Strengthening Its Presence: PNE Group Acquires Two More Wind Farms

Table of Contents

Details of the Acquired Wind Farms

Wind Farm 1: Location, Capacity, and Significance

The first wind farm, located in the picturesque region of [Specific Region, Country], boasts an impressive installed capacity of [Number] MW. This state-of-the-art facility utilizes [Turbine Type] turbines, known for their high efficiency and low environmental impact. The expected annual energy production is estimated at [Number] GWh, enough to power [Number] households.

- Location: [Specific Region, Country], benefiting from consistent high-wind conditions.

- Capacity: [Number] MW, significantly increasing PNE Group's overall wind power generation.

- Technology: Utilizing advanced [Turbine Type] turbines, maximizing energy output and minimizing noise pollution.

- Community Impact: The project has created [Number] local jobs during construction and will continue to support local employment through ongoing maintenance and operation. PNE Group is also investing in local community initiatives.

- Benefits for PNE Group:

- Increased renewable energy generation capacity.

- Expansion into a new geographical market with high wind potential.

- Diversification of the renewable energy portfolio.

- Enhanced investor confidence and potential for increased profitability.

Wind Farm 2: Location, Capacity, and Significance

The second acquisition, situated in [Specific Region, Country], adds another [Number] MW of wind power capacity to PNE Group's portfolio. This wind farm features [Turbine Type] turbines and is expected to generate approximately [Number] GWh of clean energy annually.

- Location: [Specific Region, Country], strategically positioned to capitalize on strong and consistent wind resources.

- Capacity: [Number] MW, further strengthening PNE Group's position as a major player in the renewable energy sector.

- Technology: Utilizing advanced [Turbine Type] turbines, known for their reliability and efficiency.

- Community Impact: PNE Group is committed to minimizing environmental impact and engaging with local communities. This includes initiatives to support local education and environmental conservation efforts.

- Benefits for PNE Group:

- Significant increase in renewable energy production.

- Expansion into a new geographical market.

- Diversification of the energy portfolio, reducing reliance on any single location.

- Strengthening PNE Group's reputation as a leader in sustainable energy development.

Strategic Implications of the Acquisitions

Expanding Market Share and Geographic Reach

These acquisitions significantly expand PNE Group's market share in the renewable energy sector, particularly in [mention specific regions/countries]. The strategic locations of the wind farms allow PNE Group to tap into new markets and diversify its geographical footprint, reducing reliance on specific regions and increasing resilience against market fluctuations. These acquisitions also position PNE Group to benefit from potential future policy changes promoting renewable energy. This expansion may also lead to strategic partnerships with local energy distributors and governments.

Strengthening PNE Group's Commitment to Renewable Energy

The acquisitions firmly establish PNE Group's commitment to sustainable energy practices. The increased wind energy capacity contributes significantly to reducing carbon emissions and promoting a cleaner energy future. This aligns with PNE Group's broader Corporate Social Responsibility (CSR) initiatives, which focus on environmental protection and community engagement.

- Long-term Strategic Goals:

- Become a leading provider of renewable energy in Europe.

- Expand into new geographic markets with high renewable energy potential.

- Develop innovative technologies to further enhance renewable energy efficiency.

- Invest in community initiatives to promote sustainability and environmental stewardship.

Financial Aspects and Future Outlook

Investment Details and Expected Returns

While specific financial details of the acquisitions remain confidential, PNE Group anticipates significant financial returns from these investments. The long-term contracts for power purchase agreements associated with these wind farms provide stable revenue streams, contributing to increased profitability and improved shareholder value. The expected positive impact on the company's stock price and investor confidence reflects this.

Future Growth Plans and Expansion Strategies

PNE Group plans to continue expanding its renewable energy portfolio through further acquisitions and greenfield developments. The company is actively exploring opportunities in other renewable energy sectors such as solar power and energy storage, aiming to become a fully integrated renewable energy provider. The company's vision for the future involves becoming a global leader in sustainable energy solutions.

Conclusion

The acquisition of these two wind farms represents a significant step forward for PNE Group, solidifying its position as a leader in the renewable energy sector. These strategic moves demonstrate a clear commitment to expanding its portfolio, increasing its geographic reach, and contributing to a cleaner energy future. The investment in these wind farms showcases PNE Group's dedication to sustainable energy development and its potential for future growth.

Call to Action: Learn more about PNE Group's commitment to sustainable energy and its expanding portfolio of wind farms. Stay informed about future developments in the renewable energy sector by following PNE Group's progress and exploring their commitment to strengthening its presence in the green energy market. Discover how PNE Group is leading the way in wind farm development and acquisition.

Featured Posts

-

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025

Top Seed Pegula Defeats Defending Champion Collins In Charleston

Apr 27, 2025 -

February 20 2025 A Happy Day

Apr 27, 2025

February 20 2025 A Happy Day

Apr 27, 2025 -

Farm Import Ban Progress In South Africa Tanzania Talks

Apr 27, 2025

Farm Import Ban Progress In South Africa Tanzania Talks

Apr 27, 2025 -

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025

Anti Vaccine Activist Review Of Autism Vaccine Link Sparks Outrage Nbc Chicago Sources

Apr 27, 2025 -

Sinners Doping Case A Settlement Reached

Apr 27, 2025

Sinners Doping Case A Settlement Reached

Apr 27, 2025

Latest Posts

-

Cma Cgm Bolsters Global Network Through Turkish Logistics Acquisition

Apr 27, 2025

Cma Cgm Bolsters Global Network Through Turkish Logistics Acquisition

Apr 27, 2025 -

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025

440 Million Deal Cma Cgm Acquires Major Turkish Logistics Company

Apr 27, 2025 -

Cma Cgm Expands Turkish Footprint With 440 M Acquisition

Apr 27, 2025

Cma Cgm Expands Turkish Footprint With 440 M Acquisition

Apr 27, 2025 -

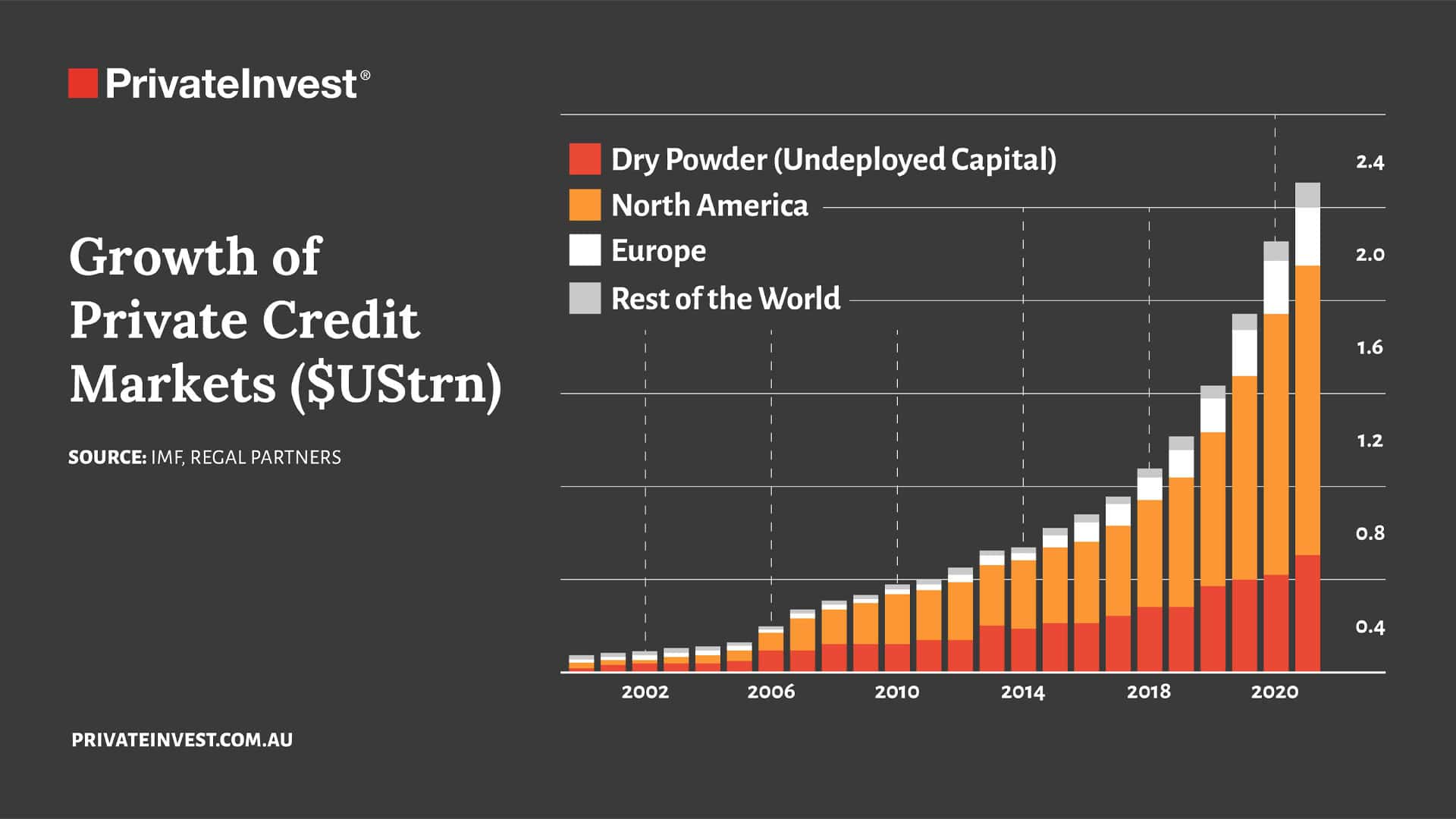

Private Credit Under Pressure A Credit Weekly Review Of Emerging Risks

Apr 27, 2025

Private Credit Under Pressure A Credit Weekly Review Of Emerging Risks

Apr 27, 2025 -

Credit Weekly Examining The Fractures In The Private Credit Market

Apr 27, 2025

Credit Weekly Examining The Fractures In The Private Credit Market

Apr 27, 2025