Thailand's Negative Inflation: Analyzing The Impact On The Economy And Monetary Policy

Table of Contents

Thailand has recently experienced a period of negative inflation, a phenomenon where the general price level decreases. This unusual economic situation, often referred to as deflation, presents both opportunities and challenges for the Thai economy and necessitates a careful analysis of its impact on various sectors and the subsequent adjustments in monetary policy. This article delves into the causes, consequences, and potential responses to Thailand's negative inflation, offering insights for businesses, investors, and policymakers alike.

Causes of Negative Inflation in Thailand

Several interconnected factors have contributed to Thailand's negative inflation. Understanding these root causes is crucial for developing effective countermeasures.

Decreased Demand

Reduced consumer spending and investment have played a significant role in driving down prices. This decreased demand is a result of several factors:

- Weakening global demand: The slowdown in global economic growth, particularly in key trading partners, has negatively impacted Thai exports, reducing overall demand for Thai goods and services.

- Impact of the COVID-19 pandemic: The pandemic severely hampered tourism, a major contributor to the Thai economy, leading to widespread job losses and reduced consumer confidence. Data from the Tourism Authority of Thailand shows a dramatic decline in tourist arrivals during this period. [Insert relevant data/citation here]

- Reduced tourism: The tourism sector, a significant driver of Thailand's economy, experienced a sharp downturn due to travel restrictions and global health concerns. This resulted in a considerable reduction in spending by tourists.

- Lower export volumes: Decreased global demand for Thai goods, particularly in sectors like electronics and automobiles, led to lower export volumes and reduced production.

Increased Supply

Simultaneously, an increase in the supply of goods and services has also contributed to deflationary pressures.

- Improved agricultural yields: Favorable weather conditions and advancements in agricultural technology led to increased production of several agricultural commodities, resulting in lower prices.

- Increased manufacturing output: Despite lower demand, some sectors experienced increased manufacturing output, leading to an oversupply in certain markets.

- Global commodity price deflation: The decline in global commodity prices, including oil and other raw materials, has lowered production costs, contributing to lower prices for finished goods.

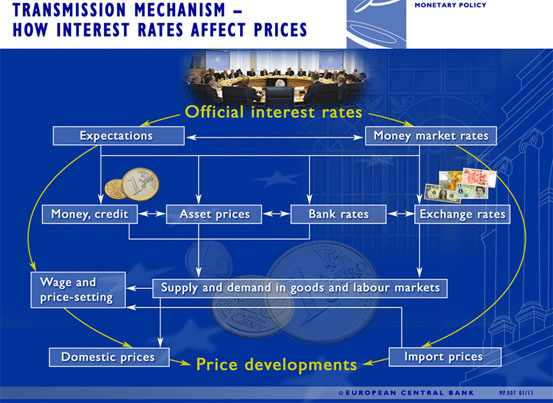

Monetary Policy

The Bank of Thailand's monetary policies have also played a role, albeit indirectly, in influencing inflation.

- Interest rate cuts: The Bank of Thailand implemented several interest rate cuts to stimulate economic activity and counteract the effects of the pandemic. However, these cuts also contributed to lower borrowing costs, potentially exacerbating deflationary pressures.

- Quantitative easing measures: While not as extensively used as in other countries, the Bank of Thailand employed some quantitative easing measures to increase liquidity in the financial system. [Insert details about specific measures and their impact].

- Unintended consequences: While intended to stimulate the economy, these policies may have unintentionally contributed to deflationary pressures by reducing the cost of borrowing and encouraging saving rather than spending.

Economic Impacts of Negative Inflation in Thailand

Thailand's negative inflation has far-reaching consequences for various sectors of the economy.

Impact on Consumers

Falling prices generally benefit consumers, but negative inflation can create a paradox.

- Delayed purchases: Consumers may postpone purchases anticipating further price drops, leading to a decline in overall consumer spending.

- Reduced consumer confidence: Deflation can erode consumer confidence, leading to further reductions in spending and investment.

- Potential deflationary spiral: A persistent decline in prices can trigger a deflationary spiral, where falling prices lead to lower consumer spending, reduced production, and further price declines. This creates a vicious cycle that's difficult to break.

- Increased savings: While lower prices benefit consumers in the short-term, deflation can encourage increased savings as consumers wait for further price drops, leading to less spending and thus lower demand.

Impact on Businesses

Businesses face considerable challenges in a deflationary environment.

- Falling revenues: Decreased consumer demand leads to falling revenues, even if sales volume remains the same.

- Reduced profit margins: Businesses struggle to maintain profit margins as they are forced to lower prices to remain competitive.

- Difficulties in pricing strategies: Companies face difficulty implementing effective pricing strategies in a deflationary environment, as price cuts can lead to a price war, further eroding profit margins.

- Potential bankruptcies: Businesses with high debt levels may face financial distress and potential bankruptcy due to falling revenues and reduced profit margins.

Impact on Debt

Negative inflation significantly impacts the real value of debt.

- Increased debt burden: The real value of debt increases during deflation, making it harder for borrowers to repay loans.

- Potential for increased defaults: Higher debt burdens can lead to an increase in loan defaults, potentially destabilizing the financial system.

- Impact on financial stability: A rise in loan defaults can negatively impact the stability of the financial system, leading to further economic contraction.

Monetary Policy Responses to Negative Inflation in Thailand

Addressing Thailand's negative inflation requires a multifaceted approach involving both monetary and fiscal policies.

The Role of the Bank of Thailand

The Bank of Thailand has employed several measures to counteract deflationary pressures.

- Interest rate adjustments: The central bank may further adjust interest rates, though care must be taken to avoid unintended consequences.

- Quantitative easing programs: Expansion of quantitative easing may be considered to increase money supply and stimulate lending.

- Interventions in the foreign exchange market: Managing the exchange rate can influence the prices of imported goods. [Further details on interventions are needed]

Fiscal Policy Coordination

Effective management of Thailand’s negative inflation necessitates close coordination between monetary and fiscal policies.

- Government spending programs: Increased government spending on infrastructure projects and social programs can boost aggregate demand.

- Tax cuts: Tax cuts for businesses and consumers can stimulate spending and investment.

- Infrastructure investments: Investing in infrastructure development creates jobs and stimulates economic activity.

- Challenges of coordination: Coordination between monetary and fiscal authorities can be challenging due to differing policy objectives and priorities.

Future Outlook

The future outlook for Thailand's economy hinges on the effectiveness of policy responses and global economic conditions.

- Potential for recovery: A strong global recovery and effective policy responses could lead to a turnaround in inflation.

- Risk of prolonged deflation: Failure to address the underlying causes of deflation could result in a prolonged period of negative inflation.

- Need for structural reforms: Structural reforms aimed at improving productivity, enhancing competitiveness, and diversifying the economy are crucial for long-term stability.

Conclusion:

Thailand's negative inflation is a complex issue with multifaceted causes and consequences. This analysis highlighted the impact on consumers, businesses, and the overall economy. The Bank of Thailand's response, along with the need for coordinated fiscal policy, are crucial in navigating this challenging economic climate. Understanding the dynamics of Thailand's negative inflation is critical for businesses and policymakers alike. Continued monitoring and analysis of Thailand's negative inflation are essential for effective policymaking and economic stability. Further research into the long-term implications and potential mitigation strategies is strongly encouraged. Addressing Thailand's negative inflation requires a comprehensive strategy combining appropriate monetary policy adjustments, coordinated fiscal stimulus, and targeted structural reforms to ensure sustained economic growth and stability.

Featured Posts

-

Interest Rate Cuts Powells Justification For Delay Amidst Trumps Criticism

May 07, 2025

Interest Rate Cuts Powells Justification For Delay Amidst Trumps Criticism

May 07, 2025 -

Knicks Vs Cavaliers Prediction Can The Knicks Secure A Victory At Home

May 07, 2025

Knicks Vs Cavaliers Prediction Can The Knicks Secure A Victory At Home

May 07, 2025 -

Ayesha Currys Comments On Marriage Before Kids Spark Debate

May 07, 2025

Ayesha Currys Comments On Marriage Before Kids Spark Debate

May 07, 2025 -

Lewis Capaldis Music Comeback New Studio Plans Confirm Return

May 07, 2025

Lewis Capaldis Music Comeback New Studio Plans Confirm Return

May 07, 2025 -

Lewis Capaldi Reaparece En Wwe Smack Down Despues De Sus Problemas De Salud

May 07, 2025

Lewis Capaldi Reaparece En Wwe Smack Down Despues De Sus Problemas De Salud

May 07, 2025

Latest Posts

-

Finding The Voice Actor Behind Kenny The White Lotus Season 3 Mystery

May 07, 2025

Finding The Voice Actor Behind Kenny The White Lotus Season 3 Mystery

May 07, 2025 -

The White Lotus Season 3 Identifying The Voice Actor For Kenny Tims Colleague

May 07, 2025

The White Lotus Season 3 Identifying The Voice Actor For Kenny Tims Colleague

May 07, 2025 -

Who Voices Kenny In The White Lotus Season 3 Revealing Tims Coworker

May 07, 2025

Who Voices Kenny In The White Lotus Season 3 Revealing Tims Coworker

May 07, 2025 -

Olympic Cyclist Laura Kenny Gives Birth After Fertility Struggles

May 07, 2025

Olympic Cyclist Laura Kenny Gives Birth After Fertility Struggles

May 07, 2025 -

Unbelievable Contestant Uses All Three Lifelines On Easy Who Wants To Be A Millionaire Question

May 07, 2025

Unbelievable Contestant Uses All Three Lifelines On Easy Who Wants To Be A Millionaire Question

May 07, 2025