Telus Announces Q1 Earnings Growth And Dividend Boost

Table of Contents

Strong Revenue Growth Fuels Q1 Earnings Surge

Telus' Q1 earnings surge is primarily attributed to robust revenue growth across various segments. This growth reflects the company's strong market position and effective strategies in a competitive landscape.

Increased Wireless Subscriber Base

- Significant Net Additions: Telus experienced substantial net additions in its wireless subscriber base. This increase is largely driven by strong demand for 5G services and highly competitive offerings, attracting new customers and retaining existing ones.

- ARPU Growth: A focus on high-value postpaid plans contributed significantly to the average revenue per user (ARPU) growth, boosting overall revenue. This strategic shift towards higher-value plans showcases Telus' ability to maximize revenue from its customer base.

- Targeted Marketing Campaigns: Successful marketing campaigns, tailored to specific demographics and needs, further fueled the growth in wireless subscribers. These targeted efforts underscore Telus' commitment to understanding its customer base and offering relevant services.

Growth in Wireline and Internet Services

- High-Speed Internet Demand: The increasing demand for high-speed internet services, fueled by remote work trends and the rise of streaming platforms, significantly contributed to revenue growth in this sector. Telus' robust infrastructure is well-positioned to capitalize on this growing demand.

- Market Expansion and Partnerships: Strategic expansion into new markets and the forging of key partnerships have broadened Telus' reach and access to new customer segments. These initiatives are crucial for long-term sustainable growth.

- Network Infrastructure Investments: Continuous investment in network infrastructure upgrades has improved service quality and capacity, enhancing customer satisfaction and attracting new subscribers. This commitment to infrastructure modernization is a key differentiator for Telus.

Improved Operational Efficiency

- Cost Optimization: Implementation of effective cost optimization strategies resulted in improved profit margins. This showcases Telus' commitment to operational excellence and efficient resource management.

- Technological Advancements: Technological advancements contributed to streamlining operations, improving efficiency, and reducing operational costs. This highlights Telus' proactive approach to leveraging technology for competitive advantage.

- Automation and Digital Transformation: A focused effort on automation and digital transformation initiatives further enhanced efficiency and reduced manual processes, leading to cost savings and improved productivity.

Dividend Increase Reflects Confidence in Future Growth

Telus' decision to increase its dividend underscores its confidence in sustained future growth and its commitment to rewarding shareholders.

Enhanced Shareholder Returns

- Dividend Increase Percentage: The specific percentage increase in the dividend payout, along with its impact on shareholder returns, needs to be detailed here (replace with actual figures from the report). This concrete information is crucial for investors assessing the value proposition.

- Rationale for Dividend Boost: The rationale behind the dividend increase, reflecting the strong financial performance and positive outlook, should be clearly explained. This transparency builds trust and confidence among investors.

- Industry Benchmark Comparison: A comparison of the dividend payout to previous payouts and industry benchmarks provides valuable context for investors. This helps assess the competitiveness of Telus' dividend policy.

Attractive Investment Opportunity

- Attractive Dividend Yield: Highlighting the attractive dividend yield for investors is essential in attracting potential investors. This quantifiable benefit is a key selling point for Telus stock.

- Future Dividend Growth Projections: A positive outlook for future dividend growth, based on projected earnings, further strengthens the investment case. This long-term perspective encourages investor confidence.

- Long-Term Strategic Plans: A discussion of Telus' long-term strategic plans and their implications for shareholder value provides context for the dividend increase and future growth prospects. This demonstrates strategic foresight and a commitment to long-term shareholder value creation.

Analysis of Key Financial Metrics for Telus Q1 Earnings

A detailed analysis of key financial metrics provides a comprehensive understanding of Telus' Q1 2024 performance.

Earnings Per Share (EPS)

- EPS Figure and Year-Over-Year Comparison: Presentation of the EPS figure and a comparison to the previous year's Q1 EPS is crucial for gauging year-on-year growth. This quantitative data provides a clear measure of financial progress.

- Factors Driving EPS Increase: A discussion of the key factors driving the increase in EPS adds valuable context and insight. This qualitative analysis complements the quantitative data.

- Analyst Forecasts and Consensus Estimates: Inclusion of analyst forecasts and consensus estimates for EPS provides further context and perspective, allowing for comparison with market expectations.

Revenue Growth

- Overall Revenue Figures and Segment Breakdown: Overall revenue figures and a breakdown by segment (wireless, wireline, etc.) provide a granular view of performance across different business units. This detailed view offers a deeper understanding of the revenue drivers.

- Market Expectations and Industry Trends: Comparison to market expectations and industry trends provides further context and helps to assess Telus' relative performance.

- Key Drivers of Revenue Growth: Identification of key drivers, such as subscriber acquisitions and service upgrades, helps in understanding the underlying reasons for the revenue growth.

Profitability and Margins

- Operating Income, Net Income, and Profit Margins: Analysis of operating income, net income, and profit margins provides insights into the company's profitability. This is a key indicator of financial health.

- Quarter-Over-Quarter and Year-Over-Year Trends: Comparison to previous quarters and year-over-year trends allows for the identification of emerging trends and patterns.

- Factors Impacting Profitability: Discussion of factors impacting profitability, such as cost management and pricing strategies, provides insights into the company's operational efficiency and pricing power.

Conclusion

Telus' Q1 2024 earnings report demonstrates robust financial health and a positive outlook for the future. Strong revenue growth, fueled by increased subscriber bases and operational efficiency improvements, enabled the company to deliver impressive results and reward shareholders with a substantial dividend increase. This makes the Telus Q1 earnings announcement a significant event for investors, highlighting the company's strength and position in the competitive telecommunications market. To stay updated on Telus' performance and future financial reports, regularly check our website for further analysis and insights. Stay informed about future Telus Q1 earnings announcements and other key developments.

Featured Posts

-

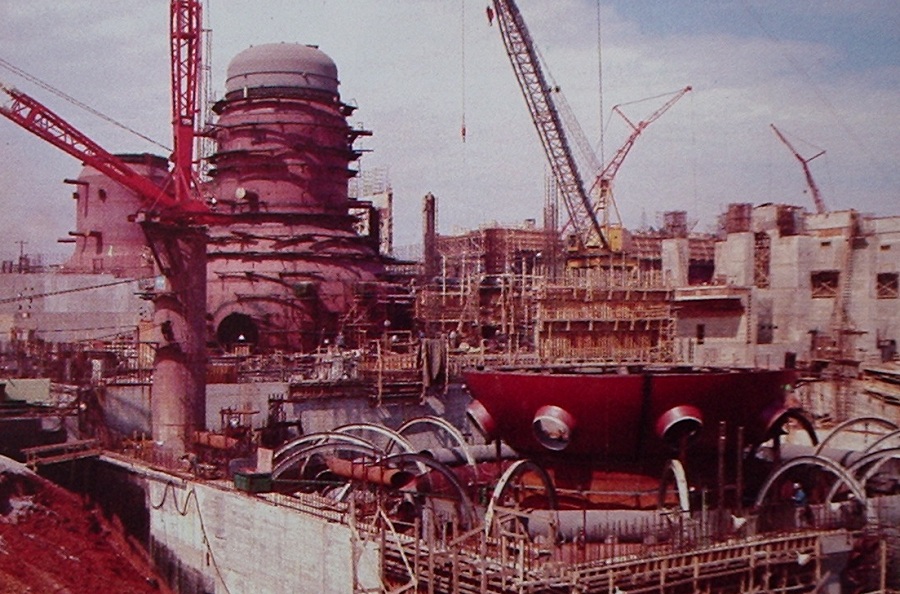

Analysis Trump Teams Proposal To Fast Track Nuclear Plant Construction

May 11, 2025

Analysis Trump Teams Proposal To Fast Track Nuclear Plant Construction

May 11, 2025 -

Ufc 315 Betting Mm Amania Coms Expert Predictions And Odds Breakdown

May 11, 2025

Ufc 315 Betting Mm Amania Coms Expert Predictions And Odds Breakdown

May 11, 2025 -

David Gentile Gpb Capital Founder Receives 7 Year Prison Sentence For Fraud

May 11, 2025

David Gentile Gpb Capital Founder Receives 7 Year Prison Sentence For Fraud

May 11, 2025 -

100 000 Up For Grabs B And W Trailer Hitches All Star Bass Fishing Event At Smith Mountain Lake Next Week

May 11, 2025

100 000 Up For Grabs B And W Trailer Hitches All Star Bass Fishing Event At Smith Mountain Lake Next Week

May 11, 2025 -

Estrategia Ganadera De Uruguay Un Regalo Con Destino A China

May 11, 2025

Estrategia Ganadera De Uruguay Un Regalo Con Destino A China

May 11, 2025