Succession Planning For The Ultra-Wealthy: A Growing Trend

Table of Contents

The Unique Challenges of Ultra-High-Net-Worth Succession Planning

Succession planning for the ultra-wealthy presents unique challenges far beyond those faced by individuals with more modest estates. The sheer scale and complexity of assets, combined with intricate family dynamics, demand a highly specialized and strategic approach.

Complex Asset Structures

Ultra-wealthy families often possess a diverse portfolio extending beyond simple investments. This includes real estate holdings spanning multiple countries, private equity stakes in various companies, valuable art collections, and other illiquid assets requiring specialized expertise in valuation and transfer. Effective succession planning must account for these complexities:

- Navigating tax implications across multiple jurisdictions: International tax laws vary significantly, making it crucial to employ experts who understand the nuances of global taxation to minimize liabilities. This often involves intricate strategies to optimize tax efficiency in different countries.

- Ensuring the preservation of family businesses and legacy assets: Passing down a family business requires careful consideration of ownership structures, management transitions, and succession plans that ensure its continued success and profitability.

- Dealing with fractional ownership and differing family member interests: When multiple heirs inherit significant assets, disagreements over ownership and distribution can lead to conflict. A well-defined plan addresses these potential issues proactively.

Family Dynamics and Governance

Succession planning isn't just about finances; it's about family harmony. Disagreements among heirs can lead to costly legal battles, damaging family relationships, and ultimately eroding the very wealth intended to be preserved. Proactive strategies are essential:

- Establishing clear communication channels and family councils: Open communication and regular family meetings provide a platform for discussion, conflict resolution, and the development of a shared understanding of the family's wealth and future.

- Implementing transparent governance structures and decision-making processes: Clear guidelines on asset management, distribution, and family governance ensure fairness and minimize the potential for disputes.

- Preemptive conflict resolution strategies and mediation: Engaging family therapists and mediators can help facilitate productive conversations and prevent disagreements from escalating into major conflicts.

Key Strategies for Effective Succession Planning for the Ultra-Wealthy

Successful succession planning requires a proactive, multi-pronged approach encompassing sophisticated tax strategies, careful asset allocation, and collaboration with a team of highly specialized professionals.

Tax Optimization and Estate Planning

Minimizing tax liabilities through sophisticated estate planning is paramount for ultra-high-net-worth individuals. This involves utilizing a variety of legal strategies to protect assets and reduce inheritance tax burdens significantly:

- International tax planning and residency considerations: Careful consideration of residency and tax implications across different countries is essential for minimizing global tax exposure.

- Utilizing trusts and foundations for asset protection and wealth preservation: Trusts and foundations provide a robust framework for managing assets, protecting them from creditors, and ensuring a smooth transfer of wealth to future generations.

- Charitable gifting strategies for tax benefits and philanthropic goals: Strategic charitable giving can provide significant tax advantages while aligning with family philanthropic objectives.

Professional Team Collaboration

Navigating the complexities of ultra-high-net-worth succession planning requires a collaborative effort from a multidisciplinary team of experts:

- Experienced estate planning attorneys: Essential for drafting legally sound and tax-efficient estate plans, ensuring compliance with all relevant laws and regulations.

- Financial advisors specializing in wealth management and portfolio diversification: Experts in managing complex investment portfolios, ensuring asset preservation and growth.

- Family therapists and counselors for conflict resolution: Crucial for mediating family disputes and fostering open communication among family members.

- Tax specialists for international tax optimization: Essential for navigating the complexities of international tax laws and minimizing global tax liabilities.

The Growing Trend and Future of Ultra-Wealthy Succession Planning

The increasing complexity of global markets and family structures is driving innovation in succession planning strategies. Several trends are shaping the future:

- Rise in demand for family offices: Family offices provide comprehensive wealth management services, offering personalized solutions for complex family needs.

- Increased focus on impact investing and sustainable wealth management: A growing number of ultra-wealthy families are integrating their values into their investment strategies, seeking both financial returns and positive social and environmental impact.

- Technological advancements enhancing transparency and efficiency in wealth transfer: Technology is playing an increasingly significant role in streamlining wealth transfer processes, improving transparency, and enhancing security.

Conclusion

Succession planning for the ultra-wealthy is a complex and multifaceted process requiring careful consideration of financial, legal, and family dynamics. By proactively addressing potential challenges and implementing robust strategies, ultra-high-net-worth families can ensure the preservation of their legacy and the continuity of their wealth across generations. Don't wait until it's too late – take control of your future and start planning your succession planning for the ultra-wealthy today. Contact a qualified professional to begin crafting a comprehensive and personalized plan tailored to your unique circumstances. Effective ultra-high-net-worth succession planning is an investment in your family's future – securing its legacy and ensuring its continued prosperity.

Featured Posts

-

Core Weave Crwv Stock Market Activity Tuesdays Drop Explained

May 22, 2025

Core Weave Crwv Stock Market Activity Tuesdays Drop Explained

May 22, 2025 -

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Konulari Ele Alindi

May 22, 2025

Antalya Daki Nato Parlamenter Asamblesi Teroerizm Ve Deniz Guevenligi Konulari Ele Alindi

May 22, 2025 -

Tikkie En Nederlandse Bankrekeningen Een Complete Gids

May 22, 2025

Tikkie En Nederlandse Bankrekeningen Een Complete Gids

May 22, 2025 -

Nvidias Core Weave Crwv Investment Stock Price Soars

May 22, 2025

Nvidias Core Weave Crwv Investment Stock Price Soars

May 22, 2025 -

Peppa Pigs Real Name Revealed Fans React To The Shocking Truth

May 22, 2025

Peppa Pigs Real Name Revealed Fans React To The Shocking Truth

May 22, 2025

Latest Posts

-

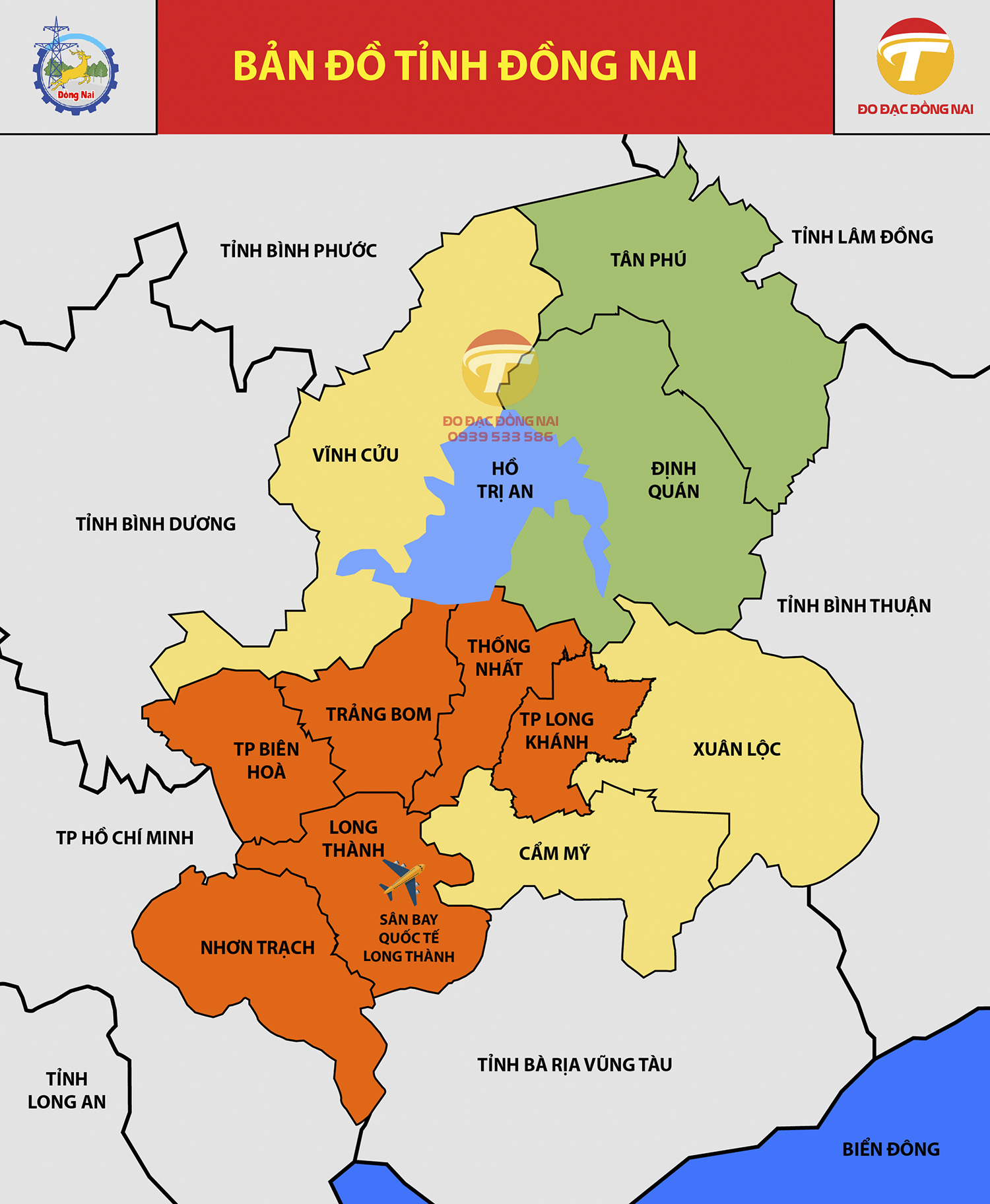

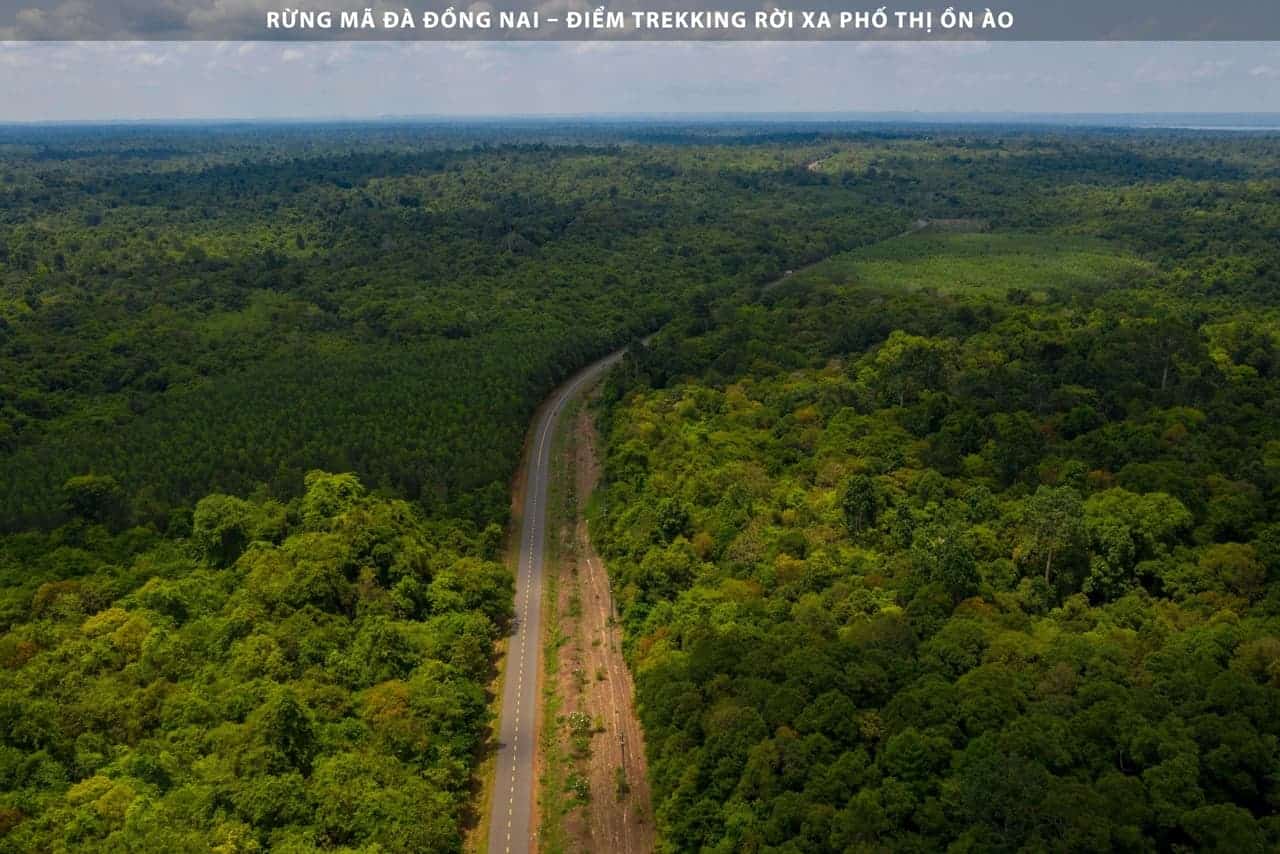

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025

Kien Nghi Xay Dung Tuyen Duong 4 Lan Xe Tu Dong Nai Den Binh Phuoc Qua Rung Ma Da

May 22, 2025 -

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025

Xay Dung Cau Ma Da Ket Noi Giao Thong Hai Tinh Dong Nai

May 22, 2025 -

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Den Binh Phuoc

May 22, 2025 -

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe 2 9

May 22, 2025

Duong Cao Toc Dong Nai Vung Tau San Sang Thong Xe 2 9

May 22, 2025 -

Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025

Duong 4 Lan Xe Xuyen Rung Ma Da Dong Nai Kien Nghi Ket Noi Binh Phuoc

May 22, 2025