Tesla Seeks To Block Shareholder Litigation After Musk Pay Dispute

Table of Contents

The Core of the Shareholder Lawsuit Against Tesla

At the heart of the "Shareholder Lawsuit Against Tesla" are claims that Elon Musk's compensation package is excessive and unfairly benefits him at the expense of shareholders. The lawsuits allege a breach of fiduciary duty by the Tesla board, arguing that they failed to adequately protect shareholder interests when approving the compensation plan. The central arguments focus on:

-

Excessive Compensation: Shareholders point to the sheer magnitude of Musk's compensation, including stock options and performance-based incentives, as evidence of excessive executive pay. Specific examples cited often include the massive stock option grants tied to ambitious, yet achievable, company milestones.

-

Lack of Shareholder Approval: The lawsuits contend that the compensation plan was not properly vetted or approved by shareholders, violating established corporate governance practices and potentially diluting the value of existing shares. This alleged procedural deficiency is a key legal argument.

-

Potential Financial Impact: The plaintiffs argue that the excessive compensation package siphons resources from other crucial areas of the business, potentially hindering Tesla's long-term growth and negatively impacting shareholder returns. This translates into direct financial losses for shareholders.

-

Specific examples of excessive compensation: One example frequently cited is a specific grant of stock options valued at billions of dollars, conditional on Tesla achieving ambitious but potentially attainable growth targets.

-

Legal arguments used by shareholders: The shareholders primarily argue breach of fiduciary duty, arguing that the board failed to act in the best interests of shareholders. They also allege violations of corporate governance best practices and potentially state securities laws.

-

Potential financial impact on Tesla and shareholders: The potential financial penalties, should Tesla lose the lawsuit, could be substantial, impacting both the company's finances and the value of shareholders' investments.

Tesla's Defense Strategy in the Shareholder Litigation

Tesla's legal team is vigorously defending against these lawsuits, employing a multifaceted strategy to have the "Tesla Shareholder Litigation" dismissed. Their arguments center on the following points:

-

Justification of Musk's Compensation: Tesla argues that Musk's compensation is justified by his extraordinary contributions to the company's success, claiming that his leadership and vision are directly responsible for Tesla's market-leading position. They assert that the market overwhelmingly values his contribution.

-

Compliance with Legal Requirements: Tesla contends that the compensation plan was structured and approved in accordance with all applicable laws and regulations. They are likely to present evidence supporting this claim.

-

Strong Legal Precedents: Tesla's defense strategy likely involves citing legal precedents supporting the validity of performance-based compensation plans, even those with substantial potential payouts. This involves referencing past cases where similar compensation structures were upheld in court.

-

Key arguments presented by Tesla's legal team: The core argument will focus on proving the direct correlation between Musk's performance and Tesla's success, demonstrating that his compensation is proportionate to his contributions.

-

Evidence used to support their defense: Tesla will likely present financial performance data, market analysis showing the impact of Musk's leadership, and legal documentation supporting the legality of the compensation plan.

-

Potential outcomes of the legal battle: Potential outcomes range from a complete dismissal of the lawsuits to a negotiated settlement involving some adjustments to the compensation structure, or even significant financial penalties for Tesla.

The Impact of the Tesla Shareholder Litigation on the Company

The "Tesla Shareholder Litigation" carries significant short-term and long-term implications for Tesla:

-

Stock Price Volatility: The ongoing legal battle has already caused fluctuations in Tesla's stock price, reflecting investor uncertainty about the potential financial impact of the lawsuit.

-

Reputational Damage: Negative publicity surrounding the lawsuit could damage Tesla's brand image and potentially impact its ability to attract and retain customers and talent.

-

Future Compensation Decisions: The outcome of the litigation will likely influence how Tesla structures future executive compensation, potentially leading to greater scrutiny and more conservative approaches.

-

Potential financial penalties if Tesla loses the lawsuit: Significant financial penalties could negatively impact Tesla's profitability and financial stability.

-

Impact on future executive compensation decisions: The outcome will likely push Tesla towards more conservative compensation structures, incorporating more shareholder oversight and potentially reducing the potential for large payouts.

-

Effect on Tesla's ability to attract investors: Negative publicity and uncertainty surrounding the litigation could affect investor confidence, potentially making it harder for Tesla to raise capital.

Expert Opinions and Market Reactions to the Tesla Musk Pay Dispute

Financial analysts and legal experts offer diverse opinions on the likely outcome of the "Tesla Musk Pay Dispute," with some predicting a dismissal of the lawsuits while others foresee a significant settlement. Market reactions have been volatile, with Tesla's stock price exhibiting sensitivity to news and developments related to the litigation.

- Quotes from relevant experts: Analysts' opinions will vary widely, with some defending Tesla's strategy and others criticizing the compensation package as excessive.

- Stock price charts illustrating market reaction: Charts depicting stock price fluctuations in response to news related to the lawsuit will help visualize market sensitivity to the litigation.

- Discussion of the implications for other companies: The outcome will likely set a precedent for other companies regarding executive compensation and corporate governance, influencing how they structure executive pay packages and engage with shareholders.

Conclusion: The Future of Tesla and the Shareholder Litigation

The "Tesla Shareholder Litigation" presents a complex legal and financial challenge for Tesla. The arguments presented by both sides highlight fundamental disagreements regarding executive compensation and corporate governance. The outcome will have significant implications for Tesla's financial health, reputation, and future strategy. The ongoing nature of the legal battle underscores the need for continuous monitoring and analysis. Stay updated on the latest in Tesla shareholder litigation and follow the developments in this crucial Tesla Musk pay dispute by following reputable financial news sources.

Featured Posts

-

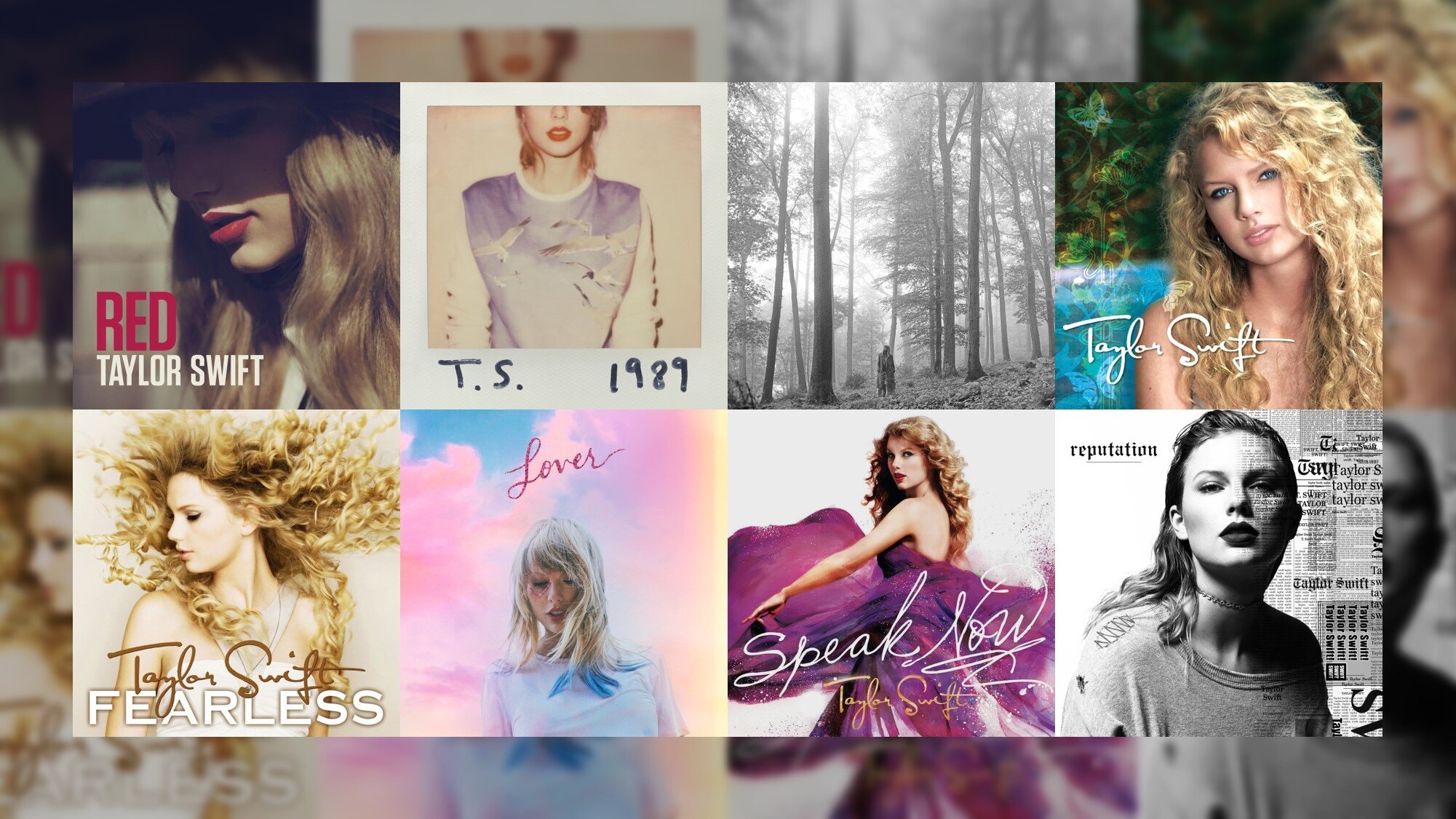

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025

Ranking Taylor Swifts Albums A Critical Analysis Of Her Discography

May 18, 2025 -

Fortnite On I Phone Explaining The Current Situation And Future Prospects

May 18, 2025

Fortnite On I Phone Explaining The Current Situation And Future Prospects

May 18, 2025 -

Metas Monopoly Defense Begins After Ftc Concludes Case

May 18, 2025

Metas Monopoly Defense Begins After Ftc Concludes Case

May 18, 2025 -

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025 -

Angels Flamethrower Ben Joyce Improves Pitching With Kenley Jansens Guidance

May 18, 2025

Angels Flamethrower Ben Joyce Improves Pitching With Kenley Jansens Guidance

May 18, 2025

Latest Posts

-

Amanda Bynes Only Fans Debut Photos Show Her Out With A Friend

May 18, 2025

Amanda Bynes Only Fans Debut Photos Show Her Out With A Friend

May 18, 2025 -

The Rise Of Celebrity Only Fans Amanda Bynes Role

May 18, 2025

The Rise Of Celebrity Only Fans Amanda Bynes Role

May 18, 2025 -

Only Fans Amanda Bynes Account And Content Guidelines

May 18, 2025

Only Fans Amanda Bynes Account And Content Guidelines

May 18, 2025 -

Only Fans Celebrity Influx Amanda Bynes Impact

May 18, 2025

Only Fans Celebrity Influx Amanda Bynes Impact

May 18, 2025 -

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025

Amanda Bynes Only Fans Strict Disclaimer And Content Details

May 18, 2025