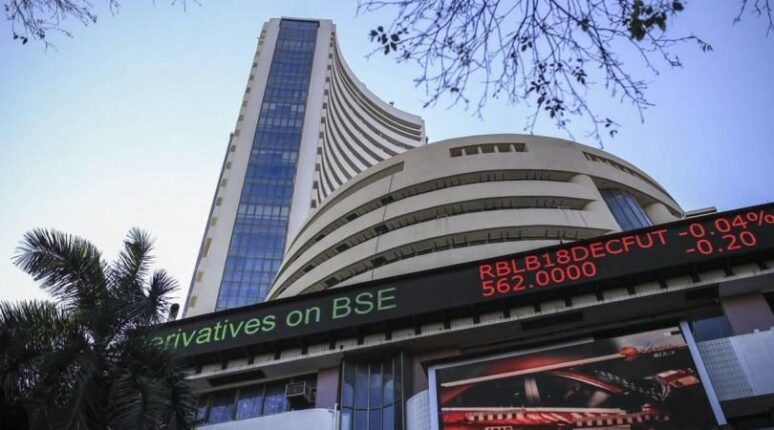

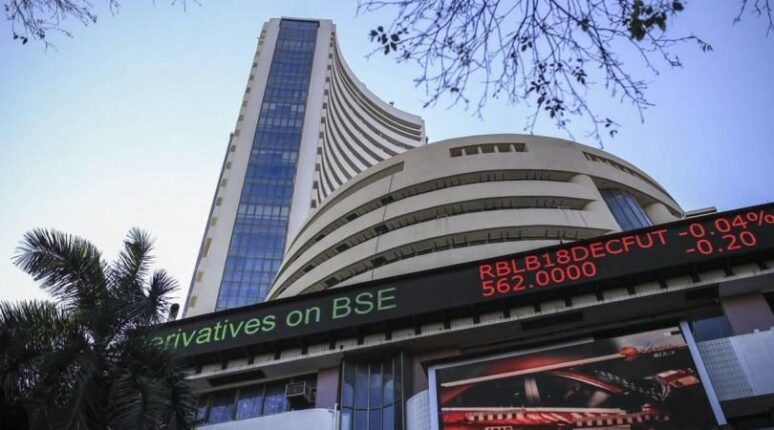

Strong Market Performance: Sensex Jumps 1400 Points, Nifty 50 Exceeds 23800 - 5 Key Drivers

Table of Contents

Global Positive Sentiment and Foreign Institutional Investor (FII) Inflows

A significant contributor to this stock market rally is the positive global market sentiment coupled with substantial Foreign Institutional Investor (FII) inflows. Positive global economic indicators have boosted investor confidence, leading to increased investment in emerging markets, including India. The easing of inflation in several major economies and strong corporate earnings reports globally have created a favorable environment for international investment.

- Increased FII investments in recent weeks: FIIs have shown a renewed interest in the Indian market, pouring billions of rupees into Indian equities. This surge in foreign investment is a clear indicator of growing confidence in the Indian economy's long-term potential.

- Positive global economic data: Easing inflation in the US and Europe, coupled with robust corporate earnings, has significantly improved global market sentiment, spilling over into the Indian stock market.

- Impact of global geopolitical events on investor sentiment: While geopolitical uncertainties persist globally, their impact on the Indian market has been relatively muted, suggesting resilience and a focus on domestic economic growth. This suggests a decoupling of the Indian market from some global uncertainties.

Keywords: FII inflows, foreign institutional investors, global market sentiment, international investment, emerging markets

Strong Domestic Economic Data and Positive Corporate Earnings

The robust performance of the Indian economy is another crucial factor driving this market rally. Positive domestic economic data, including strong GDP growth and healthy industrial production figures, has bolstered investor confidence. Furthermore, the impressive corporate earnings reported by numerous leading Indian companies have further fueled the market's upward trajectory.

- Positive GDP growth projections: India's continued strong GDP growth, outpacing many global economies, demonstrates the nation's economic resilience and potential for future growth. This positive outlook attracts both domestic and foreign investment.

- Strong performance by key sectors: Key sectors such as IT, Banking, and FMCG have shown exceptional performance, contributing significantly to the overall market growth. This diverse growth across multiple sectors points to a healthy and expanding economy.

- Positive corporate earnings announcements from leading companies: Strong quarterly results from major companies have reassured investors, reinforcing their confidence in the Indian market's potential for long-term growth and profitability.

Keywords: Indian economy, GDP growth, corporate earnings, domestic economic data, sectoral growth

Government Policies and Reforms

The Indian government's proactive approach towards economic reforms and policy initiatives has played a vital role in shaping investor sentiment. Several policy measures aimed at boosting infrastructure development, attracting foreign investment, and improving the ease of doing business have created a conducive environment for market growth.

- Recent government initiatives boosting infrastructure development: Significant investments in infrastructure projects have created jobs, improved connectivity, and fueled economic activity, ultimately benefiting the stock market.

- Impact of tax reforms on market growth: Tax reforms aimed at simplifying the tax structure and reducing compliance burdens have positively impacted business activity and investor confidence.

- Government measures to attract foreign investment: Initiatives aimed at streamlining foreign investment processes and promoting ease of doing business have significantly contributed to the increased FII inflows.

Keywords: Government policies, economic reforms, infrastructure development, fiscal policy, ease of doing business

Easing Inflation Concerns

Easing inflation concerns have also played a crucial role in bolstering investor sentiment. The Reserve Bank of India's (RBI) effective monetary policy measures to control inflation have created a more stable and predictable economic environment, encouraging investment.

- Recent inflation figures and their impact on market outlook: A decline in inflation rates has reduced investor anxieties about rising prices, leading to greater investment activity.

- Central bank's monetary policy and its effect on interest rates: The RBI's careful management of interest rates has helped maintain a balance between controlling inflation and supporting economic growth.

- Investor reaction to inflation predictions: Positive inflation predictions have further boosted investor confidence, creating a more optimistic outlook for the market.

Keywords: Inflation, interest rates, monetary policy, central bank, price stability, RBI

Sector-Specific Growth Drivers

The market rally wasn't uniform; specific sectors outperformed others. The robust growth in several key sectors has significantly contributed to the overall market strength.

- Growth in IT sector driven by global demand: The IT sector benefited from sustained global demand for technology services.

- Performance of banking sector post-reforms: The banking sector has shown resilience and growth following government reforms.

- Strong performance in consumer goods sector: The FMCG sector benefitted from a growing consumer base and increased spending.

Keywords: Sectoral growth, IT sector, banking sector, FMCG sector, specific sector performance

Riding the Wave of Strong Market Performance – What's Next?

The remarkable gains in the Sensex and Nifty 50 are the result of a confluence of factors: positive global sentiment and FII inflows, strong domestic economic data and corporate earnings, supportive government policies, easing inflation concerns, and robust sectoral growth. This strong market performance presents exciting opportunities for investors. While maintaining a positive outlook, it's crucial to remember that markets are inherently volatile. Therefore, a cautious approach combined with informed decision-making is paramount. Stay informed about market trends, conduct thorough research, and consider seeking professional financial advice to make informed investment decisions and benefit from the ongoing strong market performance. Understanding the nuances of Sensex and Nifty 50 movements is key to successful investment strategies.

Featured Posts

-

Queen Elizabeth 2 Post Makeover Exploring The Renovated 000 Passenger Vessel

May 09, 2025

Queen Elizabeth 2 Post Makeover Exploring The Renovated 000 Passenger Vessel

May 09, 2025 -

Elizabeth Hurleys Maldives Bikini Vacation Photos And Details

May 09, 2025

Elizabeth Hurleys Maldives Bikini Vacation Photos And Details

May 09, 2025 -

Analyzing The 2025 Nhl Playoffs After The Trade Deadline

May 09, 2025

Analyzing The 2025 Nhl Playoffs After The Trade Deadline

May 09, 2025 -

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025

Anchorage Welcomes Iditarod 2025 Ceremonial Start Draws Huge Crowds

May 09, 2025 -

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025

Expansion Viticole A Dijon 2500 M De Vignes Aux Valendons

May 09, 2025