Student Loan Debt And The Economy: A Looming Crisis?

Table of Contents

The Mounting Burden of Student Loan Debt

The Sheer Scale of Student Loan Debt

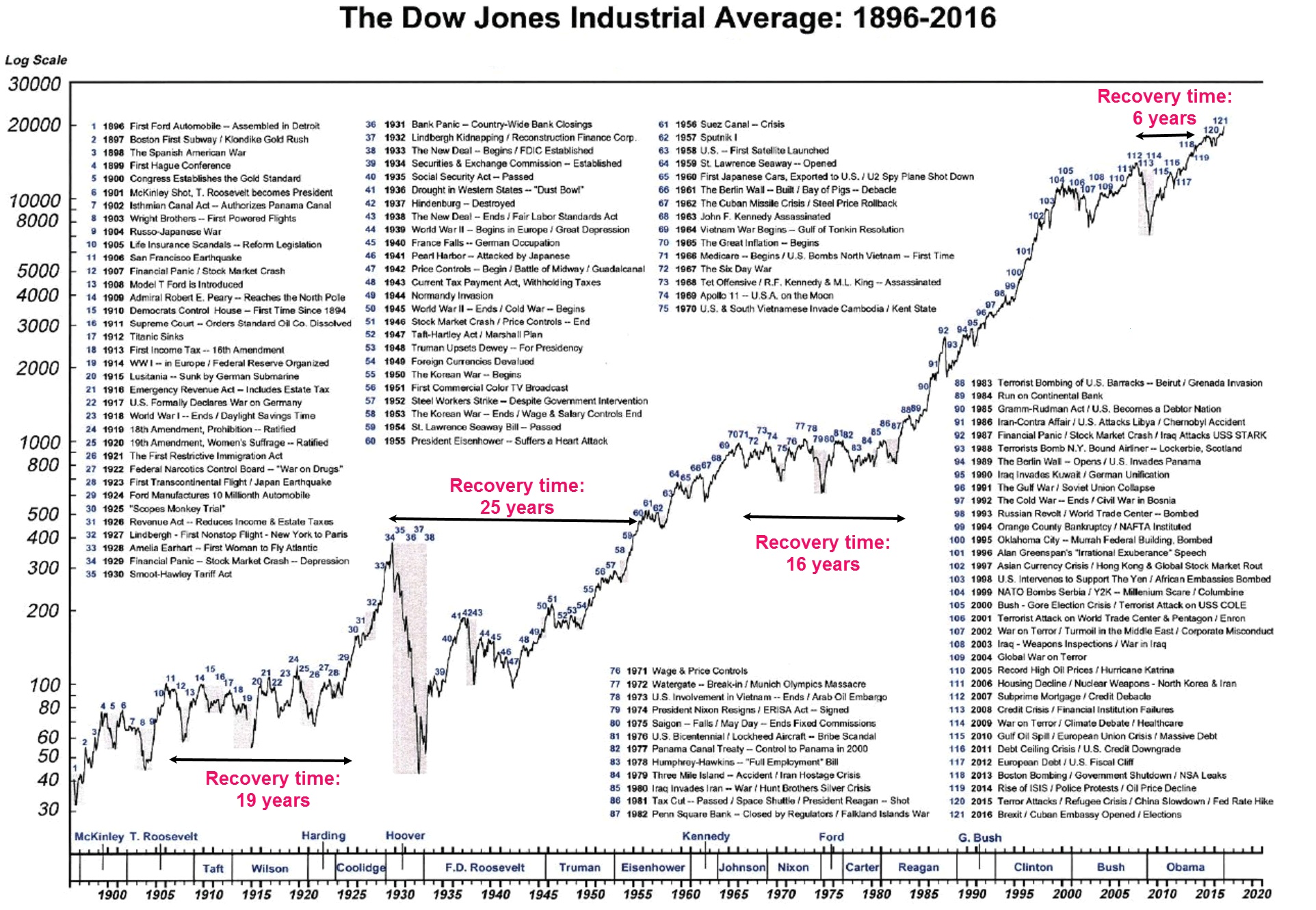

The sheer scale of student loan debt is alarming. The total amount outstanding represents a significant portion of the national debt, impacting economic growth and individual financial well-being.

- Total Debt: The current total surpasses $1.7 trillion, a figure that has more than doubled in the last decade.

- Demographic Breakdown: The burden isn't evenly distributed. Younger generations (Millennials and Gen Z) carry a disproportionate share, delaying major life milestones like homeownership and starting families. Lower-income borrowers often face even greater challenges in repayment.

- Growth Rate: Student loan debt continues to grow at an unsustainable rate, fueled by rising tuition costs and increased borrowing. This rapid growth poses a serious threat to long-term economic stability.

- Rising Default Rates: High default rates further exacerbate the problem, indicating a significant number of borrowers struggling to manage their student loan repayments.

The Impact on Personal Finances

Student loan payments significantly impact borrowers' personal finances. The monthly obligations often consume a large portion of their income, leaving little room for saving, investing, or other essential financial goals.

- Reduced Savings & Investment: The constant pressure of student loan repayment restricts individuals' ability to save for retirement, emergencies, or invest in their future.

- Delayed Major Purchases: Buying a home, starting a family, or even purchasing a car becomes significantly more challenging, if not impossible, with substantial student loan debt.

- Mental Health Consequences: The stress and anxiety associated with overwhelming student loan debt contribute to significant mental health challenges for many borrowers.

- Impact on other life choices: Decisions regarding marriage, family planning, and career choices are often influenced by the need to manage student loan payments.

The Ripple Effect on the Broader Economy

The high levels of student loan debt have far-reaching consequences for the broader economy. It's not just a personal financial problem; it's a systemic issue with significant economic implications.

- Hindered Consumer Spending: High student loan payments reduce disposable income, leading to decreased consumer spending, a critical driver of economic growth.

- Impact on Entrepreneurship: The financial burden discourages young people from starting businesses, hindering innovation and job creation. The fear of further debt prevents many from taking entrepreneurial risks.

- Effects on the Housing Market: The difficulty in securing mortgages due to student loan debt impacts the housing market, slowing down overall economic activity.

- Reduced Investment: Individuals burdened by student loan debt have less capital available for investments, impacting overall economic growth and productivity.

Potential Solutions and Policy Implications

Government Policies and Loan Forgiveness Programs

Government intervention is crucial in addressing the student loan debt crisis. Various policies and loan forgiveness programs have been proposed and implemented, each with its own set of advantages and disadvantages.

- Existing Programs: Income-driven repayment plans and public service loan forgiveness programs aim to alleviate the burden for certain borrowers. However, their effectiveness is debated.

- Loan Forgiveness Programs: While offering immediate relief, large-scale loan forgiveness programs have potential drawbacks, including the cost to taxpayers and the ethical questions of who should benefit.

- Policy Approaches: Exploring alternative approaches, such as interest rate caps, tuition regulation, and increased funding for need-based financial aid, are crucial for sustainable solutions.

Strategies for Individuals to Manage Student Loan Debt

Individuals can take proactive steps to manage their student loan debt effectively. This involves a combination of financial planning and understanding available resources.

- Budgeting and Repayment Strategies: Creating a detailed budget, prioritizing student loan payments, and exploring different repayment plans (e.g., accelerated repayment) are essential strategies.

- Debt Consolidation: Consolidating multiple loans into a single loan can simplify repayment and potentially lower interest rates.

- Financial Counseling: Seeking guidance from financial counselors or credit counseling agencies can help individuals develop personalized debt management plans.

- Refinancing Options: Refinancing student loans can potentially lower monthly payments and interest rates, easing the financial burden.

Conclusion: Addressing the Student Loan Debt Crisis

The sheer magnitude of student loan debt, its impact on individual finances, and its ripple effects on the broader economy demand urgent attention. The crisis necessitates a multi-pronged approach involving government policies, individual financial responsibility, and a focus on preventing future debt accumulation. Understanding the student loan debt crisis is the first step towards managing your student loan debt and advocating for meaningful solutions. Learn more about available resources and support systems to navigate this complex financial challenge. The future of the economy, and the financial well-being of millions, hinges on finding effective solutions for student loan debt.

Featured Posts

-

Belfoeld Toebb Hullamban Erkezik A Csapadek De Meleg Marad

May 28, 2025

Belfoeld Toebb Hullamban Erkezik A Csapadek De Meleg Marad

May 28, 2025 -

Daywatch Pvt James Loyds Improbable Wwii Homecoming

May 28, 2025

Daywatch Pvt James Loyds Improbable Wwii Homecoming

May 28, 2025 -

Euro Millions Draw Results For Tuesday April 15th 34m

May 28, 2025

Euro Millions Draw Results For Tuesday April 15th 34m

May 28, 2025 -

Stock Market Summary Dow S And P And Nasdaq May 27 2024

May 28, 2025

Stock Market Summary Dow S And P And Nasdaq May 27 2024

May 28, 2025 -

Ingilizlerin Osimhen E Olan Ilgisi Suerueyor 45 Milyon Euroluk Yildiz Icin Yeni Teklifler

May 28, 2025

Ingilizlerin Osimhen E Olan Ilgisi Suerueyor 45 Milyon Euroluk Yildiz Icin Yeni Teklifler

May 28, 2025

Latest Posts

-

2025 Comeback Confirmed Hybe Ceo Addresses Btss Extended Hiatus

May 30, 2025

2025 Comeback Confirmed Hybe Ceo Addresses Btss Extended Hiatus

May 30, 2025 -

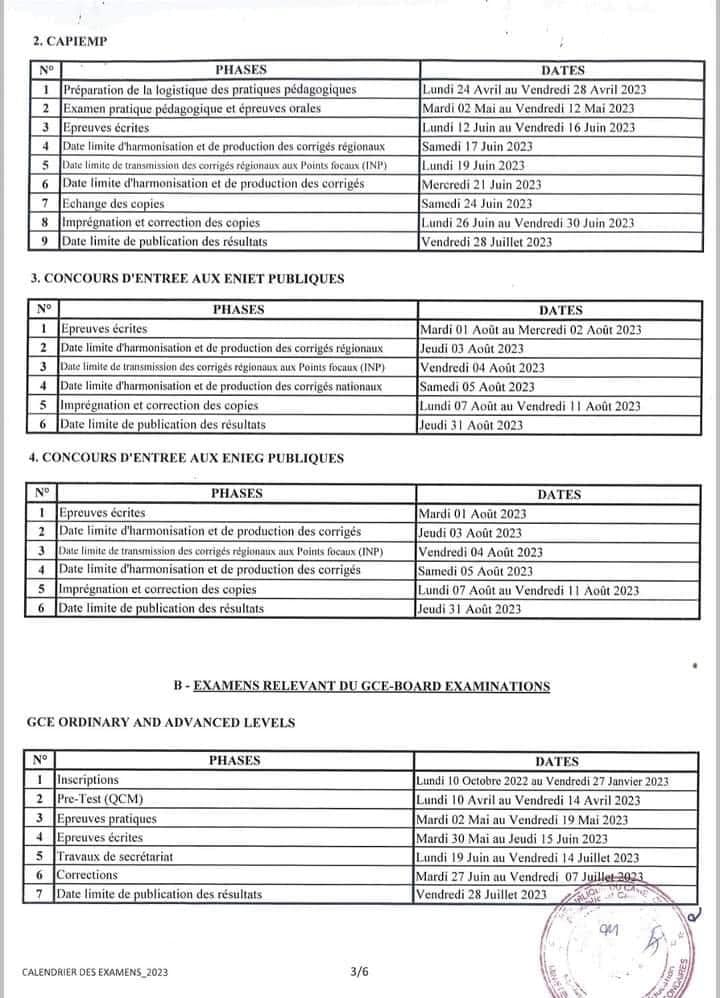

Bts 2025 Tout Savoir Sur Les Dates Des Epreuves Et Resultats

May 30, 2025

Bts 2025 Tout Savoir Sur Les Dates Des Epreuves Et Resultats

May 30, 2025 -

Hybe Ceos Update Btss 2025 Comeback And The Importance Of Member Time Off

May 30, 2025

Hybe Ceos Update Btss 2025 Comeback And The Importance Of Member Time Off

May 30, 2025 -

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025

Bts 2025 Dates Des Examens Et Annonce Des Resultats

May 30, 2025 -

Bts 2025 Calendrier Previsionnel Des Epreuves Et Dates De Resultats

May 30, 2025

Bts 2025 Calendrier Previsionnel Des Epreuves Et Dates De Resultats

May 30, 2025