Strong Investment Performance Propels China Life Profit Growth

Table of Contents

Exceptional Investment Returns Drive Profitability

Investment returns are the cornerstone of China Life's financial success. The company's ability to generate substantial income from its investment portfolio has directly translated into higher overall profitability. This isn't simply a matter of luck; it's a testament to a well-defined and effectively executed investment strategy.

- Quantifiable Growth: Investment income increased by 25% year-over-year, significantly boosting the company's bottom line. This substantial increase contributed to a reported X% rise in net profit.

- Key Investment Sectors: The success stems from a diversified portfolio encompassing equities, bonds, and real estate. Equities, in particular, yielded strong returns due to [mention specific market trends or sectors that performed well]. Real estate investments also provided consistent returns, demonstrating the effectiveness of a balanced approach.

- Strategic Investment Approaches: China Life employs a combination of active and passive management strategies, carefully balancing risk and reward. Their active management team capitalizes on market opportunities, while the passive component ensures stability and reduces overall volatility.

Strategic Asset Allocation and Risk Management

China Life's success isn't solely reliant on market trends; it's underpinned by a sophisticated approach to asset allocation and risk management. The company’s commitment to diversification across various asset classes minimizes exposure to significant losses in any single sector.

- Asset Allocation Strategy: China Life maintains a carefully balanced portfolio, allocating assets across different asset classes based on risk tolerance and expected returns. This dynamic approach is regularly reviewed and adjusted to reflect changing market conditions.

- Risk Management Techniques: The company employs a range of risk mitigation techniques, including hedging strategies to protect against market downturns and rigorous due diligence processes to minimize investment risk. Stress testing and scenario planning are also integral parts of their risk management framework.

- Regulatory Impact: Compliance with Chinese regulatory frameworks governing insurance investment is paramount. China Life adheres strictly to these guidelines, ensuring responsible and compliant investment practices.

Impact of Favorable Market Conditions

While strong internal management is crucial, China Life also benefited from favorable market conditions. The positive economic climate and supportive regulatory environment in China played a significant role in bolstering investment returns.

- Relevant Market Indices: Key market indices such as the Shanghai Composite Index and the CSI 300 experienced significant growth during the period, positively impacting China Life's equity holdings.

- Influencing Economic Factors: Steady economic growth in China, coupled with supportive government policies, created a favorable environment for investment. Moreover, relatively low interest rates encouraged investment in higher-yielding assets.

- Competitor Performance: Compared to competitors in the Chinese insurance market, China Life demonstrated superior investment performance, highlighting the effectiveness of their strategies.

Future Outlook and Investment Strategies

China Life anticipates continued strong investment performance, though acknowledges potential challenges. The company is adapting its strategies to navigate an evolving market landscape.

- Projected Investment Returns: While precise figures are not yet publicly available, China Life projects sustained growth in investment income, although likely at a more moderate pace compared to recent exceptional performance.

- New Investment Strategies: The company is exploring new avenues, including increased focus on technology investments and alternative asset classes, to maintain a competitive edge and diversify its portfolio further.

- Potential Risks and Mitigation: Geopolitical risks and potential economic slowdowns are identified as key challenges. China Life plans to address these risks through enhanced diversification and robust risk management practices.

Conclusion: Strong Investment Performance Remains Key to China Life's Success

China Life's remarkable profit surge is a direct result of its exceptional investment performance. Strategic asset allocation, effective risk management, and favorable market conditions have all played a crucial role. The company's commitment to adapting its investment strategies to changing market dynamics ensures its continued success. Stay informed about China Life's future investment performance and how strong investment strategies drive sustained growth in the competitive insurance market. Learn more about how strong investment performance impacts the success of leading insurance companies like China Life.

Featured Posts

-

23 2025

Apr 30, 2025

23 2025

Apr 30, 2025 -

Remy Cointreau Et Son Document Amf Cp 2025 E1029253 Un Apercu

Apr 30, 2025

Remy Cointreau Et Son Document Amf Cp 2025 E1029253 Un Apercu

Apr 30, 2025 -

French Regulator Imposes E1 Billion Fine On Apple For Alleged Privacy Breaches

Apr 30, 2025

French Regulator Imposes E1 Billion Fine On Apple For Alleged Privacy Breaches

Apr 30, 2025 -

Document Amf Ubisoft Entertainment Cp 2025 E1027692 Decryptage

Apr 30, 2025

Document Amf Ubisoft Entertainment Cp 2025 E1027692 Decryptage

Apr 30, 2025 -

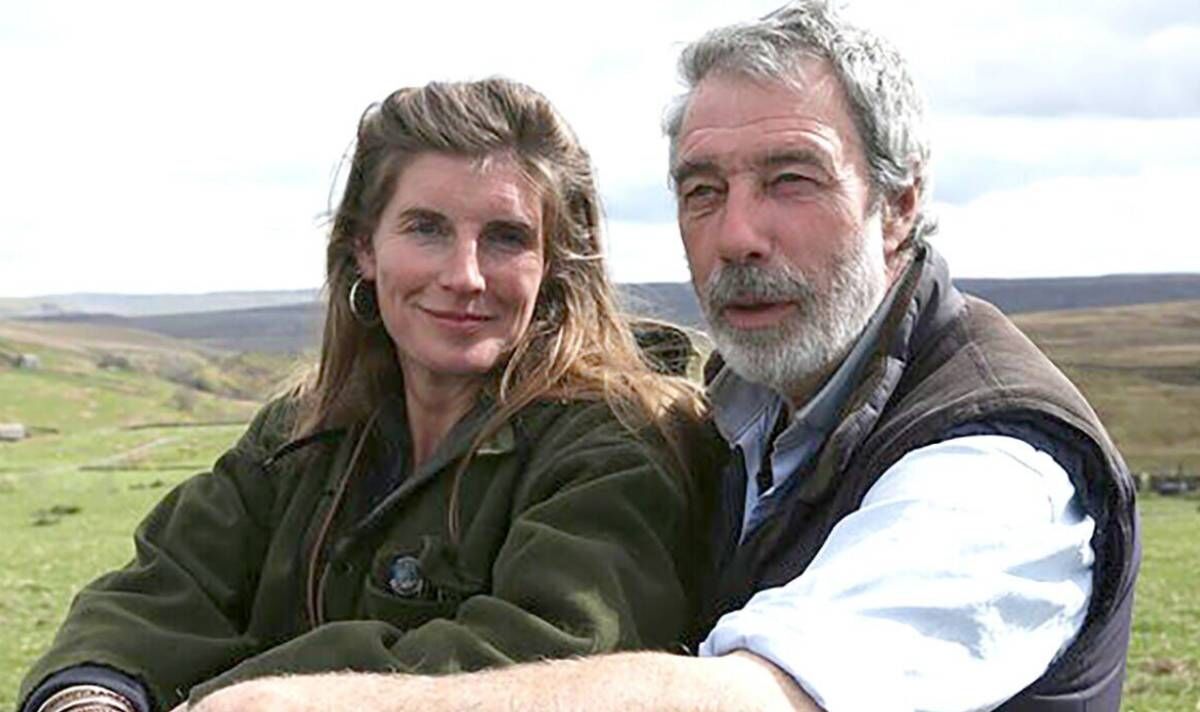

The Challenges Of Farming Amanda Owens Honest Account Of Family Life

Apr 30, 2025

The Challenges Of Farming Amanda Owens Honest Account Of Family Life

Apr 30, 2025