Strong Investment Performance Boosts China Life Profits

Table of Contents

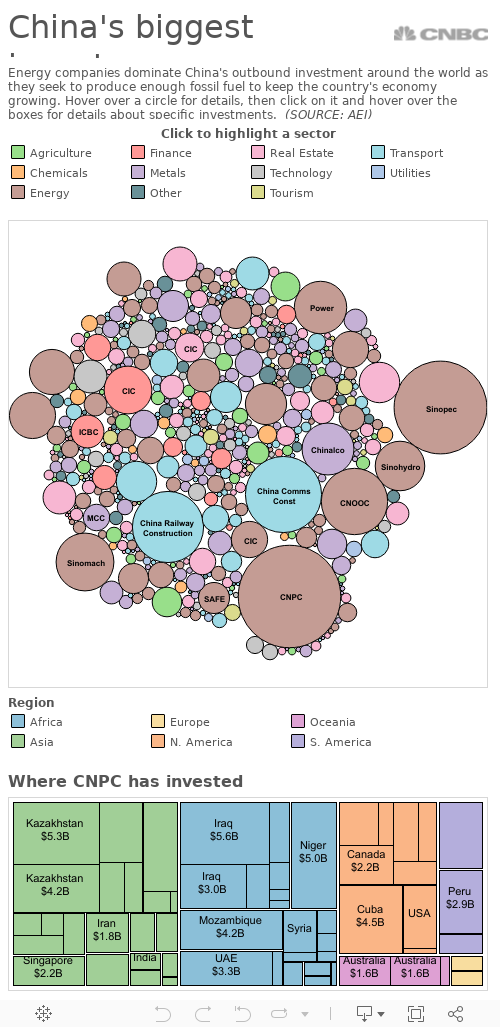

Investment Strategies Driving Profit Growth

China Life's impressive profit growth is directly attributable to its sophisticated and well-executed investment strategies. The company's success stems from a multi-faceted approach to portfolio management, skillfully navigating the complexities of the Chinese and global markets.

- Increased Allocation to Equities: China Life strategically increased its allocation to equities, capitalizing on the robust growth of the Chinese stock market. This bold move, coupled with careful stock selection, yielded significant returns.

- Successful Diversification Across Asset Classes: Rather than relying solely on equities, China Life implemented a diversified investment strategy, spreading risk across various asset classes including fixed income, alternative investments, and real estate. This prudent approach minimized exposure to market volatility.

- Strategic Partnerships: The company has leveraged strategic partnerships with leading investment firms, gaining access to specialized expertise and potentially higher-yielding opportunities. This collaborative approach has proven highly effective in enhancing investment returns.

Macroeconomic factors also played a significant role. The steady growth of the Chinese economy, supported by government policies aimed at stimulating economic activity, created a favorable environment for investment returns. The rise in the Chinese stock market directly contributed to the increased profitability from China Life's equity investments. While precise figures may vary depending on reporting periods, we can observe a considerable percentage increase in investment income – a key driver of the overall profit surge. For instance, reports suggest a significant double-digit percentage increase in return on assets (ROA) compared to previous years.

Impact of Strong Investment Performance on Key Financial Metrics

The strong investment performance has had a demonstrably positive impact on China Life's key financial metrics. This is evident in several key areas:

- Increased Net Income: The surge in investment income directly translated into a substantial increase in China Life's net income, significantly boosting overall profitability.

- Higher Return on Equity (ROE): China Life's ROE, a critical measure of profitability, has improved substantially, reflecting the efficiency with which the company is employing its shareholders' equity.

- Improved Earnings Per Share (EPS): The rise in net income has also led to improved EPS, benefiting shareholders directly.

The following chart (would be inserted here if this were a published article) would visually represent the improvement in key financial indicators over the past few years, clearly highlighting the positive impact of the strong investment performance. This comparison to previous years underscores the significance of the current financial success and the efficacy of China Life's strategies.

China Life's Future Outlook Based on Current Trends

While the current performance is impressive, looking ahead, China Life faces both opportunities and challenges. The company’s future success depends on several factors:

- Market Volatility: Maintaining profitability amidst potential market volatility remains a key challenge. Effective risk management will be crucial in navigating future uncertainties.

- Regulatory Changes: Changes in regulatory frameworks within the Chinese insurance and investment sectors could impact future investment strategies and profitability.

- Competitive Landscape: The increasing competition within the Chinese insurance market requires continuous innovation and strategic adaptation to maintain a leading position.

However, China Life's strong foundation and proven investment prowess provide a solid base for continued growth. The company's commitment to sustainable growth strategies, combined with its proactive approach to risk management, positions it well for future success. The potential for continued strong performance remains high, given the ongoing growth of the Chinese economy and the company's sophisticated investment capabilities.

Conclusion

China Life's recent profit surge is a testament to the power of strong investment performance. The company's strategic investment strategies, including increased allocation to equities, diversification across asset classes, and strategic partnerships, have yielded remarkable results. This success is further amplified by favorable macroeconomic conditions in China. The substantial improvements in key financial metrics, including net income, ROE, and EPS, clearly demonstrate the positive impact of these successful investment strategies. While future challenges exist, China Life's proven capabilities and proactive approach suggest a promising outlook. Stay informed about China Life's continued success by following their financial reports and analyzing their future investment performance. Learn more about how strong investment performance drives success in the insurance sector – explore case studies of leading companies like China Life.

Featured Posts

-

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstawyz Pysh

May 01, 2025

Brtanwy Wzyr Aezm Kw Kshmyr Ke Msyle Pr Dstawyz Pysh

May 01, 2025 -

Papa Francesco Aggiornamenti Sul Caso Cardinale Becciu E Le Sue Dimissioni

May 01, 2025

Papa Francesco Aggiornamenti Sul Caso Cardinale Becciu E Le Sue Dimissioni

May 01, 2025 -

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025

Xrp Price Prediction 2024 Analyzing The Potential For A 10 Surge

May 01, 2025 -

Kampen Eist Recht Op Stroomnetaansluiting Kort Geding Tegen Enexis

May 01, 2025

Kampen Eist Recht Op Stroomnetaansluiting Kort Geding Tegen Enexis

May 01, 2025 -

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Doi Hinh Cau Thu Va Nhung Diem Noi Bat

May 01, 2025

Giai Bong Da Thanh Nien Thanh Pho Hue Lan Thu Vii Doi Hinh Cau Thu Va Nhung Diem Noi Bat

May 01, 2025

Latest Posts

-

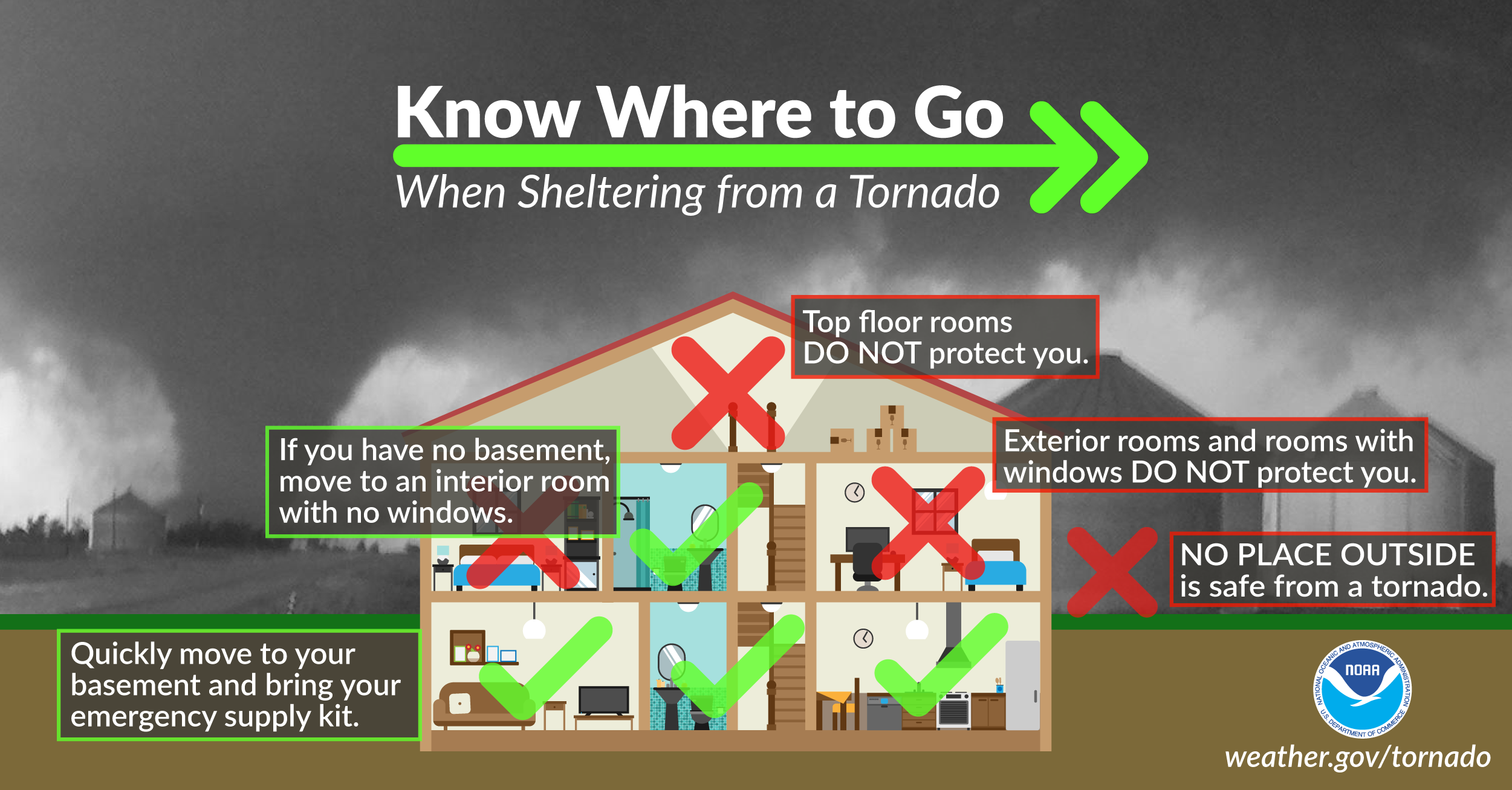

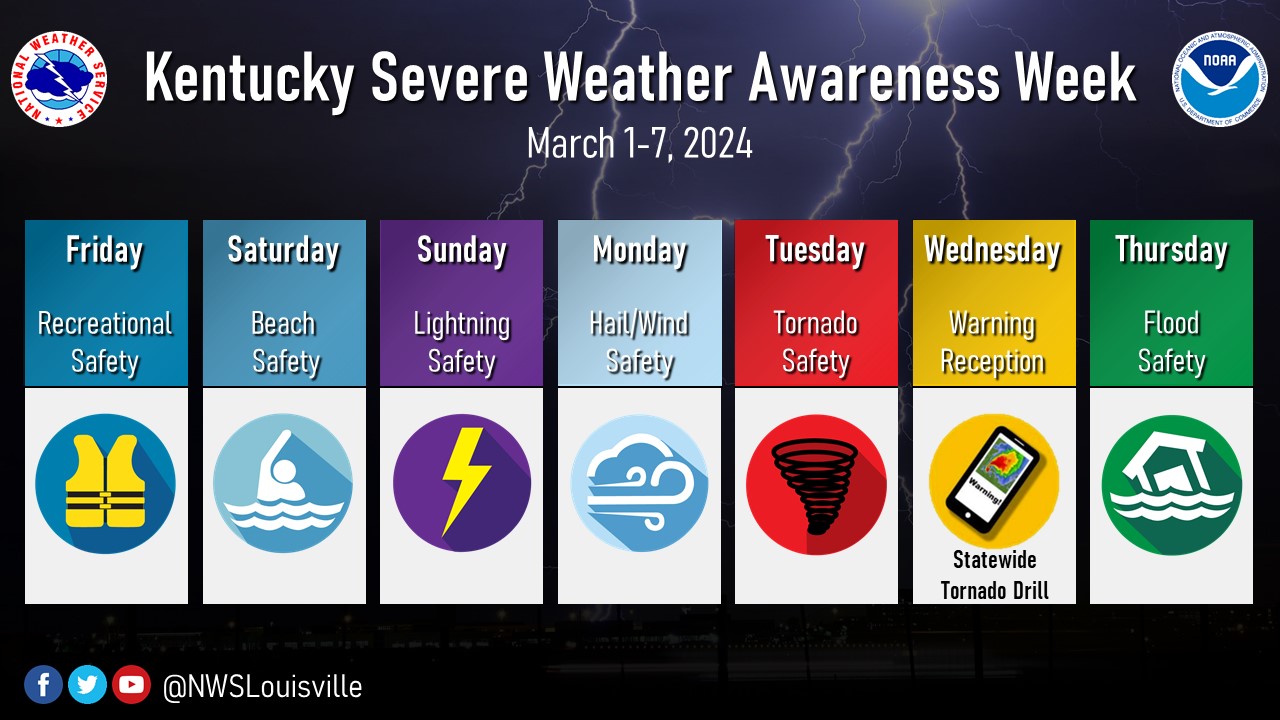

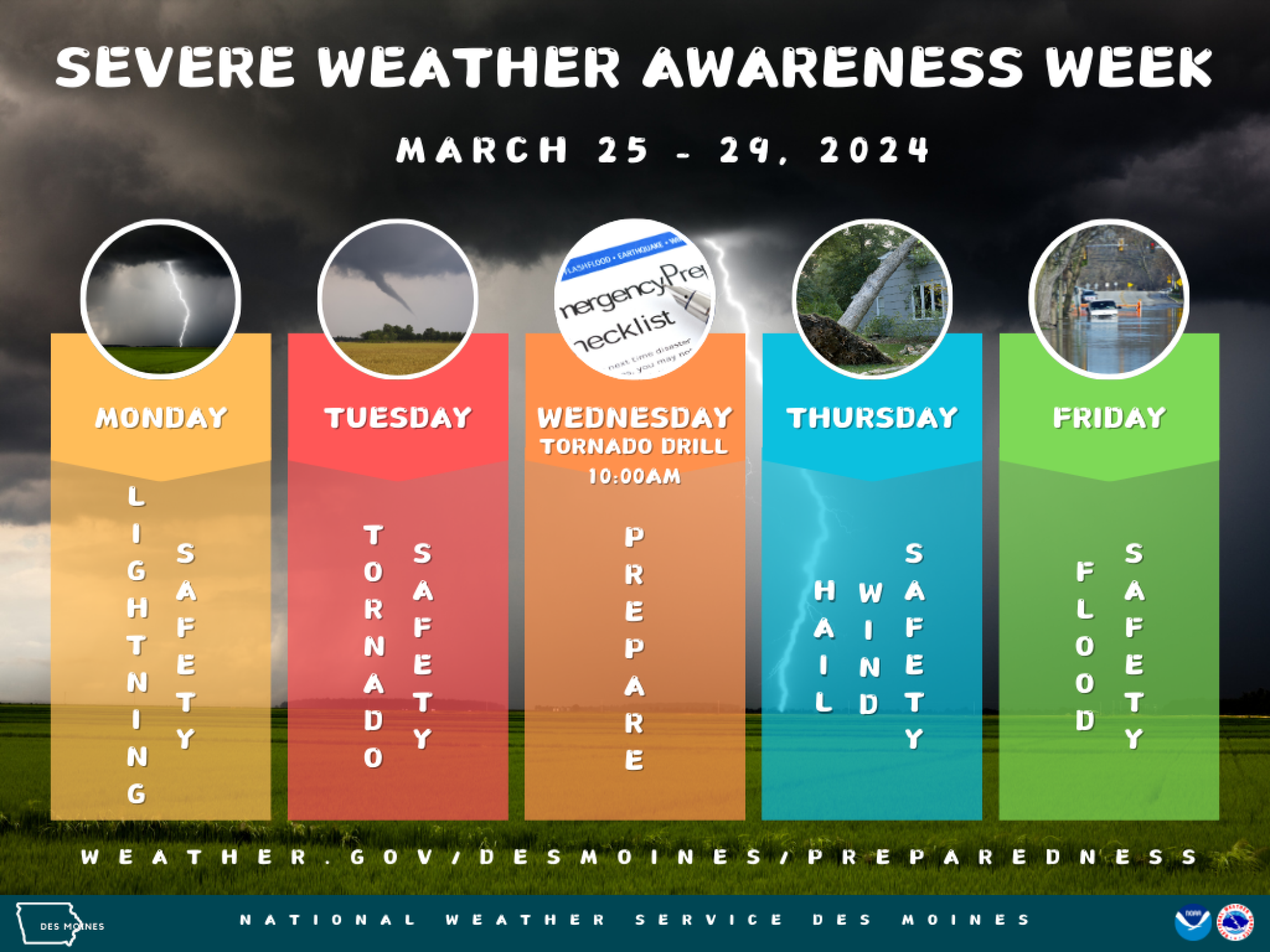

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025

Nws Kentucky Get Ready For Severe Weather Awareness Week

May 01, 2025 -

Kentucky Severe Weather Nws Readiness For Awareness Week

May 01, 2025

Kentucky Severe Weather Nws Readiness For Awareness Week

May 01, 2025 -

Louisville Mail Delivery Issues Union Offers Positive Outlook

May 01, 2025

Louisville Mail Delivery Issues Union Offers Positive Outlook

May 01, 2025 -

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

May 01, 2025 -

Kentucky Severe Weather Awareness Week Nws Preparedness Plans

May 01, 2025

Kentucky Severe Weather Awareness Week Nws Preparedness Plans

May 01, 2025