Taiwan Regulator Investigates Firms Over ETF Sales Pressure On Staff

Table of Contents

The Investigation's Scope and Allegations

The Securities and Futures Bureau (SFB), Taiwan's primary financial regulator, is leading the investigation into allegations of unethical sales pressure related to ETFs. The probe centers on claims that several financial institutions imposed unrealistic sales targets on their employees, leading to potentially harmful sales practices. Specific allegations include the imposition of aggressive, unattainable sales quotas for various ETF products, resulting in pressure tactics and potentially misleading client interactions. The investigation encompasses a significant number of firms and involves a range of ETFs, including both equity and fixed-income products.

- Unrealistic sales quotas imposed on employees: Employees faced intense pressure to meet often impossible sales targets, regardless of client suitability.

- Retaliatory measures against staff who fail to meet targets: Those who didn't achieve targets faced penalties, including reduced bonuses, demotions, or even termination.

- Misrepresentation of ETF risk profiles to clients: In some instances, clients were allegedly given inaccurate or incomplete information about the risk associated with specific ETFs to push sales.

- Lack of adequate training for sales staff on ETF products: Insufficient training contributed to a lack of understanding of the products being sold, further exacerbating the risks of misrepresentation.

Potential Impacts on the Taiwanese ETF Market

The investigation into ETF sales pressure in Taiwan has significant implications for the market's future. In the short term, investor confidence is likely to erode, leading to decreased trading volumes and potentially impacting market liquidity. Negative publicity surrounding the investigation could deter investors from participating in the ETF market. In the long term, the consequences could be far-reaching.

- Erosion of investor trust in the ETF market: The revelation of unethical sales practices can significantly damage public trust in the integrity of the ETF market.

- Decrease in ETF trading activity due to negative publicity: Negative press and public concern could lead to reduced investor participation and lower trading volumes.

- Increased regulatory scrutiny and stricter compliance requirements: The SFB is expected to implement stricter regulations and increased oversight to prevent future occurrences of sales pressure.

- Potential for higher costs associated with increased compliance: Financial institutions will likely incur increased costs associated with implementing enhanced compliance measures and training programs.

Ethical Considerations and Best Practices in ETF Sales

Ethical sales practices are paramount in the financial industry. Selling ETFs responsibly requires prioritizing client suitability over sales targets and ensuring full transparency in all communications. Robust training programs are crucial in equipping sales staff with the knowledge and skills needed to provide accurate and unbiased information.

- Prioritizing client needs over sales targets: Sales strategies should focus on meeting the specific financial needs and risk tolerance of each client, not simply achieving sales quotas.

- Providing accurate and unbiased information about ETFs: Clients deserve complete and transparent information, including potential risks and limitations, before making investment decisions.

- Ensuring staff have adequate knowledge and training on ETF products: Comprehensive training programs are necessary to enable staff to provide informed advice and answer client questions accurately.

- Implementing robust compliance programs to monitor sales practices: Regular monitoring and audits of sales practices are crucial to identify and address any unethical conduct.

- Establishing clear reporting channels for ethical concerns: Whistleblower protection is essential to encourage employees to report unethical behavior without fear of retribution.

Lessons Learned and Future Regulatory Changes

The investigation into ETF sales pressure highlights the need for stronger regulatory oversight and increased transparency within the Taiwanese ETF industry. Financial firms must prioritize ethical conduct, while regulators must implement stricter penalties for non-compliance.

- Enhanced regulatory oversight of ETF sales practices: More frequent and rigorous inspections of sales practices are needed to ensure compliance with regulations.

- Strengthening of whistleblower protection mechanisms: Robust protection for whistleblowers is crucial to encourage the reporting of unethical conduct within financial institutions.

- Increased penalties for firms engaging in unethical sales practices: Higher penalties will deter firms from engaging in unethical sales practices.

- Mandatory training programs for sales staff on ethical conduct: Comprehensive training programs on ethical sales practices should be mandatory for all sales staff.

Conclusion

The investigation into ETF sales pressure in Taiwan reveals critical flaws in the ethical standards of some financial institutions. The potential damage to investor confidence and market stability necessitates swift and decisive action. This situation underscores the urgent need for strengthened regulations, enhanced compliance procedures, and a renewed focus on ethical sales practices within the Taiwanese ETF market. It is crucial for both regulators and financial institutions to prioritize investor protection and ensure transparency in all aspects of ETF sales. The future of the Taiwanese ETF market depends on addressing this issue head-on and implementing meaningful changes to prevent further instances of ETF sales pressure. Stay informed on the ongoing developments related to this investigation and related ETF regulatory changes in Taiwan.

Featured Posts

-

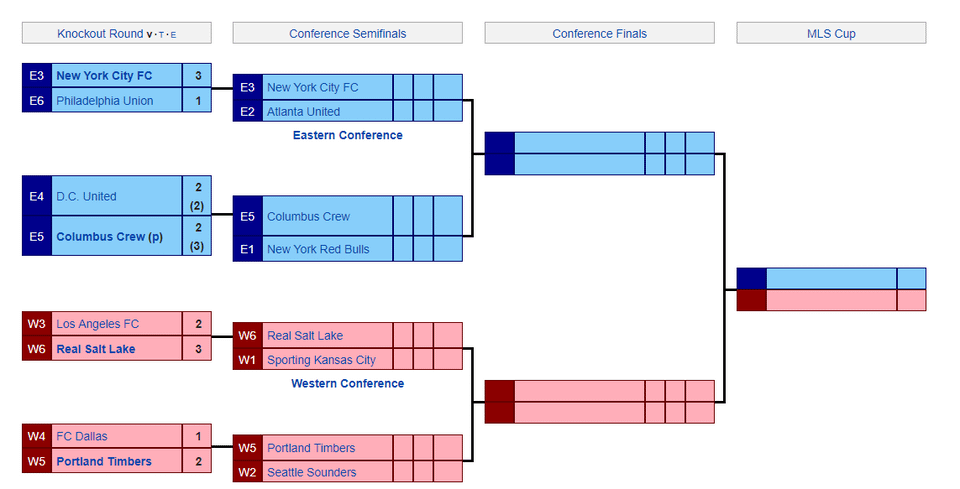

Updated Mls Injury Report Weekend Game Impacts

May 15, 2025

Updated Mls Injury Report Weekend Game Impacts

May 15, 2025 -

Auction Of Kid Cudis Personal Items Shatters Expectations

May 15, 2025

Auction Of Kid Cudis Personal Items Shatters Expectations

May 15, 2025 -

I Dont Hear A Heartbeat Disturbing Video Shows Events Leading To Ohio Mans Death

May 15, 2025

I Dont Hear A Heartbeat Disturbing Video Shows Events Leading To Ohio Mans Death

May 15, 2025 -

Where To Watch San Diego Padres Games Without Cable In 2025

May 15, 2025

Where To Watch San Diego Padres Games Without Cable In 2025

May 15, 2025 -

Ufc 314 Predictions Chandler And Pimblett Unite For Joint Interview

May 15, 2025

Ufc 314 Predictions Chandler And Pimblett Unite For Joint Interview

May 15, 2025