Taiwan Investors Retreat From US Bond ETFs: A Shift In Investment Strategy

Table of Contents

Rising Interest Rates and the US Dollar's Strength

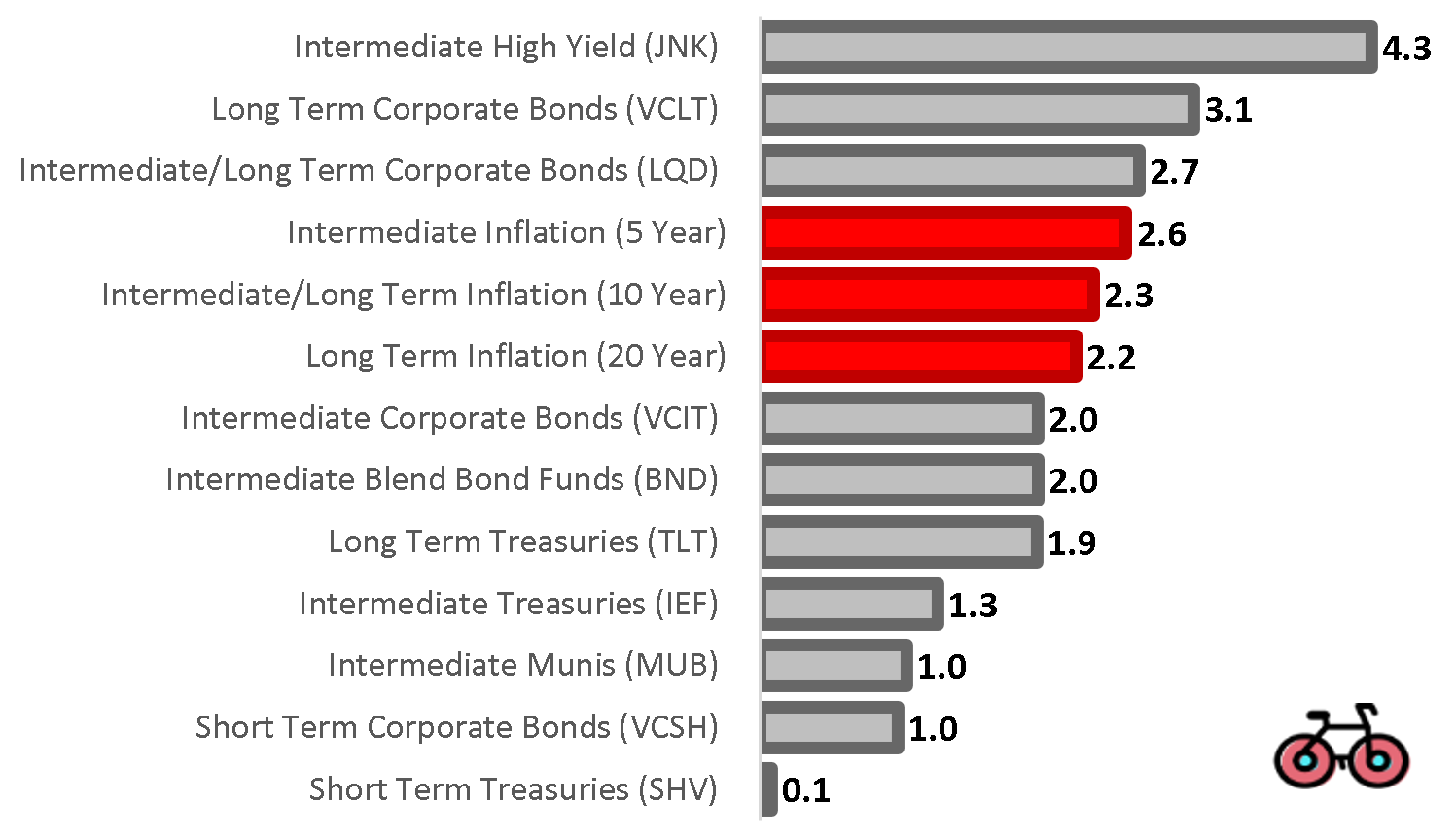

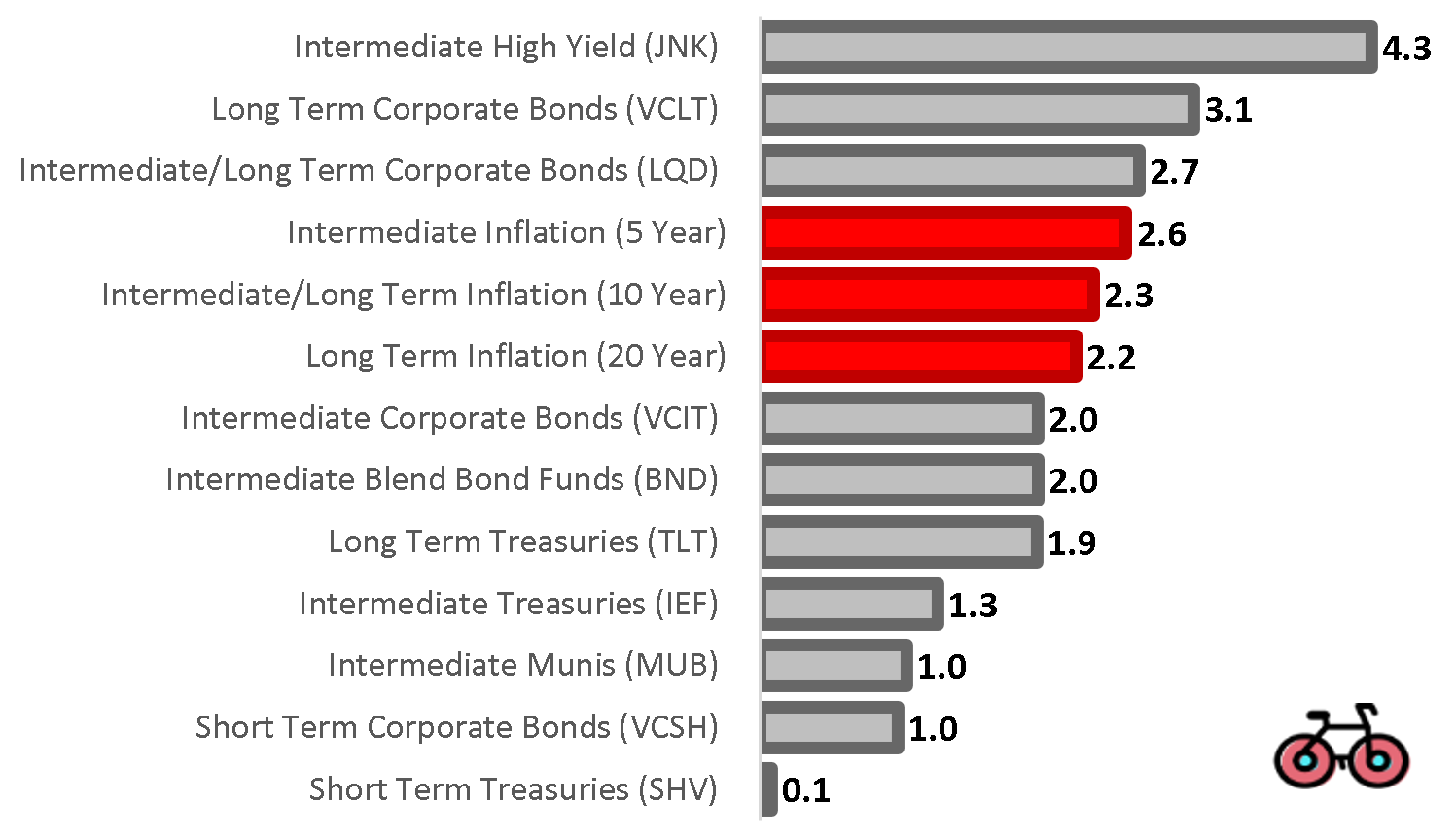

Increased US interest rates and the strengthening US dollar are key factors driving Taiwanese investors away from US bond ETFs. These two elements significantly impact the profitability and attractiveness of these investments.

-

Increased US interest rates: The Federal Reserve's monetary policy tightening, aimed at combating inflation, has led to increased interest rates on US dollar-denominated bonds. This makes them less attractive compared to other investment options offering potentially higher yields. The return on investment (ROI) for these bonds is now comparatively lower.

-

US dollar appreciation: The strengthening US dollar creates substantial currency exchange risks for Taiwanese investors. When converting their returns back into New Taiwan dollars (TWD), the appreciation of the US dollar can significantly diminish their profits. This currency risk adds another layer of uncertainty to an already less-lucrative investment.

-

Higher yields elsewhere: The relatively lower yields in the US bond market compared to emerging markets and other developed economies incentivize Taiwanese investors to explore alternatives. Higher bond yields in other countries offer potentially better returns, offsetting the currency risks involved in international investment.

The Federal Reserve's monetary policy directly influences investor decisions. As interest rates rise, the appeal of US bond ETFs for Taiwanese investors with a focus on maximizing returns diminishes. This has led to a significant re-evaluation of their investment strategies.

Geopolitical Uncertainty and Risk Aversion

Growing geopolitical uncertainty, especially concerning US-China relations and tensions in the Taiwan Strait, plays a significant role in the shift in Taiwanese investment strategies. This uncertainty is increasing overall investment risk, prompting a move towards what are perceived as safer assets.

-

US-China relations: The complex and often volatile relationship between the US and China adds a significant layer of geopolitical risk to investments in US assets. This uncertainty makes investors reconsider the safety and stability of holding US bond ETFs.

-

Taiwan Strait tensions: The ongoing tension in the Taiwan Strait further contributes to risk aversion among Taiwanese investors. This geopolitical instability makes investors prioritize safety and stability over potentially higher but riskier returns from US bond ETFs.

-

Diversification and risk tolerance: In response to heightened geopolitical risks, many Taiwanese investors are diversifying their portfolios to reduce their exposure to any single market or geopolitical event. This strategy minimizes risk and enhances portfolio resilience in uncertain times. Risk tolerance has become a central factor in investment decisions.

Attractive Alternatives in Emerging Markets and Domestic Investments

The relative underperformance of US bond ETFs compared to other investment opportunities is driving Taiwanese investors to explore alternative avenues. Emerging markets and domestic investments are increasingly attracting capital.

-

Emerging market investments: Many emerging markets offer potentially higher returns than the US bond market, attracting investors seeking greater returns. These markets present opportunities for diversification and growth, compensating for potential risks.

-

Domestic investment in Taiwan: The Taiwanese stock market and other domestic investment opportunities are becoming more attractive, offering investors a degree of familiarity and comfort compared to global markets. This "home bias" is playing a role in the shift of investment strategies.

-

Geographical diversification: The move away from US bond ETFs reflects a broader trend towards geographical diversification. By spreading investments across multiple regions and asset classes, Taiwanese investors aim to mitigate risk and enhance their overall portfolio performance.

The Role of Regulatory Changes and Tax Implications

Regulatory changes and tax implications can also indirectly influence investment decisions. Although not the primary drivers, these factors can add complexity and cost to holding US bond ETFs.

-

Tax regulations: Changes in tax laws and regulations, either in Taiwan or the US, can affect the overall returns of US bond ETFs, impacting their attractiveness. This makes it crucial for investors to stay up-to-date on all relevant tax regulations.

-

Compliance costs: Navigating different regulatory environments and complying with international regulations can incur additional costs, reducing the net return on investment. This administrative burden can be significant and contribute to the decision to move investments elsewhere.

Conclusion

The retreat of Taiwanese investors from US bond ETFs is a multifaceted phenomenon driven by rising interest rates, a strong US dollar, increased geopolitical uncertainty, and the appeal of more lucrative alternatives. The changing global economic landscape requires investors to constantly reassess their strategies. This shift highlights the dynamic nature of the global bond market. Understanding these evolving trends is crucial for investors seeking to optimize their portfolios. Stay informed about shifts in global investment strategies and consider professional guidance to navigate the complexities of the global bond market and effectively manage your Taiwanese investments in US bond ETFs.

Featured Posts

-

The Xrp Etf Challenge Overcoming Supply Headwinds And Attracting Institutional Investment

May 08, 2025

The Xrp Etf Challenge Overcoming Supply Headwinds And Attracting Institutional Investment

May 08, 2025 -

T

May 08, 2025

T

May 08, 2025 -

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025 -

Beyond The Bodysuit Examining Rogues X Men Costume Evolution

May 08, 2025

Beyond The Bodysuit Examining Rogues X Men Costume Evolution

May 08, 2025 -

Urgent Directives For Enhanced Crime Control Actionable Steps

May 08, 2025

Urgent Directives For Enhanced Crime Control Actionable Steps

May 08, 2025