Successfully Applying For Private Credit Roles: A 5-Step Guide

Table of Contents

H2: Step 1: Crafting a Compelling Resume and Cover Letter for Private Credit Positions

Your resume and cover letter are your first impression – make it count. They must highlight your qualifications and demonstrate your understanding of the private credit industry.

H3: Highlighting Relevant Skills and Experience:

Your resume should showcase skills essential to private credit roles. This includes:

- Financial modeling: Demonstrate proficiency in building and utilizing various financial models (DCF, LBO, etc.).

- Credit analysis: Highlight your expertise in assessing creditworthiness, analyzing financial statements, and evaluating credit risk.

- Due diligence: Showcase experience in conducting thorough due diligence investigations, including financial, legal, and operational aspects.

- Underwriting: Emphasize your ability to evaluate loan applications, assess risk, and make informed lending decisions.

- Portfolio management: Detail experience in managing loan portfolios, monitoring performance, and mitigating risk.

- Legal documentation: Mention familiarity with loan agreements, security documents, and other legal aspects of private credit transactions.

Quantify your achievements whenever possible. Instead of simply stating "Managed loan portfolio," say "Managed a $50 million loan portfolio, resulting in a 10% reduction in non-performing loans." Tailor your resume and cover letter to each specific role and company, highlighting the skills and experience most relevant to the position.

H3: Showcasing Your Knowledge of the Private Credit Landscape:

Demonstrate a deep understanding of the private credit market. This includes:

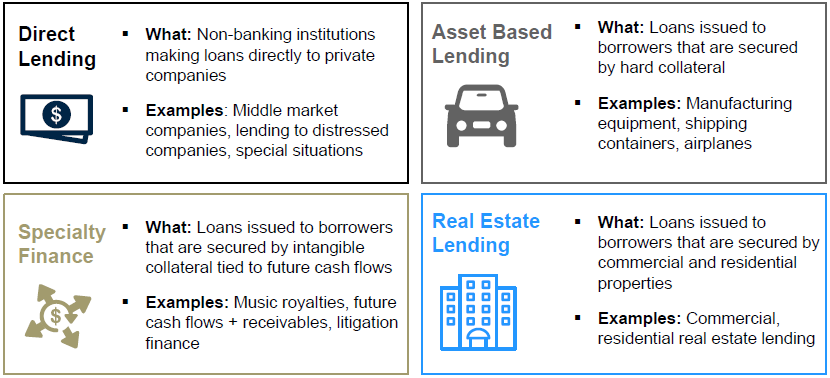

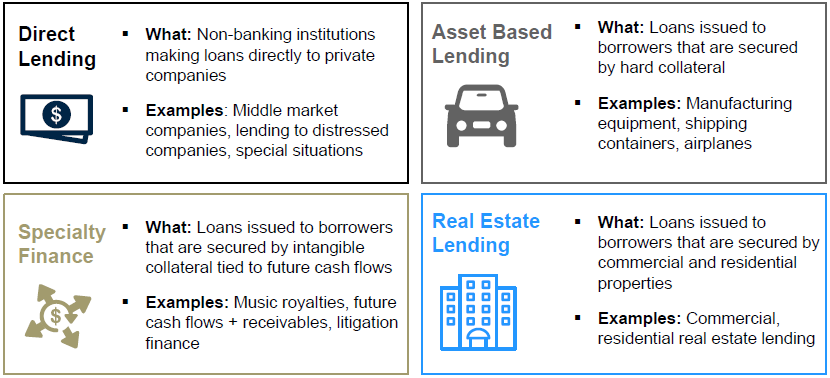

- Familiarity with various private credit strategies such as direct lending, mezzanine financing, distressed debt, and special situations investing.

- Awareness of current industry trends, regulations, and market dynamics.

- Mentioning any relevant certifications like CFA, CAIA, or other specialized qualifications.

H2: Step 2: Networking and Building Relationships in the Private Credit Industry

Networking is paramount in the private credit world. Building relationships with professionals in the industry can significantly increase your chances of securing a role.

H3: Leveraging LinkedIn for Private Credit Connections:

- Actively search for private credit professionals on LinkedIn and connect with them.

- Join relevant LinkedIn groups and participate in discussions to showcase your expertise and build connections.

- Utilize LinkedIn's job search features to identify open positions and connect with recruiters.

H3: Attending Industry Events and Conferences:

- Attend conferences and events focused on private credit and alternative investments to network with industry professionals.

- Prepare insightful questions and actively engage in conversations to build relationships.

- Always follow up with new contacts after networking events with a personalized message.

H2: Step 3: Preparing for the Private Credit Interview Process

Thorough preparation is crucial for success in private credit interviews.

H3: Researching the Firm and Interviewers:

- Deeply research the firm's investment strategy, portfolio companies, recent transactions, and overall culture.

- Look up your interviewers on LinkedIn to understand their background and experience. This allows you to tailor your responses and ask insightful questions.

H3: Practicing Behavioral and Technical Interview Questions:

Prepare for both behavioral and technical questions.

- Behavioral Questions: Practice answering common questions using the STAR method (Situation, Task, Action, Result). Examples include: "Tell me about a time you failed," "Describe your work style," and "How do you handle pressure?"

- Technical Questions: Expect questions related to financial modeling, credit analysis, and private credit strategies. Examples include: "Walk me through your DCF model," "Explain your understanding of covenant violations," and "How would you assess the credit risk of a particular company?"

H2: Step 4: Negotiating Your Private Credit Job Offer

Once you receive an offer, be prepared to negotiate.

H3: Understanding Your Market Value:

- Research salary ranges for similar private credit roles using resources like Glassdoor, Salary.com, and industry reports.

- Consider total compensation, including salary, bonus, benefits, and any potential equity or profit sharing.

H3: Negotiating Effectively:

- Know your desired salary range and your bottom line.

- Be prepared to walk away if the offer doesn't meet your expectations. This shows confidence and can sometimes lead to a better offer.

H2: Step 5: Onboarding and Early Career Success in Private Credit

Your journey doesn't end with the job offer. Continued success requires dedication and continuous learning.

H3: Making a Strong First Impression:

- Maintain professionalism and demonstrate a strong work ethic from day one.

- Actively seek mentorship and guidance from senior colleagues to learn best practices and navigate the firm's culture.

H3: Continuous Learning and Development:

- Stay updated on industry trends, regulations, and best practices by reading industry publications and attending webinars.

- Consider pursuing further education or certifications to enhance your expertise and career prospects.

3. Conclusion:

Successfully applying for private credit roles requires a multi-faceted approach. By meticulously crafting your resume and cover letter, actively networking, preparing thoroughly for interviews, negotiating effectively, and committing to continuous learning, you significantly increase your chances of securing your desired position. Implement these five steps and start your journey towards landing your dream private credit job and advancing your private credit career. To find relevant job postings, check out [link to job board or resource].

Featured Posts

-

La Poderosa Frase Para Marcelo Rios El Ex Numero 3 Del Mundo

May 30, 2025

La Poderosa Frase Para Marcelo Rios El Ex Numero 3 Del Mundo

May 30, 2025 -

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025

Kyriaki 11 5 Ti Na Deite Stin Tileorasi

May 30, 2025 -

Chinese Bridge Competition Amman Hosts Grand Finale 24th Edition

May 30, 2025

Chinese Bridge Competition Amman Hosts Grand Finale 24th Edition

May 30, 2025 -

Dinkes Gorontalo Tingkat Imunisasi Anak Rendah Picu Peningkatan Kasus Suspek Campak Di Pohuwato

May 30, 2025

Dinkes Gorontalo Tingkat Imunisasi Anak Rendah Picu Peningkatan Kasus Suspek Campak Di Pohuwato

May 30, 2025 -

June 2025 Air Jordans Release Dates And Where To Buy

May 30, 2025

June 2025 Air Jordans Release Dates And Where To Buy

May 30, 2025

Latest Posts

-

Birmingham Supercross Round 10 2025 Final Results

May 31, 2025

Birmingham Supercross Round 10 2025 Final Results

May 31, 2025 -

How Provincial Governments Can Speed Up Homebuilding

May 31, 2025

How Provincial Governments Can Speed Up Homebuilding

May 31, 2025 -

Final Preparations Complete For Down East Bird Dawgs First Game

May 31, 2025

Final Preparations Complete For Down East Bird Dawgs First Game

May 31, 2025 -

Updated Results Birmingham Supercross Round 10 2025

May 31, 2025

Updated Results Birmingham Supercross Round 10 2025

May 31, 2025 -

Provincial Policies And Their Impact On Home Construction Efficiency

May 31, 2025

Provincial Policies And Their Impact On Home Construction Efficiency

May 31, 2025