Tesla's Strength Fuels Tech-Driven US Stock Market Gains

Table of Contents

Tesla's Exceptional Financial Performance and its Ripple Effect

Tesla's recent quarterly earnings have been nothing short of spectacular, sending shockwaves through the financial world. Strong revenue growth, record production figures, and increasing profit margins have solidified Tesla's position as a market leader and significantly boosted investor confidence. This positive sentiment isn't confined to Tesla itself; it's spreading a ripple effect across the EV and renewable energy sectors.

- Specific financial data: Tesla's recent quarter showcased a X% increase in revenue, exceeding analyst expectations and demonstrating robust growth. Profit margins also saw a significant improvement, indicating increasing efficiency and profitability.

- Significant product launches: The successful launch of new models and the expansion of its charging infrastructure have further bolstered investor confidence.

- Analyst upgrades: Numerous analysts have upgraded their price targets for Tesla stock, reflecting a positive outlook on the company's future prospects and fueling further investment.

This exceptional performance isn't just a testament to Tesla's innovative technology and strong leadership; it serves as a powerful signal to investors, indicating the immense growth potential within the EV and clean energy sectors.

The Broader Tech Sector's Correlation with Tesla's Success

Tesla's success is not an isolated phenomenon; it's deeply intertwined with the fortunes of other tech companies. The company's leadership in electric vehicles, autonomous driving technology, and artificial intelligence (AI) sets a positive tone for the entire sector. This concept of "sector leadership" is crucial; Tesla's performance acts as a benchmark, influencing investor perception of other players in these emerging tech fields.

- Positively affected companies: Companies like [Ticker Symbol 1], [Ticker Symbol 2], and [Ticker Symbol 3], all involved in related technologies such as battery production, autonomous driving software, or charging infrastructure, have experienced positive market reactions correlated with Tesla's strong performance.

- Investor optimism: Investor optimism in Tesla often spills over into investments in related tech companies, creating a synergistic effect that boosts the entire sector.

- Reasons for correlation: This correlation stems from shared technological advancements, investor sentiment, and the perception that success in one area of the EV and clean energy ecosystem translates to broader success across the board.

Investor Sentiment and Market Volatility Driven by Tesla

Tesla's stock price movements have a demonstrably significant impact on overall market volatility. Its strong performance can boost investor confidence, injecting optimism into the broader market. Conversely, negative news or significant stock price drops can trigger broader market sell-offs, showcasing the substantial influence Tesla holds.

- Recent instances: [Mention specific examples of Tesla's stock movements influencing broader market trends]. For instance, a significant positive movement in Tesla's stock price often correlates with increased investment in other tech and EV stocks.

- Psychological aspects: The "Tesla effect" on market sentiment is partly driven by psychological factors. Tesla's perceived innovation and disruptive potential attract a highly engaged investor base, making its stock price highly sensitive to news and market sentiment.

- Role of social media: Social media plays a crucial role in amplifying Tesla's impact. Positive or negative news about the company spreads rapidly, influencing investor decisions and driving market reactions.

Long-Term Implications of Tesla's Influence on the US Stock Market

Tesla's continued success holds significant long-term implications for the US stock market and the broader economy. The growth of the EV and renewable energy sectors, largely driven by Tesla's pioneering efforts, is expected to continue, creating numerous opportunities.

- Job creation and economic growth: Tesla's expansion and the growth of related industries promise substantial job creation and significant economic growth.

- Impact on traditional automakers: Traditional automakers are facing increasing pressure to adapt their strategies in response to Tesla's success, leading to further innovation and investment within the automotive sector.

- Government policies: Government policies and regulations related to electric vehicles and renewable energy will also play a significant role in shaping Tesla's future influence on the market.

Understanding Tesla's Impact on US Stock Market Gains

Tesla's performance has a demonstrably significant impact on the US tech sector and the broader stock market. Tesla's strength fuels tech-driven US stock market gains, acting as a powerful indicator of the health and future direction of the EV and renewable energy industries. The company's influence extends beyond its own stock price, shaping investor sentiment, driving market volatility, and promising substantial long-term economic benefits.

Stay tuned for further analysis of Tesla's continuing influence on the market and its implications for future tech-driven stock market gains. Subscribe to our newsletter to stay updated!

Featured Posts

-

Red Sox Vs Blue Jays Starting Lineups Buehlers Debut And Key Player Update

Apr 28, 2025

Red Sox Vs Blue Jays Starting Lineups Buehlers Debut And Key Player Update

Apr 28, 2025 -

Mets Pitcher Earns High Praise For Strong Performance

Apr 28, 2025

Mets Pitcher Earns High Praise For Strong Performance

Apr 28, 2025 -

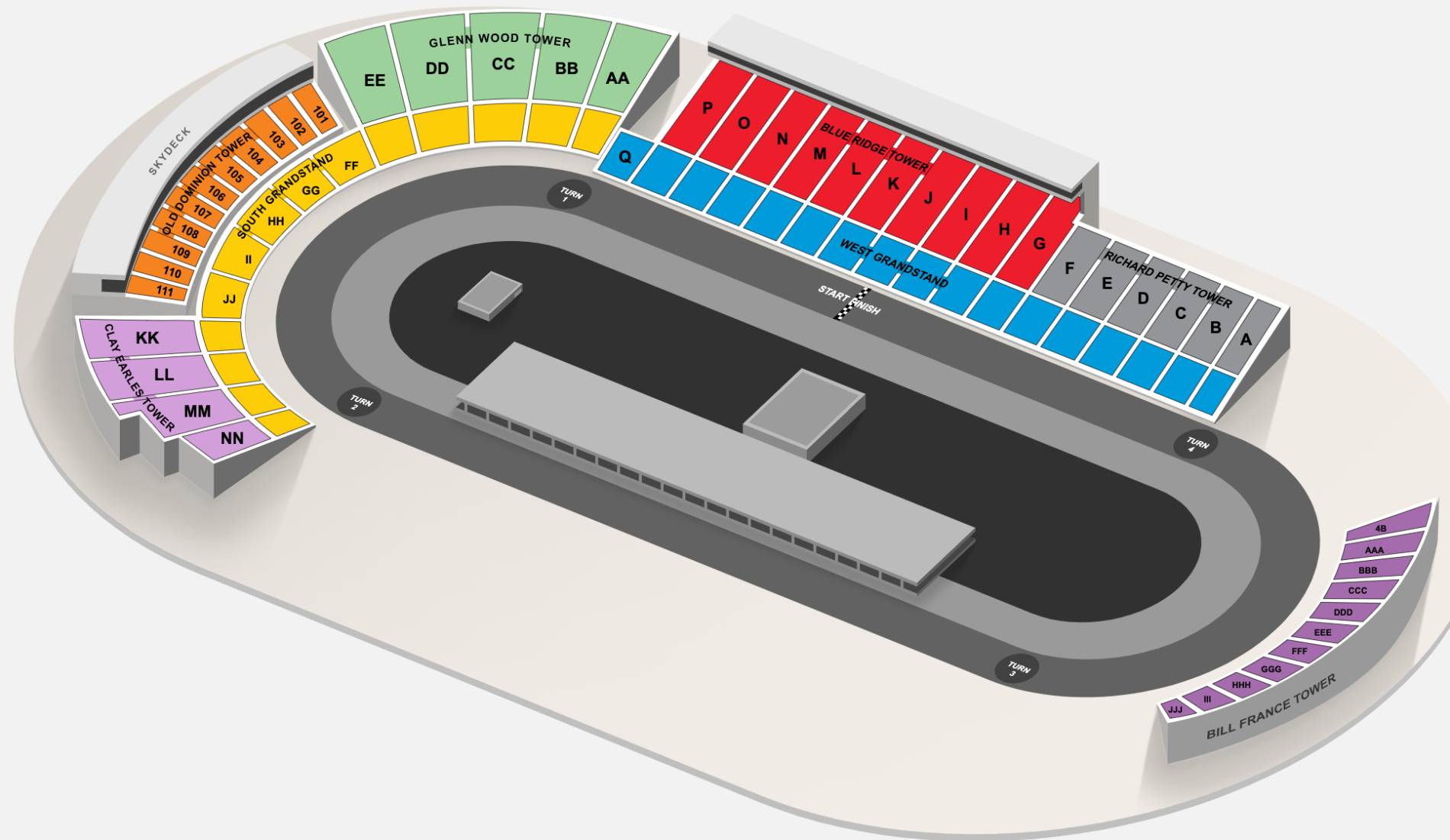

Martinsville Speedway Hamlins Long Awaited Victory

Apr 28, 2025

Martinsville Speedway Hamlins Long Awaited Victory

Apr 28, 2025 -

Us Iran Nuclear Talks A Summary Of The Recent Discussions

Apr 28, 2025

Us Iran Nuclear Talks A Summary Of The Recent Discussions

Apr 28, 2025 -

The Recent Market Dip Professional Selling And Increased Retail Participation

Apr 28, 2025

The Recent Market Dip Professional Selling And Increased Retail Participation

Apr 28, 2025