Taiwanese Investors' US Bond ETF Pullback: Analyzing The Recent Trend

Table of Contents

Rising Interest Rates and their Impact on US Bond ETF Appeal

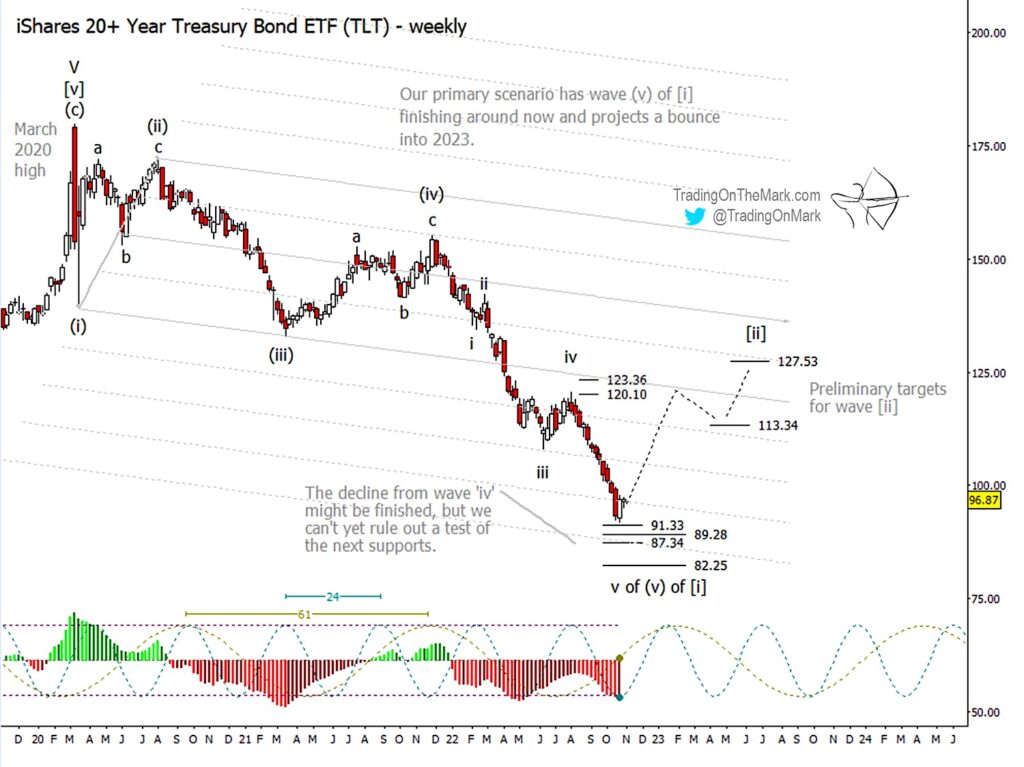

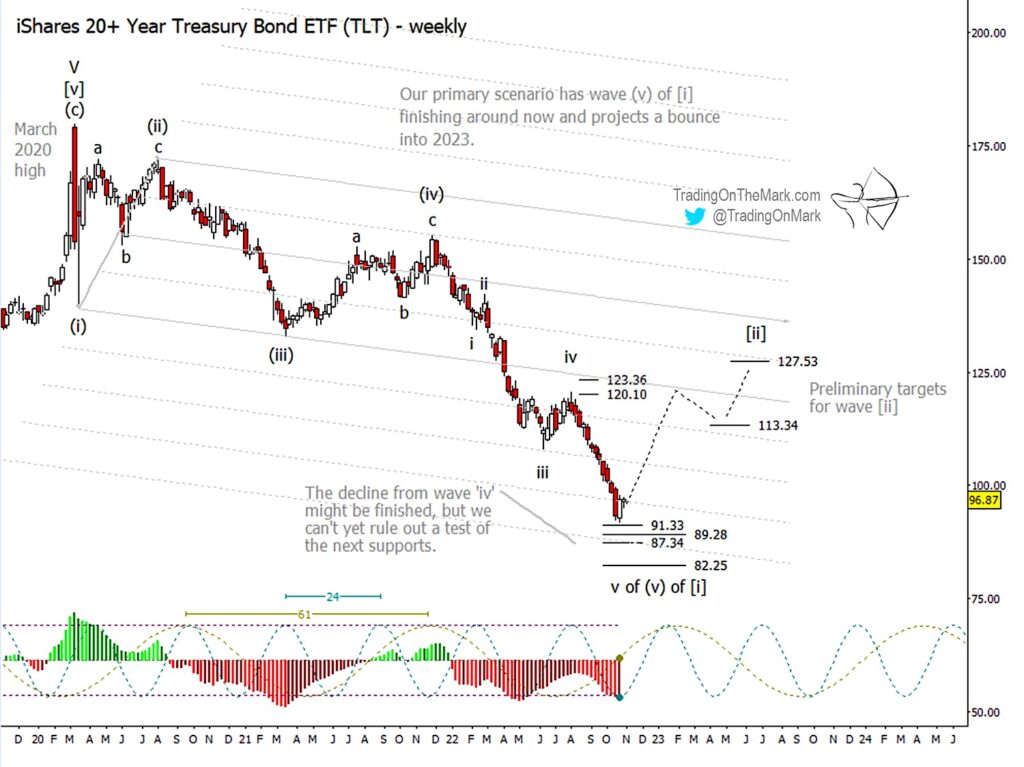

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. As interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower coupon rates less attractive. This directly impacts the value of US bond ETFs, which hold a portfolio of these bonds.

-

The Inverse Relationship Between Interest Rates and Bond Prices: The Federal Reserve's recent interest rate hikes, aimed at curbing inflation, have resulted in a decline in the value of US Treasury bonds. For instance, the 10-year Treasury yield, a key benchmark, has significantly increased, leading to capital losses for investors holding US bond ETFs. This is because bond prices fall when interest rates rise.

-

Examples of Recent Interest Rate Hikes and their Correlation with US Bond ETF Performance: The March, May, and June 2023 interest rate hikes by the Federal Reserve are prime examples. These hikes coincided with a noticeable drop in the performance of many US bond ETFs, highlighting the sensitivity of these investments to interest rate changes. Data from major financial indices clearly illustrates this correlation.

-

Attractiveness of Alternative Investments: Rising rates make other investments more appealing. Higher-yielding corporate bonds, emerging market debt, and even certain equity investments may become more attractive alternatives for Taiwanese investors seeking better returns.

-

Examples of Alternative Investment Options: Taiwanese investors might be shifting funds towards higher-yielding corporate bonds offering greater returns to compensate for the inflation risk, or exploring alternative strategies in the Asian bond market.

-

Risk Appetite: The willingness to embrace risk also plays a part. While higher-yielding options offer potentially higher returns, they also come with increased risk. Conservative investors might prefer to wait for interest rate hikes to plateau before reinvesting in US bonds.

-

Currency Exchange Rate Fluctuations and their Effect on Returns

Fluctuations in the Taiwan dollar (TWD) against the US dollar (USD) significantly impact the returns of US bond ETF investments for Taiwanese investors. When the TWD strengthens against the USD, the returns in TWD terms are reduced, even if the US bond ETF itself performs well in USD.

-

The TWD/USD Exchange Rate and its Impact on Investment Returns: Recent periods of TWD appreciation against the USD have negatively impacted the returns realized by Taiwanese investors holding US bond ETFs, offsetting any potential gains from the underlying bonds.

-

Examples of Recent Exchange Rate Movements and their Impact on Returns: A hypothetical example: If an investor purchased a US bond ETF at a favorable TWD/USD exchange rate and the TWD subsequently appreciated against the USD, the investor’s return in TWD would be lower when converting USD back to TWD.

-

Hedging Strategies and their Costs: Taiwanese investors can employ hedging strategies, such as using forward contracts or options, to mitigate currency risk. However, these strategies come with costs that can reduce overall returns.

-

Different Hedging Strategies and their Implications: Forward contracts lock in a future exchange rate, while options provide flexibility but involve premium costs. The choice depends on the investor’s risk tolerance and market outlook.

-

Trade-off Between Risk Mitigation and Potential Cost Implications: The cost of hedging needs to be carefully weighed against the potential reduction in currency risk. It may not always be economically viable for every investor.

-

Geopolitical Factors and Investor Sentiment

Geopolitical uncertainties, particularly concerning US-China relations and global economic instability, significantly influence investor sentiment and risk appetite.

-

US-China Relations and their Influence on Investment Decisions: Escalating tensions between the US and China can create uncertainty in the global markets, making investors hesitant to invest in US assets. Recent trade disputes and geopolitical events have contributed to this investor apprehension.

-

Global Economic Uncertainty and its Effect on Risk Appetite: Global factors such as high inflation and recessionary fears in major economies affect Taiwanese investors' risk tolerance. Investors may seek safer havens during times of economic turmoil, potentially reducing their exposure to US bond ETFs. This is often reflected in increased demand for assets perceived as less risky.

Conclusion

The recent pullback by Taiwanese investors from US bond ETFs is a complex phenomenon influenced by several interconnected factors. Rising interest rates reduce the attractiveness of existing bonds, while TWD/USD exchange rate fluctuations affect returns in TWD terms. Geopolitical uncertainties and global economic anxieties further contribute to a more risk-averse investment environment. Understanding these dynamics is critical for navigating the evolving global investment landscape.

Key Takeaways: Taiwanese investors' decisions are driven by a combination of macroeconomic conditions, currency movements, and geopolitical risks. The dynamic nature of global finance underscores the need for continuous market analysis and diversified investment strategies.

Call to Action: Stay informed about evolving market trends impacting Taiwanese investors' US bond ETF investments. Conduct thorough due diligence and consult financial advisors before making any significant investment decisions. Further research into US bond market forecasts and international investment strategies will help you make well-informed choices in this dynamic environment.

Featured Posts

-

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025

Is This Ethereum Buy Signal Real Weekly Chart Analysis And Predictions

May 08, 2025 -

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025

Arsenal Psg Semi Final Why Its A Bigger Challenge Than Real Madrid

May 08, 2025 -

Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025

Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025 -

Secure Your Psl 10 Tickets Sale Begins Today

May 08, 2025

Secure Your Psl 10 Tickets Sale Begins Today

May 08, 2025 -

The Aftermath Of La Fires Examining Allegations Of Landlord Price Gouging

May 08, 2025

The Aftermath Of La Fires Examining Allegations Of Landlord Price Gouging

May 08, 2025