Strong Performance Of Emerging Market Stocks: A Contrast To The US

Table of Contents

Economic Growth Drivers in Emerging Markets

Emerging markets are experiencing robust economic growth fueled by several powerful engines. This growth is significantly outpacing that of developed economies, including the US.

Robust Domestic Demand

Many emerging economies are witnessing a surge in consumer spending and investment.

- Examples of strong domestic consumption sectors: India's burgeoning middle class is driving significant growth in consumer durables, automobiles, and technology. Similarly, Southeast Asia's expanding urban populations are fueling demand across various sectors.

- Data points supporting infrastructure investment growth: Massive infrastructure projects across countries like China, Indonesia, and Brazil are boosting economic activity and creating jobs, further stimulating domestic demand. Data from the Asian Development Bank and the World Bank consistently show significant increases in infrastructure spending in these regions.

Favorable Demographics

A young and rapidly growing population presents a significant advantage for many emerging markets.

- Specific examples of countries with young populations and their economic impact: Countries like Nigeria, the Philippines, and Vietnam boast large youth populations, providing a substantial pool of labor and fueling entrepreneurial activity. This translates into increased productivity and economic expansion.

- Data on population growth and its effect on GDP: Studies consistently show a strong correlation between a young, working-age population and higher GDP growth rates in emerging markets. This demographic dividend contributes significantly to their overall economic strength.

Government Initiatives and Reforms

Many emerging market governments are actively implementing supportive policies and structural reforms.

- Examples of successful economic reforms in specific emerging markets: Several countries have successfully implemented reforms to improve their business environments, such as streamlining regulations, reducing bureaucracy, and attracting foreign investment. Examples include India's Goods and Services Tax (GST) implementation and various reforms in African countries aimed at improving ease of doing business.

- Positive impacts of government initiatives on foreign direct investment (FDI): These reforms have led to significant increases in FDI, further boosting economic growth and creating opportunities for businesses and investors.

Challenges Facing the US Market

In contrast to the dynamism of emerging markets, the US market is facing several headwinds.

Inflation and Interest Rate Hikes

High inflation and the Federal Reserve's aggressive interest rate hikes are significantly impacting the US stock market.

- Data on inflation rates and interest rate changes: Data from the Bureau of Labor Statistics consistently shows inflation remaining above the Federal Reserve's target rate. Consequently, the Fed has implemented several interest rate hikes, impacting borrowing costs and economic activity.

- Explanation of how these factors negatively impact stock valuations: Higher interest rates increase borrowing costs for businesses, potentially slowing investment and reducing corporate earnings, thus impacting stock valuations negatively.

Geopolitical Uncertainty

Global uncertainties and geopolitical risks pose significant challenges to the US economy and its stock market.

- Examples of geopolitical events impacting the US market: The ongoing war in Ukraine, tensions with China, and other geopolitical events contribute to market volatility and investor uncertainty.

- Analysis of investor sentiment and market volatility: These factors negatively affect investor sentiment, leading to increased market volatility and potential downward pressure on stock prices.

High Valuations in US Stocks

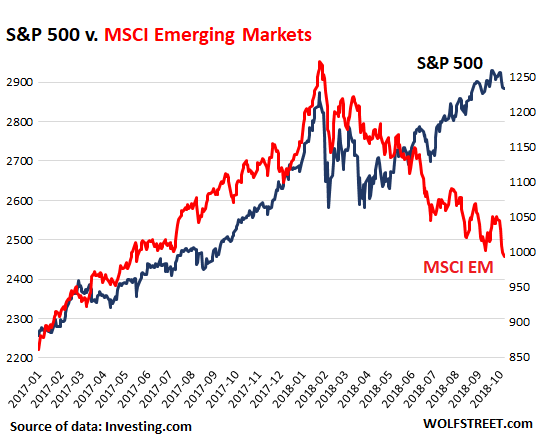

Compared to emerging markets, US stocks are trading at relatively high valuations.

- Comparison of P/E ratios and other valuation metrics: A comparison of Price-to-Earnings (P/E) ratios and other key valuation metrics reveals that many US stocks are trading at significantly higher multiples than their counterparts in emerging markets.

- Risks associated with high valuations: High valuations suggest a potential for a market correction, making emerging markets comparatively more attractive from a valuation perspective.

Investing in Emerging Market Stocks: Opportunities and Risks

Investing in emerging markets presents both significant opportunities and inherent risks.

Diversification Benefits

Investing in emerging markets offers valuable diversification benefits.

- Arguments for global diversification: Diversification across different asset classes and geographies reduces portfolio risk and improves overall returns.

- Data on correlation between US and emerging market stocks: Historically, emerging market stocks have shown lower correlation with US stocks, providing a natural hedge against potential market downturns in the US.

Potential for Higher Returns

Emerging markets offer the potential for significantly higher returns.

- Historical data comparing returns of emerging and developed markets: Historical data suggests that emerging markets have generated higher average returns over the long term compared to developed markets, though with higher volatility.

- Discussion on risk tolerance and investment horizon: Investing in emerging markets requires a longer-term investment horizon and higher risk tolerance given the potential for greater volatility.

Risk Mitigation Strategies

Investors can implement strategies to mitigate the risks associated with emerging markets.

- Strategies like hedging currency risk: Currency hedging can help reduce the impact of fluctuations in exchange rates.

- Diversification across different emerging markets: Diversification across various emerging markets reduces exposure to specific country-specific risks.

Conclusion: Strong Performance of Emerging Market Stocks: A Contrast to the US

The strong performance of emerging market stocks in recent times stands in stark contrast to the challenges faced by the US market. Robust domestic demand, favorable demographics, and supportive government policies fuel growth in emerging economies. Conversely, high inflation, interest rate hikes, geopolitical uncertainty, and high valuations weigh on the US market. Investing in emerging markets offers diversification benefits and the potential for higher returns, though with higher volatility. Consider diversifying your portfolio by including emerging market stocks to potentially capture higher growth opportunities. However, remember to conduct thorough research and consider your risk tolerance before investing in emerging market stocks. Understanding the nuances of emerging market investing is crucial for maximizing returns while effectively managing risk.

Featured Posts

-

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025

Understanding Google Fis New 35 Unlimited Data Plan

Apr 24, 2025 -

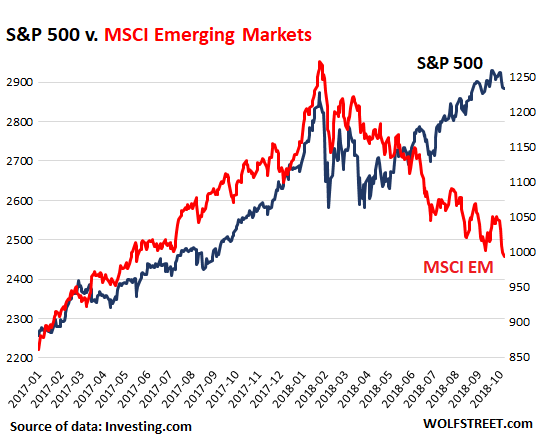

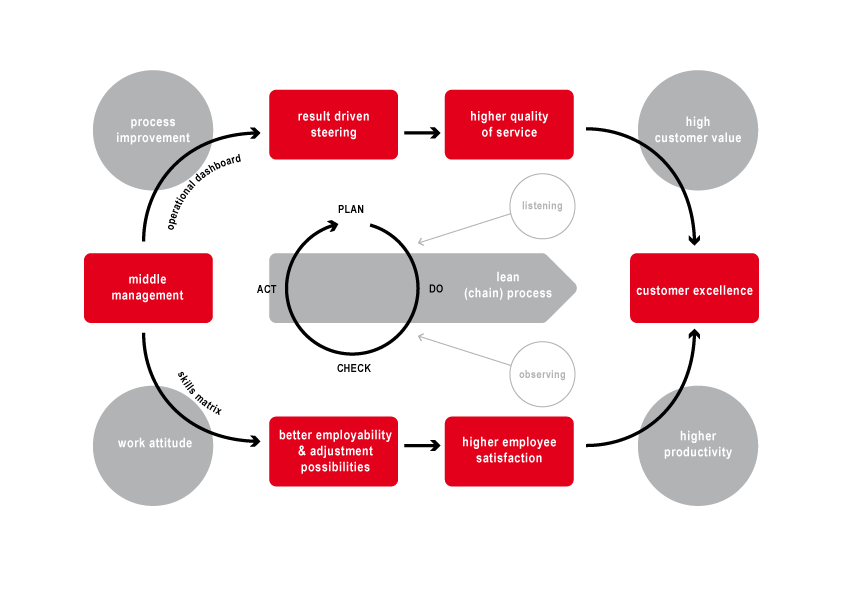

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025

How Middle Management Drives Company Performance And Employee Satisfaction

Apr 24, 2025 -

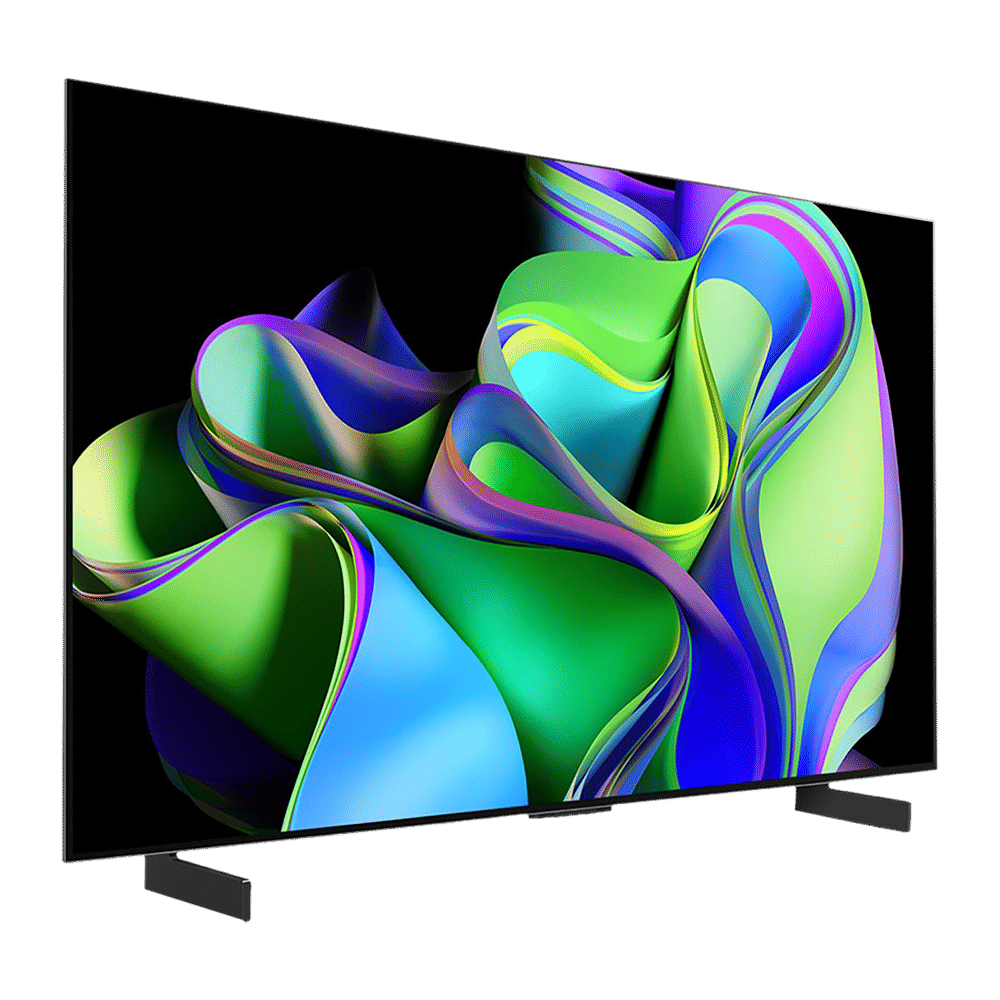

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025

A Practical Review Of The Lg C3 77 Inch Oled Television

Apr 24, 2025 -

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 24, 2025

Bof As Take Why Current Stock Market Valuations Shouldnt Worry Investors

Apr 24, 2025 -

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025

Secret Service Closes White House Cocaine Investigation

Apr 24, 2025