Supply Chain Disruptions And Inflation: The Result Of Trump's Tariffs On China

Table of Contents

The Mechanics of Tariffs and Their Impact on Supply Chains

The Trump administration's tariffs on Chinese goods directly increased the cost of importing numerous products. This had a cascading effect, significantly impacting global supply chains and contributing to broader economic instability.

Increased Import Costs

Tariffs act as a tax on imported goods, directly increasing their price. This simple mechanism had a profound effect on businesses reliant on Chinese imports. For example, tariffs increased the cost of:

- Consumer electronics: Tariffs on components like screens and processors led to higher prices for smartphones, laptops, and televisions.

- Manufacturing inputs: Raw materials and intermediate goods used in various manufacturing processes saw significant price increases, impacting everything from automobiles to furniture.

- Textiles and apparel: Clothing and textile products became more expensive due to tariffs on fabrics and finished goods.

The magnitude of these tariff increases varied depending on the product, but studies consistently showed a substantial rise in import prices for many key product categories. For example, the average tariff on certain steel imports from China increased by over 25%, directly impacting construction and manufacturing costs.

Supply Chain Bottlenecks and Disruptions

Facing higher import costs, many businesses sought alternative suppliers outside of China. This shift, however, created new challenges.

- Longer lead times: Finding and vetting new suppliers took time, leading to delays in production and delivery.

- Disruption of "just-in-time" inventory: The "just-in-time" manufacturing system, which relies on efficient, timely delivery of components, was severely disrupted. Companies were forced to hold larger inventories, increasing costs and tying up capital.

- Increased reliance on less reliable suppliers: The rush to find alternatives sometimes meant accepting less reliable suppliers with lower quality control and longer lead times, further exacerbating the situation.

Examples of specific bottlenecks included delays in the automotive industry due to shortages of key components, and disruptions in the furniture industry due to difficulties sourcing raw materials. The increased reliance on less reliable suppliers contributed to a greater risk of further supply chain disruptions.

The Link Between Tariffs, Supply Chain Issues, and Inflation

The combination of increased import costs and supply chain disruptions directly contributed to inflationary pressures.

Cost-Push Inflation

Higher import costs translate directly into higher production costs for businesses. When businesses face these increased input costs, they often pass them on to consumers in the form of higher prices, leading to cost-push inflation. Statistical analysis clearly demonstrated a correlation between the increase in import prices due to tariffs and the subsequent rise in consumer prices.

Reduced Supply and Increased Demand

The supply chain disruptions caused by tariffs further fueled inflationary pressures. Reduced supply, coupled with relatively stable or even increased consumer demand, inevitably leads to price increases. The limited availability of certain goods, caused by the difficulties in sourcing from China and establishing new supply lines, created a classic scenario of supply shortages driving up prices. Examples include specific electronics components and certain types of furniture which experienced dramatic price hikes.

Impact on Different Sectors

The impact of tariffs and resulting supply chain disruptions varied across different economic sectors. Some industries, particularly those heavily reliant on Chinese imports, were disproportionately affected. For instance, the manufacturing sector, which uses many imported components, faced significantly higher production costs. Conversely, sectors less dependent on Chinese imports experienced a less dramatic impact. This unequal effect exacerbated economic inequalities.

Alternative Perspectives and Counterarguments

While the link between Trump's tariffs on China, supply chain disruptions and inflation is compelling, it's crucial to acknowledge other contributing factors.

The Role of Other Factors

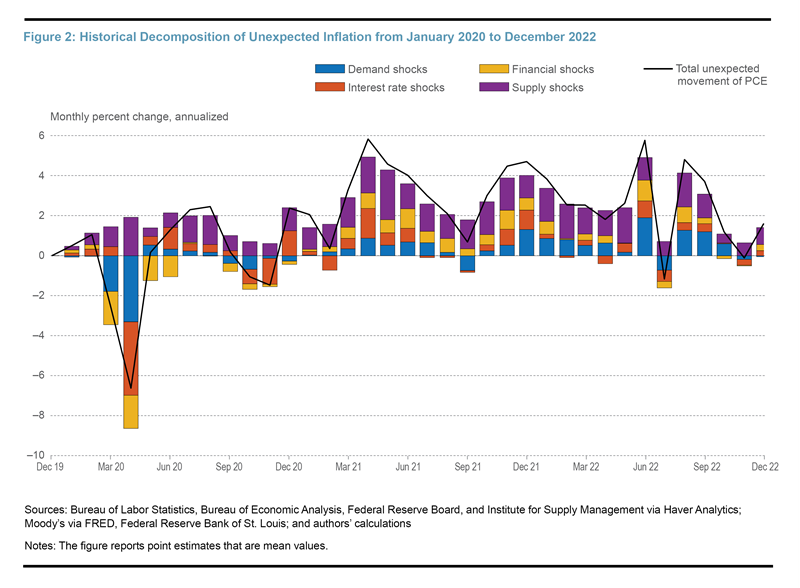

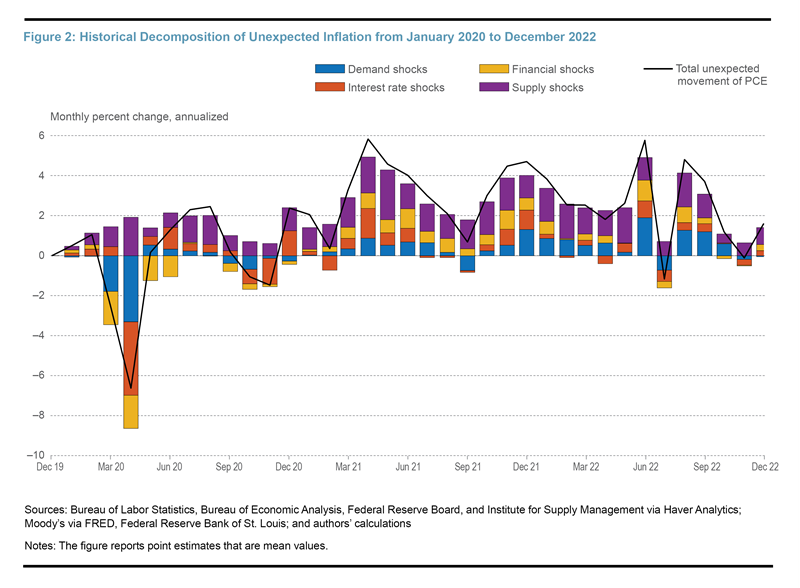

The COVID-19 pandemic, for example, significantly disrupted global supply chains independent of tariffs. Increased global demand, particularly post-pandemic, also contributed to inflationary pressures. It's important to consider these factors when evaluating the relative impact of tariffs on inflation. While tariffs certainly played a significant role, they were not the sole driver. Research examining the relative contributions of different factors, isolating the tariff effect, is critical for a full understanding of the situation.

Intended vs. Unintended Consequences

The intended goal of the tariffs was to protect American industries and reduce the trade deficit with China. However, the unintended consequences—namely, significant supply chain disruptions and inflation—clearly outweighed the intended benefits for many consumers and businesses. A thorough cost-benefit analysis is essential to understanding the overall economic impact of these protectionist measures. The economic harm caused by the disruption and increased costs significantly undermined the purported positive effects.

Conclusion

Trump's tariffs on China significantly contributed to supply chain disruptions and subsequent inflation through increased import costs, supply chain bottlenecks, and cost-push inflation. While other factors undoubtedly played a role, the evidence strongly suggests that the tariffs exacerbated existing vulnerabilities and created new challenges. Understanding this complex relationship is crucial for developing effective future economic policies. Further research and analysis are needed to mitigate similar risks in global trade. Learn more about the long-term effects of trade policies and how to navigate the challenges of global supply chain management in the face of future disruptions caused by protectionist trade policies like these China tariffs.

Featured Posts

-

From Outsider To Contender Arne Slots Liverpool Journey

Apr 29, 2025

From Outsider To Contender Arne Slots Liverpool Journey

Apr 29, 2025 -

Dc Helicopter Crash Report Pilot Failure To Follow Instructions

Apr 29, 2025

Dc Helicopter Crash Report Pilot Failure To Follow Instructions

Apr 29, 2025 -

Pressure Builds On Israel To Address Gazas Humanitarian Emergency

Apr 29, 2025

Pressure Builds On Israel To Address Gazas Humanitarian Emergency

Apr 29, 2025 -

Khazna Data Centers Saudi Arabia Expansion Plans After Silver Lake Deal

Apr 29, 2025

Khazna Data Centers Saudi Arabia Expansion Plans After Silver Lake Deal

Apr 29, 2025 -

Is This The New Quinoa A Look At The Latest Supergrain Trend

Apr 29, 2025

Is This The New Quinoa A Look At The Latest Supergrain Trend

Apr 29, 2025