The Angry Elon Musk Effect: A Tesla Stock Analysis

Table of Contents

The Correlation Between Musk's Tweets and Tesla Stock Volatility

The relationship between Elon Musk's tweets and Tesla stock volatility (TSLA price fluctuations) is undeniable. His social media activity often triggers significant and rapid price swings. Understanding this correlation is crucial for anyone invested in or considering investing in Tesla stock.

-

Examples of Musk's Tweets Causing Significant Stock Price Swings: Numerous instances demonstrate the power of Musk's words. For example, his tweets announcing production milestones or new product reveals often lead to immediate price increases. Conversely, controversial statements or unexpected announcements can result in sharp declines. Analyzing these events reveals a direct impact on Tesla stock.

-

Speed and Magnitude of Reactions: The market's response to Musk's tweets is remarkably swift and substantial. Price changes can occur within minutes of a tweet, indicating the immediate and powerful influence he wields over investor sentiment regarding Tesla stock. The magnitude of these swings can be significant, sometimes exceeding several percentage points in a single trading session.

-

Psychological Impact on Investor Sentiment: Musk's tweets directly influence investor psychology. Positive announcements create excitement and optimism, driving up demand and consequently, the Tesla stock price. Conversely, negative or uncertain tweets generate anxiety and fear, leading to sell-offs and a decrease in the TSLA stock price. This psychological impact is a core component of the "Angry Elon Musk effect."

-

Charts Illustrating Correlation: [Here, you would insert charts illustrating the correlation between specific tweets and subsequent stock price movements. Data visualization is crucial for reinforcing the analysis.] These charts would visually demonstrate the immediate and dramatic impact of Musk's communications on Tesla stock.

Analyzing the Sentiment Behind Musk's Communication

Understanding the sentiment behind Elon Musk's communication is key to predicting its impact on Tesla stock. His communication style, characterized by a mix of aggressive pronouncements, sarcastic remarks, and optimistic predictions, significantly influences investor perception.

-

Tone and Content of Musk's Tweets: Analyzing the tone—aggressive, sarcastic, positive, or even seemingly random—helps gauge the likely market reaction. A bullish tweet, for example, is far more likely to result in a positive price movement than a tweet expressing frustration or uncertainty.

-

Impact of Communication Style on Investor Perception: Musk's unconventional communication style creates both excitement and uncertainty. While some investors appreciate his transparency (or at least the perceived transparency), others are concerned about the lack of predictability and the potential for impulsive decisions that could negatively impact the Tesla stock.

-

Impact on Tesla Brand Image and Reputation: Musk's public persona is inextricably linked to Tesla's brand. His actions and words directly influence public perception of the company. Negative publicity stemming from his tweets can impact the company's reputation and potentially affect sales and investor confidence in Tesla stock.

The Regulatory and Legal Implications of Musk's Public Statements

Elon Musk's public statements have faced significant regulatory scrutiny, primarily from the Securities and Exchange Commission (SEC). Understanding these legal implications is crucial for assessing the risks associated with Tesla stock.

-

Previous SEC Investigations and Sanctions: Musk has faced several SEC investigations and sanctions related to his tweets, highlighting the legal ramifications of misleading or inaccurate public statements concerning Tesla stock. These actions underscore the seriousness with which regulators view his communications.

-

Legal Ramifications of Misleading Statements: Public statements about Tesla stock that are demonstrably false or misleading can lead to significant legal consequences, including substantial fines and even potential criminal charges. This risk underscores the importance of careful analysis of his communications.

-

Potential Risks for Investors: The regulatory uncertainty surrounding Musk's tweets represents a significant risk for Tesla stock investors. The potential for unforeseen legal repercussions could negatively impact the stock price regardless of the company's underlying performance.

Strategies for Investing in Tesla Stock Considering the "Angry Elon Musk Effect"

Investing in Tesla stock requires a strategic approach that acknowledges the unique volatility introduced by Elon Musk's public pronouncements.

-

Risk Mitigation Strategies: Diversification is key. Don't put all your eggs in one basket. Consider a diversified portfolio that minimizes your exposure to the volatility associated with Tesla stock. Dollar-cost averaging can also help mitigate risk by spreading your investments over time.

-

Managing Volatility: Avoid short-term trading based solely on Musk's tweets. The "Angry Elon Musk effect" creates short-term price fluctuations that are difficult to predict accurately. Instead, focus on a long-term investment strategy.

-

Importance of Long-Term Investment Perspectives: Tesla's long-term prospects in the electric vehicle market are generally viewed positively. A long-term perspective allows you to weather the short-term storms caused by Musk's tweets.

-

Analyzing News Related to Musk: Develop a critical approach to news and information. Don't react instantly to every tweet. Analyze the context and potential impact on the company's fundamentals before making any investment decisions related to Tesla stock.

Conclusion

This analysis highlights the significant impact of Elon Musk's public statements on Tesla's stock price. His often unpredictable communication style creates substantial volatility, presenting both opportunities and risks for investors. Understanding the "Angry Elon Musk effect" is crucial for navigating the complexities of investing in TSLA stock. The correlation between his tweets and Tesla stock volatility is clear, and understanding the regulatory landscape and implementing sound risk management strategies are essential for any Tesla stock investor.

Call to Action: To stay informed about the latest developments affecting Tesla stock and the ongoing "Angry Elon Musk effect," continue following our analysis and subscribe to our newsletter for regular updates. Learn how to mitigate risk and make informed decisions about your Tesla stock investment.

Featured Posts

-

La Wildfires A Case Study In The Moral And Social Implications Of Disaster Betting

May 27, 2025

La Wildfires A Case Study In The Moral And Social Implications Of Disaster Betting

May 27, 2025 -

Povidomlennya Zmi Pro Zustrich Predstavnikiv Trampa Ta Putina V Peterburzi

May 27, 2025

Povidomlennya Zmi Pro Zustrich Predstavnikiv Trampa Ta Putina V Peterburzi

May 27, 2025 -

1923 Season 2 Episode 5 Free Streaming Options Tonight

May 27, 2025

1923 Season 2 Episode 5 Free Streaming Options Tonight

May 27, 2025 -

Pregnancy Rumors Swirl Is Gwen Stefani Expecting A Baby With Blake Shelton

May 27, 2025

Pregnancy Rumors Swirl Is Gwen Stefani Expecting A Baby With Blake Shelton

May 27, 2025 -

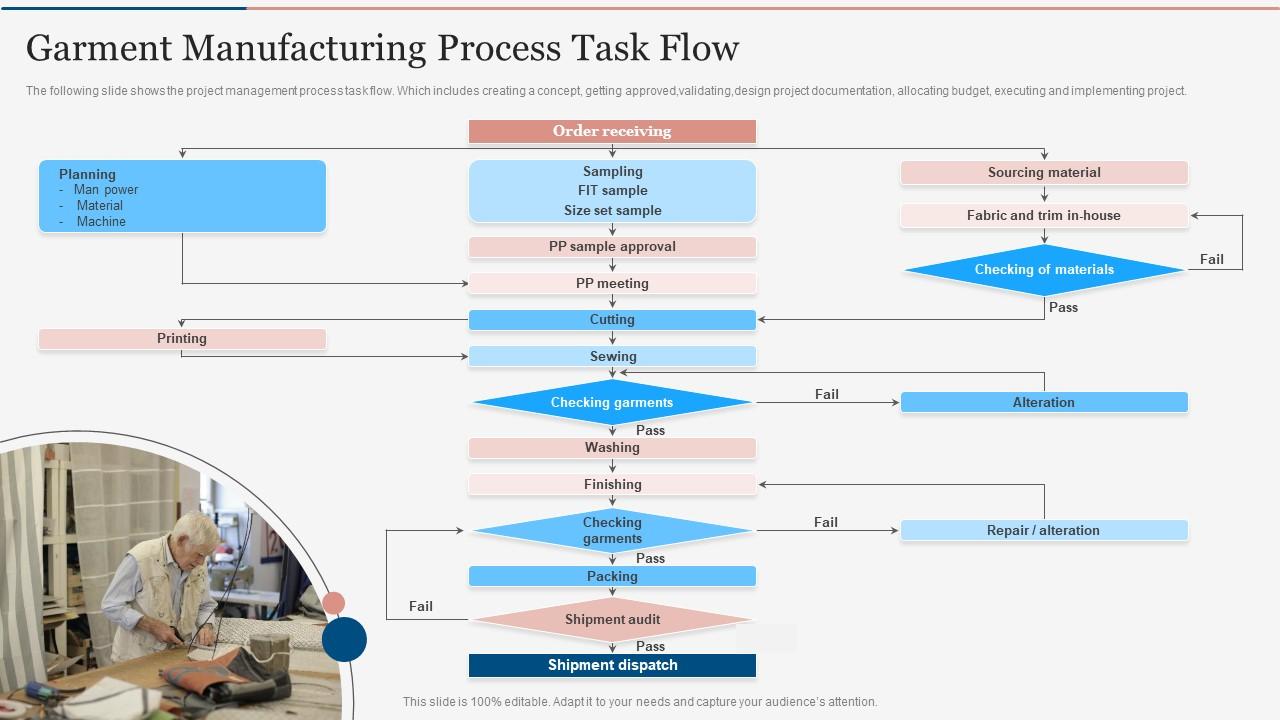

Understanding Guccis Bamboo A Look At The Brands Manufacturing Process

May 27, 2025

Understanding Guccis Bamboo A Look At The Brands Manufacturing Process

May 27, 2025

Latest Posts

-

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025

Duncan Bannatynes Charitable Contribution To Children In Morocco

May 31, 2025 -

Bannatyne Ingleby Barwick Padel Court Development Underway

May 31, 2025

Bannatyne Ingleby Barwick Padel Court Development Underway

May 31, 2025 -

Duncan Bannatyne On Supreme Court Ruling Protecting Womens Safety In Changing Rooms

May 31, 2025

Duncan Bannatyne On Supreme Court Ruling Protecting Womens Safety In Changing Rooms

May 31, 2025 -

40 Profit Boost For Dragons Den Entrepreneur

May 31, 2025

40 Profit Boost For Dragons Den Entrepreneur

May 31, 2025 -

Padel Courts Coming To Bannatyne Health Club Ingleby Barwick

May 31, 2025

Padel Courts Coming To Bannatyne Health Club Ingleby Barwick

May 31, 2025