Strong Payout For Vodacom (VOD) As Earnings Surpass Estimates

Table of Contents

Vodacom's Exceeding Earnings

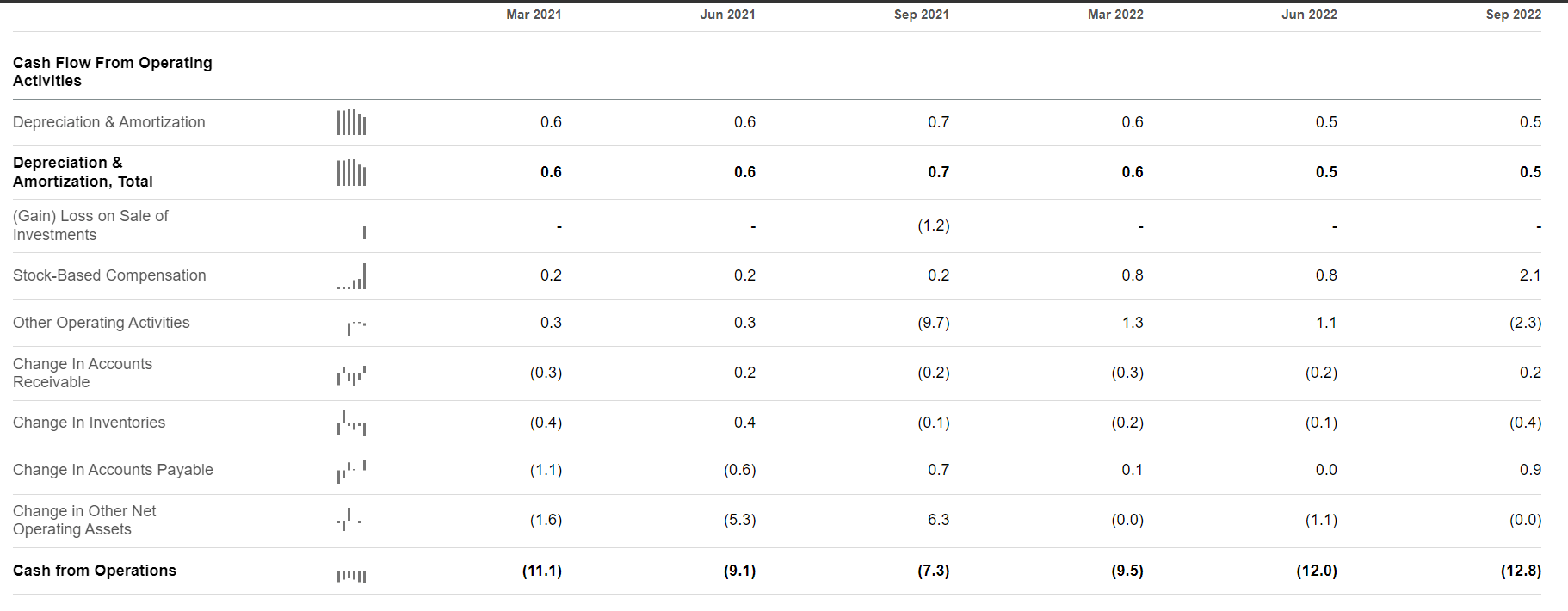

Vodacom's latest financial performance has significantly exceeded expectations, demonstrating robust revenue growth and improved profitability. The company reported impressive figures across various key performance indicators. Let's examine the specifics:

- Earnings Per Share (EPS): Vodacom reported an EPS of [Insert Actual EPS Figure], significantly higher than the predicted [Insert Analyst Prediction] and the previous quarter's [Insert Previous Quarter's EPS]. This substantial increase showcases strong earnings growth.

- Revenue Growth: Total revenue reached [Insert Actual Revenue Figure], representing a [Insert Percentage]% increase compared to the same period last year. This growth is largely attributed to increased mobile data usage and the success of its fintech initiatives.

- Operating Income: Operating income also showed significant improvement, reaching [Insert Actual Operating Income Figure], a [Insert Percentage]% increase year-on-year. This demonstrates improved operational efficiency and cost management.

Key areas driving this exceptional growth include:

- Mobile Data: The continued surge in mobile data consumption across its markets fueled significant revenue growth.

- Fintech Services: Vodacom's expansion into mobile financial services (M-Pesa) has proven highly successful, contributing substantially to overall earnings.

- Enterprise Services: The company's enterprise business, catering to corporate clients, experienced solid growth, showcasing diversified revenue streams.

- Improved Operational Efficiency: Streamlining operational processes has contributed to higher profit margins.

- Strategic Partnerships: Collaborations with other businesses have expanded market reach and generated new revenue opportunities.

Robust Dividend Payout and Investor Implications

The strong earnings translate into a robust dividend payout for Vodacom shareholders. The company announced a dividend of [Insert Dividend Amount] per share, representing a dividend yield of [Insert Dividend Yield Percentage]. This payout is scheduled for [Insert Payment Date].

The implications for investors are significant:

- Attractive Dividend Income: The high dividend yield makes Vodacom an attractive option for investors seeking reliable dividend income streams.

- Long-Term Growth Potential: The company's strong financial performance suggests significant potential for long-term growth, making it appealing for investors with a longer-term investment horizon.

- Stock Valuation: The recent performance should positively impact Vodacom's stock valuation, making it an attractive investment opportunity.

Potential investment strategies based on this strong payout include:

- Holding for Dividend Income: Investors can hold Vodacom shares primarily for the consistent dividend income.

- Dividend Reinvestment: Reinvesting dividends back into Vodacom shares can accelerate long-term growth through compounding.

- Valuation Assessment: Investors should carefully assess the stock's current valuation against market conditions before making any investment decisions.

Future Outlook and Growth Projections for Vodacom

Vodacom’s future growth prospects look promising, driven by several key factors:

- 5G Rollout: The expansion of 5G network coverage presents significant opportunities for growth in data services.

- Fintech Innovation: Continued innovation in mobile financial services will likely drive further growth in this high-potential sector.

- Expansion into New Markets: Exploring new markets could unlock significant growth opportunities.

- Strategic Acquisitions: Acquisitions of complementary businesses could further enhance Vodacom's market position.

However, challenges remain:

- Increased Competition: The telecommunications market is highly competitive, and Vodacom faces pressure from established players and new entrants.

- Regulatory Changes: Changes in regulations could affect Vodacom's operations and profitability.

- Economic Conditions: The overall economic climate in its key markets can impact consumer spending and, subsequently, Vodacom's performance.

Conclusion

Vodacom's (VOD) strong earnings and exceeding expectations have resulted in a substantial payout for its shareholders. This positive performance highlights the company's robust growth and presents compelling opportunities for investors. The strong dividend payout is just one indicator of Vodacom's success and its potential for future strong payouts.

Are you interested in learning more about Vodacom (VOD) and its potential for continued strong payouts? Conduct thorough research and consider seeking advice from a financial professional before making any investment decisions related to Vodacom's stock performance. Understanding the implications of this strong payout is crucial for making informed investment choices around Vodacom (VOD).

Featured Posts

-

New Mexico Gop Arson Attack Examining The Role Of Abc Cbs And Nbc In News Reporting

May 20, 2025

New Mexico Gop Arson Attack Examining The Role Of Abc Cbs And Nbc In News Reporting

May 20, 2025 -

One Child Missing Another Injured After Train Strikes Family On Railroad Bridge

May 20, 2025

One Child Missing Another Injured After Train Strikes Family On Railroad Bridge

May 20, 2025 -

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 20, 2025

Femicide Understanding The Rise In Cases And Its Underlying Causes

May 20, 2025 -

Agatha Christie Et L Ia Un Cours D Ecriture Creative

May 20, 2025

Agatha Christie Et L Ia Un Cours D Ecriture Creative

May 20, 2025 -

Ai Powered Agatha Christie Writing Classes From The Bbc

May 20, 2025

Ai Powered Agatha Christie Writing Classes From The Bbc

May 20, 2025

Latest Posts

-

D Wave Quantum Inc Qbts A Deep Dive Into This Weeks Stock Market Performance

May 20, 2025

D Wave Quantum Inc Qbts A Deep Dive Into This Weeks Stock Market Performance

May 20, 2025 -

Understanding The Recent Increase In D Wave Quantum Qbts Stock Value

May 20, 2025

Understanding The Recent Increase In D Wave Quantum Qbts Stock Value

May 20, 2025 -

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Rise

May 20, 2025

D Wave Quantum Inc Qbts Stock Surge Reasons Behind The Rise

May 20, 2025 -

D Wave Quantum Qbts Stock Soars Analyzing The Factors Contributing To The Rise

May 20, 2025

D Wave Quantum Qbts Stock Soars Analyzing The Factors Contributing To The Rise

May 20, 2025 -

Why Did D Wave Quantum Qbts Stock Price Increase This Week

May 20, 2025

Why Did D Wave Quantum Qbts Stock Price Increase This Week

May 20, 2025