Tariff Uncertainty? Why Microsoft Stands Out In The Software Sector

Table of Contents

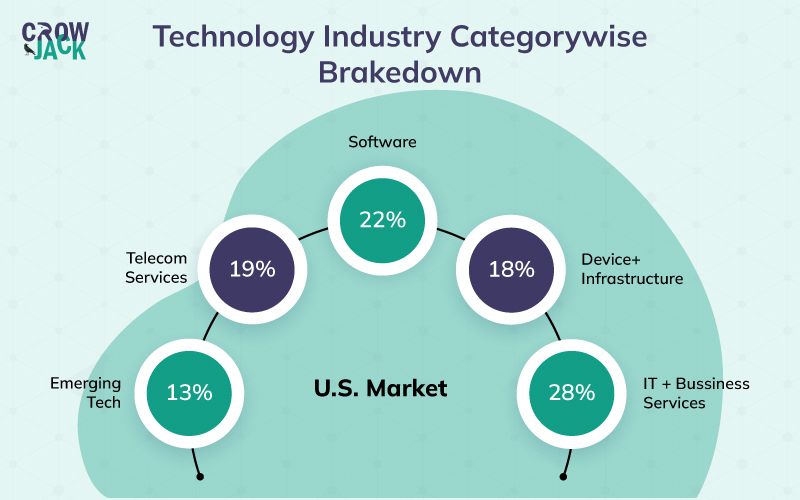

Microsoft's Diversified Revenue Streams Mitigate Tariff Risks

Microsoft's success isn't solely reliant on any single product or market segment. Its diversified revenue streams act as a powerful buffer against the negative impacts of tariffs.

Cloud Services (Azure) as a Protective Shield:

- Azure's global infrastructure minimizes reliance on specific geographic regions vulnerable to tariffs. Microsoft's extensive network of data centers spans the globe, reducing dependence on any single location potentially impacted by import duties or export restrictions. This global presence means that disruptions in one region have minimal impact on overall Azure operations.

- The subscription model of Azure provides predictable revenue streams, less susceptible to immediate tariff impacts. Unlike one-time hardware sales, Azure's subscription-based model generates consistent recurring revenue, insulating it from the immediate shock of tariff changes. This predictable income flow is a significant advantage in uncertain economic times.

- Azure's diverse customer base across various industries further buffers against sector-specific tariff effects. Because Azure serves a broad range of industries, the impact of tariffs on any single sector is diluted. If one industry experiences a downturn due to tariffs, the others can help offset the loss.

The global nature of cloud services significantly reduces reliance on physical goods subject to tariffs. Unlike hardware manufacturers who rely on the physical transportation of goods, Azure’s services are delivered digitally, making it far less vulnerable to the logistical and financial challenges posed by tariffs.

Robust Software Licensing Model:

- Long-term licensing agreements provide stable revenue, even with fluctuating market conditions. Microsoft's extensive portfolio of licensed software provides a predictable income stream, mitigating the effects of short-term tariff changes. These long-term contracts secure revenue and create stability.

- Microsoft's extensive enterprise customer base offers a diverse and resilient revenue source. This large and diversified client base ensures that revenue is not concentrated in specific sectors or geographical locations, thus reducing the impact of any tariff-related disruptions.

- Licensing revenue is less directly affected by physical goods tariffs compared to hardware manufacturers. Software licensing is primarily a digital transaction; it avoids the tariffs associated with importing or exporting physical products, offering a substantial advantage in navigating tariff complexities.

The predictable income generated by software licenses is a key factor in Microsoft's resilience to tariff volatility. This stable revenue base is a crucial element in maintaining its competitive edge.

Microsoft's Global Reach and Strategic Partnerships Reduce Vulnerability

Microsoft's global presence and strategic alliances are crucial in mitigating the risks associated with Microsoft tariffs.

International Infrastructure & Data Centers:

- Strategic data center locations minimize potential disruptions from regional tariff policies. The strategic placement of data centers worldwide enables Microsoft to avoid concentrating its infrastructure in regions vulnerable to tariffs.

- Global partnerships help navigate complex tariff regulations across different markets. Microsoft's partnerships with local providers offer valuable insights into navigating diverse regulatory landscapes. This localized expertise is essential for compliance and efficient operations.

- Diversified supply chains reduce reliance on single-source suppliers vulnerable to tariffs. Multiple sourcing reduces dependency on any single supplier susceptible to tariff impacts, ensuring business continuity.

Microsoft's proactive approach in building a robust global infrastructure is evident in its strategic data center locations and resilient supply chain management. This forward-thinking strategy ensures business continuity even in the face of unpredictable tariff changes.

Strategic Acquisitions and Integrations:

- Acquisitions diversify Microsoft’s product portfolio and market reach, creating resilience. Acquisitions such as LinkedIn and GitHub have expanded Microsoft's product portfolio and market reach, diversifying its revenue streams and reducing dependence on any single product line.

- Integration of acquired companies strengthens existing infrastructure and capabilities. The integration of acquired companies enhances Microsoft's overall technological capabilities and strengthens its competitive position.

- Strategic partnerships with global players further enhance market position and resilience. Collaborations with major technology players create synergies, improving market share and overall resilience.

Examples such as the acquisition of GitHub underscore Microsoft's commitment to diversification and strategic growth, reinforcing its global reach and market dominance.

Microsoft's Strong Brand and Market Dominance

Microsoft's powerful brand and significant market share act as a protective barrier against the adverse effects of tariffs.

Brand Loyalty and Market Share:

- Established brand loyalty provides a strong foundation during economic uncertainty. Customers' trust in the Microsoft brand creates a robust foundation that helps maintain sales during economic fluctuations.

- Significant market share offers greater pricing power and resilience to tariff impacts. Microsoft's large market share enables it to better absorb the costs associated with tariffs, maintaining profitability even in volatile market conditions.

- Microsoft's widespread adoption reduces the impact of potential tariff-induced substitutions. The high adoption rate of Microsoft products makes it less vulnerable to customers switching to alternative products due to tariff-related price increases.

Brand recognition and market dominance create a significant buffer against tariff challenges. This strong position provides Microsoft with significant flexibility and resilience.

Continuous Innovation and Product Development:

- Consistent investment in R&D ensures a competitive edge in the evolving tech market. Microsoft's substantial investment in research and development maintains its technological edge, allowing it to adapt to changing market dynamics and minimize the impact of tariff-related disruptions.

- New product offerings and upgrades maintain market relevance and customer loyalty. Continuous innovation attracts and retains customers, further strengthening its position in the market.

- Innovation minimizes the impact of potential market disruptions caused by tariffs. By constantly adapting and innovating, Microsoft reduces its vulnerability to disruptions from external factors such as tariffs.

Microsoft's commitment to innovation ensures long-term market dominance and minimizes the impact of external pressures like tariff changes. This ongoing investment in R&D is a key factor in its resilience.

Conclusion

In conclusion, while tariff uncertainty poses challenges for many companies in the tech sector, Microsoft’s diversified revenue streams, global reach, strong brand, and continuous innovation create a unique resilience against these external pressures. Its strategic positioning in the cloud computing market, coupled with a robust software licensing model, significantly mitigates the impact of tariff fluctuations. Therefore, understanding why Microsoft stands out amidst the complexities of Microsoft tariffs is crucial for investors and businesses alike. Learn more about how Microsoft navigates the complexities of global trade and remains a leader in the software sector. Explore Microsoft's [link to relevant Microsoft resource].

Featured Posts

-

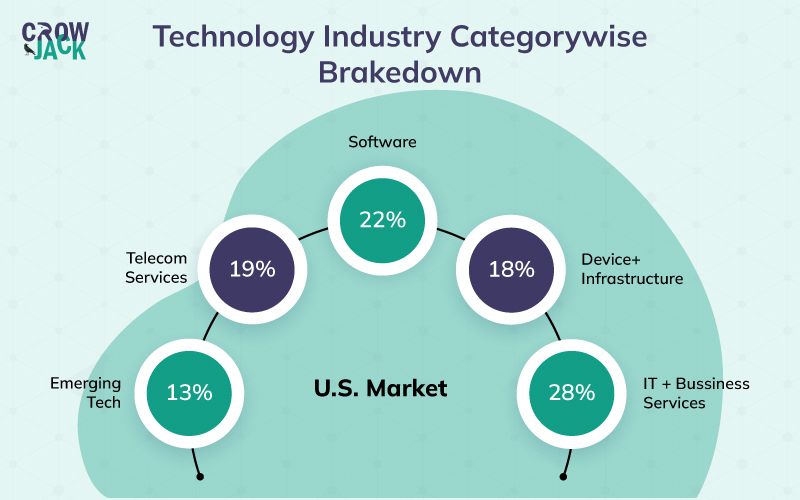

Cassie Ventura Details Freak Offs In Diddy Sex Trafficking Case

May 16, 2025

Cassie Ventura Details Freak Offs In Diddy Sex Trafficking Case

May 16, 2025 -

Shooting At Ohio City Apartment Complex Victims Condition Unknown

May 16, 2025

Shooting At Ohio City Apartment Complex Victims Condition Unknown

May 16, 2025 -

The Gsw Lockdown Student Accounts Of A Frightening Event

May 16, 2025

The Gsw Lockdown Student Accounts Of A Frightening Event

May 16, 2025 -

Rapids Victory Calvin Harris Cole Bassett Score Zack Steffens 12 Saves

May 16, 2025

Rapids Victory Calvin Harris Cole Bassett Score Zack Steffens 12 Saves

May 16, 2025 -

Analysis Gordon Ramsay Comments On Chandlers Loss To Pimblett And Training

May 16, 2025

Analysis Gordon Ramsay Comments On Chandlers Loss To Pimblett And Training

May 16, 2025