Tariffs And The Fed: Jerome Powell's Concerns About Economic Stability

Table of Contents

Inflationary Pressures from Tariffs

Increased Costs for Consumers and Businesses

Tariffs, essentially taxes on imported goods, directly increase the cost of those goods. This leads to higher prices for consumers and businesses. The impact ripples throughout the economy.

- Examples of specific goods affected by tariffs: Steel, aluminum, and various consumer goods have been subject to tariffs, leading to price increases across multiple sectors.

- Impact on supply chains: Tariffs disrupt established supply chains, forcing businesses to seek more expensive alternatives or reduce production. This further contributes to inflation.

- Reduced consumer purchasing power: Higher prices for essential goods and services reduce consumer purchasing power, potentially leading to decreased consumer spending and slower economic growth. This ultimately impacts business profitability and investment. The interplay between tariff impact and consumer behavior is a key concern for economists.

The Fed's Response to Inflationary Pressures

The Federal Reserve (Fed) uses monetary policy tools to manage inflation. When inflation rises due to tariffs or other factors, the Fed might:

- Interest rate hikes: Increasing interest rates makes borrowing more expensive, slowing down economic activity and reducing inflationary pressure. This is a classic method of cooling down an overheating economy.

- Quantitative tightening: This involves reducing the money supply by selling government bonds, further curbing inflation. This is a less common but equally effective tool for inflation control.

However, these actions have potential consequences:

- Slowed economic growth: Raising interest rates can stifle economic growth, potentially leading to job losses and reduced investment. Balancing inflation control with economic growth is a delicate act for the Fed.

- Challenges in balancing inflation control and economic growth: The Fed faces the difficult task of finding the right balance between controlling inflation and maintaining sustainable economic growth. Overly aggressive measures can lead to a recession.

Uncertainty and Investment

Tariffs Create Economic Uncertainty

The unpredictable nature of tariff policies creates significant economic uncertainty. This uncertainty discourages business investment and hiring.

- Examples of businesses delaying investment decisions due to tariff uncertainty: Businesses hesitate to invest in expansion or new equipment when facing uncertain import costs and potential retaliatory tariffs.

- Impact on job creation: Reduced business investment directly impacts job creation, as companies postpone or cancel hiring plans.

- Reduced business confidence: Uncertainty undermines business confidence, leading to a more cautious approach to spending and investment. This creates a negative feedback loop that further dampens economic growth.

The Fed's Role in Mitigating Uncertainty

The Fed attempts to mitigate the economic uncertainty caused by tariffs through communication and transparency.

- Importance of clear communication from the Fed: Clear and consistent communication from the Fed helps to manage investor expectations and stabilize markets. Transparency builds trust and confidence.

- Impact of Fed statements on investor sentiment: The Fed's statements and actions significantly influence investor sentiment and market reactions. Careful communication is therefore crucial.

- Challenges in forecasting economic outcomes amidst tariff uncertainty: The unpredictable nature of tariff policies makes accurate economic forecasting incredibly challenging for the Fed. This increases the difficulty of implementing effective monetary policy.

Global Economic Impacts and Interconnectedness

Tariffs' Ripple Effects on Global Trade

Tariffs don't just impact the domestic economy; they have significant ripple effects on global trade.

- Examples of retaliatory tariffs: Countries often retaliate against tariffs imposed by other nations, leading to trade wars and escalating tensions.

- Impact on global supply chains: Tariffs disrupt global supply chains, increasing costs and creating uncertainty for businesses worldwide.

- Potential for trade wars: Escalating tariffs can easily trigger trade wars, leading to significant disruptions in international trade and global economic stability.

The Fed's Limited Control over Global Factors

The Fed's primary mandate is to manage the US economy. Its influence on global economic events driven by tariffs is limited.

- Focus on the Fed's domestic mandate: The Fed primarily focuses on domestic economic conditions, such as inflation and employment within the United States.

- Challenges in coordinating with other central banks: While international cooperation is important, coordinating monetary policy with other central banks to counter the effects of global tariffs is a complex challenge.

- The interconnected nature of the global economy: The global economy is interconnected; therefore, events in one country can have significant effects elsewhere. The Fed can only partially mitigate the impacts of global tariff-driven shocks.

Conclusion

Jerome Powell's concerns regarding tariffs highlight their disruptive impact on economic stability. Tariffs fuel inflationary pressures, create uncertainty that discourages investment, and contribute to global trade tensions. The Federal Reserve attempts to manage these challenges through monetary policy, but its influence is limited by the unpredictable nature of tariffs and the interconnectedness of the global economy. Understanding the interplay between tariffs and the Fed's monetary policy is crucial for navigating the current economic climate. Stay informed about the latest developments regarding tariffs and the Federal Reserve's response to ensure you make informed decisions regarding your investments and business strategies. Continue to follow updates on tariffs and the Fed for a better understanding of economic stability.

Featured Posts

-

Pertimbangan Investasi Pada Mtel Dan Mbma Dampak Msci Small Cap Inclusion

May 25, 2025

Pertimbangan Investasi Pada Mtel Dan Mbma Dampak Msci Small Cap Inclusion

May 25, 2025 -

Naomi Kempbell 55 Let Luchshie Foto Supermodeli

May 25, 2025

Naomi Kempbell 55 Let Luchshie Foto Supermodeli

May 25, 2025 -

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 25, 2025

Camunda Con 2025 Amsterdam How Orchestration Drives Ai And Automation Success

May 25, 2025 -

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025

Memorial Service For Hells Angels Member Craig Mc Ilquham Held Sunday

May 25, 2025 -

Exclusive Porsche 911 S T In Riviera Blue Details And Pricing

May 25, 2025

Exclusive Porsche 911 S T In Riviera Blue Details And Pricing

May 25, 2025

Latest Posts

-

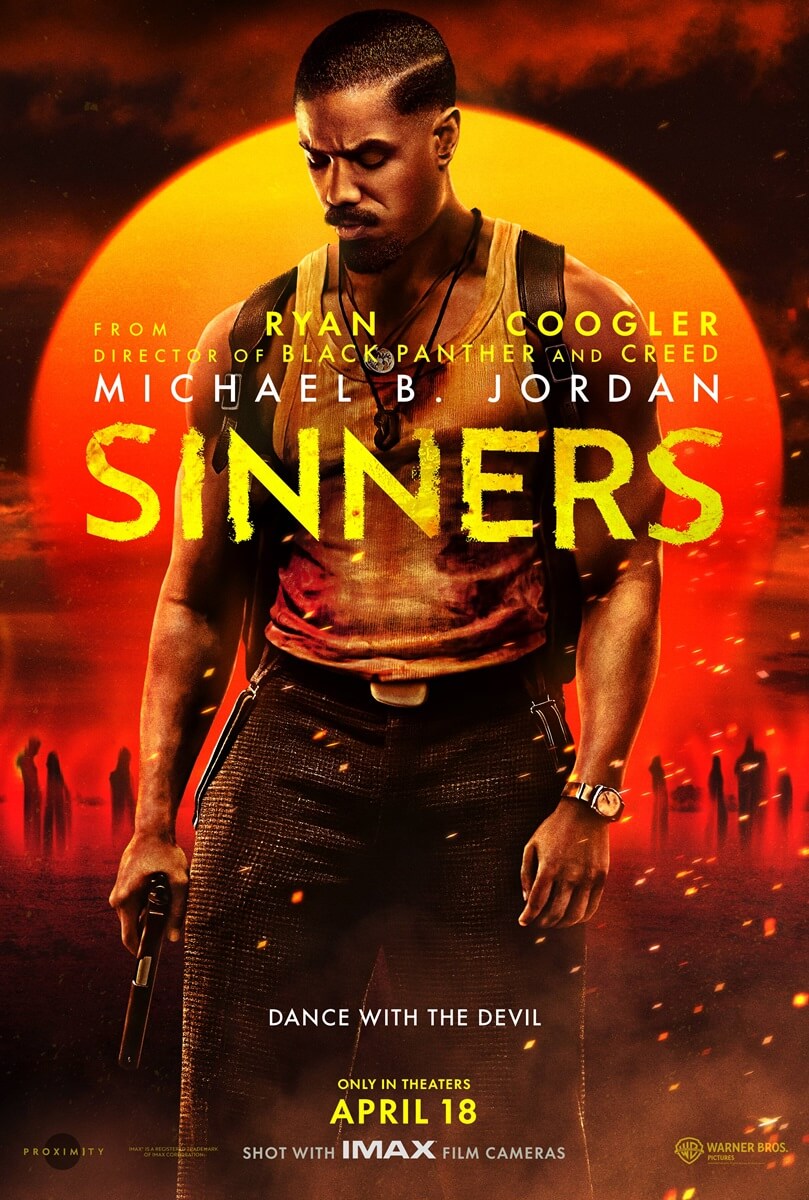

Louisiana Horror Film Sinners To Hit Theaters

May 26, 2025

Louisiana Horror Film Sinners To Hit Theaters

May 26, 2025 -

Sinners New Horror Movie Filmed In Louisiana Prepare For Terror

May 26, 2025

Sinners New Horror Movie Filmed In Louisiana Prepare For Terror

May 26, 2025 -

Louisiana Horror Film Sinners Theatrical Release Date Announced

May 26, 2025

Louisiana Horror Film Sinners Theatrical Release Date Announced

May 26, 2025 -

Sinners A Louisiana Horror Movie Coming Soon To Theaters

May 26, 2025

Sinners A Louisiana Horror Movie Coming Soon To Theaters

May 26, 2025 -

Get Ready The Horror Film Sinners Filmed In Louisiana Is Almost Here

May 26, 2025

Get Ready The Horror Film Sinners Filmed In Louisiana Is Almost Here

May 26, 2025