Tesla Stock And Elon Musk's Recent Outbursts

Table of Contents

The Impact of Elon Musk's Twitter Activity on Tesla Stock

Elon Musk's prolific use of Twitter, often marked by controversial statements and unpredictable pronouncements, has undeniably influenced Tesla's stock price. His social media activity presents a significant risk factor for Tesla investors. The direct correlation between his tweets and market reactions is a key concern.

-

Controversial Tweets and Market Reactions: Musk's tweets have triggered dramatic swings in Tesla's stock price. For instance, announcements regarding potential private takeovers, comments on cryptocurrency investments, and even seemingly innocuous remarks have caused immediate and substantial market fluctuations. A simple tweet can send ripples through the market, impacting investor sentiment and trading decisions.

-

Mechanism of Social Media Influence: Musk's massive Twitter following amplifies his influence. His pronouncements are instantly disseminated, shaping public perception of Tesla and impacting investor confidence. This rapid spread of information, often before official company statements, creates a volatile trading environment.

-

Data and Charts: Numerous studies and analyses have demonstrated a statistically significant correlation between Musk's tweets and Tesla stock price movements. Charts illustrating these correlations would clearly demonstrate the immediate and sometimes prolonged impact of his social media activity. (Note: Charts would be included here in an actual published article.)

-

Regulatory Implications: The Securities and Exchange Commission (SEC) has already taken action against Musk regarding his tweets, highlighting the regulatory risks associated with his social media use. His tweets can be interpreted as market manipulation, leading to potential legal and financial repercussions for both Musk and Tesla.

Analyzing the Underlying Factors Contributing to Tesla Stock Volatility

While Elon Musk's actions are a significant factor, Tesla stock volatility stems from a combination of factors beyond his tweets. Understanding these broader market forces is crucial for a comprehensive analysis.

-

Market Factors Beyond Musk: Broad market trends, economic indicators, and general investor sentiment play a role in Tesla's stock price fluctuations. Recessions, inflation, and changes in interest rates all impact investor behavior and affect the price of Tesla stock, independent of Musk's pronouncements.

-

Competition in the EV Market: The electric vehicle (EV) market is increasingly competitive. The emergence of new players, technological advancements from established automakers, and shifts in consumer preferences all contribute to Tesla's stock price volatility.

-

Macroeconomic Factors: Global macroeconomic conditions, such as interest rate hikes and inflation, significantly influence investor decisions regarding growth stocks like Tesla. Higher interest rates, for example, can decrease the appeal of growth-oriented investments.

-

Supply Chain Issues: Disruptions to Tesla's supply chain, resulting from factors like global pandemics or geopolitical instability, impact production and sales, directly affecting the company's financial performance and stock price.

-

Long-Term Growth Potential: Despite the volatility, the long-term growth potential of the EV market remains substantial. Tesla's position as a market leader in this sector offers a counterbalance to the risks associated with Musk's behavior. The future of the EV market and Tesla’s ability to maintain its dominance is a critical aspect of evaluating the stock.

Assessing the Risks and Rewards of Investing in Tesla Stock

Investing in Tesla stock presents a unique blend of risks and rewards. The high potential for returns is counterbalanced by considerable volatility stemming from several factors, particularly Musk's public actions.

-

Risks Associated with CEO Influence: The heavy reliance on Elon Musk's leadership and public image presents a significant risk. His unpredictable behavior can negatively affect investor confidence and trigger substantial stock price drops.

-

Potential for High Returns: Tesla's innovative technology, market leadership in the EV sector, and expansion into related industries offer the potential for significant long-term capital appreciation.

-

Investment Strategies for Mitigation: Investors can employ diversification strategies, focusing on a broader portfolio to reduce risk. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, can help mitigate the impact of short-term price fluctuations.

-

Diversification and Risk Management: Diversification across different asset classes is vital to reduce the overall risk associated with Tesla stock investment. Risk tolerance assessment should be a critical part of any investment strategy involving TSLA.

-

Expert Opinions and Forecasts: While forecasting future stock performance is inherently uncertain, analyzing expert opinions and market analyses can provide valuable insights for informed investment decisions.

Conclusion

Elon Musk's recent actions and public statements have demonstrably impacted Tesla stock, highlighting the significant risks associated with investing in companies heavily reliant on a single individual's influence. While Tesla’s innovative technology and potential for long-term growth remain attractive, investors must carefully weigh these factors against the considerable volatility introduced by Musk’s public behavior. The interplay between Tesla stock price and Elon Musk’s actions requires careful consideration.

Call to Action: Understanding the complex interplay between Tesla stock and Elon Musk’s public image is crucial for informed investment decisions. Continue your research on Tesla stock and stay informed about the latest news and developments to make sound investment choices. Learn more about mitigating the risks associated with Tesla stock volatility and building a diversified investment portfolio.

Featured Posts

-

Klopi Se Oikia Xalkidikis Anazitisi Ton Draston

May 27, 2025

Klopi Se Oikia Xalkidikis Anazitisi Ton Draston

May 27, 2025 -

Dali Kje Se Odrzhi Nov Razgovor Me U Putin I Tramp

May 27, 2025

Dali Kje Se Odrzhi Nov Razgovor Me U Putin I Tramp

May 27, 2025 -

Gwen Stefanis Admission A Third Partys Role In Her Marriage To Blake Shelton

May 27, 2025

Gwen Stefanis Admission A Third Partys Role In Her Marriage To Blake Shelton

May 27, 2025 -

Watch 1923 Season 2 Episode 7 Finale Streaming Guide And Details

May 27, 2025

Watch 1923 Season 2 Episode 7 Finale Streaming Guide And Details

May 27, 2025 -

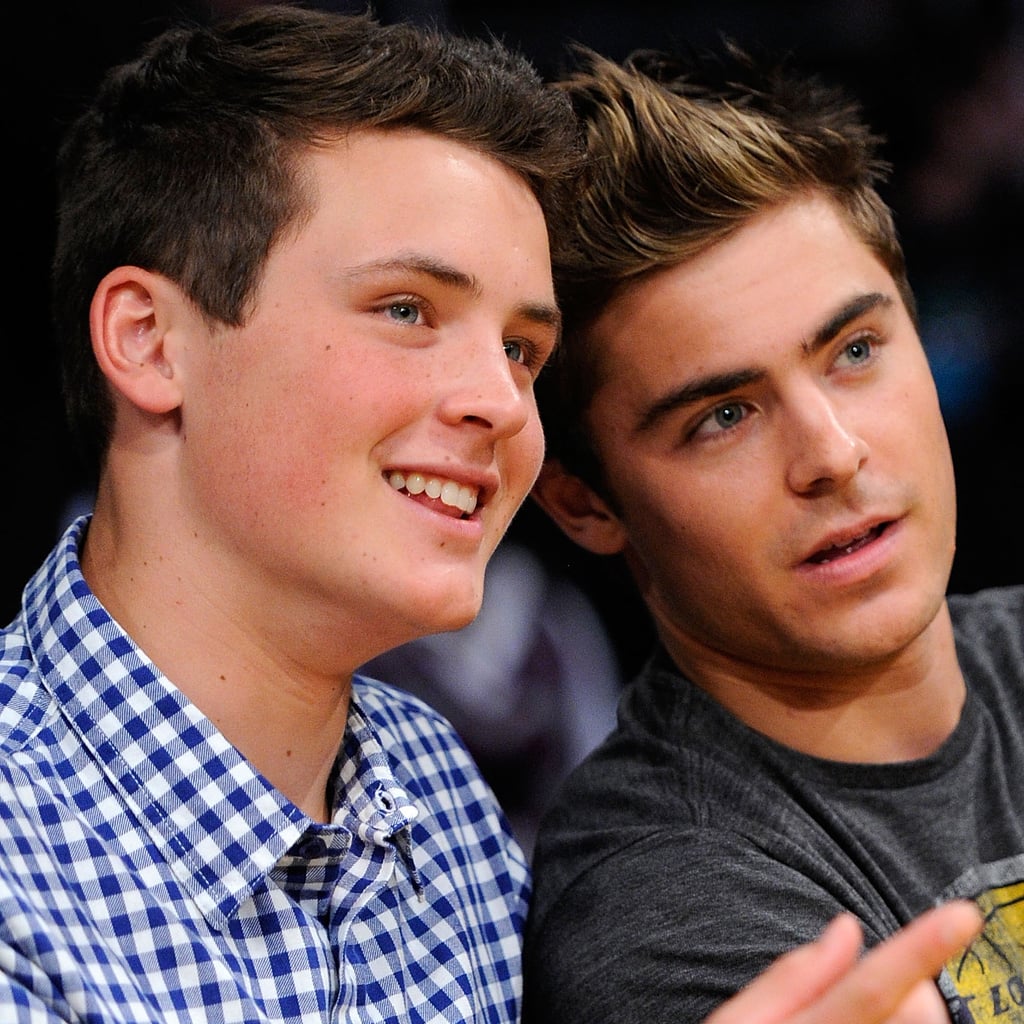

Zac Efrons Brother Dylan Steals The Show Fans Favor Him After The Traitors

May 27, 2025

Zac Efrons Brother Dylan Steals The Show Fans Favor Him After The Traitors

May 27, 2025

Latest Posts

-

Danske Chefer Under Kritik Stjerne Beskylder For Mangel Pa Respekt

May 30, 2025

Danske Chefer Under Kritik Stjerne Beskylder For Mangel Pa Respekt

May 30, 2025 -

Kasper Dolberg Faktorer Bag Den Store Interesse

May 30, 2025

Kasper Dolberg Faktorer Bag Den Store Interesse

May 30, 2025 -

Risiko Og Belonning Anderlechts Beslutning Om Et Godt Tilbud

May 30, 2025

Risiko Og Belonning Anderlechts Beslutning Om Et Godt Tilbud

May 30, 2025 -

Stjernes Vrede Kritik Af Dansk Leder Manglende Respekt

May 30, 2025

Stjernes Vrede Kritik Af Dansk Leder Manglende Respekt

May 30, 2025 -

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025

Chokskifte Eller Realisme Dolbergs 25 Malssaeson

May 30, 2025