Telus Reports Higher Q1 Profit, Announces Dividend Increase

Table of Contents

Strong Q1 Profit Growth: Key Performance Indicators

Telus' Q1 2024 financial performance exceeded expectations, demonstrating robust growth across its core business segments. Several key performance indicators highlight this success:

-

Increased Q1 Profit: Telus reported a [Insert Specific Percentage or Dollar Amount]% increase in Q1 profit compared to Q1 2023. This significant jump reflects the company's effective strategies and strong market position.

-

Robust Revenue Growth: Key revenue drivers included strong performance in wireless services, with a [Insert Percentage]% year-over-year increase, fueled by increased subscriber additions and higher average revenue per user (ARPU). The internet segment also contributed significantly, showcasing a [Insert Percentage]% growth driven by increased demand for high-speed internet and fiber optic services. Growth in other services, such as [mention specific services, e.g., home security, managed services], further bolstered overall revenue.

-

EBITDA Growth: Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) also experienced substantial growth, increasing by [Insert Percentage]%. This metric demonstrates the company's operational efficiency and ability to generate cash flow from its core operations.

-

Earnings Per Share (EPS): Earnings per share (EPS) saw a positive increase of [Insert Percentage]%, reaching [Insert EPS Value] per share. This signifies enhanced profitability for each outstanding share, benefiting shareholders directly.

-

One-Time Events: [Mention any significant one-time events affecting profitability, providing context and impact].

Dividend Increase: A Positive Sign for Investors

The announcement of a dividend increase is a significant positive for Telus investors. This demonstrates confidence in the company's future financial performance and its commitment to returning value to shareholders.

-

Increased Dividend Payout: Telus announced a [Insert Percentage or Dollar Amount]% increase in its quarterly dividend. The new dividend payout will be [Insert New Dividend Payout per Share].

-

Higher Dividend Yield: This increase translates to a higher dividend yield for investors, enhancing their returns. The new dividend yield will be [Insert New Dividend Yield Percentage].

-

Shareholder Returns: This dividend increase reinforces Telus' strong track record of returning value to its shareholders. The company has a history of consistently increasing its dividend, highlighting its commitment to long-term shareholder value creation.

-

Rationale Behind the Increase: The dividend increase reflects Telus' confidence in its future growth prospects and strong financial position. The company's strong Q1 performance and optimistic outlook for the remainder of the year justify this shareholder-friendly action.

Future Outlook and Growth Projections

Telus' management expressed a positive outlook for the remainder of 2024 and beyond. Key growth drivers include:

-

Continued 5G Expansion: Telus plans to continue its significant investment in 5G network expansion, providing faster speeds and improved connectivity to its customers. This will drive further subscriber growth and higher ARPU.

-

Fiber Optic Network Expansion: Expansion of its fiber optic network will further enhance its competitive advantage, providing high-speed internet access to a wider customer base.

-

Strategic Initiatives: Telus is actively pursuing strategic initiatives in [Mention Specific Initiatives, e.g., IoT solutions, cloud services], aiming to diversify its revenue streams and accelerate growth.

-

Challenges and Risks: While the outlook is positive, Telus acknowledges potential challenges such as increased competition, economic uncertainty, and regulatory changes. The company is actively mitigating these risks through strategic planning and investment.

Analyst Reactions and Market Response

The market reacted positively to Telus' Q1 2024 earnings report.

-

Stock Price Movement: Following the announcement, Telus' stock price experienced a [Insert Percentage]% increase/decrease [Mention the timeframe].

-

Analyst Commentary: Several analysts have issued positive comments on Telus' Q1 performance, upgrading their ratings and increasing price targets. [Mention specific examples of analyst comments if available].

-

Investor Sentiment: The overall investor sentiment towards Telus remains positive, driven by strong financial results and a positive outlook for future growth.

Conclusion

Telus' Q1 2024 earnings report demonstrated strong financial performance, exceeding expectations with higher profits and a significant dividend increase. This positive news reflects well on the company's strategic direction and operational efficiency. The increased dividend payout further underscores Telus' commitment to shareholder value. The company's positive outlook suggests continued growth in the coming quarters.

Call to Action: Stay informed on the latest developments regarding Telus' financial performance and future strategies by regularly checking their investor relations website. Learn more about Telus' Q1 earnings and dividend increase by visiting [link to Telus investor relations]. Investing in strong companies like Telus can be a rewarding strategy for long-term growth.

Featured Posts

-

Chainalysis Expands With Ai Agent Startup Acquisition Alterya

May 12, 2025

Chainalysis Expands With Ai Agent Startup Acquisition Alterya

May 12, 2025 -

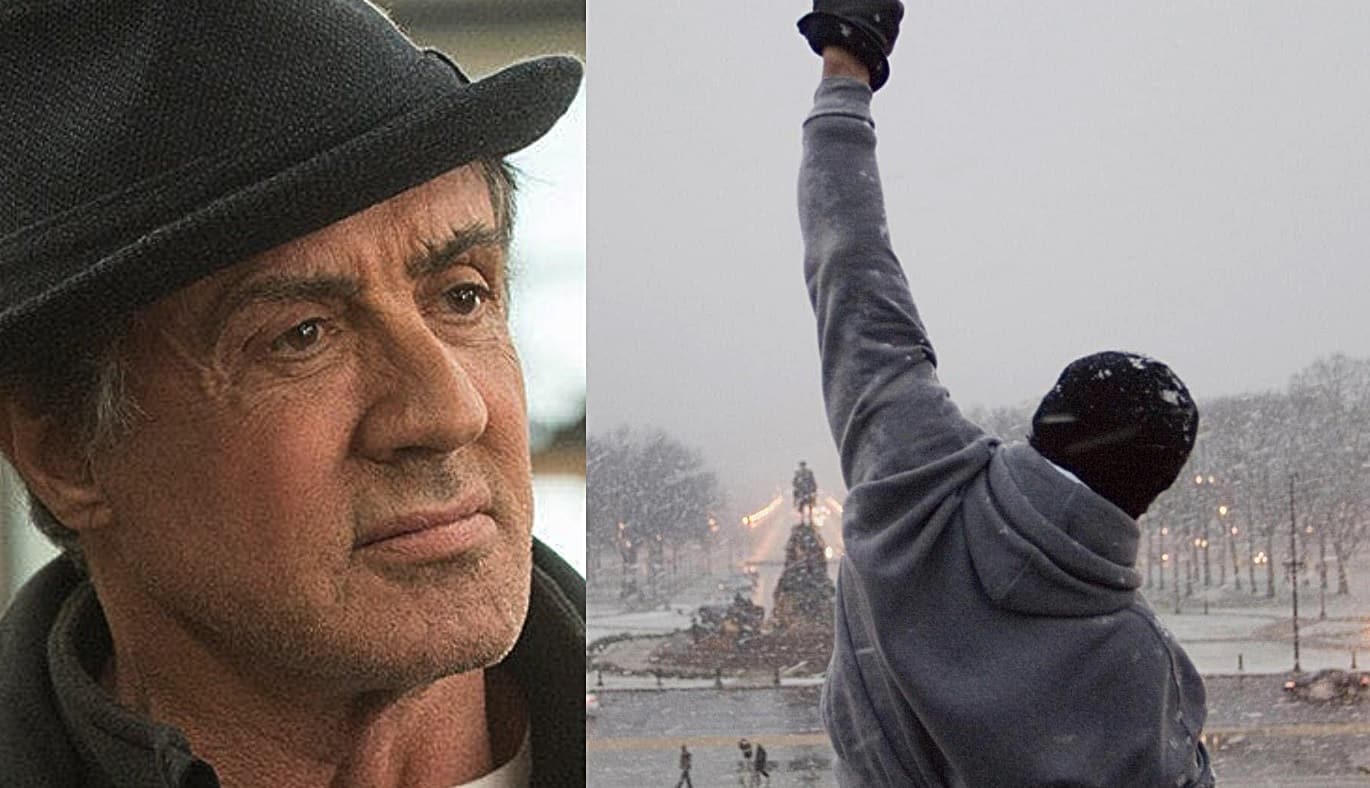

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025 -

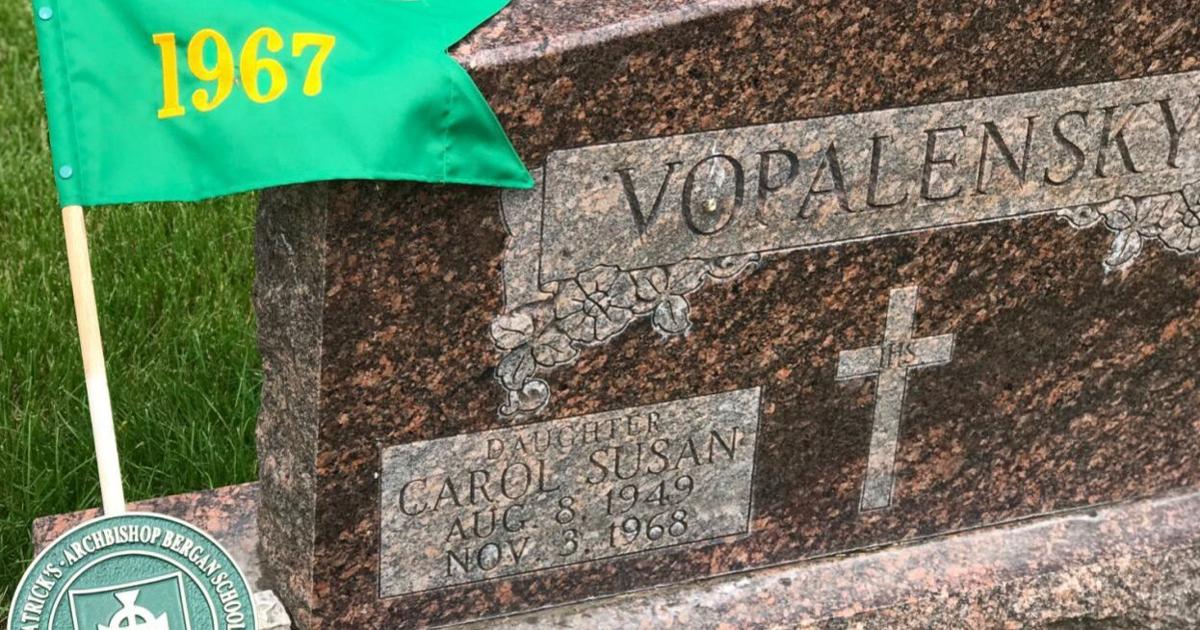

Norfolk Catholics District Final Loss To Archbishop Bergan

May 12, 2025

Norfolk Catholics District Final Loss To Archbishop Bergan

May 12, 2025 -

Quand C Est L Heure C Est Mueller Analyse Du Match Bayern Inter Milan Ligue Des Champions

May 12, 2025

Quand C Est L Heure C Est Mueller Analyse Du Match Bayern Inter Milan Ligue Des Champions

May 12, 2025 -

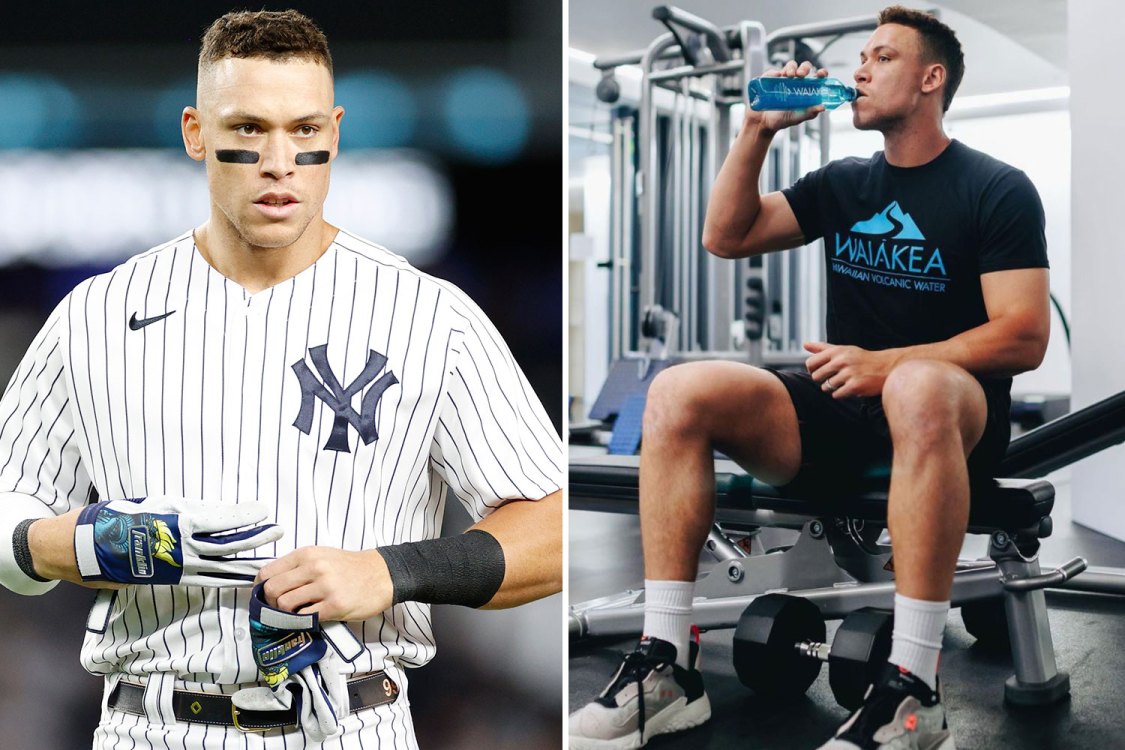

Aaron Judges 2025 Push Up Goal Understanding The Significance

May 12, 2025

Aaron Judges 2025 Push Up Goal Understanding The Significance

May 12, 2025