Tesla And Tech Power US Stock Market Surge

Table of Contents

Tesla's Impact: More Than Just Electric Vehicles

Tesla's Stock Performance and Market Influence

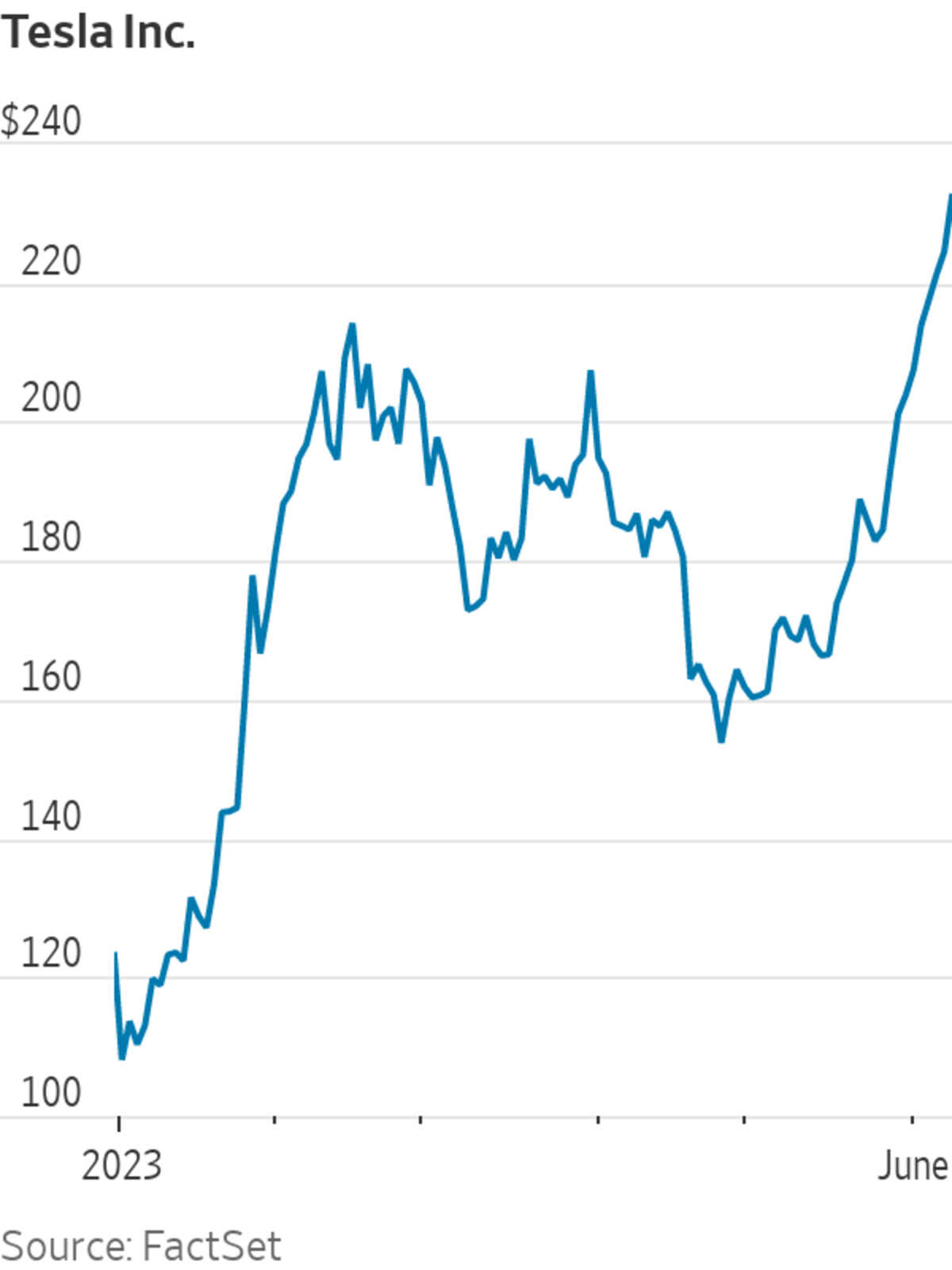

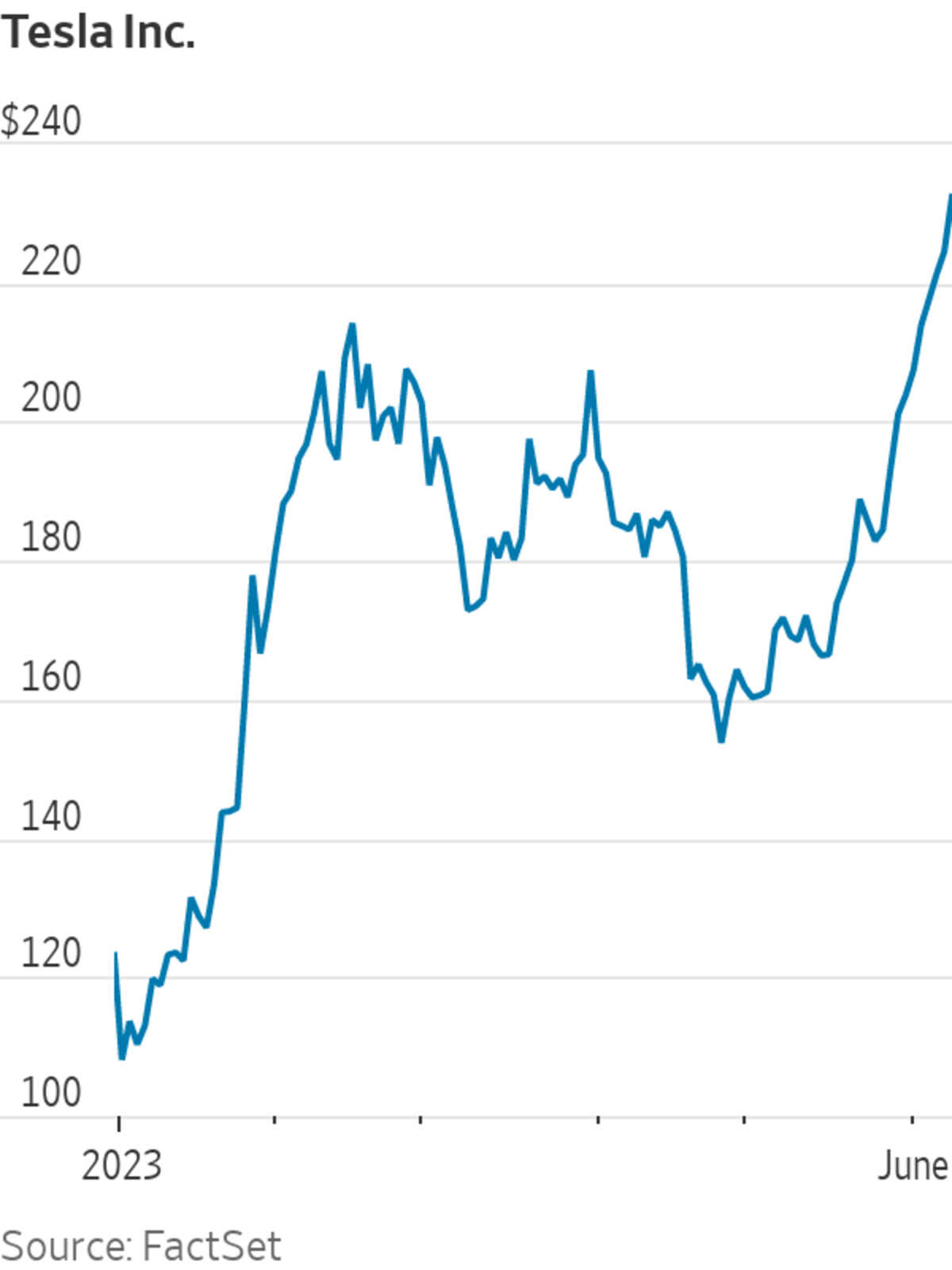

Tesla's recent stock price increases have been nothing short of phenomenal, significantly impacting overall market sentiment. The company's market capitalization has soared, boosting investor confidence and creating a ripple effect across various sectors. Analyst predictions remain largely positive, forecasting continued growth driven by several key factors. For example, in Q3 2023, Tesla reported a substantial percentage increase in revenue, exceeding analyst expectations.

- Strong Q[Quarter] earnings reports: Consistently exceeding expectations fuels investor optimism.

- Positive investor outlook on future product launches (Cybertruck, etc.): Anticipation for new models drives demand and stock prices.

- Expansion into new markets and energy sectors: Diversification reduces risk and opens new avenues for growth.

Beyond the Car: Tesla's Energy Business and its Contributions

Tesla's foray into renewable energy, through Tesla Energy (solar panels and Powerwall batteries), has been another significant driver of growth and investor confidence. This diversification positions Tesla as a leader not just in electric vehicles, but in the broader sustainable energy sector. Large-scale contracts with utilities and partnerships with home builders further solidify this position.

- Growing demand for renewable energy solutions: A global shift towards sustainability benefits Tesla Energy.

- Increased investment in energy storage technology: Powerwall's success underscores the importance of energy storage.

- Government incentives and subsidies supporting Tesla Energy: Policy support strengthens market position and profitability.

The Tech Sector's Resurgence: A Key Driver of the Surge

Key Tech Players and Their Contributions

The tech sector's resurgence has been a crucial component of the overall market rally. Major players like Apple, Microsoft, and Google have all reported strong earnings, exceeding expectations and bolstering investor confidence. Specific positive developments, such as Apple's continued success with the iPhone and services, Microsoft's dominance in cloud computing, and Google's advancements in AI, have collectively fueled the market surge.

- Strong earnings reports from major tech firms: Solid financial performance reinforces positive investor sentiment.

- Positive forecasts for future growth in the tech sector: Future projections drive investment and stock valuations.

- Innovations in AI, cloud computing, and other key areas: Technological advancements fuel excitement and market growth.

Investor Sentiment and the Tech Rally

Several factors have contributed to the positive investor sentiment surrounding the tech sector. Easing inflation concerns, coupled with positive economic data and a renewed appetite for risk, have all played a role. A shift in interest rates also impacted investor decisions, leading to increased investment in growth stocks.

- Easing inflation concerns: Reduced inflation risk makes investing in growth stocks more attractive.

- Positive economic data: Strong economic indicators boost investor confidence and market sentiment.

- Increased investor appetite for risk: A willingness to take on more risk fuels investment in higher-growth sectors.

Interconnectedness and Synergies: Tesla and the Tech Ecosystem

Tesla's Technological Advancements and Their Ripple Effects

Tesla's technological advancements, particularly in AI, battery technology, and autonomous driving, have had a ripple effect throughout the broader tech sector. These innovations not only benefit Tesla directly but also create opportunities and drive innovation in related industries. Partnerships and collaborations with other tech companies further amplify these effects.

- Advancements in battery technology benefiting other EV manufacturers: Tesla's battery technology advancements indirectly support the entire EV industry.

- AI advancements influencing other tech sectors: Tesla's AI expertise impacts various sectors, from autonomous vehicles to robotics.

- Tesla’s influence on the development of autonomous driving technology: Tesla's leadership in autonomous driving pushes the field forward.

Conclusion: Tesla and Tech – Shaping the Future of the US Stock Market

The recent surge in the US stock market is undeniably linked to the impressive performance of Tesla and the tech sector. Tesla's success, extending beyond electric vehicles to encompass renewable energy solutions, has significantly impacted investor sentiment. Simultaneously, the tech sector's strong earnings and innovative advancements have driven market growth. The interconnectedness of these two forces highlights the importance of understanding their symbiotic relationship for navigating the future of the US stock market. The continued influence of Tesla and tech suggests a potentially bright outlook, but careful monitoring of economic indicators and company performance remains crucial. To make informed investment decisions, stay updated on the latest news and analysis concerning Tesla and tech stocks. Consider exploring reputable financial news sources and investment research to deepen your understanding of this dynamic market segment.

Featured Posts

-

Offiziell Carsten Jancker Ist Neuer Austria Klagenfurt Coach

Apr 29, 2025

Offiziell Carsten Jancker Ist Neuer Austria Klagenfurt Coach

Apr 29, 2025 -

An Interview With Jeff Goldblum His Thoughts On The Flys Ending

Apr 29, 2025

An Interview With Jeff Goldblum His Thoughts On The Flys Ending

Apr 29, 2025 -

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 29, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 29, 2025 -

Celebrating A Happy Day February 20 2025

Apr 29, 2025

Celebrating A Happy Day February 20 2025

Apr 29, 2025 -

Garantia De Gol De Alberto Ardila Olivares Analisis Y Perspectivas

Apr 29, 2025

Garantia De Gol De Alberto Ardila Olivares Analisis Y Perspectivas

Apr 29, 2025