Swissquote Bank: Sovereign Bond Market Analysis And Outlook

Table of Contents

Current State of the Sovereign Bond Market

The current state of the sovereign bond market is a multifaceted picture shaped by interacting global forces. Understanding these forces is key to successful navigation of this complex investment landscape.

Interest Rate Environments and their Impact

Current interest rate environments significantly influence sovereign bond yields. Rising interest rates generally lead to falling bond prices, while falling rates typically boost bond prices. This inverse relationship is a cornerstone of understanding sovereign bond investment.

- Quantitative Easing (QE) and Quantitative Tightening (QT): Central banks' QE policies, involving large-scale asset purchases, historically pushed down long-term bond yields. Conversely, QT, the unwinding of QE, tends to increase yields. The recent shift towards QT in many major economies has had a palpable impact on sovereign bond markets.

- Inflation and Bond Yields: Inflation erodes the purchasing power of fixed-income investments like sovereign bonds. Higher inflation generally leads to higher bond yields as investors demand a greater return to compensate for inflation risk. This correlation is a crucial factor in bond pricing.

- Examples: The US Treasury bond market, the benchmark for global sovereign debt, has experienced significant yield fluctuations reflecting changing monetary policy. Similarly, German Bunds and UK Gilts have shown sensitivity to both domestic and global economic conditions. The differing monetary policies adopted by central banks across the globe have created divergent yield curves and investment opportunities.

Geopolitical Risks and their Influence

Geopolitical instability significantly impacts investor sentiment and sovereign bond markets. Periods of uncertainty often lead to a "flight-to-safety," driving demand for bonds issued by perceived safe-haven countries like the US, Germany, or Switzerland.

- Investor Sentiment: Geopolitical events can trigger sudden shifts in investor sentiment, leading to sharp price movements in sovereign bonds. Unexpected conflicts or political crises can cause significant volatility.

- Flight-to-Safety: During times of global uncertainty, investors often flock to the perceived safety of sovereign bonds issued by stable, developed economies. This increased demand pushes bond prices up and yields down.

- Sanctions and their Influence: International sanctions can severely impact the bond markets of targeted countries, limiting their access to capital and increasing borrowing costs.

- Recent Examples: The ongoing war in Ukraine, for example, has significantly impacted global bond markets, leading to increased volatility and shifts in investor preferences.

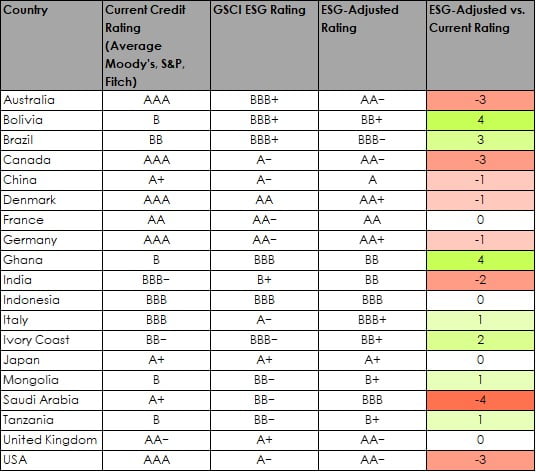

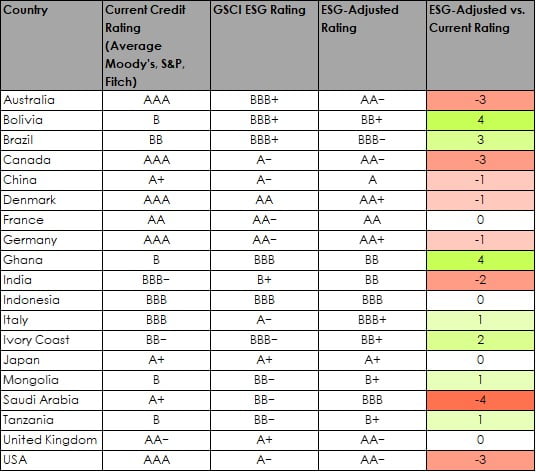

Credit Ratings and Sovereign Debt Sustainability

The creditworthiness of a sovereign issuer is a key determinant of its bond yields. Credit rating agencies like Moody's, S&P, and Fitch assess the credit risk associated with sovereign debt, influencing investor confidence and bond pricing.

- Role of Credit Rating Agencies: These agencies provide independent assessments of a country's ability to repay its debt. Higher credit ratings translate to lower borrowing costs and increased investor confidence.

- Debt-to-GDP Ratios: A country's debt-to-GDP ratio is a crucial indicator of its debt sustainability. High debt levels generally increase the risk of default and lead to higher bond yields.

- Impact on Market Implications: Countries with strong credit ratings enjoy lower borrowing costs and access to international capital markets, while those with weaker ratings face higher yields and potentially limited access to funding.

Outlook for the Sovereign Bond Market

Predicting the future of the sovereign bond market requires careful consideration of numerous economic and political factors. While precise forecasting is impossible, we can analyze key trends to anticipate potential movements.

Yield Curve Predictions

Forecasting sovereign bond yields involves analyzing projected inflation, economic growth, and interest rate policies.

- Inflation, Economic Growth, and Interest Rates: Expectations regarding these key economic indicators directly influence bond yields. Higher inflation and faster economic growth generally lead to higher yields, while slower growth and lower inflation suggest lower yields.

- Yield Curve Shifts: The shape of the yield curve (the relationship between short-term and long-term bond yields) can provide insights into future economic prospects. An inverted yield curve (short-term yields exceeding long-term yields) is often considered a recessionary signal.

- Potential Risks: Unforeseen geopolitical events, unexpected economic shocks, or changes in central bank policies can significantly alter yield curve predictions.

Investment Strategies and Opportunities

Several investment strategies can be employed within the sovereign bond market, depending on investor risk tolerance and goals.

- Diversification: Diversifying across different sovereign issuers and maturities can reduce overall portfolio risk.

- Duration Management: Managing the duration (sensitivity to interest rate changes) of a bond portfolio is crucial for mitigating interest rate risk.

- Active Bond Management: Active management strategies aim to outperform benchmark indices by identifying undervalued bonds and exploiting market inefficiencies.

- ESG Factors: Increasingly, investors are considering Environmental, Social, and Governance (ESG) factors when making investment decisions, seeking bonds issued by countries with strong ESG profiles.

Potential Risks and Challenges

Investing in the sovereign bond market carries inherent risks.

- Rising Interest Rates: Rising interest rates can negatively impact bond prices, especially for longer-maturity bonds.

- Inflation: High inflation erodes the real return of fixed-income investments.

- Geopolitical Uncertainty: Geopolitical events can trigger significant volatility in bond markets.

- Credit Downgrades: A sovereign credit downgrade can lead to sharp declines in bond prices.

- Risk Management: Effective risk management strategies, including diversification and hedging, are essential for mitigating these risks.

Conclusion

The sovereign bond market presents both opportunities and challenges for investors. Understanding the current state of the market, the impact of global events, and potential future trends is essential for making informed investment decisions. Swissquote Bank offers a range of investment solutions to help navigate the complexities of the sovereign bond market. By analyzing interest rate environments, geopolitical factors, and credit ratings, investors can effectively manage risk and capitalize on potential opportunities. Contact Swissquote Bank today to learn more about our sovereign bond market analysis and how we can help you build a robust investment strategy within this dynamic asset class. Explore our resources and expertise in the sovereign bond market to optimize your portfolio performance.

Featured Posts

-

Erling Haaland Injury Update How Long Will Man Citys Striker Be Out

May 19, 2025

Erling Haaland Injury Update How Long Will Man Citys Striker Be Out

May 19, 2025 -

Boyleyma Symvoylioy Efeton Dodekanisoy 210 Enorkoi Sto Mikto Orkoto Efeteio

May 19, 2025

Boyleyma Symvoylioy Efeton Dodekanisoy 210 Enorkoi Sto Mikto Orkoto Efeteio

May 19, 2025 -

Mets Offensive Woes A Persistent Slump And Lack Of Big Hits

May 19, 2025

Mets Offensive Woes A Persistent Slump And Lack Of Big Hits

May 19, 2025 -

Ierosolyma I Kyriaki Ton Myroforon Kai I Simasia Tis

May 19, 2025

Ierosolyma I Kyriaki Ton Myroforon Kai I Simasia Tis

May 19, 2025 -

Haalands New Bugatti Rs 44 Crore Supercar With 277 Mph Top Speed

May 19, 2025

Haalands New Bugatti Rs 44 Crore Supercar With 277 Mph Top Speed

May 19, 2025