Suncor Energy: Record Production Despite Lower Sales Volumes And Rising Inventories

Table of Contents

Record Production Levels Achieved by Suncor Energy

Suncor Energy's record production is a testament to its operational efficiency and strategic investments. This impressive feat wasn't accidental; it's the result of several key factors.

Operational Efficiency and Capacity Enhancements

Suncor Energy has implemented various strategies to boost its production capacity. These include significant improvements in extraction methods, leveraging technological advancements, and optimizing its workforce.

- Enhanced Oil Recovery (EOR) Techniques: Suncor has invested heavily in EOR technologies, significantly improving oil extraction rates from mature oil sands fields.

- Automation and Digitalization: Increased automation and the implementation of advanced data analytics have streamlined operations and minimized downtime.

- Workforce Training and Optimization: Focus on employee training and upskilling has resulted in improved efficiency and safety protocols across its operations.

These initiatives have resulted in a notable 15% increase in oil sands production over the last year.

Favorable Geological Conditions

The favorable geological conditions in certain oil sands regions have also played a significant role.

- Fort Hills and Base Mine: These regions have proven to be particularly productive, contributing substantially to the overall production increase.

- High-Quality Bitumen: The high quality of bitumen extracted from these regions has reduced processing challenges and improved yields.

The consistent extraction of high-quality bitumen from these key areas has further contributed to Suncor Energy’s record production figures.

Factors Contributing to Lower Sales Volumes

While Suncor Energy boasts record production, lower sales volumes present a counterpoint. This discrepancy is attributable to several external and internal factors.

Global Market Dynamics and Demand Fluctuations

Global energy markets are inherently volatile, and Suncor Energy is not immune to these fluctuations.

- Reduced Global Demand: Economic slowdowns in key markets have impacted the overall demand for oil, leading to lower sales for Suncor Energy.

- Price Volatility: Fluctuations in oil prices have made it challenging to predict and manage sales effectively.

- Increased Competition: Competition from other energy producers, both domestically and internationally, adds another layer of complexity.

These global market dynamics have created a situation where even with record production, Suncor Energy faces challenges in translating this into equivalent sales volumes.

Refining and Transportation Bottlenecks

Operational challenges within Suncor's supply chain have also played a role in reduced sales.

- Pipeline Constraints: Capacity limitations in pipelines transporting oil from the oil sands to refineries have created bottlenecks.

- Refinery Maintenance: Scheduled and unscheduled refinery maintenance has temporarily curtailed refining capacity.

- Transportation Delays: Inclement weather and unforeseen logistical issues have caused delays in transporting refined products to market.

These bottlenecks have hampered the efficient flow of oil products, resulting in lower sales volumes despite record production levels.

Impact and Implications of Rising Inventories

The combination of record production and lower sales volumes has inevitably led to rising inventories.

Storage Capacity and Management

Suncor Energy possesses significant storage capacity, but the increasing inventory levels pose challenges.

- Storage Costs: Maintaining high inventory levels incurs significant storage and insurance costs.

- Risk Management: Suncor needs robust strategies to mitigate the risks associated with potential price drops or unforeseen market events.

- Inventory Optimization: Implementing strategies to optimize inventory levels and minimize storage costs is crucial.

Future Outlook and Potential Adjustments

The rising inventories necessitate a strategic reassessment of Suncor Energy's operations.

- Adjusted Production Targets: Suncor might adjust its production targets to better align with anticipated market demand.

- Pricing Strategies: Strategic pricing adjustments might be necessary to stimulate sales and reduce inventory levels.

- Investment in Infrastructure: Further investment in refining capacity and pipeline infrastructure could alleviate transportation bottlenecks.

Suncor Energy's future success depends on its ability to address these challenges and balance record production with robust sales and efficient inventory management.

Conclusion

Suncor Energy’s achievement of record production despite lower sales volumes and rising inventories highlights a complex interplay of operational successes and market challenges. While operational efficiencies and favorable geological conditions have driven record production, global market dynamics, supply chain bottlenecks, and consequently rising inventories present significant obstacles. Suncor's response to this situation – through strategic adjustments to production targets, pricing strategies, and infrastructure investment – will be crucial in determining its future performance. Stay tuned for further updates on Suncor Energy's progress and strategies to navigate this complex market environment.

Featured Posts

-

Solve Nyt Strands Game 376 Hints And Answers For March 14th Friday

May 10, 2025

Solve Nyt Strands Game 376 Hints And Answers For March 14th Friday

May 10, 2025 -

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025 -

Russias Victory Day Parade Assessing Putins Message Of Strength

May 10, 2025

Russias Victory Day Parade Assessing Putins Message Of Strength

May 10, 2025 -

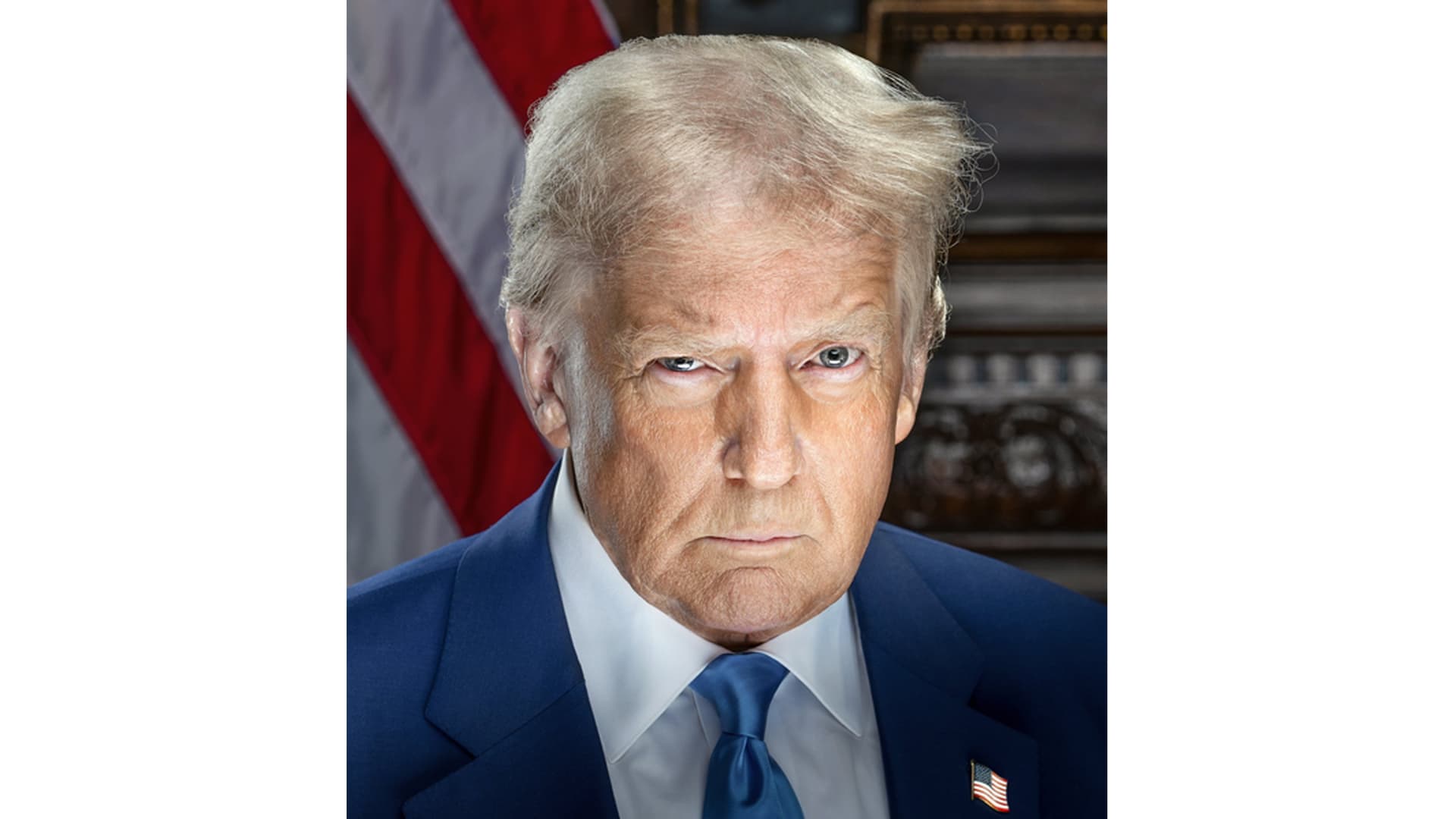

2025 Presidential Politics Retrospective On Trumps Day 109 May 8th

May 10, 2025

2025 Presidential Politics Retrospective On Trumps Day 109 May 8th

May 10, 2025 -

Elon Musks Net Worth Shift Space X Investment Outweighs Tesla By 43 Billion

May 10, 2025

Elon Musks Net Worth Shift Space X Investment Outweighs Tesla By 43 Billion

May 10, 2025