Successfully Navigate The Private Credit Job Market: 5 Do's And Don'ts

Table of Contents

5 Do's to Secure Your Private Credit Job

Do Your Research: Become a Private Credit Market Expert

Thoroughly investigating the firms and roles you're targeting is paramount. Understanding their investment strategies, portfolio companies, and team dynamics is vital for showcasing your genuine interest and preparedness. Don't just apply; demonstrate you've done your homework.

- Analyze firm websites for recent investments and news: Look for press releases, case studies, and investor updates to understand their current focus and recent successes. This shows initiative and a deep understanding of their operations.

- Network with professionals already working in the private credit space: LinkedIn is an invaluable tool. Identify professionals in your target firms and connect with them. Engage in informative conversations; don't just ask for jobs.

- Research industry trends and regulations impacting private credit: Stay updated on regulatory changes (e.g., Dodd-Frank, LIBOR transition) and emerging market trends (e.g., ESG investing in private credit). This demonstrates your commitment to the field.

- Demonstrate a deep understanding of different private credit strategies (e.g., direct lending, mezzanine financing, distressed debt): Show you know the difference between various lending strategies and their associated risks and rewards. This is crucial for demonstrating expertise in private credit roles.

Network Strategically: Build Your Private Credit Connections

Attend industry conferences, join relevant professional organizations (like the CFA Institute or industry-specific associations), and leverage LinkedIn to connect with potential employers and mentors. Networking is the lifeblood of the private credit job market.

- Target specific individuals within firms that interest you: Don't just attend events and hope for the best. Identify key people and strategically engage with them.

- Prepare concise and impactful elevator pitches highlighting your skills and experience: Practice your pitch until it's natural and engaging. Clearly communicate your value proposition.

- Follow up on networking interactions with personalized thank-you notes: A simple email expressing your gratitude can make a lasting impression. Reference specific details from your conversation.

- Cultivate relationships within the private credit community for long-term career success: Networking isn't a one-time event; it's an ongoing process. Maintain contact and build genuine relationships.

Tailor Your Resume and Cover Letter: Highlight Your Private Credit Skills

Highlight relevant skills and experience, using keywords commonly found in private credit job descriptions. Quantify your achievements whenever possible to showcase your impact. Generic applications will be overlooked.

- Use action verbs to showcase your accomplishments: Instead of saying "Responsible for financial modeling," say "Developed and implemented financial models leading to a 15% improvement in investment return."

- Emphasize skills such as financial modeling, credit analysis, and due diligence: These are core competencies in private credit. Show you possess them.

- Customize your resume and cover letter to each specific job application: Don't send the same materials to every firm. Each application should be tailored to the specific requirements.

- Proofread meticulously for any errors in grammar and spelling: Typos are a major red flag. Have someone else review your materials before submitting them.

Master the Interview Process: Ace Your Private Credit Interviews

Prepare for behavioral questions, technical questions related to financial analysis, and questions about your understanding of the private credit market. Practice makes perfect.

- Practice your answers to common interview questions: Use the STAR method (Situation, Task, Action, Result) to structure your responses and showcase your accomplishments.

- Research the interviewer and the company thoroughly: Demonstrate your knowledge of their work and investment strategies.

- Prepare insightful questions to ask the interviewer: Asking thoughtful questions shows your interest and engagement.

- Demonstrate enthusiasm and a genuine interest in the role and the firm: Your passion for private credit should be evident throughout the interview.

Follow Up Professionally: Maintain Momentum in Your Private Credit Job Search

After each interview, send a personalized thank-you note reiterating your interest and highlighting key discussion points. Don't leave it to chance.

- Express gratitude for the interviewer's time: A simple "thank you" goes a long way.

- Reinforce your qualifications and enthusiasm for the role: Reiterate your key strengths and how they align with the job requirements.

- Maintain professional communication throughout the hiring process: Respond promptly to emails and calls.

- Follow up politely if you haven't heard back within a reasonable timeframe: A polite follow-up email shows your continued interest.

5 Don'ts in Your Private Credit Job Search

Don't Neglect Networking: It's Key to the Private Credit Job Market

Avoid solely relying on online job boards. Networking is crucial for accessing unadvertised opportunities and building relationships within the industry.

Don't Submit Generic Applications: Personalize Your Approach

Tailoring your application materials is essential to stand out from the competition. Generic applications show a lack of interest and effort.

Don't Underestimate Technical Skills: Master the Fundamentals

Demonstrate a strong understanding of financial modeling, credit analysis, and due diligence. These are non-negotiable skills in private credit.

Don't Be Unprepared for Interviews: Practice and Preparation are Crucial

Thorough preparation is key to a successful interview. Practice answering common questions and research the firm and interviewers.

Don't Neglect Follow-Up: Stay Top of Mind

Following up after interviews demonstrates your interest and professionalism. A simple thank-you note can significantly increase your chances.

Conclusion: Secure Your Place in the Private Credit Job Market

Successfully navigating the private credit job market requires a strategic blend of targeted networking, meticulous preparation, and consistent follow-up. By following these "dos" and avoiding the "don'ts," you significantly increase your chances of securing a rewarding career in this dynamic field. Start building your network and refining your skills today to successfully enter the competitive private credit job market. Remember, thorough preparation and strategic networking are your key to landing your dream private credit role.

Featured Posts

-

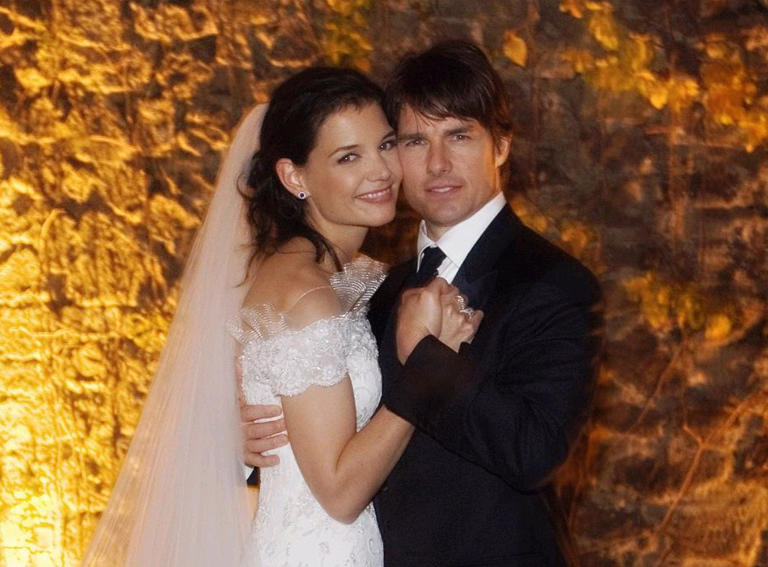

Tom Cruises Dating History From Nicole Kidman To Ana De Armas Rumors

May 16, 2025

Tom Cruises Dating History From Nicole Kidman To Ana De Armas Rumors

May 16, 2025 -

Giant Sea Wall Menko Ahy Pastikan Proyek Nasional Segera Dimulai

May 16, 2025

Giant Sea Wall Menko Ahy Pastikan Proyek Nasional Segera Dimulai

May 16, 2025 -

Ufc 314 Chandler And Pimbletts Joint Interview And Fight Predictions

May 16, 2025

Ufc 314 Chandler And Pimbletts Joint Interview And Fight Predictions

May 16, 2025 -

12

May 16, 2025

12

May 16, 2025 -

Update On Jaylen Wells Condition After On Court Fall And Stretcher Removal

May 16, 2025

Update On Jaylen Wells Condition After On Court Fall And Stretcher Removal

May 16, 2025