Tariffs And The Fed: Powell Highlights Potential Conflicts

Table of Contents

The Impact of Tariffs on Inflation

Tariffs, essentially taxes on imported goods, have a direct and significant impact on inflation. Understanding this impact is crucial for comprehending the challenges faced by the Federal Reserve.

Increased Prices for Consumers and Businesses

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers and businesses. This fundamental economic principle creates a ripple effect throughout the economy.

- Reduced consumer purchasing power: Higher prices for goods reduce the disposable income of consumers, potentially leading to decreased spending and slower economic growth. This is a key concern for the Fed as it monitors consumer sentiment and spending patterns.

- Increased input costs for businesses: Businesses reliant on imported materials or components face increased production costs. This can lead to reduced profit margins, job losses, and potentially higher prices for finished goods, further fueling inflation.

- Supply chain disruptions exacerbating price increases: Tariffs can disrupt established supply chains, leading to shortages and further driving up prices. The complexity of global supply chains makes it difficult to accurately predict the full impact of tariffs.

- Potential for a wage-price spiral: Increased prices may lead to demands for higher wages, creating a wage-price spiral where rising wages push up prices even further, creating a challenging environment for the Fed to manage.

The Fed's Response to Tariff-Induced Inflation

The Fed's primary mandate is price stability. When tariffs contribute to inflation, the Fed may respond by raising interest rates. This is a classic tool to cool down an overheating economy.

- Interest rate hikes to curb inflation: Raising interest rates makes borrowing more expensive, reducing investment and consumer spending, thereby slowing economic growth and ideally curbing inflation.

- Potential for a recessionary environment due to aggressive rate increases: However, aggressively raising rates to combat tariff-induced inflation risks triggering a recession, as businesses cut back on investment and consumers reduce spending.

- Balancing inflation control with economic growth: This presents a classic dilemma for the Fed: balancing the need to control inflation with the need to support economic growth. The optimal response depends on various economic indicators and projections.

- Difficulty in predicting the full impact of tariffs on the economy: The complex and interconnected nature of the global economy makes accurately predicting the full impact of tariffs challenging, making the Fed’s job even more difficult.

Tariffs and the Exchange Rate

The impact of tariffs extends beyond domestic prices to influence currency exchange rates, adding another layer of complexity for the Fed.

Impact on the US Dollar

Tariffs can significantly influence the value of the US dollar. For example, increased tariffs might lead to a stronger dollar in the short term as foreign investors seek safe haven assets. However, this can have negative consequences.

- Currency fluctuations impacting import/export prices: A stronger dollar makes US exports more expensive on the global market, potentially harming US businesses and slowing economic growth. Conversely, imports become cheaper, which while good for consumers, can put pressure on domestic producers.

- Uncertainty impacting investor confidence and capital flows: The uncertainty surrounding trade policies can impact investor confidence, leading to capital flight and further currency fluctuations.

- Fed's consideration of exchange rate implications in policy decisions: The Fed must carefully consider the implications of exchange rate movements when making monetary policy decisions, adding another variable to their already complex equation.

- Trade wars impacting global exchange rate stability: Escalating trade wars can create significant instability in global exchange rates, making international trade and investment even riskier.

The Fed's Dilemma

The Fed faces a significant dilemma when dealing with exchange rate fluctuations influenced by trade policies.

- Limited control over external factors like trade policy: Monetary policy tools have limited influence over external factors such as trade policy, leaving the Fed with less direct control over the situation.

- Need for effective communication regarding policy adjustments: Clear and effective communication with the public is crucial to managing expectations and maintaining market stability during periods of trade uncertainty.

- Balancing domestic economic concerns with global market dynamics: The Fed must carefully balance its concerns about the domestic economy with the impact of trade policies on global market dynamics.

- Increased uncertainty making policy decisions even more complex: The unpredictable nature of trade policies significantly increases the uncertainty surrounding economic forecasting, making policy decisions even more challenging.

Uncertainty and Investor Confidence

Trade disputes and tariffs create significant uncertainty, directly impacting investor confidence and economic growth.

Impact of Trade Wars on Market Sentiment

The uncertainty surrounding tariffs and trade disputes negatively impacts investor confidence, leading to a range of negative economic consequences.

- Reduced business investment due to uncertainty: Businesses delay or cancel investment projects due to the uncertainty surrounding future trade policies and potential costs.

- Volatility in financial markets: Increased uncertainty leads to greater volatility in financial markets, impacting investor returns and potentially triggering market corrections.

- Decreased consumer spending due to apprehension: Consumers may postpone purchases due to apprehension about future price increases, slowing economic growth.

- Overall economic slowdown driven by lack of confidence: A decrease in investment and consumer spending can lead to an overall economic slowdown.

The Fed's Role in Maintaining Stability

Despite the limitations, the Fed plays a vital role in trying to maintain investor confidence during periods of uncertainty caused by trade disputes.

- Importance of clear communication and transparency: Open and transparent communication about the Fed’s assessment of the situation and its policy responses is essential for maintaining confidence.

- Maintaining market stability through appropriate monetary policy: The Fed attempts to maintain market stability by adjusting monetary policy to mitigate the negative impact of trade uncertainty.

- Managing expectations to mitigate negative impacts on investor sentiment: The Fed tries to manage expectations about future inflation and economic growth to minimize negative impacts on investor sentiment.

- Limited ability to control external political and economic factors: It’s crucial to acknowledge that the Fed has limited control over external political and economic factors driving trade disputes and uncertainty.

Conclusion

The interplay between tariffs and the Fed’s monetary policy decisions presents significant challenges. Tariffs can trigger inflation, influence exchange rates, and undermine investor confidence, forcing the Fed to navigate a complex landscape with limited control over external factors. Understanding the potential conflicts between tariffs and the Fed is vital for anyone involved in the financial markets or concerned about economic stability. Staying informed about the latest developments regarding tariffs and the Fed’s response is crucial for navigating this complex economic environment. Continue to monitor news and analysis on tariffs and the Fed, including the impact of trade wars and the Fed's response to inflation, to make informed decisions in these uncertain times.

Featured Posts

-

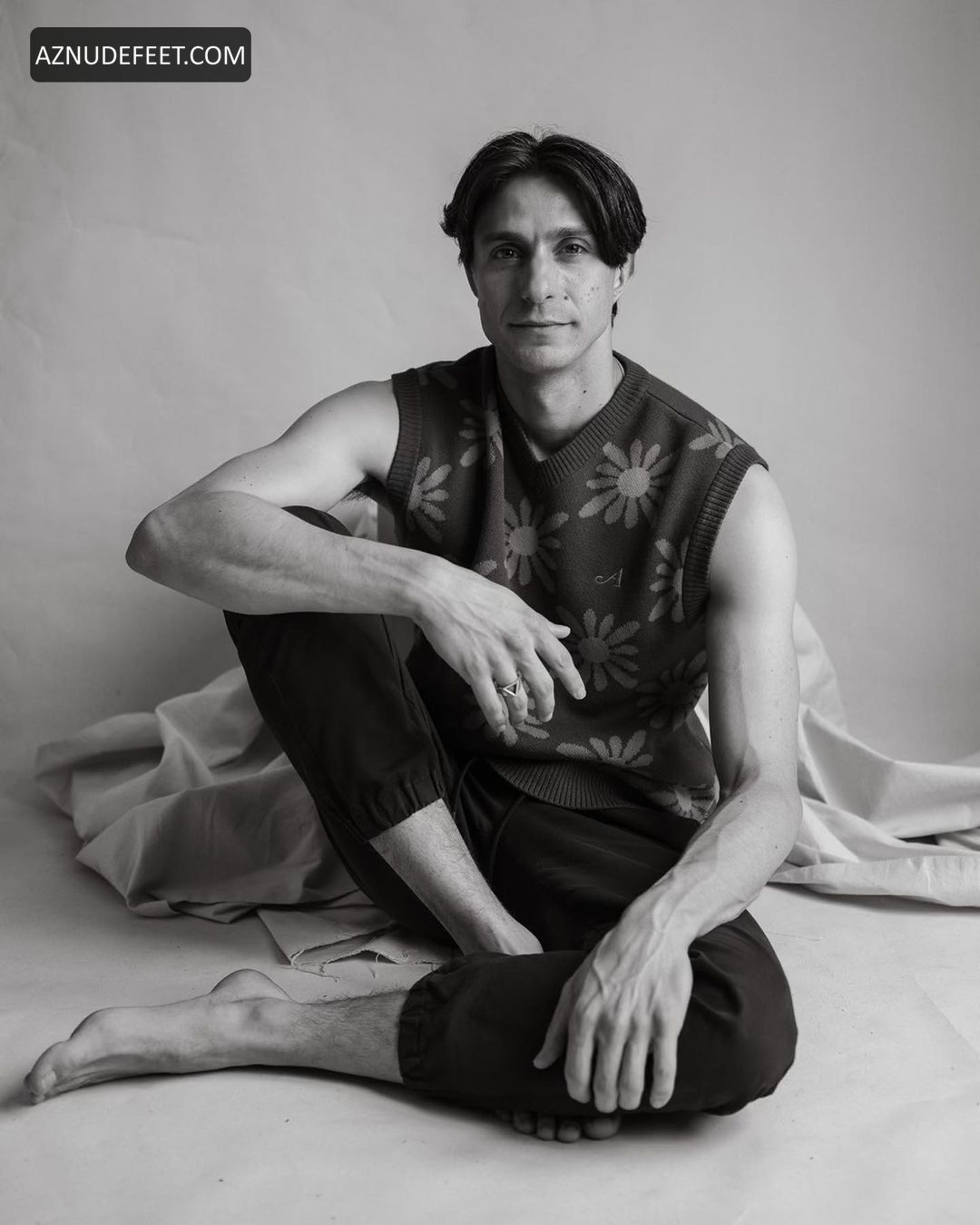

Gideon Glick Shines In Amazon Primes Etoile

May 26, 2025

Gideon Glick Shines In Amazon Primes Etoile

May 26, 2025 -

Formula 1 Rule Changes The Impact Of Lewis Hamiltons Advocacy

May 26, 2025

Formula 1 Rule Changes The Impact Of Lewis Hamiltons Advocacy

May 26, 2025 -

Maccabi Tel Aviv Edges Closer To Israeli League Championship

May 26, 2025

Maccabi Tel Aviv Edges Closer To Israeli League Championship

May 26, 2025 -

Zivot Penzionera U Bogatstvu Skrivene Lokacije I Visoki Prihodi

May 26, 2025

Zivot Penzionera U Bogatstvu Skrivene Lokacije I Visoki Prihodi

May 26, 2025 -

Popular Southern Vacation Spot Fights Back Against Negative Safety Perception

May 26, 2025

Popular Southern Vacation Spot Fights Back Against Negative Safety Perception

May 26, 2025

Latest Posts

-

Transfer Race Heats Up Arsenal And Newcastle Vie For Ligue 1 Star

May 28, 2025

Transfer Race Heats Up Arsenal And Newcastle Vie For Ligue 1 Star

May 28, 2025 -

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025

Ligue 1 Talent Arsenal And Newcastle To Compete For Signing

May 28, 2025 -

Man Utd Interference In Liverpools 25m Transfer Pursuit

May 28, 2025

Man Utd Interference In Liverpools 25m Transfer Pursuit

May 28, 2025 -

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025

Arsenal And Newcastle Target Promising Ligue 1 Youngster

May 28, 2025 -

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025

Liverpool Eye Two Wingers Contract Negotiations With Salah Take Center Stage

May 28, 2025