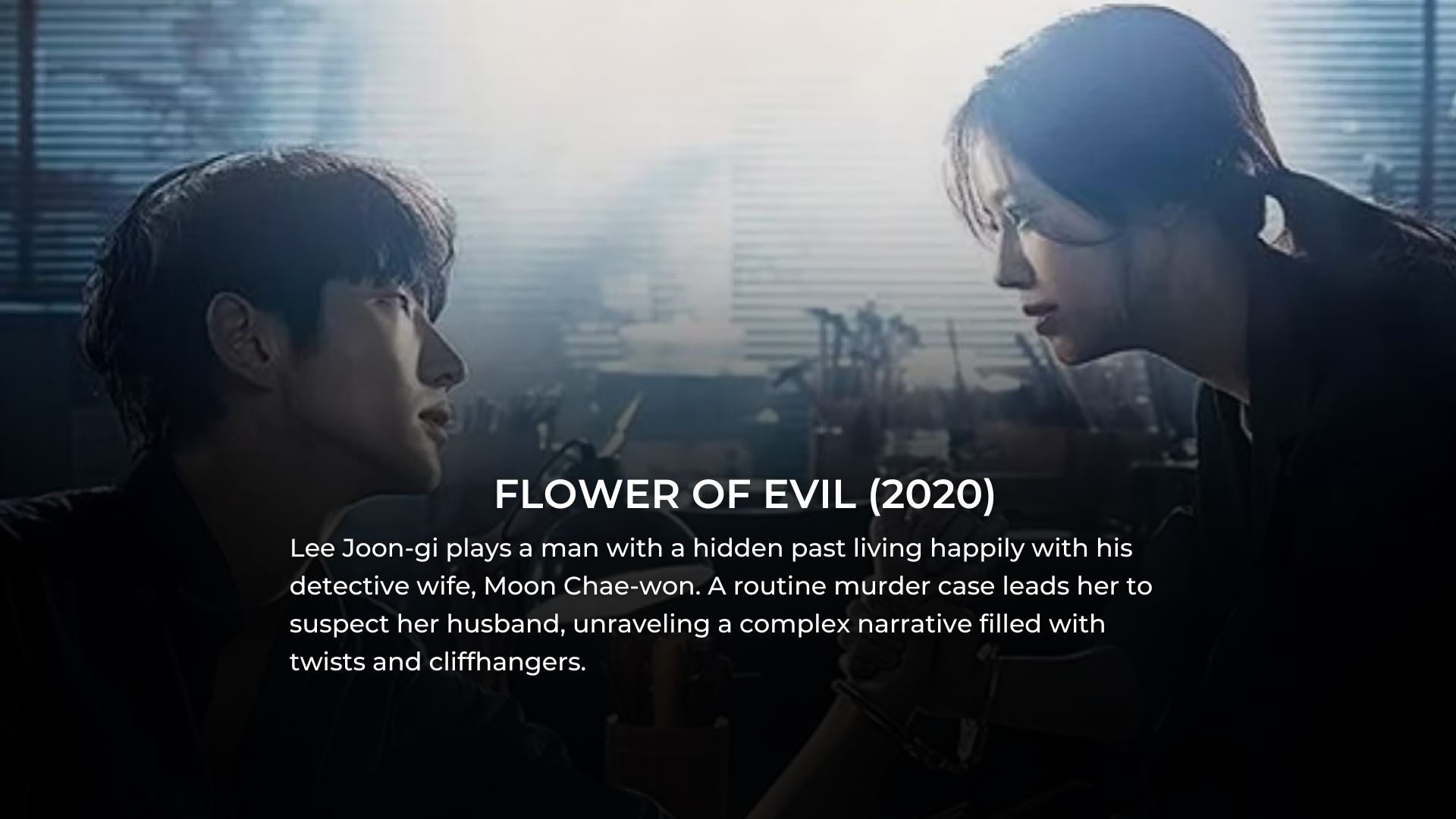

10 Must See Romance Dramas Featuring Incredible Plot Twists

Apr 30, 2025

10 Must See Romance Dramas Featuring Incredible Plot Twists

Apr 30, 2025 -

Charlotte Mothers Death Jury Selection Begins

Apr 30, 2025

Charlotte Mothers Death Jury Selection Begins

Apr 30, 2025 -

Apurate Clases De Boxeo En Edomex 3 Dias Para La Inscripcion

Apr 30, 2025

Apurate Clases De Boxeo En Edomex 3 Dias Para La Inscripcion

Apr 30, 2025