Succeeding In The Private Credit Industry: 5 Do's And Don'ts

Table of Contents

5 Do's for Success in Private Credit

Do Thorough Due Diligence

Comprehensive due diligence is paramount in private credit investing. This goes far beyond simply reviewing financial statements; it demands a holistic assessment of the borrower and the investment opportunity. Effective due diligence in the private debt market is crucial for mitigating risk.

- Independently verify financial information: Don't rely solely on the borrower's provided data. Engage independent auditors or accounting firms to ensure accuracy and transparency.

- Analyze the management team's experience and track record: A strong management team is crucial for the success of any business. Assess their expertise, past performance, and ability to navigate challenges.

- Conduct thorough industry and competitive analysis: Understand the market dynamics, competitive landscape, and the borrower's position within it. This helps assess the potential for growth and profitability.

- Assess the borrower's creditworthiness and repayment capacity: Employ robust credit scoring and financial modeling to evaluate the borrower's ability to repay the debt. Consider stress testing scenarios to gauge resilience.

- Evaluate the collateral and security offered: Understand the value and liquidity of any collateral offered as security for the loan. This is particularly critical in the private credit space, where personal guarantees often play a significant role.

Details: Engaging external experts is often necessary for specialized due diligence. For example, legal counsel can review contracts and regulatory compliance, while technical experts may be needed to assess the viability of complex projects. This comprehensive approach reduces risk and enhances your investment decision-making process in the private credit space.

Do Diversify Your Portfolio

Diversification is a cornerstone of successful investing, and private credit is no exception. Spreading your investments across various sectors, geographies, and borrower types helps mitigate risk.

- Diversification minimizes the impact of any single investment failing: A diversified portfolio reduces the potential for catastrophic losses from a single bad investment.

- Consider allocating funds to different private credit strategies (e.g., direct lending, fund investments): Explore various private debt strategies to achieve optimal diversification and exposure to different risk-return profiles.

- Regularly rebalance your portfolio to maintain optimal diversification: Over time, your portfolio's allocation may drift from your target. Regular rebalancing ensures alignment with your investment goals.

Details: Different diversification strategies exist within private credit. For instance, you can diversify by industry (technology, healthcare, real estate), by geography (domestic vs. international), or by loan type (senior secured, subordinated, mezzanine). Each strategy offers unique risk-return characteristics which must be carefully considered as part of your overall private credit investment strategy.

Do Build Strong Relationships

Networking is essential in the private credit industry. Trusted relationships unlock access to exclusive deals, valuable market insights, and potential collaborations.

- Attend industry conferences and events: These events offer invaluable networking opportunities and provide exposure to new trends and strategies.

- Cultivate relationships with investment bankers, lawyers, and other industry professionals: These individuals possess in-depth market knowledge and can provide deal flow and insights.

- Develop strong working relationships with borrowers: Positive borrower relationships can lead to future opportunities and smoother transactions.

Details: Building strong relationships requires professional integrity and a consistent demonstration of trust and reliability. A strong reputation is invaluable in this relationship-driven industry.

Do Employ Robust Risk Management

Private credit inherently involves risk. Proactive and robust risk management is non-negotiable for long-term success.

- Regularly monitor portfolio performance: Track key metrics and indicators to identify potential problems early on.

- Employ robust credit scoring and risk rating systems: Utilize quantitative and qualitative tools to assess and monitor credit risk.

- Have a clear exit strategy for each investment: Know how and when you will exit each investment to maximize returns and mitigate risk.

Details: Risk management techniques include stress testing your portfolio against various economic scenarios, utilizing scenario analysis, and employing sophisticated credit scoring models. These help you anticipate and prepare for potential adverse events.

Do Stay Updated on Market Trends

The private credit landscape is dynamic, shaped by regulatory changes, economic shifts, and evolving investor preferences. Continuous learning is paramount.

- Stay abreast of regulatory changes and market developments: Keep informed about relevant regulations and market trends impacting private credit.

- Follow industry publications and attend educational seminars: Access leading resources to gain insights into market trends and best practices.

- Engage with thought leaders in the private credit industry: Network with and learn from those with extensive experience in the field.

Details: Follow reputable industry publications like Private Debt Investor, attend conferences hosted by organizations like the Alternative Credit Council, and stay updated on regulatory changes from bodies like the SEC.

5 Don'ts for Success in Private Credit

Don't Underestimate Due Diligence: Cutting corners on due diligence significantly increases the risk of substantial financial losses.

Don't Overconcentrate Your Portfolio: Over-reliance on a few investments exposes you to unacceptable levels of risk. Diversification is key.

Don't Neglect Relationship Building: Strong relationships are a critical element of success in this relationship-driven industry.

Don't Ignore Risk Management: Proactive risk mitigation is crucial for achieving consistent long-term success in private credit.

Don't Become Complacent: The private credit market is ever-evolving; continuous learning is essential to stay ahead of the curve and avoid becoming outdated.

Conclusion

Succeeding in the private credit industry demands a multifaceted approach combining rigorous due diligence, strategic portfolio diversification, strong relationship-building, proactive risk management, and continuous learning. By diligently following these "do's" and avoiding the "don'ts," investors can significantly improve their chances of navigating the complexities of private credit investing and achieving substantial returns. Don't delay – start implementing these strategies for successful private credit investment today!

Featured Posts

-

Uyku Keyfinizi Arttiracak 2025 Nevresim Takimi Trendleri Gencler Ve Aileler

May 19, 2025

Uyku Keyfinizi Arttiracak 2025 Nevresim Takimi Trendleri Gencler Ve Aileler

May 19, 2025 -

Nea Stoixeia Fotizoyn To Tampoy Ton Fonon

May 19, 2025

Nea Stoixeia Fotizoyn To Tampoy Ton Fonon

May 19, 2025 -

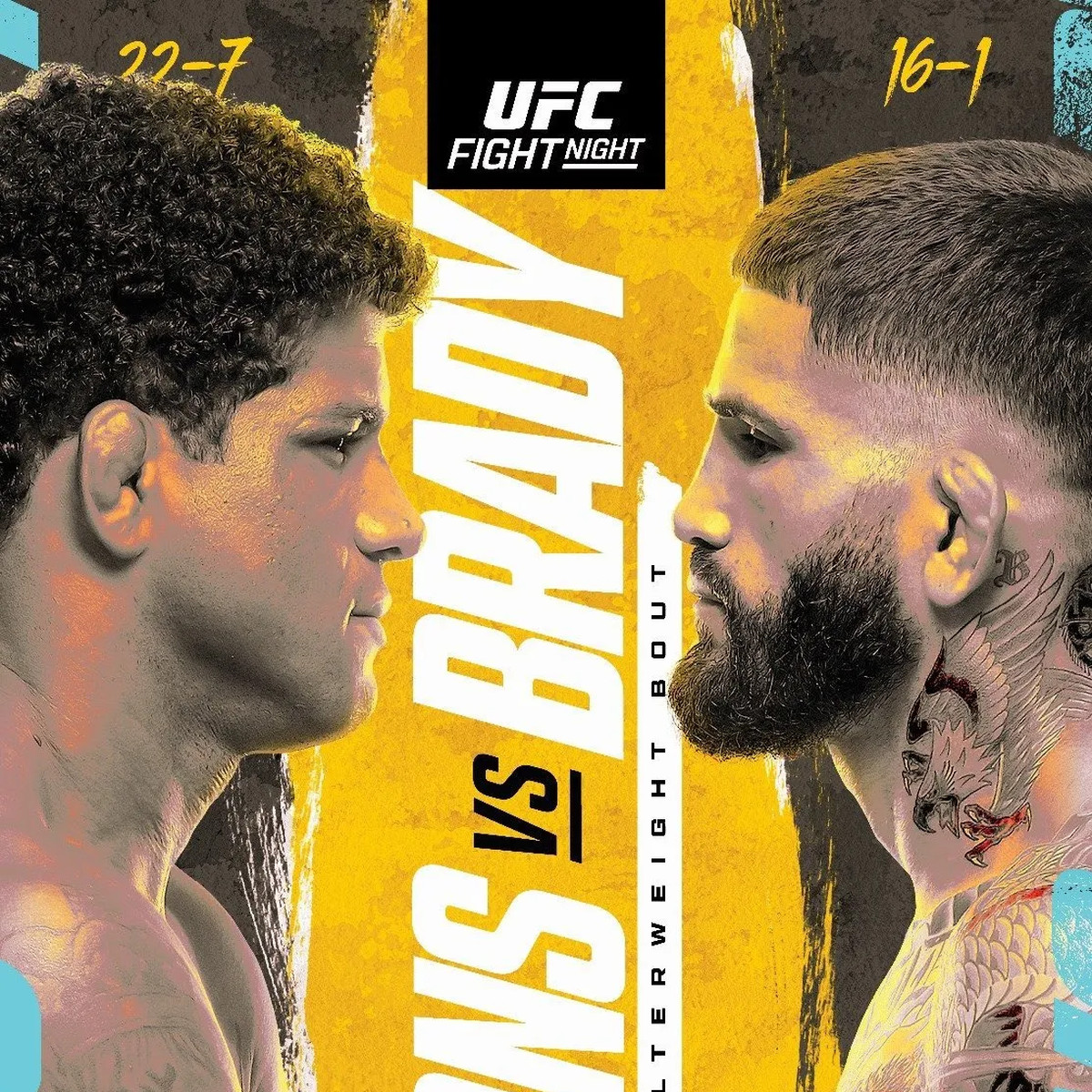

Complete Ufc Vegas 106 Fight Card Breakdown Burns Vs Morales Odds And Predictions

May 19, 2025

Complete Ufc Vegas 106 Fight Card Breakdown Burns Vs Morales Odds And Predictions

May 19, 2025 -

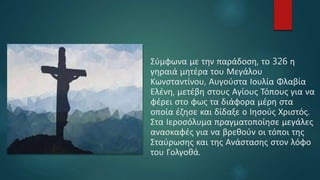

Eyaggelismos Tis T Heotokoy Sta Ierosolyma Topoi Teletes Kai Simasia

May 19, 2025

Eyaggelismos Tis T Heotokoy Sta Ierosolyma Topoi Teletes Kai Simasia

May 19, 2025 -

Royal Mail Increases Stamp Prices Again April 7th Changes Explained

May 19, 2025

Royal Mail Increases Stamp Prices Again April 7th Changes Explained

May 19, 2025