Thailand's Central Bank Governor Search: Economic Uncertainty And Tariffs

Table of Contents

The Economic Challenges Facing the Next Governor

The incoming governor of the Bank of Thailand will inherit a complex economic landscape demanding astute leadership and a nuanced understanding of both domestic and global economic forces.

Global Trade Wars and their Impact on Thailand

The ongoing impact of global trade wars, particularly the US-China trade conflict, presents a significant challenge. Thailand, heavily reliant on exports, is vulnerable to disruptions in global supply chains and retaliatory tariffs.

- Impact of US-China trade war on Thai exports: Sectors like electronics, automotive parts, and agricultural products have felt the pinch, leading to decreased export volumes and revenue.

- Reliance on specific export markets: Over-dependence on a few key markets increases vulnerability to shifts in global trade dynamics.

- Vulnerability to tariff increases: Increased tariffs can significantly impact Thai export competitiveness and profitability.

- Diversification strategies: The need for the BOT governor to promote diversification of export markets and enhance resilience to future trade disruptions is crucial.

The Thai government has implemented several initiatives to mitigate these risks, including promoting investment in new technologies and exploring new export markets. However, the next governor will need to actively support these efforts and develop new strategies to ensure the long-term health of the Thai export sector.

Commodity Price Volatility and its Effects

Thailand's economy is significantly reliant on agricultural exports, making it highly susceptible to commodity price fluctuations. This volatility directly impacts farmer income, inflation rates, and overall economic stability.

- Thailand's reliance on agricultural exports: Rice, rubber, and other agricultural products are major contributors to Thailand's GDP and export earnings.

- Price fluctuations of key commodities (e.g., rice): Global demand and supply dynamics, as well as weather patterns, heavily influence commodity prices, creating significant uncertainty.

- Impact on inflation and farmer income: Price spikes can lead to increased inflation, hurting consumers, while price drops reduce farmers' income, impacting rural livelihoods.

- Strategies to manage price risks: The BOT governor will need to implement effective monetary policies to mitigate the impact of commodity price volatility on inflation and support the agricultural sector. This could involve exploring hedging mechanisms and other risk management tools.

The ability to forecast and manage the impact of these fluctuations will be critical for maintaining price stability and ensuring fair returns for farmers.

Post-Pandemic Economic Recovery

Thailand's post-pandemic recovery, while showing positive signs, remains uneven. The tourism sector, a significant contributor to the economy, is still recovering, and stimulating domestic demand requires careful management.

- Tourism sector recovery: While tourism is rebounding, it is not yet at pre-pandemic levels, and the recovery is uneven across regions.

- Challenges in stimulating domestic demand: Weak consumer confidence and lingering economic uncertainty hinder domestic spending.

- Unemployment rates: While declining, unemployment rates remain a concern, particularly amongst younger workers.

- Government spending plans: Government investment in infrastructure and social programs is crucial in supporting the recovery.

- Monetary policy tools to support recovery: The BOT governor will need to use monetary policy tools effectively to support economic growth while managing inflation risks.

The next governor will play a pivotal role in navigating the remaining challenges and ensuring a sustainable and inclusive recovery.

The Qualities and Expertise Needed in the New Governor

The next Thailand Central Bank Governor requires a unique blend of expertise and leadership skills to tackle these intricate economic challenges.

Monetary Policy Expertise

A deep understanding of monetary policy is fundamental. The governor must possess the expertise to:

- Manage inflation: Effectively control inflation while supporting economic growth.

- Set interest rates: Make informed decisions on interest rate adjustments to influence economic activity.

- Foreign exchange market intervention: Manage exchange rate fluctuations to maintain stability.

- Understanding of monetary policy tools: Employ a range of monetary policy instruments to achieve macroeconomic objectives.

The ability to fine-tune monetary policy in response to shifting economic conditions will be crucial for maintaining stability.

International Relations and Economic Diplomacy

Given Thailand's integrated role in the global economy, strong international relations skills are vital:

- Understanding of global financial markets: Navigating complex global financial markets and anticipating potential risks.

- Ability to negotiate with international organizations (IMF, World Bank): Securing beneficial agreements and accessing international financial support when needed.

- Experience in fostering international economic cooperation: Building strong relationships with other central banks and international organizations.

Effective engagement with international institutions will be crucial for attracting foreign investment and securing Thailand's economic interests in a globalized world.

Financial Market Stability and Regulation

Maintaining the stability of Thailand's financial system is paramount:

- Experience in banking regulation: Overseeing and strengthening the regulatory framework for banks and financial institutions.

- Risk management: Identifying and mitigating potential risks within the financial system.

- Financial stability oversight: Monitoring financial markets for systemic risks and taking preemptive action.

- Crisis management: Developing and implementing effective strategies to respond to financial crises.

A robust and well-regulated financial sector is essential for fostering economic growth and investor confidence.

Potential Candidates and Their Approaches (If known, otherwise remove this section)

(This section would include profiles of potential candidates, their economic viewpoints, and relevant experience. This information needs to be sourced from credible news outlets and official statements, avoiding speculation.)

Conclusion

The selection of Thailand's next Central Bank Governor is a critical decision impacting the nation's economic trajectory. The successful candidate will need to possess a comprehensive understanding of monetary policy, international economics, and financial regulation. Furthermore, the ability to navigate the complex interplay of global trade, volatile commodity prices, and post-pandemic recovery will be paramount. The choice will significantly affect the effectiveness of monetary policy in controlling inflation, driving sustainable growth, and ensuring the stability of the Thai Baht. Stay informed on the developments in the Thailand Central Bank Governor search to understand how this appointment will shape Thailand's economic future. Understanding the complexities surrounding the Thailand Central Bank Governor selection process is crucial for anyone interested in the future of the Thai economy.

Featured Posts

-

How Donald Trumps First 100 Days Impacted Elon Musks Net Worth

May 10, 2025

How Donald Trumps First 100 Days Impacted Elon Musks Net Worth

May 10, 2025 -

Greenlands Future Navigating A Changing Geopolitical Landscape Under Danish Influence

May 10, 2025

Greenlands Future Navigating A Changing Geopolitical Landscape Under Danish Influence

May 10, 2025 -

Adae Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 10, 2025

Adae Fyraty Me Alerby Thlyl Bed Antqalh Mn Alahly

May 10, 2025 -

Top College Towns In Michigan Why City Name Stands Out

May 10, 2025

Top College Towns In Michigan Why City Name Stands Out

May 10, 2025 -

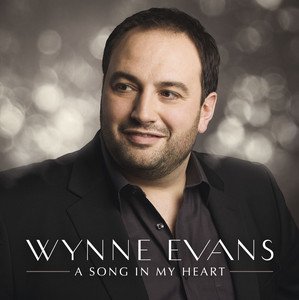

Singer Wynne Evans Reveals Health Struggle Hints At Return To Showbiz

May 10, 2025

Singer Wynne Evans Reveals Health Struggle Hints At Return To Showbiz

May 10, 2025