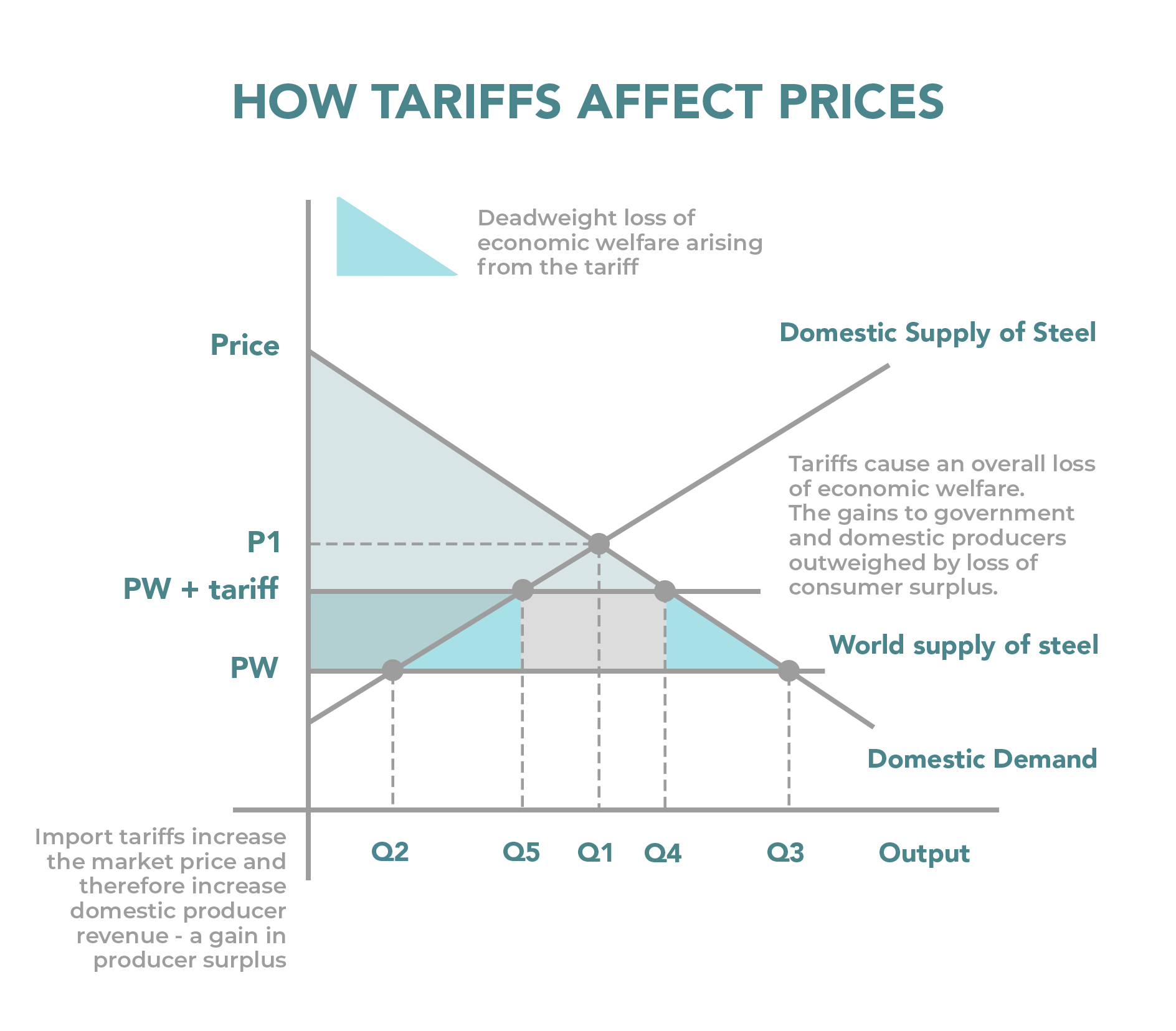

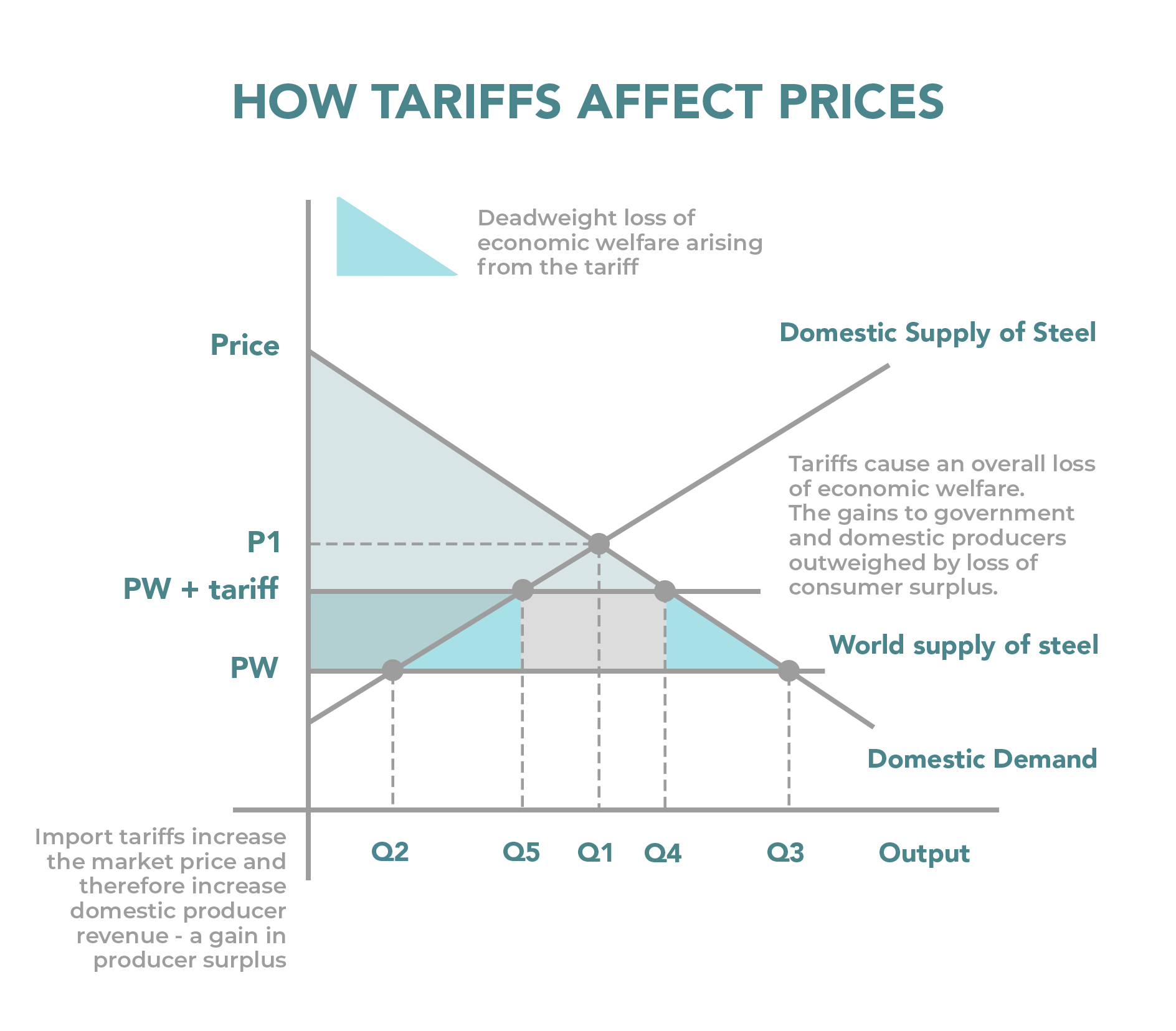

Tariff Wars And Tech Stocks: Why Microsoft Might Be A Top Choice

Table of Contents

Microsoft's Diversified Revenue Streams: A Buffer Against Tariff Impacts

One of the primary reasons Microsoft appears better positioned to weather tariff wars is its incredibly diversified revenue streams. Unlike companies heavily reliant on a single product or sector, Microsoft's portfolio spans multiple areas, mitigating the risk associated with any one sector being disproportionately affected by tariffs.

- Azure's Global Reach: Microsoft's cloud computing platform, Azure, benefits from a global infrastructure. This minimizes the reliance on any specific geographical market heavily impacted by tariffs. Revenue is spread across numerous countries, lessening the blow from localized trade disputes.

- Enterprise Software Dominance: Microsoft's strong enterprise software sales provide significant stability. Businesses rely on products like Windows Server, SQL Server, and Dynamics 365, regardless of fluctuating international trade policies. This consistent demand creates a predictable revenue stream.

- Gaming Revenue Resilience: While the gaming industry can be sensitive to economic downturns, Xbox revenue is less directly impacted by international trade tensions compared to hardware-dependent companies. Digital distribution and a global player base lessen the reliance on physical product shipping and import/export costs affected by tariffs.

- Predictable Recurring Revenue: The subscription model of Office 365 provides Microsoft with predictable recurring revenue, creating financial stability and reducing vulnerability to the short-term shocks caused by tariff wars. This consistent income flow helps offset potential losses in other areas.

Reduced Dependence on Global Supply Chains Compared to Hardware Companies

Microsoft's software-centric business model significantly reduces its dependence on complex, tariff-sensitive global supply chains. This contrasts sharply with hardware manufacturers who rely on intricate networks of international suppliers for components, making them highly vulnerable to increased import costs due to tariffs.

- Software Development's Geographic Flexibility: Software development is far less geographically constrained than hardware manufacturing. Microsoft can leverage its global workforce and development centers to adapt and mitigate potential disruptions.

- Minimized Shipping and Import/Export Costs: The digital nature of Microsoft's products minimizes reliance on extensive international shipping and related import/export costs directly impacted by tariffs. This significantly lowers the company's exposure to trade-related price increases.

- Greater Control Over Production Costs: As a software company, Microsoft has greater control over its production costs compared to hardware manufacturers reliant on external suppliers and fluctuating component prices. This allows for better cost management and profitability during times of economic uncertainty.

Microsoft's Strong Balance Sheet and Financial Health

Microsoft boasts a remarkably strong balance sheet and excellent financial health, giving it the resilience to weather economic downturns, including those caused by tariff wars.

- High Credit Rating: Microsoft's high credit rating reflects its low risk profile, allowing access to capital even during periods of economic uncertainty. This financial stability enables the company to continue investing and expanding.

- Robust R&D Investment: The company's strong cash reserves allow Microsoft to continue investing heavily in research and development, ensuring its long-term competitiveness and innovation despite short-term market volatility driven by tariff wars.

- Strategic Acquisition Potential: Microsoft's substantial financial resources provide the capacity for strategic acquisitions, allowing the company to further diversify its portfolio or expand into new, less tariff-sensitive markets.

Long-Term Growth Potential Despite Short-Term Volatility

Despite the short-term volatility caused by tariff wars, Microsoft's long-term growth prospects remain incredibly strong, particularly in the rapidly expanding cloud computing market with Azure. This strategic position further strengthens its resilience during these turbulent times.

- Cloud Computing and AI Leadership: Microsoft's continued growth potential in cloud computing and artificial intelligence positions it favorably for sustained success, regardless of short-term trade conflicts. This future-focused strategy provides a buffer against current economic headwinds.

- Dominant Market Share: Microsoft maintains strong market share in key sectors, providing a stable base from which to weather economic storms and capitalize on future opportunities.

- New Market and Technology Expansion: Microsoft consistently demonstrates a capacity for expansion into new markets and technologies, further diversifying its revenue streams and reducing dependence on any single sector vulnerable to tariff impacts.

Conclusion: Investing in Microsoft During Tariff Wars

In conclusion, Microsoft's diversified revenue streams, reduced reliance on global supply chains, robust financial health, and significant long-term growth potential make it a relatively strong choice during the ongoing "Tariff Wars and Tech Stocks" turmoil. Its ability to mitigate tariff risks is a key advantage in this volatile climate. To secure your tech investments and weather tariff wars with Microsoft, consider adding it to your diversified portfolio. Further research into Microsoft's financial statements and future projections is recommended for a more thorough understanding of its resilience and long-term growth potential.

Featured Posts

-

La Ligas Illegal Blocking Cloudflare Asks Court To Intervene And Protect User Privacy

May 15, 2025

La Ligas Illegal Blocking Cloudflare Asks Court To Intervene And Protect User Privacy

May 15, 2025 -

Ps 1 Classics Return New Steam Deck Verified Games

May 15, 2025

Ps 1 Classics Return New Steam Deck Verified Games

May 15, 2025 -

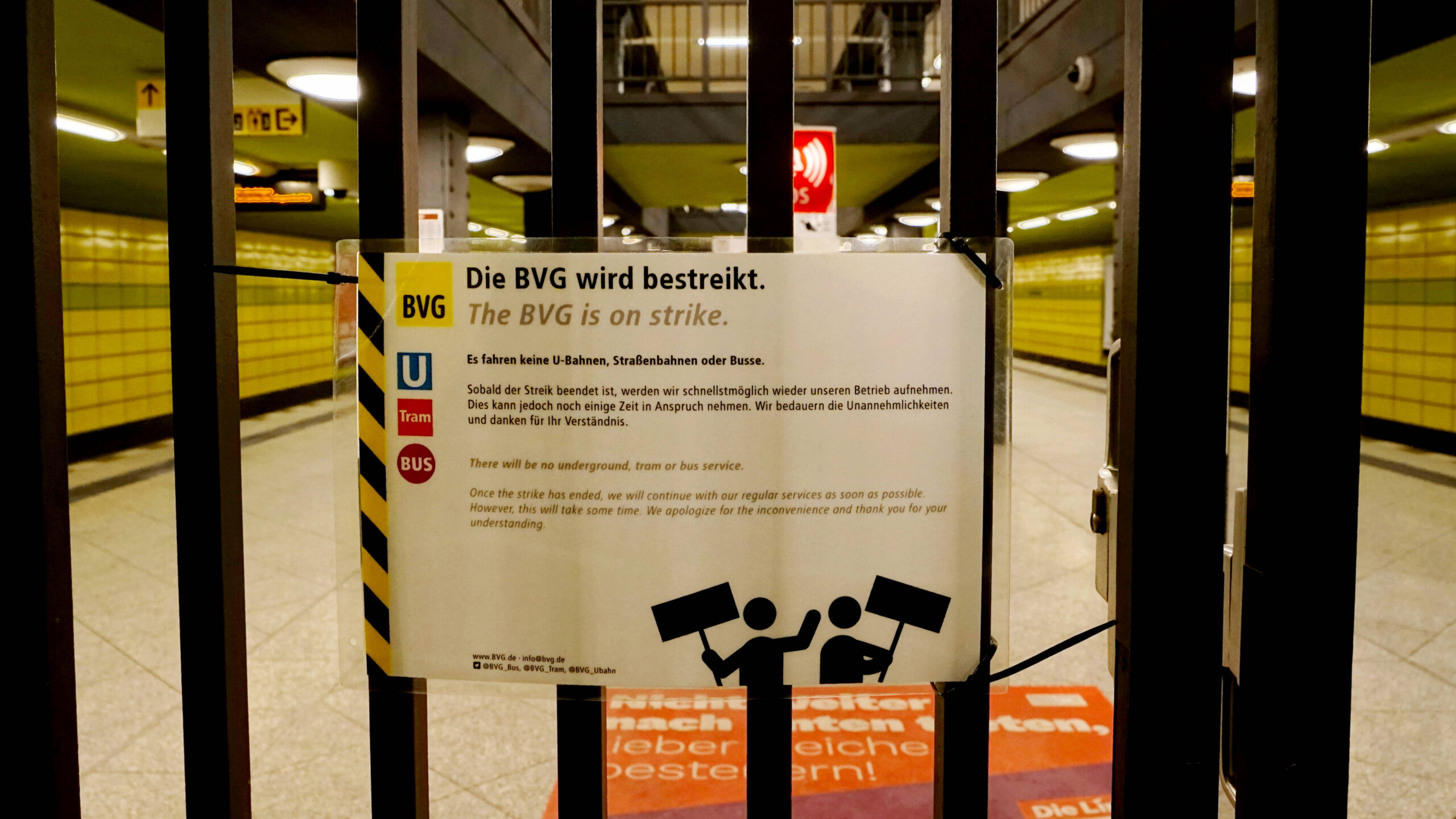

Bvg Streik Berlin Auswirkungen Und Forderungen Der Beschaeftigten

May 15, 2025

Bvg Streik Berlin Auswirkungen Und Forderungen Der Beschaeftigten

May 15, 2025 -

Paddy Pimbletts Take On Dustin Poiriers Ufc Retirement Announcement

May 15, 2025

Paddy Pimbletts Take On Dustin Poiriers Ufc Retirement Announcement

May 15, 2025 -

Pley Off N Kh L Vashington Ovechkina Vstretitsya S Monrealem Demidova

May 15, 2025

Pley Off N Kh L Vashington Ovechkina Vstretitsya S Monrealem Demidova

May 15, 2025