The Bank Of Canada's Inflation Challenge: Interest Rate Hikes On The Horizon?

Table of Contents

Current Inflationary Pressures in Canada

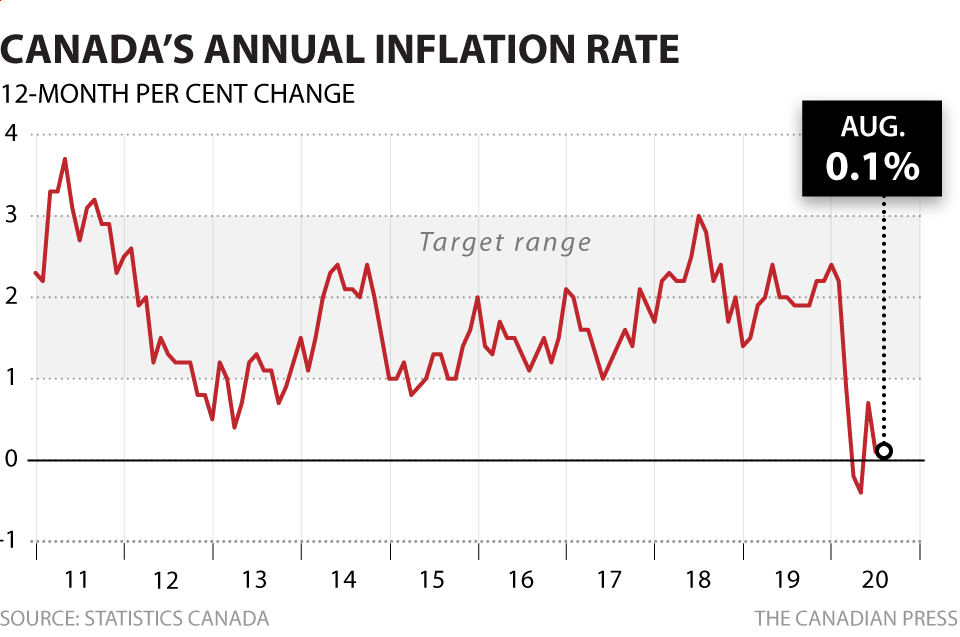

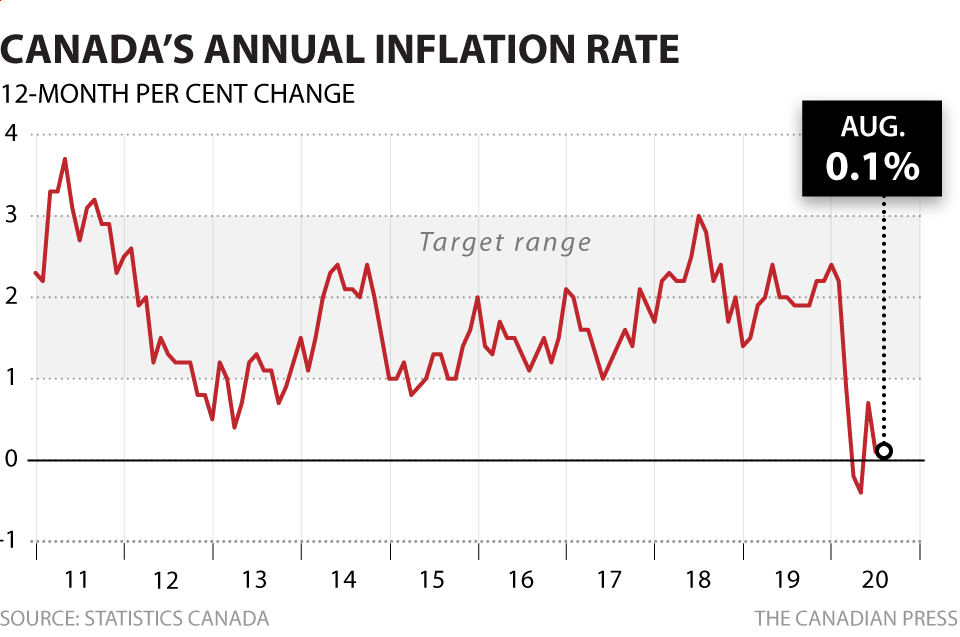

Canada's inflation rate remains a key concern. High inflation, as measured by the Consumer Price Index (CPI), significantly impacts the cost of living for Canadians. Several factors contribute to these inflationary pressures:

- Analyzing the Consumer Price Index (CPI) Data: Recent CPI data shows inflation consistently above the Bank of Canada's target range of 1-3%. This persistent inflation necessitates a strong response from the central bank.

- Global Supply Chain Disruptions: Ongoing global supply chain bottlenecks continue to constrain the availability of goods, driving up prices. These disruptions, exacerbated by geopolitical events, are a major contributor to inflationary pressures in Canada.

- Soaring Energy Prices: Fluctuations in global energy markets, particularly oil and natural gas, have significantly impacted energy prices in Canada, pushing up inflation across various sectors. This is directly reflected in increased transportation costs and higher household energy bills.

- Wage Growth and Inflationary Pressures: While wage growth is essential, rapid increases can fuel a wage-price spiral, where higher wages lead to higher prices, further exacerbating inflation. The Bank of Canada carefully monitors wage growth to assess its impact on inflation.

The Bank of Canada's Monetary Policy Tools

The Bank of Canada employs several monetary policy tools to manage inflation. The primary tool is adjusting interest rates:

- Interest Rate Hikes and Borrowing Costs: Raising interest rates increases borrowing costs for consumers and businesses, reducing spending and cooling down demand-pull inflation. This is a key mechanism to curb inflationary pressures.

- The Mechanism of Interest Rate Changes: Higher interest rates make it more expensive to borrow money, leading to decreased investment and consumer spending. This reduced demand helps to bring down prices and control inflation.

- Quantitative Easing (QE) and its Potential Impact: While the Bank of Canada has previously used quantitative easing (QE) – purchasing government bonds to inject liquidity into the market – this tool is less likely to be used in the current inflationary environment. QE is typically used to stimulate the economy during periods of low inflation and slow growth. Currently, the focus is on curbing inflation.

Potential Scenarios and Their Economic Impacts

The Bank of Canada's response to inflation will likely involve interest rate hikes, but the magnitude and timing remain uncertain. Several scenarios are possible, each with significant economic consequences:

- Aggressive Interest Rate Hikes and Economic Growth: Aggressive interest rate hikes could effectively curb inflation but risk slowing economic growth significantly, potentially leading to a recession. This represents a challenging trade-off for policymakers.

- Recession Risk and Monetary Policy: The risk of triggering a recession is a major concern for the Bank of Canada. Balancing the need to control inflation with the desire to avoid a recession is a delicate act.

- Impact on Employment Rates: Interest rate hikes can lead to job losses as businesses cut back on investment and hiring in response to higher borrowing costs. The Bank of Canada carefully monitors employment data to assess the impact of its policies.

- Impact on the Canadian Dollar: Interest rate hikes can attract foreign investment, strengthening the Canadian dollar. However, a stronger dollar can also make Canadian exports more expensive, impacting trade balances.

Predicting the Bank of Canada's Next Move

Predicting the Bank of Canada's next move is challenging, but several key factors will influence their decision:

- Inflation Forecasts: The Bank of Canada closely monitors inflation forecasts to assess the persistence and severity of inflationary pressures. These forecasts are crucial in guiding their policy decisions.

- Economic Growth Projections: Projections for economic growth provide insights into the overall health of the Canadian economy and its resilience to interest rate hikes.

- Global Economic Conditions: Global economic conditions, including global inflation and interest rate policies of other central banks, also play a significant role in shaping the Bank of Canada's decisions.

- Expert Predictions and Market Sentiment: Analysts' predictions and market sentiment offer valuable insights into potential future interest rate movements. However, these should be interpreted cautiously.

Conclusion

The Bank of Canada faces a complex challenge in balancing the need to control inflation with the need to maintain economic stability. The current inflationary pressures, driven by factors such as supply chain disruptions and energy price increases, necessitate a careful response. While interest rate hikes are a likely tool, the magnitude and timing of these increases remain uncertain, presenting potential risks to economic growth and employment. The Bank of Canada's decisions will significantly impact the Canadian economy and the personal finances of Canadians.

Call to Action: Stay informed about the Bank of Canada's decisions regarding interest rates and their potential impact on your personal finances and the Canadian economy. Regularly review the Bank of Canada's website and other reliable sources for updates on inflation and monetary policy. Understanding the Bank of Canada's response to the inflation challenge is crucial for navigating the current economic climate.

Featured Posts

-

Peppa Pig Theme Park Texas Official Opening Date And Attractions

May 22, 2025

Peppa Pig Theme Park Texas Official Opening Date And Attractions

May 22, 2025 -

Unpacking The Controversy Australian Trans Influencers Record Breaking Feat

May 22, 2025

Unpacking The Controversy Australian Trans Influencers Record Breaking Feat

May 22, 2025 -

Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025

Phat Trien Ha Tang Giao Thong Tp Hcm Binh Duong Thuc Trang Va Trien Vong

May 22, 2025 -

Experience Hellfest Concert Au Noumatrouff De Mulhouse

May 22, 2025

Experience Hellfest Concert Au Noumatrouff De Mulhouse

May 22, 2025 -

Live Tv Chaos Bbc Breakfast Guest Disrupts Broadcast

May 22, 2025

Live Tv Chaos Bbc Breakfast Guest Disrupts Broadcast

May 22, 2025

Latest Posts

-

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025

Box Truck Accident Leads To Significant Route 581 Closure

May 22, 2025 -

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025

Route 581 Traffic At Standstill Box Truck Involved In Crash

May 22, 2025 -

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025

Traffic Delays On Route 581 Following Box Truck Accident

May 22, 2025 -

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025

Firefighters Respond To Major Used Car Lot Fire

May 22, 2025 -

Crews Battle Blaze At Used Car Dealership

May 22, 2025

Crews Battle Blaze At Used Car Dealership

May 22, 2025